Gold Holds Great Value To Citizens Of Volatile Countries, Russia In Particular

Strengths

- In July, the U.S. Mint sold the most physical gold in two years even as the price of the precious metal briefly slid to its lowest level in five years.

- Goldcorp cut its dividend as part of a strategy to cope with slumping prices. The decision was made even after the company said it became cash-flow positive in the second quarter, after years of capital expenditures to build two new mines in Argentina and Canada. The company hasn’t been cash-flow positive since the third quarter of 2012. Sibanye Gold’s CEO announced he is willing to work on a compromise with the unions in order to find a solution without a strike. In a lucky move, Barrick Gold was able to leverage a lofty price for its copper mine in Chile. The company is selling a 50-percent stake in its Zaldivar mine to Antofagasta for $1 billion.

- Comstock Mining announced it reached a definitive agreement with John Winfield to amend the terms of the operating agreement for its Northern Comstock LLC joint venture. The agreement will reduce the company’s remaining capital contributions from $31.05 million down to $9.75 million. In addition, any prior or future royalty commitments for the Northern Comstock properties and Mr. Winfield will be eliminated. This strengthens the balance sheet by significantly reducing liabilities while improving liquidity and lowering future capital costs. The company has consolidated an unprecedented land position in the world-class Comstock silver and gold district. Mr. Winfield also announced that he intends to donate all of his resulting personal dividends to the Comstock Foundation, an established 501(c)3 organization dedicated to the protection, preservation and restoration of Comstock. He also informed the company of his intention to step down from his duties on its board to focus more on the community-enhancing work of the foundation. Comstock’s share price rose 58 percent for the week on the good news as the change in capital structure will allow a new group of inventors to start purchasing the stock.

Weaknesses

- Gold traders are the most bearish since April as U.S. policymakers move closer to raising interest rates this year. According to the Perth Mint Treasurer, the market expects bullion to decline to $1,000 per ounce before prices begin to recover.

- Gold slipped to five-and-a-half year lows on Friday and had its sixth straight weekly fall, its longest retreat since 1999, after upbeat U.S. economic data strengthened expectations for a near-term interest rate hike. The S&P Goldman Sachs Commodity Index has lost more than 12 percent month-to-date, bringing its level to the lowest since February 25, 2002. It has now exceeded the bottom of the 2008 global financial crisis.

- According to Capital Economics, China’s imports of gold are yet to respond to low prices. The company also believes investors are becoming increasingly worried about a more pronounced correction in China’s stock market and will return to gold to diversify their portfolios.

Opportunities

- First Majestic agreed to purchase SilverCrest Mines for C$154 million, which represents a 37-percent premium to SilverCrest’s 30-day weighted average price. Separately, OceanaGold announced it will acquire Romarco Minerals in an all-share transaction representing a 73-percent premium based on the July 29 closing prices. The combination is expected to create the lowest cost gold producer in the market that is propelled by a long reserve life, a portfolio of high quality assets that generate significant free cash flow, and a solid pipeline of organic growth opportunities. This represents two acquisitions announced in less than a week. This is a good sign that parties are now more willing to get a deal done, and could bode well for more deals in the near future.

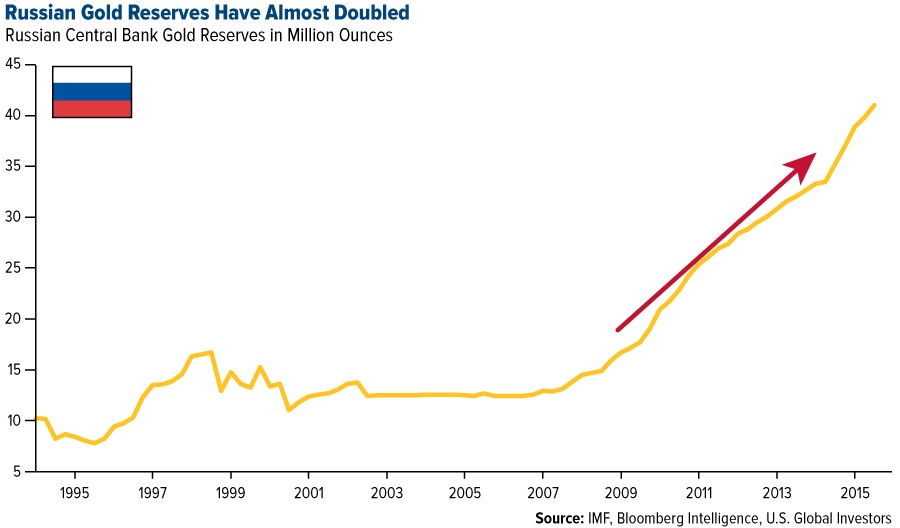

- Russia’s central bank has turned away from buying U.S. treasuries and opted for buying all its domestically-produced gold instead.

