Mother Of All Bubbles…US Stocks

There are eleven indisputable signs on Wall Street that US Stocks have formed the Mother Of All Bubbles! Only the financially naïve will not see these historic signs…as they are blinded by unbridled greed. Would that all intelligent investors who have gained profits for this long in the tooth bull will see and appreciate these 11 indications that the current IRRATIONAL EXHUBERANCE Mother Of All Bubbles is beginning to burst, which will herald a gathering of the stock bears…en masse.

Here following are the 11 indicators that the bears are gathering for the kill (in no particular order):

-

Price Earnings Ratio

-

Utilities Index as an early indicator of Stock Market Reversals

-

DJ Transportation Index Is An Early Indicator Of Stock Market Reversals

-

Caterpillar Stock Price as an early indicator of Stock Market Reversals

-

Treasury Yield Spread

-

Volatility Index (VIX)

-

Palladium Price Correlation with US Stock Indices

-

NYSE Margin Debt vs S&P500 Index

-

Worst Stock Crash In Lifetime per Jim Rogers

-

Stock Indices have recently broken the upward bull trend

-

MSCI World Stock Index vs SPX500

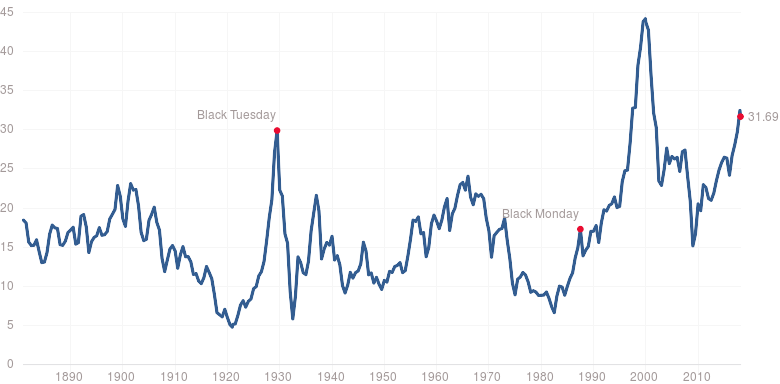

Price Earnings Ratio

One of Wall Street’s widely accepted indicators measuring the valuation level of US stocks has traditionally been the S&P500 Price Earnings Ratio. Clearly, today’s PER is one of the highest in the past 148 years (i.e. since 1870). Indeed and fact today’s PE ratio of nearly 32:1 is higher than it was in October 1929 (right before the Great Crash of Wall Street). Only naïve Pollyannas delude themselves into thinking US stocks are NOT SEVERELY OVER-VALUED.

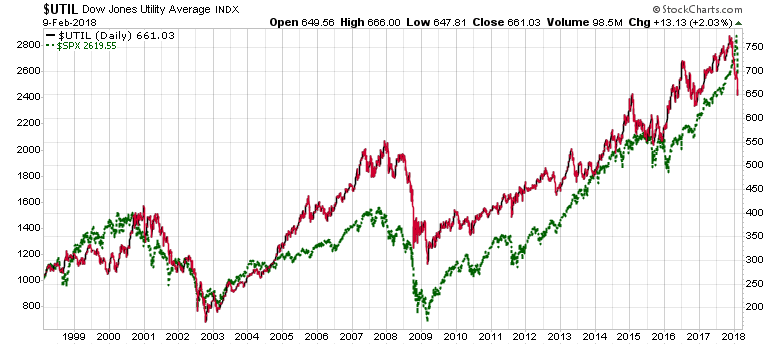

Utilities Index Is An Early Indicator Of Stock Market Reversals

HISTORICALLY, the Utilities Index demonstrates an uncanny correlation with the S&P500 Index. In fact it may be rightfully considered as an early indicator of Stock Market Reversals. In the chart below, please take particular notice how the Utility Index led US stocks in the 2000-2002 and 2007-2009 crashes in the S&P500 Index. Moreover, Utilities are again crashing in concert with US stocks…thus confirming a stock market correction is indeed in progress.

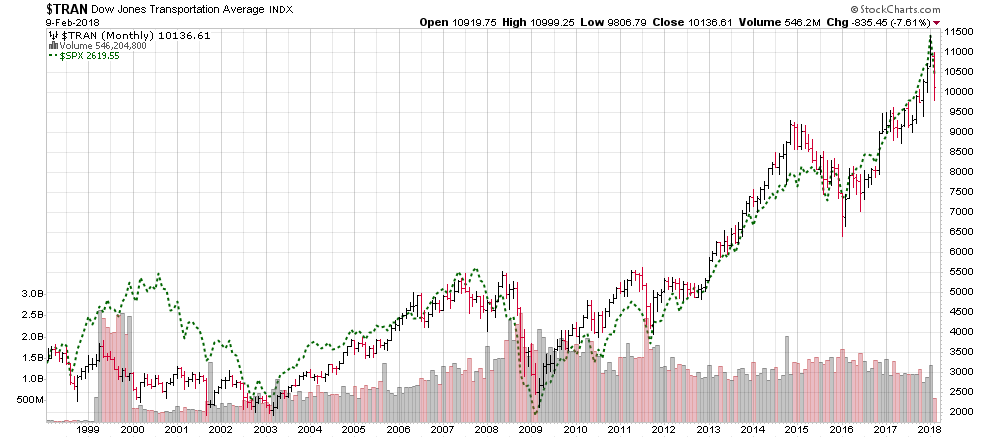

DJ Transportation Index Is An Early Indicator Of Stock Market Reversals

Like the Utilities Index, the DJ Transportation Index has also demonstrated an uncanny correlation with the S&P500 Index. In fact it may be rightfully considered as an early indicator of Stock Market Reversals. In the chart below, please take particular notice how the Trans Index led US stocks in the 1999-2002 and 2007-2009 crashes in the S&P500 Index. Moreover, the Trans Index is again crashing in concert with US stocks…thus confirming a stock market correction is indeed in progress

Caterpillar Stock Price Is An Early Indicator Of Stock Market Reversals

Summarily like the Utilities Index, the Caterpillar stock price has historically acted as an early indicator of stock market reversals. In the chart below take particular notice how the CAT stock price led US stocks in the 2000-2002 and 2007-2009 crashes in the S&P500 Index. Moreover, CAT is again today crashing in concert with US stocks…thus confirming a stock market correction is indeed in progress.

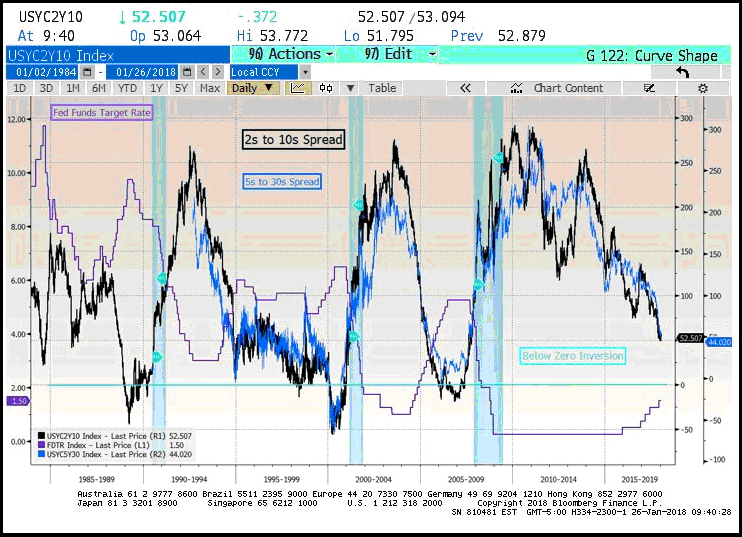

Treasury Yield Spread Chart

The last time the US Treasury Yield Spread went almost totally flat was immediately before the 2007-2008 subprime mortgage crisis. It served as the key signal, and accurately so, for what was to come in the following several months. The same warning signal is now flashing red, but (unfortunately) it is not being given much attention. The record setting stock market, and quick advances by 1000 points, and new era are catching the headlines. Market internals defy the ballyhooed story. This too will end badly. In the busy chart below, the purple series is the Fed Funds target rate. The black series is the spread between 2-year yield versus 10-year yield. The blue series is the spread between 5-year yield versus 30-year yield. Both are heading toward zero, where the red alarm will flash with sirens for all smart investors to hear the on-coming crash.

(Source: US Treasury Bonds: Fuse To Light The Bonfire

Volatility Index (VIX)

A rapidly increasing Volatility Index (VIX) is a sure sign stocks are becoming over-valued – as was noted in mid-2002 and in late 2008…which were followed by horrific stock sell-offs. Fast forward to February 2018, again we see the red light of warning that the bears may be amassing.

