Gold Forecast – Decline In Gold Price And Corresponding Markets

One of the best indicators for gold outside of the precious metals market is the USD Index (and we discussed it in our previous article), but it doesn’t mean that it’s the only one there is. Other ways to look at the gold market include analyzing the markets that move in tune with it, to check if the moves in gold are confirmed, or is gold the only part of the precious metals market that’s actually showing a specific kind of behavior. For example, the 2019 run-up is big when you look at gold, but it’s not the case if you look at other key parts of the PM sector. Silver, gold stocks, or silver stocks didn’t even manage to move above their 2016 highs. This means that taking gold’s rally at its face value and thinking that gold just started a new multi-year bull market is likely to be misleading.

Looking at the related markets and their interdependencies can give one the edge over those who look at the core market alone. In today’s analysis, we will discuss what one of the key parts of the precious metals sector – gold stocks – is doing and whether it’s last week’s rally made the outlook bullish. Additionally, we will discuss how gold stocks perform relative to gold, and we will conduct the same analysis with regard to gold and silver.

Let’s start with the signals from gold stocks.

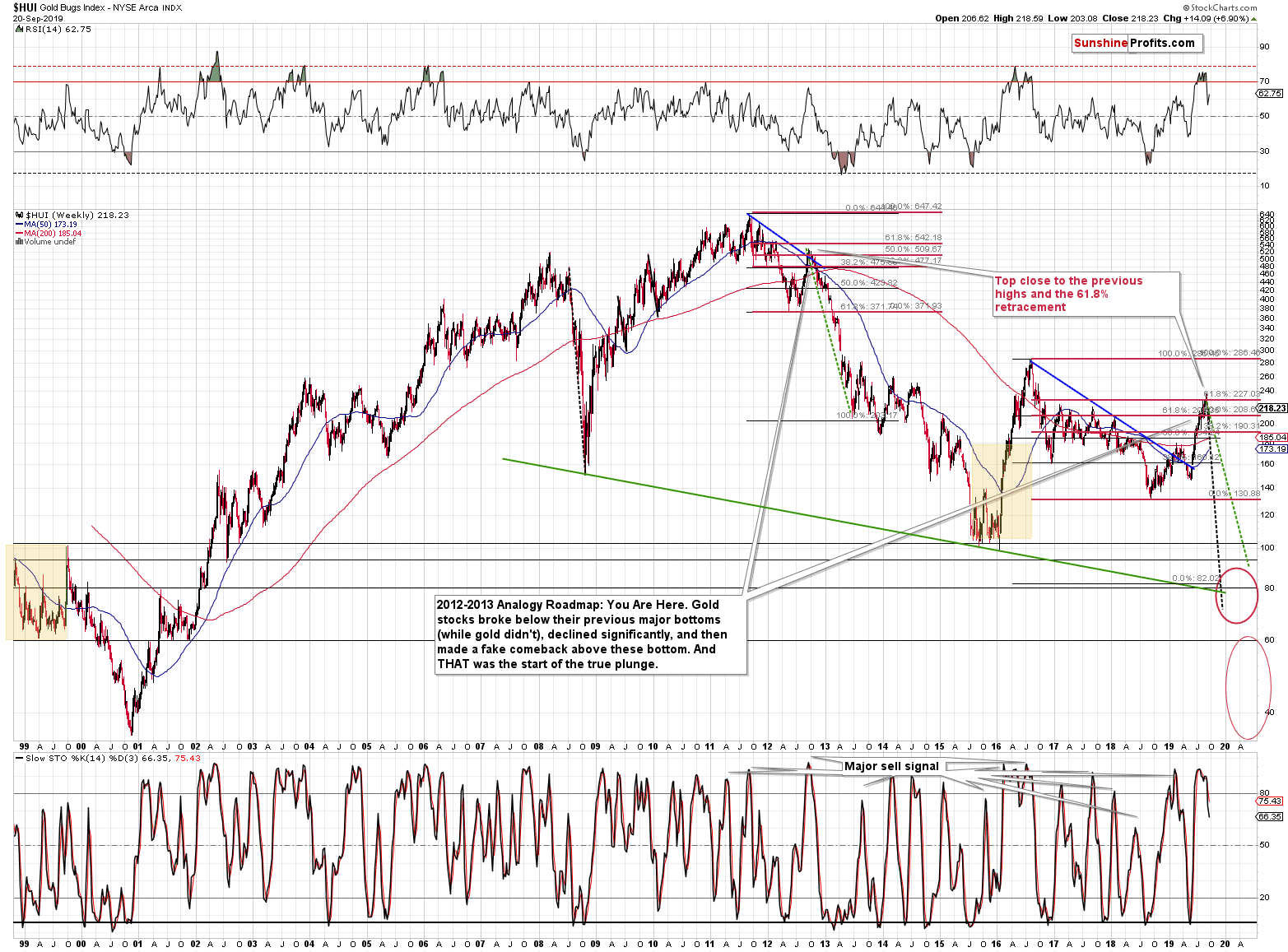

It is true that gold stocks recovered more visibly last week, but its relatively common for them to be more volatile than gold on a short-term basis. The key question is if this upswing was significant enough to change the trend. It wasn’t. The black and green lines that we copied to the recent high represent the analogies to the 2008 and 2012-2013 declines. Did last week’s rally make the current decline look any different? No. That’s the kind of volatility and “strength” that was visible even during the biggest and sharpest declines of the past decades. This “strength” was not only not enough to make the outlook appear bullish. It wasn’t even enough to make the outlook appear less bearish. Consequently, we don’t view it as anything bullish.

Gold stocks invalidated their tiny breakout above the 61.8% Fibonacci retracement level, which means that the 2018-2019 upswing was just a correction within a bigger downtrend.

The situation in gold miners is particularly bearish because the gold stocks to gold ratio visible on the above chart recently invalidated its small breakout above the declining resistance line. Last week’s upswing was just yet another move to the resistance line. There was no breakout and thus the implications of the previous invalidation remain in place. Gold miners were not strong enough to push the ratio above the resistance. They were not even strong enough to keep the previous gains. This shows that it was just the momentum that “accidentally” pushed the ratio higher, it was not the true strength of the precious metals sector.

We wrote about this earlier, but it’s worth re-stating it again. It was practically only gold that rallied recently in any meaningful manner. In other words, most of the PM sector didn’t rally significantly this year. Sure, the rest of the PM sector moved higher as well, but it was nothing to call home about when looking at the market from the long-term point of view. Neither silver, nor gold stocks, nor silver stocks managed to move to, let alone above, their 2016 highs.

