Gold Stocks Following Bull Analogs

The gold stocks started to correct this week as large caps were off 13% at Thursday’s low. Both juniors and large caps have made tremendous gains since the January 19 bottom and are ripe for some profit taking. The Fed minutes provided the catalyst for such and we should also note the tendency for gold stocks while in a bull market to peak in May. History argues that the miners could correct at least 20% now before moving higher.

The gold stocks started to correct this week as large caps were off 13% at Thursday’s low. Both juniors and large caps have made tremendous gains since the January 19 bottom and are ripe for some profit taking. The Fed minutes provided the catalyst for such and we should also note the tendency for gold stocks while in a bull market to peak in May. History argues that the miners could correct at least 20% now before moving higher.

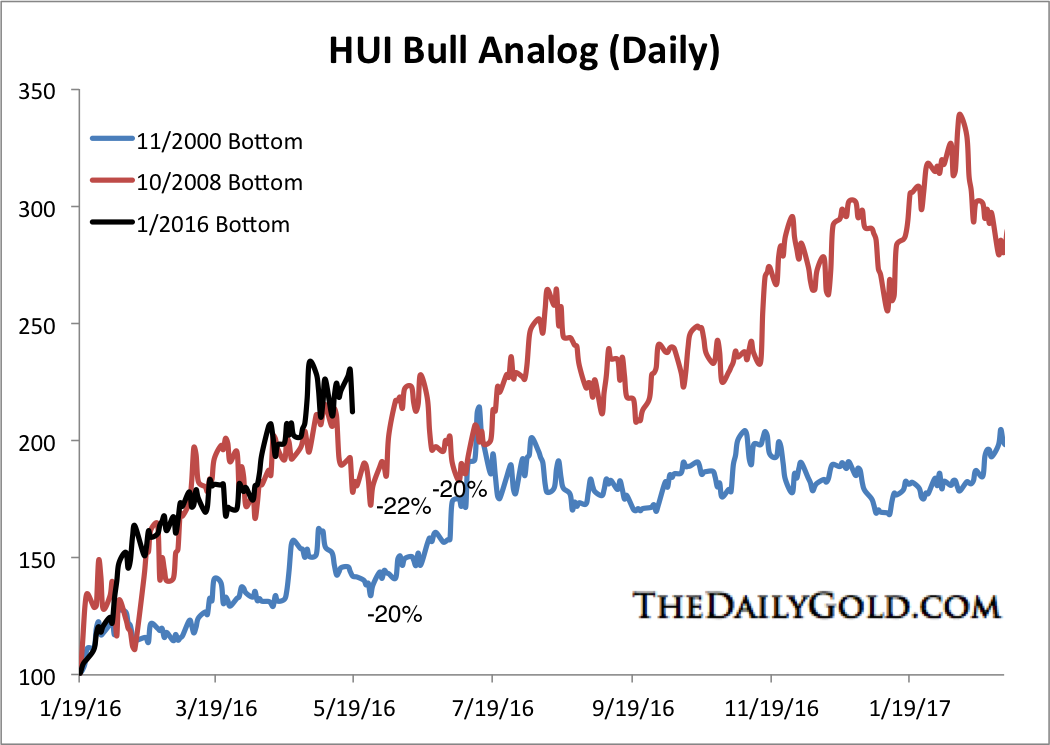

Below is the HUI Bull Analog chart which is updated through Wednesday. At this point in the 2008-2009 recovery the HUI corrected 22% and at this point in the 2000-2001 recovery the HUI corrected by 20%.

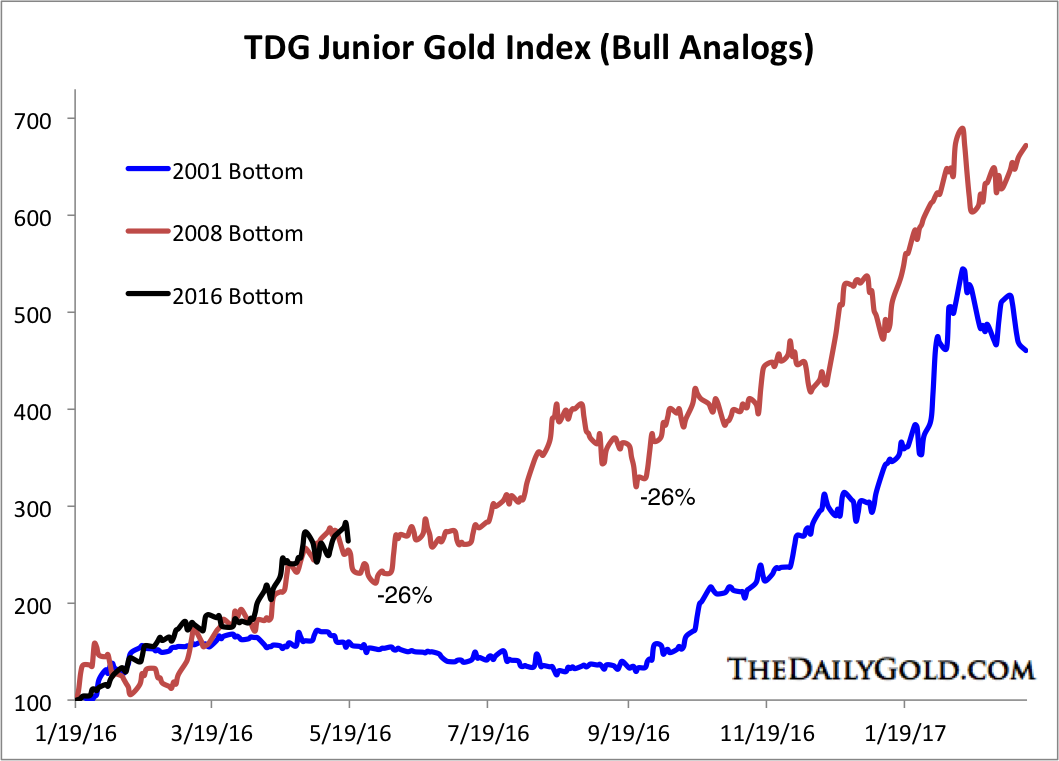

Next is the bull analog of our custom Junior Gold Index. The index contains 18 stocks and a median market capitalization of ~$300 Million. Note how the current recovery has tracked the 2008-2009 recovery with precision. If that continues, juniors would continue to trend higher while enduring two 26% corrections in the next four months.

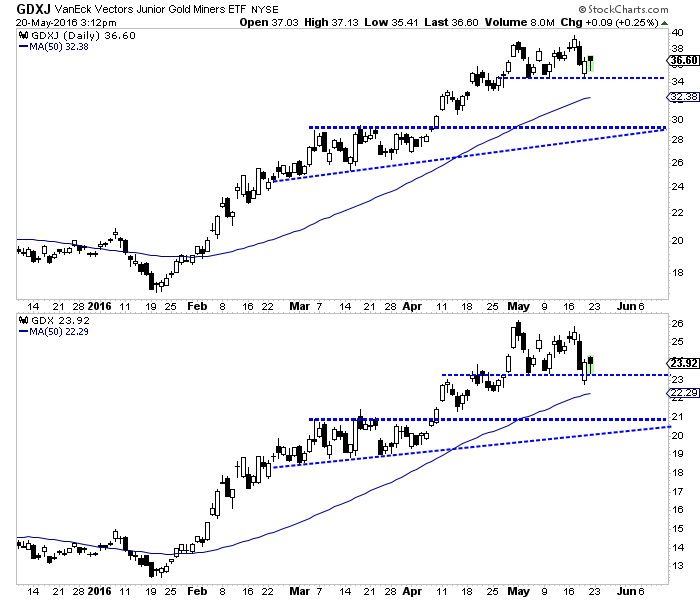

Although the analogs urge caution in the short-term, the miners will close the week on strength. The key supports are $34 for GDXJ and $23 for GDX. If the miners break support next week then look for support at $21 GDX and $30 GDXJ. Do note that GDXJ continues to show more strength than GDX.

The strong close to the week gives hope that the miners could make a final push higher although we think that is the less likely outcome. History, which is a powerful yet overlooked and ignored indicator suggests that the gold stocks should continue to correct in the days and weeks ahead. The good news for bulls, as we can see is history also suggests the gold stocks should trend higher in the months and quarters ahead. If miners become even more overbought and reach the 2014 highs then we would consider hedging. Otherwise we are content to buy and hold. Those on the sidelines are best advised to buy if the current correction reaches a 20% threshold.

********

Jordan Roy-Byrne, CMT