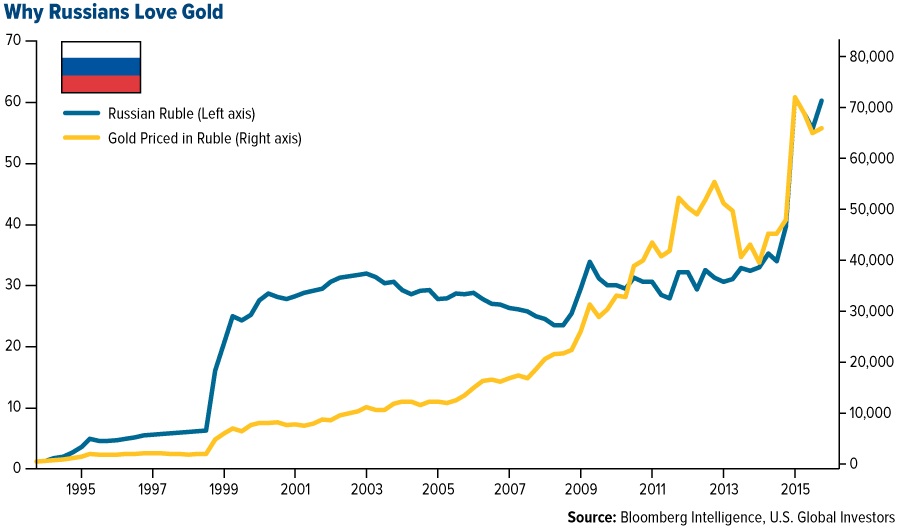

- According to Gold Mining Union, Russia became the world’s second biggest producer of gold last year, extracting 288 tonnes. In Russia (where the ruble to the dollar has depreciated to more than 57 to $1, from 1.17 in 1993), the ruble price of gold has risen 15,030 percent during that time period. Gold holds great value to citizens of countries where the currency has shown historical bouts of severe volatility.

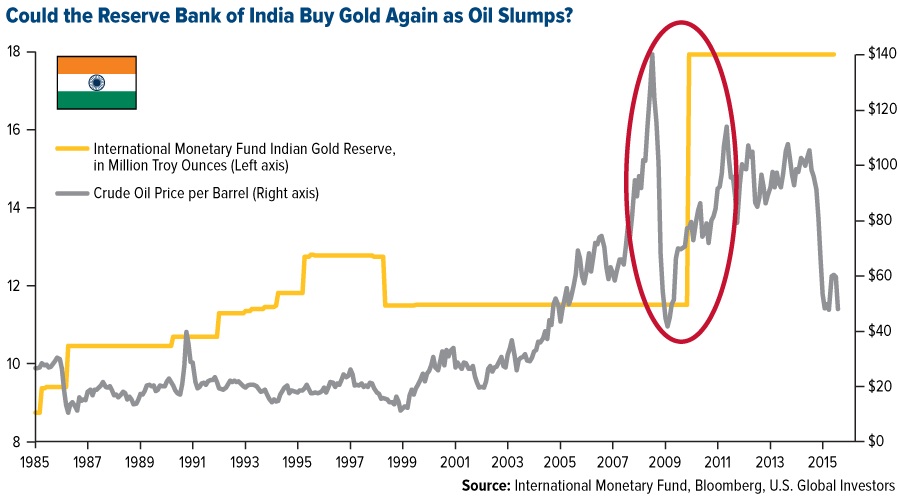

- The Reserve Bank of India bought significant amounts of gold when oil prices plunged in 1986, the early 1990s and in 2009. Lower oil prices bolster India’s balance of payments, giving the central bank room to make gold purchases. With India being the world’s largest buyer of the metal, perhaps its central bank could be a big buyer now that oil prices have slumped.

- Even as the Federal Reserve may be getting closer to raising interest rates for the first time in almost a decade, currency forecasters are ratcheting back expectations for gains in the dollar. Back in April, analysts were calling for the ICE U.S. Dollar Index to reach a 12-year high of 100.7 at year end. Now they see it finishing the year at 98.6. It seems to be an enigma why dollar bulls are losing confidence given the likelihood of rate hikes.

Threats

- According to the average estimate in a Bloomberg News survey, the price of gold will drop to $984 per ounce before January. That would be the lowest since 2009 and a 10-percent retreat from Tuesday’s closing price. ANZ sees gold averaging $1,020 in December versus a previous forecast of $1,125. Citigroup cut its three-month gold target to $1,000 and has a six to 12 month target of $1,025. HSBC lowered its average gold price forecasts for 2015 and 2016 to $1,160 and $1,205, respectively. According to Morgan Stanley, gold could sink to $800 in its worst-case scenario and has the largest downside risk of all commodities.

- According to Bank of America Merrill Lynch (BofAML), hedge funds have gone net short on gold for the first time since 2006.

- While the mantra says sell in May and go away, the current three-month seasonality suggests selling in July/August, as the worst three-month period of the year is August-October.

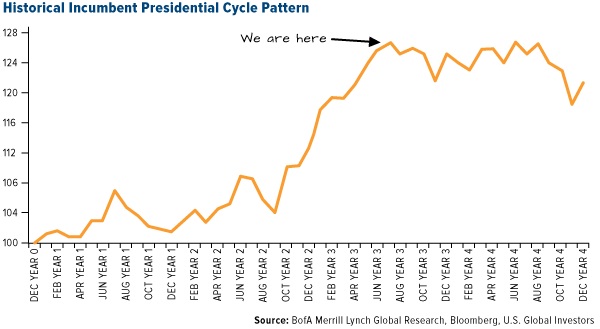

- The incumbent presidential cycle calls for a mid-year 2015 peak ahead of a weaker period into year-end and 2016. This weaker part of the cycle opens the window for a cyclical bear market within the larger secular bull market trend, according to BofAML. Weakness ahead may also be foreshadowed by the collapse of net free credit to a new record low. Net free credit is free credit balances in cash and margin accounts net of the debit balance in margin accounts. As of April, net free credit stood at a new record low of -$227 billion. If the market drops and triggers margin calls, investors do not have cash in their accounts and would be forced to sell stocks or get cash from other sources to meet the margin calls. This would likely exacerbate an equity market sell-off.

Courtesy of http://www.usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of