Gold was almost forced to rally due to the exaggeration of the Twitter politics, but the market seems to have learned to pay less and less attention to what Trump is saying and to focus on what actions are really taking place. Just look at the USD Index for confirmation. Trump is calling for zero or negative interest rates, and the USD Index is close to its yearly highs. Moreover, even though the USD declined after almost every dovish comment from Trump or the Fed, the reactions were smaller in each case and the rebounds were getting bigger. This resulted in an overall uptrend despite Trump’s comments and despite the shift from rate hikes to rate cuts. The implications for the USD Index are tremendously bullish, and the consequences for gold are bearish. They are bearish for the gold market not only because of the rising USDX. They are bearish because the market shows to be paying smaller attention to what President Trump is saying and reacting in a less volatile way to it. Lower perceived risk means lower safe-haven demand for gold. The latter seems to have peaked a few weeks ago and how the trend has reversed.

Since we are discussing ratios, let’s take a look at the one between gold and silver.

The ratio tends to move in the opposite way to the way in which both precious metals are moving. For instance, the ratio topped at the 2008 bottom in the PMs and it bottomed in 2011, more or less when the precious metals were topping. Please note that this tendency is visible in the long run – over the short-term there are other dynamics that one needs to look at. This means that there might be short- or even medium-term deviations from the trend in the ratio, but overall, the individual metals tend to catch up with what the ratio is predicting.

The gold to silver ratio first soared above the 2008 high and the rising red resistance line and then it invalidated the breakout, after which it declined sharply. The move was sharp, but it was not sustainable. The major trend remains up and the ratio is once again above the 2008 high. The decline in the ratio was fake, just like the early-2008 and mid-2012 declines were. The situation in the gold to silver ratio simply doesn’t confirm any bullish silver forecasts.

On a short-term basis, the breakdown below the line based on the 2016 and 2018 lows was just invalidated, which bodes well for the ratio’s rally. It also points to a decline in the both precious metals in the following weeks, with silver leading the way. Today’s strength in silver might be the final move against the trend, similar to shooting a slingshot. The following rally in the ratio is likely to take the ratio back above the lower border of the rising long-term trend channel, which would be a perfect way for the ratio to start its next medium-term upswing. Of course, this would imply a medium-term decline in the precious metals.

Summary

Summing up, the big decline in the precious metals sector appears to be finally underway as in the past few weeks gold and silver declined even without rallying USD Index. Once the latter takes off, it will likely serve as fuel to the fire-like decline. Let’s keep in mind that taking the big investment picture into account, out of the following: gold, silver, gold stocks, silver stocks, the recent upswing was visible only in case of gold prices. Most of the precious metals’ portfolio: silver, gold miners, and silver miners suggest that what we saw in the last several months is nothing more than a corrective upswing within a bigger downtrend.

We know that these are not pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months, but what’s profitable is rarely the thing that feels good initially. Predicting higher gold prices without a bigger decline first is likely to be misleading. There will most likely be times when gold is trading well above the 2011 highs, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,