Japanese QE Trumps American Tapering

Precious metals market investing requires patience, and an international outlook. “We have gone on and on about the FED tapering, but if you look at the scale of what the BOJ is doing, that has huge global ramifications. I suspect behind the scenes, they are probably slowly buying more and more emerging markets debt and equities. I could imagine that is going to at least continue, if not possibly accelerate.” – Jim O’Neill, India Times, November 26, 2013.

Gold investors may be overly-focused on the possibility of an American Fed taper. My professional opinion is that the Fed will taper in 2014, and by the end of the year, the American QE program will be ended.

It’s probably time for the Western gold community to focus more on the huge quantitative easing program in Japan, and less on American QE tapering. Gold and silver prices can rise in 2014, even while the Fed tapers “all the way to zero”.

Liquidity flows from Japanese QE appear to be making their way into markets like India, and that’s inflationary. I believe Japanese QE will accelerate, and some of that liquidity should be directed at American markets in 2014.

Also, the national elections in India begin in April, and Narendra “Mr. Business” Modi may be elected. He is seen as pro-gold and pro-development.

In China and India, the younger generation is enormous, gaining wealth, and loves gold. Huge precious metals storage facilities are being constructed in many Asian countries, to handle the fast-growing demand. In America, retiring baby boomers are creating a declining employment participation rate. That puts long term pressure on the US dollar.

The growth of the middle class in China and India, against a background of Japanese QE, represents a tidal wave of gold demand. These bullish gold price drivers could make the American Fed’s “taper caper” almost irrelevant to the price of gold.

In China, the reform revolution is accelerating, which means the number of gold buyers is accelerating, and so is their buying power on a per capita basis. “The central government is relaxing its grip on the level of enterprise investment that requires its approval, with as much as 60 percent no longer needing central authorization, according to an official. The move comes 10 days after the release of a historic reform document charting China's course for the next decade.” – China Daily News, November 26, 2013.

While most gold investors think 2014 will be a terrible year, I think they could be in for a very pleasant surprise.

In the shorter term, silver looks particularly good. I own a lot of silver, but I may not own enough! Note the bull wedge breakout that’s now in play.

Also, the position of the stokeillator (14,7,7 Stochastics series) is spectacular, and very close to flashing a crossover buy signal.

I expect silver could outperform gold in 2014 by a significant margin.

That's the short term outlook for the gold. The gold price is coiling into a bullish wedge pattern.

I’ve suggested that $1228 is a good buying area, and gold bounced aggressively higher from that price zone yesterday.

It’s never wise to make statements such as, “The low is in!”, but the overall technical picture is definitely becoming more positive. I would be a light seller in the $1305 price zone.

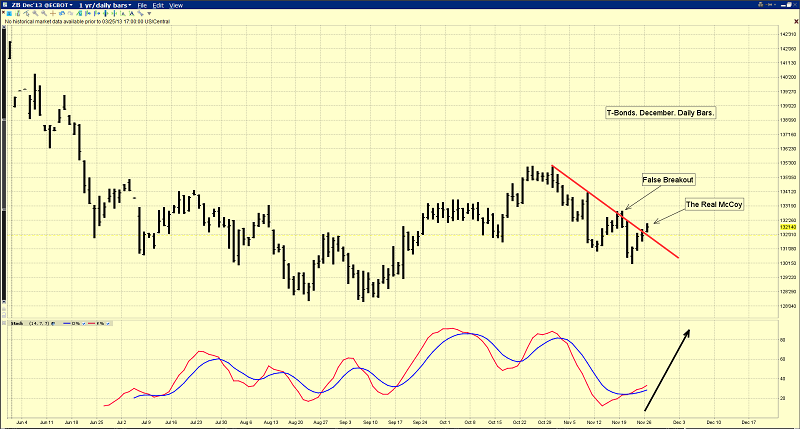

That’s the daily T-bond chart. In the short term, T-bonds are “gold’s friend”. Last week, T-bonds seemed to be on the verge of an upside breakout above the red downtrend line.

That breakout turned out to be false, but today’s move appears to be the “real McCoy” (or “real MacKay” if you are Scottish).

The lead line of the stokeillator is now at about 33, and there’s a crossover buy signal in play. That’s good news for gold.

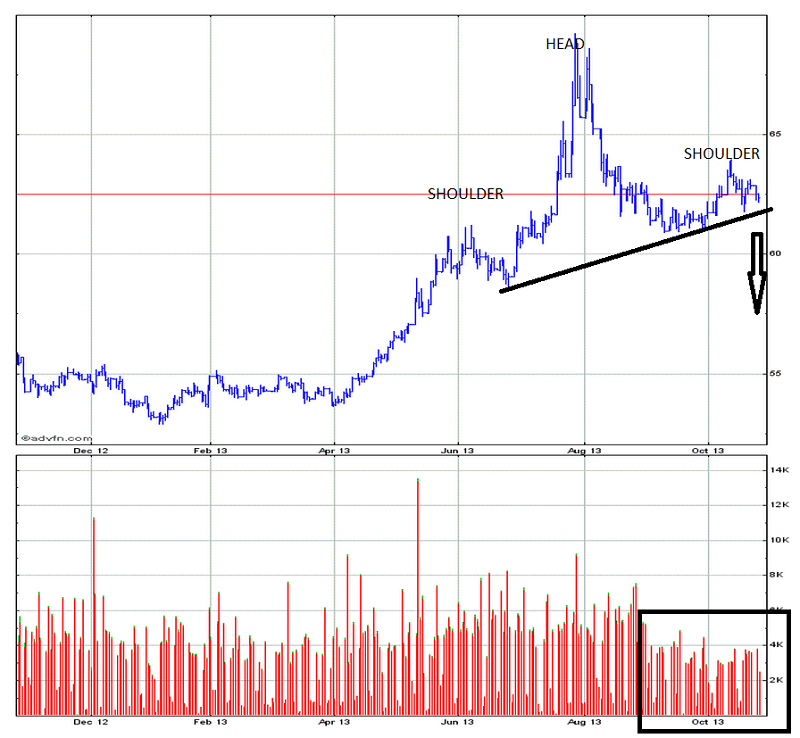

There’s more positive news for gold fans. That’s the daily chart of US dollar versus the Indian rupee.

Trading volume has dried up, and there’s a sizable head and shoulders top pattern that has ominous implications for the dollar, and positive implications for India’s current account deficit.

Many gold stock investors are wondering if heavy tax-loss selling is beginning. If so, could it push gold stock prices lower?

That’s possible, but most weak hands likely exited in the summer. You are viewing the GDX daily chart. A potential double bottom pattern is now in play.

Note how the volume on bottom #1 is higher than on bottom #2. That’s a textbook pattern, but investors should not get too excited until the price rises above the red sell-side HSR line, in the $31 area.

The GDX stokeillator is sitting at about 11. It seems “eager” to flash a crossover buy signal and move higher. In 2014, is Japanese QE likely to overwhelm American tapering? I think so. Is it possible that Narendra Modi wins the Indian national election and unleashes a record amount of gold buying by Indian citizens? Yes. Is it possible that the Chinese middle class gets bigger, wealthier, and expands their gold buying efforts? Yes. The outlook for precious metals in 2014 is not “parabola time!”, but it is more fundamentally solid than it’s been in many years.

********

Special Offer For Gold-Eagle readers: Send me an email to [email protected] and I’ll send you my free “Bitcoins Are Bullish For Gold!” report. Bitcoin currency is taking the world of fiat by storm. I own them. In this report I’ll explain what they are, and how to buy them. I’ll explain how the “bitcoin phenom” may put upwards pressure on the gold price, in the coming year!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: