Gold Price: Deaf Prophets

The United States needs a wake-up call and the loss of leadership and credibility on economic issues is exacerbated by the dysfunction and divisive nature on Capital Hill. Also, no longer is the US a reliable partner internationally (redlines are blurred). Respect, compromise or reasoning have been lost in the ideological battles as the priority of politicians seems more ideological than issues driven today. The world’s financial elite ignore thousands of years of history that proves money printing never works, and everyone celebrates every round of quantitative easing with new market highs. The era of quantitative easing has spawned an extraordinary financial bubble that shares the same characteristics as the housing bubble whose origins began with the same central banks determined to give everyone a house. This bubble, like others will end badly.

Lower and lower

Despite signs of growth, the Fed seems to be keeping yields at less than one percent and the divide between American and European rates is at the widest since the seventies. Germany’s bunds currently yield 0.10 percent, and only Greece has a higher yield than the US. Risk has been mispriced as money flooded into the dollar. No longer is there a risk premium for moral hazard. Meantime, the over-indebted global economy is stuck in neutral despite the unprecedented financial engineering by central banks that created a huge global asset bubble. The resulting currency war already claimed its first casualty when the Swiss removed their currency cap in January. We believe this disconnect between rates and the economy is the product of the central bank’s ironclad control of the economy. Furthermore, the Fed has yet to exit from its unconventional monetary policy which included an era of cheap and abundant dollar liquidity through trillions of bond purchases after more than six years of near-zero interest rates. This cannot last, and because of the mounting deficits of the last few years, America’s net debt has exploded to 100 percent of GDP.

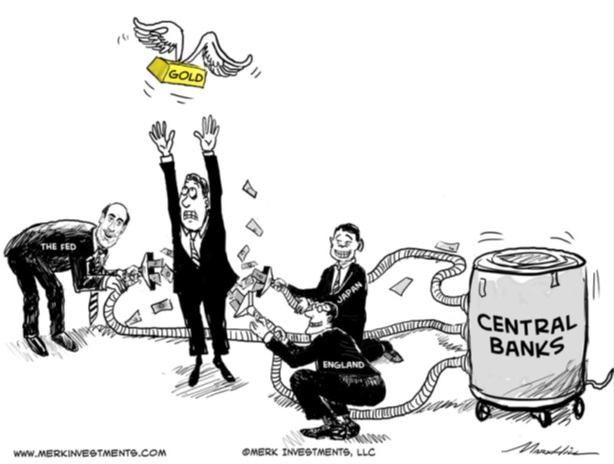

Central Banks are the New Oligarchs

That increase in the federal debt was financed three ways: borrowings from foreigners, borrowings from America’s taxpayers and third, the printing of money. For a time, foreign central banks were taking down an extreme share of US Treasuries as the appetite among the income starved private sector waned. So far, foreigners have financed over $6 trillion of America’s debt, led by Japan and China, who have warned Americans that they have enough dollars. And domestically? Because America simply did not enough savings to finance Treasury purchases, the Fed printed money under a made-in-US quantitative easing policy. Government still spent, but on a permanent basis with no distinction between monetary and fiscal policies. The Fed funded these debt purchases by inflating reserves and money supply by some $4 trillion, money that had not previously existed. And seduced by zero interest rates, the overflow has gone into real estate, surging stock prices, classic cars and vintage watches. The giant cash hoards also financed mammoth share buybacks and mega-mergers. Simply there was too much money and too few opportunities. Booming stock prices should have sparked an investment boom. But it has not, in part due to the debasement of currency.

Money is no longer money. And, most problematic is that we are likely to see a QE 4, since the other three QE programs have proven to be unsuccessful. This Ponzi scheme is the new norm in printing money. A virtuous circle of currency devaluations is about to be tested in the real world as the strong dollar hurts America’s multinationals and exporters giving the Fed another reason to delay monetary tightening and keep the casino open. In fact, money has been so debased it has little value and thus the rush to buy hard assets. Lenders are actually paying for the privilege to extend cash to governments, not the reverse. The new oligarchs are the central banks, led by the Federal Reserve who appears sanguine about the risks of a “beggar thy neighbour” currency war.

Cash Is No Longer King

Central banks have become part of the problem. At one time cash was king. Today there is no benefit for holding cash. Central banks have been acting like deaf prophets, so convinced of their own truths and doctrine that they don’t need to listen. They even ignore history, a history that shows money printing debases currencies which is ultimately inflationary. Central banks have become creators, not stewards of our money. That former custodian of hard currency, Switzerland is the first government in history to sell benchmark ten year at a negative interest rate.

Today over fifty percent of all global government bonds yield one percent or less and twenty-five percent of the Eurozone’s members have negative yields with four actually charging investors for the privilege of owning them. In Denmark, banks are paying customers not to save but to borrow. How ludicrous. Central banks have changed the cardinal rule of finance by rebranding bonds. Bonds are no longer obligations to be held and paid back at par but have become yet another speculative asset class like commodities. The world is upside down. In this world of negative capital, gold has resurfaced. It is the alternative - a store of value in a topsy-turvy world.

What The World Looks Like

The Bank for International Settlements (BIS) estimates that emerging markets rose almost five percent in the past five years despite struggling against the stronger dollar and weak commodity prices. And now with the “race to the bottom” currency war, there is increasing pressure on those governments with large current account deficits and of course, their respective currencies. One third of Turkey’s government debt is denominated in dollars. Countries such as Brazil and South Africa took advantage of the low cost dollar financings to finance their external debts. Brazil’s GDP fell in the first quarter and the Brazilian real has lost more than a fifth of value against the US dollar since yearend. Not surprisingly this problem is the unintended consequence of the trillions of dollars created by the United States. Those dollars became involved in the world’s largest carry trade and are now returning back to the United States. Herein lies the fodder for higher inflation and higher interest rates. Worrisome is when interest rates in the United States eventually rise, the fault lines in the international monetary system will have been exposed by the sharp divergence in monetary policy between the west and the east.

The evolution of the dollar’s role in the international monetary system has ebbed, While America has flooded the world with dollars, capital has become too abundant. The dollar, is no longer worth a dollar. That puts pressure on those countries that borrowed dollars and in turn those countries are looking for alternatives. Money has also left those economies and the exodus of capital is a problem. Worrisome is that this exodus of capital has outpaced the housing 2009 crisis. China too has experienced an outflow of almost $100 billion in the final quarter of last year. Part of that outflow has flooded into Hong Kong via the Shanghai-Hong Kong Stock Connect created to give mainland investors access to the Hong Kong Stock Exchange such that the HKEx has become the largest exchange in the world.

No Need for Bretton Woods

Yet China did not have to introduce a QE program like the US. China in turn has set about internationalizing the renminbi and as part of China’s answer to the World Bank, established the Asian Infrastructure Investment Bank (AIIB) with an initial capital raise of $50 billion and fifty-seven founding members. The bank will finance roads, railways and infrastructure projects and complements the newly formed “BRIC” development bank set up in Shanghai. European countries including Germany and Italy jumped on board much to the consternation of the United States.

China’s goals are twofold. By establishing institutions that use the renminbi, it further internationalizes the renminbi while at the same time, lessens the influence of the dollar denominated Western global financial institutions. The establishment of AIIB and other institutions by China is a way to tilt US hegemony towards a more balanced prospective giving the East influence in global institutions. For almost three quarters of a century, the world has been dominated by the fiat monetary system set up under the Bretton Woods Agreement. The International Monetary Fund (IMF) and the World Bank were established after Bretton Woods which gave the US dollar a preeminent position at the expense of gold in the international financial system. And today in a feeble attempt to be more inclusive, the IMF proposes new quotas but still too small and disproportionate for the dollars involved.