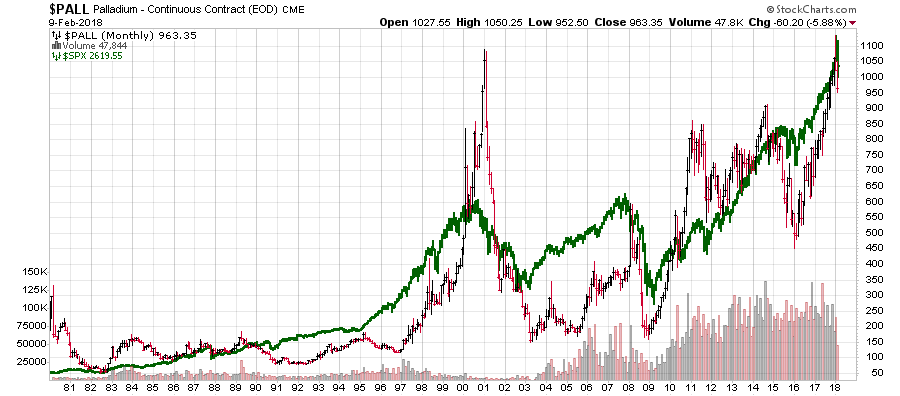

Palladium Price Correlation With US Stock Indices

For those who know, PALLADIUM is more of an industrial used metal than it is a precious metal. Indubitably, palladium is more an industrial metal than a precious metal. Here’s why per Wikpedia:

“The largest use of palladium today is in catalytic converters.] Palladium is also used in jewelry, dentistry, watch making, blood sugar test strips, aircraft spark plugs and in the production of surgical instruments and electrical contacts. Palladium is also used to make professional transverse flutes. As a commodity, palladium bullion has ISO currency codes of XPD and 964. Palladium is one of only four metals to have such codes, the others being gold, silver and platinum. Because of its ability to absorb hydrogen, palladium is a key component of the controversial cold fusion experiments that began in 1989.” (Source: https://en.wikipedia.org/wiki/Palladium)

It is imperative to appreciate that the Palladium price and the S&P500 Index have in general run parallel since 1980. Moreover, there is nothing on the horizon which might alter this in tandem movement. Furthermore, the chart below clearly shows the price of palladium has a Bearish Double Top. It is also imperative to notice palladium’s spot price has fallen substantially during the past 4 weeks This implies palladium demand is substantially diminishing, which suggests US stocks may well be subject to a sharp correction.

Moreover, the palladium chart suggests the metal might decline to 2016 support at about $450. Consequently, the S&P500 will most likely soon follow suit by plunging south…which means the rebirth of a Bear Market in stocks.

NYSE Margin Debt vs S&P500 Index

In 2001 and again in 2007 NYSE Margin Debt vs S&P500 Index peaked, which heralded the S&P500 over-valuations that marked the beginning of horrific Bear Markets. Well again early this year, this indicator has forged an all-time peak…thus spot-lighting the probable entrance of Mr. Bear. Actually, this Bear Market Indicator is at an all-time record high! Effectively, ignorant US investors have “bitten off” more Margin Debt than they can “chew” (i.e. pay back without massive margin CALL SELLING).

(Source: http://www.advisorperspectives.com/dshort/updates/2016/08/31/nyse-margin-debt-and-the-market )

Worst Stock Crash In Our Lifetime Per Jim Rogers

Legendary investor Jim Rogers sat down with Business Insider CEO Henry Blodget on the recent week's episode of "The Bottom Line." Jim Rogers predicts a market crash in the next few years, one that he says will rival anything he has seen in his lifetime. Following is a transcript of the video:

http://www.businessinsider.com/jim-rogers-worst-crash-lifetime-coming-2017-6

Stock Indices Have Recently Broken The 9-Year Upward Bull Trend

In years 2000 and 2007 the S&P500 broke below its 8-month moving average, which was the open door to a terrible fall in stock values…across the board. Well again last week the S&P500 penetrated (fell below) the same 8-month moving average (albeit a quick bounce above…due probably to massive SHORT COVERING). However, if we see continuing stock price declines in the new week, many intelligent investors (hopefully) will take their money and run. Only the greed blinded Pollyannas will turn a jaundiced eye and ignorantly await the marauding bears.

MSCI World Stock Index vs SPX500

The MSCI World Stock Index (MSWORLD) takes into account all major world stock indices (except the US S&P500 Index).

The chart of the MSWORLD shows that it has run parallel to the S&P500 Index for the past 20 years. Moreover, it clearly shows that the MSWORLD Index just peaked as the RSI technical indictor recently topped as it peaked above 70 – just as it did in 2000 and 2007, which were the open door signals to two horrific Bear Markets In Stocks…WORLDWIDE!!

Beware of the coming bear stock market!

Sage words of wisdom from the world’s 3rd richest man, Warren Buffett, whose net worth is $85 BILLION:

“I will tell you the secret to getting rich on Wall Street. You try to be greedy when others are fearful. And you try to be fearful when others are greedy.”

Needless to say it’s time to be FEARFUL AS THE BEARS ARE AMASSING IN WALL STREET!

*********