Is The Gold Bull Market Over?

As we approach the fourth year of an extended correction in gold, we must re-analyze where it is we’ve been and where we are likely to go. Frankly, we must ask the question is the Gold Bull Market over? By taking the emotions out of it and getting our politics, beliefs, ideals, dreams, wants and desires all in order, we hope to analyze the facts, fundamentals and charts objectively. Very few markets can bring forth the raw emotion and extreme passions as seen in the Gold Markets. Therefore, it is critical for the Gold investor to keep his/her mind clear of all unwavering, stronghold type beliefs, which may cloud their minds.

How did Bull Markets get their name? It’s my opinion that they are called this because it’s a lot like riding an arena Bull. The Bull doesn’t want to be ridden, throwing, thrashing and trampling anyone that attempts to confront it. Recently, I read an article where the author was explaining how the next leg of the Gold Bull Market would have different riders than the first leg had. I can’t recall the author, but it was an interesting point of view that may hold some merit. I can only imagine this multi-year correction has laid waste to many investors mental and monetary capital, preventing them from participating in the final leg.

As a technical analyst, my focus is on the charts, relying mostly on others for their expertise regarding the fundamentals. Today, let’s take a look at a few charts with the intention of bring some clarity to the current market conditions.

As a technical analyst, my focus is on the charts, relying mostly on others for their expertise regarding the fundamentals. Today, let’s take a look at a few charts with the intention of bring some clarity to the current market conditions.

First, looking at gold from a long-term point of view, you’ll see how the advance into the 1980 peak was parabolic in form, nearly a vertical ascent. Whereas the 12-year move from 1999-2011 appears more orderly, not showing the signs of a parabolic top forming. Notice also, how the current correction were enduring is somewhat minuscule and hardly worth fretting over.

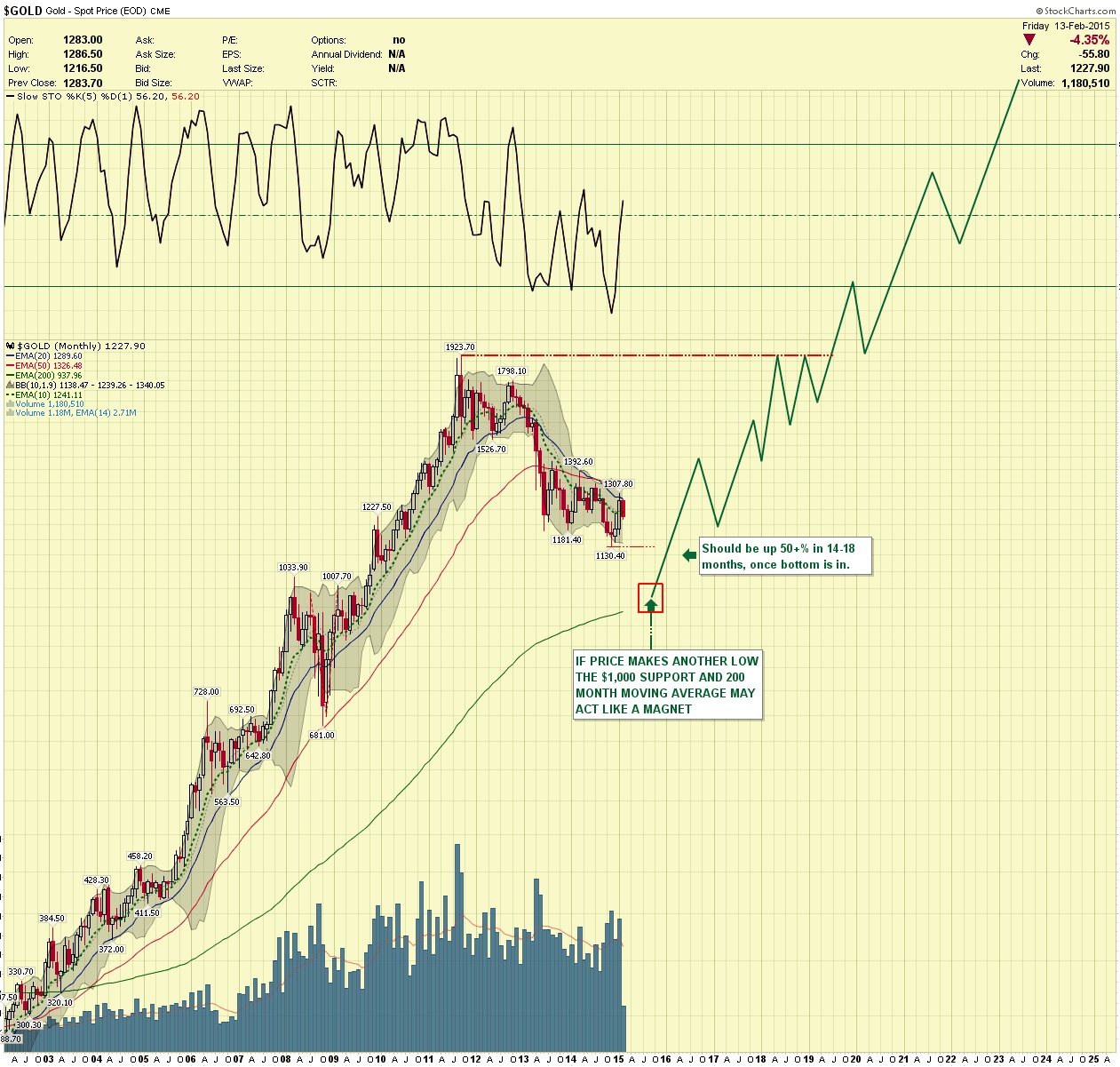

Secondly, let’s look at a monthly chart. This chart has the appearance of just a correction also, enter the million dollar question “Is it over or will it continue?” If it continues (my current belief), then I see price being drawn down to the $1,000 level like a magnet. In order to fully clear sentiment that $1,000 may be broken temporarily. If so then the 200 month moving average at approx. $950 should slow/stop the decline.

Lastly, the weekly chart shows a clear pattern of forming a support, consolidating, and then breaking that support. During this correction, we have two such patterns. When the second pattern cut support, it didn’t have a waterfall type decline as expected. Rather, it immediately reversed and closed back above support. Though this reversal is indicative of a bottom, it’s difficult for me to believe that an extended correction such as this would end in that manner. Most corrections conclude with capitulation, resetting the bull market for another leg.

So, what do we do as investors? We patiently wait for the market to tip its hand. In our Chartseek Example Portfolio (EP) we are positioning ourselves for a final capitulation type move but are also prepared for the next leg up if, in fact, the bottom has arrived.

The Gold Bull will do everything it can to knock you off, prepare yourself as a professional would and don’t allow anything to blind you.

We wait. It's hard doing nothing at times…but it feels better than being on the wrong side of the trade.

********

Courtesy of http://www.chartseek.com/