Meantime, foreign exchange reserves have increased six-fold to $12 trillion overshadowing the $4 trillion fixed income market. The convergence of the geo-economics and geo-political is a natural evolution of the global financial ecosystem but a bigger role is expected for China which of course would include, gold. Gold is being repatriated in Europe and the central banks of the East, namely Russia and China are buying gold as an alternative to the dollar. China is the largest producer in the world at 460 tonnes and consumer at an estimated 1,200 tonnes. We believe China has accumulated gold as part of the internationalization of the renminbi, adding to its reserves of 1,054 tonnes last reported in 2009. That amount is less than 2 percent of foreign exchange reserves, pale in comparison to the average holdings of 10 percent held by other major countries.

Gold has made a bottom, having tested the $1,150 support level four times in part due to the currency war that has seen gold easily outperform every currency but the US dollar. We believe growing investor nervousness about the waves of money printing that has devalued sovereign currencies will prove to be the main driver that will carry gold to all-time highs. Meantime, the total supply of gold grows slowly as producer costs increase. Since central banks can create new money by just a click of the mouse, the debasement of paper money will prove to be the main driver to push gold beyond $2,000 this year.

Gold is an alternative to the dollar. For that reason, nineteen central banks purchased gold last year on the open market, and countries such as Portugal, have used their bullion as collateral to reduce debt service cost. We expect gold to do well under this perfect storm of negative interest rates, complacent bond buyers and uber easy central bank policies. Gold is a hedge against the chance that the world’s central banks will prove no better at preventing another financial collapse than they were in fueling the global asset boom.

The conventional view is that normal growth will reassert itself. Our view is pessimistic. We have created debt upon debt. The global economy is now weaker and more leveraged than it was. We believe that the bottoming of gold is telling us the truth. The dollar will fall. Today no government stands for sound money. No candidate is calling for a return to sound money principles, other than Rand Paul. No central bank (other than Switzerland) is prepared to face up to markets and make the tough disciplined choice. Eighteen months from now, Americans will re-elect another inflationary president. That too will be good for gold.

Recommendations

Gold equities have bottomed. The modern day gold rush continues as mining companies buy each other taking advantage of the low valuations. It is now cheaper to buy reserves than fund and develop them. The industry has been plagued with high costs and low prices so miners have been scrambling to cut costs or ditch higher cost mines to pacify investors. Allied Nevada was a casualty because of its debt load. The recently announced Aurico merger with Alamos is driven by the need for Alamos’ cash to pay down Aurico’s debt load after building the Young Davidson Mine. Goldcorp picked up Probe Mines even though that property has no PEA because of the need to build up reserves.

While gold companies have wrestled their costs down, the last quarter showed profits and in some cases, free cash flow. The market has developed along tiers. The top tier led by Barrick continues to attract investor attention while the junior third tier remains neglected. Capital remains a problem for the latter group and thus companies with constrained balance sheets are cutting back on major expenditures. While costs have stabilized, it will take a couple of years for new mines to come into production. Peak gold is finally a reality for this sector. Of the top tier names, we continue to like Barrick and Agnico-Eagle and in the second tier we prefer Eldorado and B2 Gold. In the third tier juniors we like McEwen Gold and St. Andrews Goldfields.

Barrick Gold Corporation

There is much ado about John Thornton and his executives’ compensation despite the introduction of almost a dozen corporate initiatives including a Towers Watson review and assessment of ten peer companies’ executive compensation. No one seems to be concerned about the multimillion dollar packages for the underperforming Toronto Maple Leafs but Mr. Thornton has come under criticism for his compensation. We believe that this criticism is misplaced. In fact, Mr. Thornton is underpaid. Barrick is the largest gold company in the world and in the last year, he has changed the board, reduced bodies at head office, rebuilt a technically competent management group of 35 executives, flattened decision making to the mine level, pruned higher cost mines thereby widening margins, surprised the Street with back to back positive quarters, begun a balance sheet rebuild, established a China desk with an experienced China hand, salvaged Madan with a deal with the Saudi government and most of all changed Barrick’s culture. Most importantly, what lies ahead? What Mr. Thornton has not done is follow many mining companies with ill-timed acquisitions (some without PEAs), loaded bureaucracies, nor has he catered to the Street. We believe that John Thornton is Peter Munk’s last great decision. We continue to like the shares here.

B2Gold Corporation

B2Gold announced results that were in line with expectations, including contributions from Otjikoto and Masbate. Otjikoto and B2Gold’s next mine Fekola are to be lower cost. B2Gold is an emerging mid-tier gold producer with four mines, Libertad, Limon, Masbate and Otjikoto in Nambia which opened in February. In the first quarter, B2Gold produced 115,000 ounces. Newly acquired Fekola in Mali, will have a feasibility study completed by midyear. Road construction has already begun. Fekola is a potential 300,000 ounce producer. We like the shares here.

Eldorado Gold Corporation

Eldorado shares have lagged in the last six months due in part to the uncertain outlook in Greece. Eldorado has about 2,000 employees in Greece and work at Skouries has been delayed by the government. While Greece dickers over money, Eldorado is going ahead with the $1 billion expansion. We believe that not even the Greeks would be so foolish to shelve a money producer and expect the government will eventually give the go ahead. There is no plan to use cyanide at Skouries and a concentrate will be produced. Eldorado’s Chinese production continues to do well and Jinfeng will produce 170,000 ounces this year. Gold production at Tanjianshan will be more than 100,000 ounces at a low cash cost of $560 an ounce. The problem is that permit approval at Eastern Dragon is still forthcoming but we have not included that mine in our forecast. Nonetheless we like Eldorado’s array of assets in five countries and believe that eventually there will be a breakthrough at Skouries. Eldorado’s core strength is management who have shown accomplished technical capability. With a strong balance sheet, low cost core mines in Turkey and China, Eldorado is a buy here.

Goldcorp Inc.

Goldcorp will produce about 3,500,000 ounces this year with a successful ramp up at Eleonore in Quebec along with Cerro Negro in Argentina this year. Production in the first quarter was in line with guidance. The disappointment was the performance from Penasquito which is in a harvest situation. Goldcorp will spend between $1.3 billion, this year less than last year. The expansion of Camino Rosa might extend Penasquito’s life. A new mine plan is needed. At Red Lake, Cochenour’s integration will help Red Lake produce 500,000 ounces next year. Goldcorp has an extensive pipeline however that pipeline will require big spending which is manageable with Eleonore and Cerro Negro completed. However, we prefer undervalued Barrick here.

IAMGold Corporation

With four operating gold mines, mid-tier IAMGold’s results were a disappointment. IAMGold’s reserves are declining with Rosebel in Suriname and Essakane oxides declining. (reserves based on $1,500 gold price). We continue to believe that there will be further write-downs ahead particularly from newly opened Westwood. Production will be flat this year. All-in costs are still over $1,000 an ounce and the sale of Niobec removes a cash flow generator. Still IAMGold has a healthy balance sheet but it’s share performance and acquisition record (Cote Gold) is poor. Sell.

Newmont Mining

Newmont’s results were in line with expectations with all in cost below $1,000. However production this year will be flat but Newmont is building Turf Vent shaft in Nevada which should come into production in 2017. Newmont’s problem is that most of its mines are in a harvest mode. The Company produces one third of its gold in Australia, including Kalgoorlie, which is jointly owned with Barrick Gold. Although there are no current discussions with Barrick, we believe the combination makes sense. Newmont operates mines in US, Australia, Peru, Ghana and Indonesia with abundant free cash flow allowing it to pay down debt. The problem is that there is no encore and Newmont’s culture seems to be more of a country club attitude in the executive suite. Newmont is a company built for yesterday. While the shares are undervalued at current levels, we prefer Barrick here.

Yamana Gold Inc.

Yamana produced 1.4 million gold equivalent ounces last year from seven mines. Yamana spun off Brio Gold with much fanfare. However, those assets of Brio Gold were unwanted and further write-downs are likely. Yamana is focusing on its core assets such as El Penon in Chile which produces 450,000 gold equivalent ounces at under $500 an ounce. There was some improvement at Mercedes and Jacobina. Fifty percent owned Canadian Malartic produced 143,000 ounces and the acquisition was paid for by a recent stock issue which helped Yamana’s debt heavy balance sheet. We prefer Agnico Eagle here.

John R. Ing

416-947-6040