Gold Price: Debates, Inflation And Option Expiry

If gold is to move substantially higher and retain the bulk of those gains, inflation needs to become a significant concern.

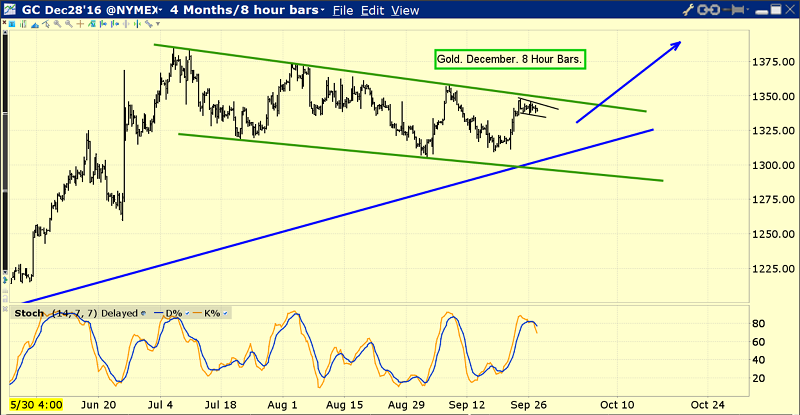

This is the 8-hour bars gold chart. An upside breakout seems imminent, but patience is required.

A breakout from that drifting rectangle pattern I’ve highlighted on the chart is significant, because it creates a much bigger breakout on the monthly chart.

Gold is almost ready to begin a significant leg higher!

The US presidential debate had almost no effect on the gold price, because most of the questions had nothing to do with the economy.

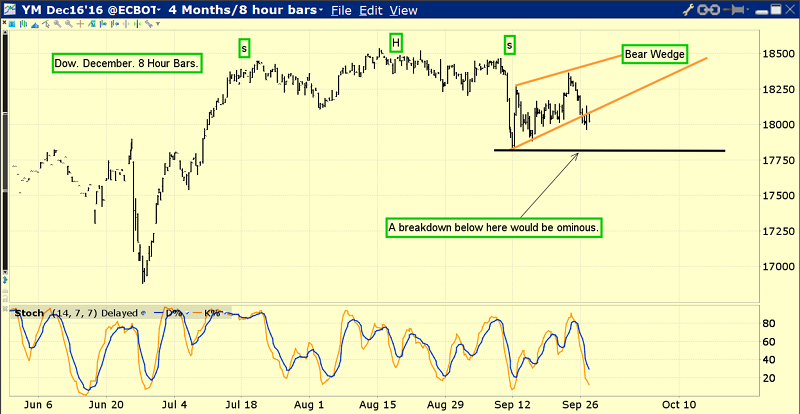

This is the interesting 8-hour bars chart of the Dow.

The US stock market initially rallied after the debate, but it has since given back most of those gains.

There’s a clear bear wedge pattern in play on the chart -- and that follows a breakdown from a Head&Shoulders Top pattern.

The bottom line is that the September – October time frame is crash season for the US stock market. Consequently, the situation is grim.

Who won the debate? Well, mainstream media is essentially socialist, and they say Hillary won.

Social media statistics suggest that Trump won the debate - and that’s because social media was more focused on the economy than mainstream media.

There are a lot of Trump fans in the Western gold community. Therefore, I suggest they focus on social media as much as mainstream media…in order to keep on top of the pre-election action.

Merrill analysts have just issued a blockbuster report, suggesting that a multi-year crude oil supply output squeeze is coming.

I think they are correct. Subsequently, this has significant implications for the price of oil, which is by far the single largest component of most commodity indexes.

This is the 8-hour bars crude oil chart.

Oil is coiled in a nice bull wedge pattern, and poised to surge towards the $50 area highs, and perhaps to $53/bbl.

Some oil bears have suggested that electric cars could put pressure on long-term oil demand. I agree, but they will put more pressure on oil companies to cancel new mega-projects.

Electric cars will not produce a lower oil price, but ironically, a higher one! There are many factors working synergistically to drive inflation higher - and oil is certainly one of them.

I’m getting a lot of emails from investors who are worried that gold stocks could get hit hard if the US stock market crumbles. Here’s the bottom line:

Unquestionably, there appears to be more margin used presently in the gold stocks arena than the bullion arena.

It’s a different situation from 2008. In 2008 hedge funds were forced to liquidate gold to meet margin calls caused by the OTC derivatives crisis.

Now, a loss of confidence theme is brewing with the focus on central banks and US government Treasury Bonds. That means that institutional money managers are much more likely to buy gold in a market meltdown event. Gold stocks can decline initially if the stock market crashes, but they will soon follow gold to move higher.

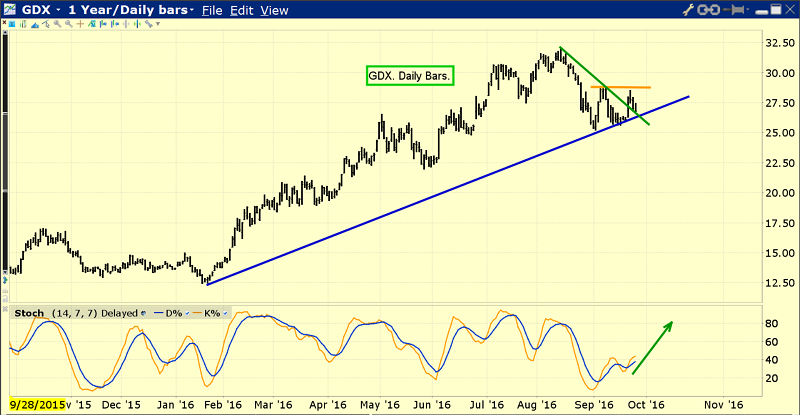

This is the GDX chart. Note the position of the Stochastics oscillator at the bottom of the chart. GDX is more solid here than most investors think.

While the presidential debate received a lot of attention, I’ll dare to suggest that tomorrow’s COMEX option expiry is much more likely to be the catalyst that produces a fresh leg higher for gold…and for stock in the companies that mine this mighty metal!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “America’s Top Gold Stocks” report. In this report, I outline six of the best gold stocks on US soil that are poised to hold strong now, and blast higher in 2017, with key entry and exit points for each stock!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: