Chinese Gold Consumption Rose 9.4 Percent In 2017

Strengths

·Despite the headwinds of rising interest rates, gold was the best performing metal this week, although down slightly by 1.24 percent. Gold traders are bullish for the fourth week in a row after the yellow metal posted its biggest monthly advance in five months in January, according to Bloomberg’s weekly survey. The government of India is presenting a policy to develop gold as an asset class and establish a trade-efficient system of regulated gold exchanges. This would allow bank customers to deposit their gold holdings for a fixed period of time in return for a 2.25 percent to 2.50 percent interest rate.

·Gold consumption in China rose 9.4 percent in 2017, a big hike from a 6.7 percent slump the previous year. Jewelry demand was also strong at 10.4 percent, up from the 19 percent drop in 2016. The rise in consumption is in part due to lower-tier cities accumulating income and using it to buy gold products.

·China’s gold production, on the other hand, dropped 6 percent in 2017, the first major drop since 2000, reports Bloomberg. The reduced production is due to environmental protection taxes, resources taxes and the closure of some mines.

Weaknesses

·The worst performing metal this week was silver, down 4.63 percent. Bloomberg reports that gold futures dropped this week after hiring and wages picked up in January with nonfarm payrolls rising 200,000, compared with the median estimate for an 180,000 increase. The unemployment rate held at 4.1 percent while average hourly earnings rose 2.9 percent, higher than expected.

·A power failure due to a storm on Wednesday night at South Africa’s Sibanye Gold Ltd.’s Beatrix mine left almost 1,000 workers trapped underground overnight. All workers made it out of the mine without injuries after power was restored using backup generators. South Africa has some of the deepest mines in the world and the mine expects to reopen on Monday.

·The Democratic Republic of Congo made last minute changes to a mining law that will go into effect immediately and will negatively affect every mining project, reports Bloomberg. DRC lawmakers hiked royalties for mining companies and added a new 50 percent tax on super-profits. The country is the world’s biggest source of cobalt and is potentially raising the royalty from 2 percent to 10 percent on the mineral.

Opportunities

·Goldman Sachs is the most bullish it’s been on commodities since 2008, expecting copper to rise 12 percent in the next 12 months to $8,000 a metric ton. Bloomberg Intelligence writes that broad demand versus supply measures are the most favorable in a decade with the CBOE Volatility Index at the lowest for the longest period in 30 years. Bill McQuaker, multi asset investment manager at Fidelity, says that gold is a prudent investment right now because it can perform well regardless of market conditions.

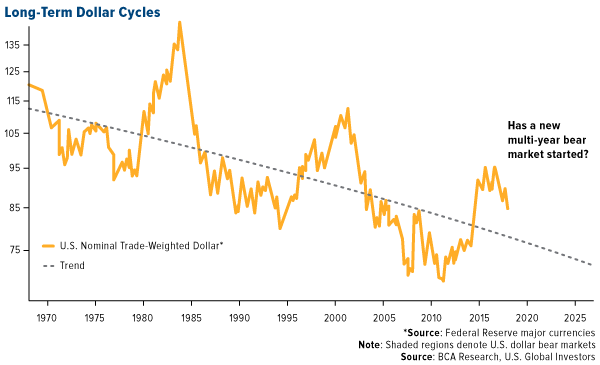

·According to Pacific Investment Management Co., the U.S. is fighting and winning a “cold currency” war, as the U.S. dollar has fallen almost 12 percent since the start of 2017. According to Pimco global economic advisor Joachim Fels, a widening trade deficit will foster a continued American interest in a weaker dollar. Bank Credit Analysts released a report showing that the dollar has oscillated between bear markets lasting 10 years and bull markets lasting five years. If this holds true, the dollar’s five-year bull market from 2011 to 2016 fits the pattern of the dollar entering a bear market now for the next 10 or so years.

·Matthew Sigel, portfolio strategist at CLSA, released a report detailing that the U.S. dollar has “broken down” after the policy error of tax cuts were passed. This is due to lost relevance as a means of exchange as the dollar percentage of foreign exchange reserves and its use for SWIFT payments continues to decline. In addition, Sigel notes that U.S. recently fell out of the top 10 in the Bloomberg Innovation Index, and in terms of patents, China has filed 10 times more over the last 10 years than the U.S. Gold has historically performed positively when the U.S. dollar is weak.

Threats

·Wells Fargo analysts are warning of a commodities bear market and said they doubt a weakening dollar will result in commodity performance rising. They released a report saying “We expect bear market dynamics (over-supply and range bound prices) to dominate commodities for the next five to 10 years.” Austin Pickle wrote.

·Bloomberg reports that OPEC and Russia will allow prices to rise as high as the market can take. The downside of higher oil prices is that mining costs can rise as well. Unit costs for miners might rise 5 to 10 percent this year as commodity prices are rallying.

·Renaissance Technologies, the world’s most profitable hedge fund, warns of a significant risk of a market correction and is preparing for possible market turbulence. The group cites rising valuations as being unjustified entirely by accelerating global growth and corporate tax reform. In the prior week there were all-time highs in money flows into equities.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of