Palladium Price Is Forecasting A Decline In The US Economy

Palladium - Industrial Uses As Well As A Precious Metal

Today, understanding palladium is more important than ever, because there are important correlations between the palladium/gold ratio and stock market prices. Currently, the ratio of palladium to gold is giving warning signals for both the economy and the stock markets.

Without any doubt palladium is more an industrial metal than a precious metal. Here’s why per Wikpedia:

“The largest use of palladium today is in catalytic converters.] Palladium is also used in jewelry, dentistry, watch making, blood sugar test strips, aircraft spark plugs and in the production of surgical instruments and electrical contacts. Palladium is also used to make professional transverse flutes. As a commodity, palladium bullion has ISO currency codes of XPD and 964. Palladium is one of only four metals to have such codes, the others being gold, silver and platinum. Because of its ability to absorb hydrogen, palladium is a key component of the controversial cold fusion experiments that began in 1989.” (Source: https://en.wikipedia.org/wiki/Palladium )

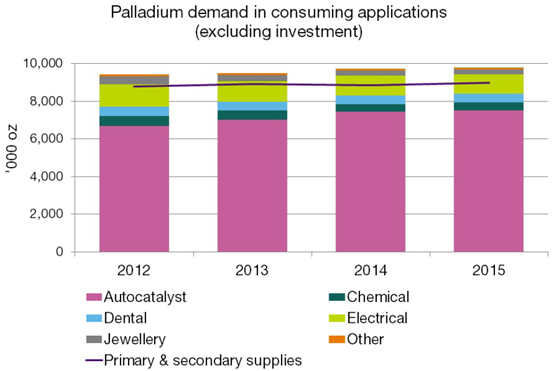

Only a small portion of total palladium demand is attributed to its precious metal characteristic…as shown per the following table of uses.

(Source: http://www.napalladium.com/palladium/supply-and-demand/default.aspx )

Palladium Versus Gold as An Economic Indicator

“Though it is less popular and beloved by investors than gold is, palladium is actually a far better economic indicator. This is because palladium happens to be the most industrially used metal of the precious metals class. While the demand for palladium is overwhelmingly derived from industrial uses and sources at approximately 90% of its allocation, gold receives less than 10% of its demand from industrial applications. Palladium owes much of its popularity to emission controls. Though platinum is perhaps better known for its uses in catalytic converters, palladium has become the main emission control catalyst in vehicles using gasoline. This has a lot to do with the fact that palladium is less expensive than is platinum. Palladium is also widely used in electronics of all kinds because of its excellent conductivity and durability.

The importance of palladium became more obvious after the end of the Great Recession. In a significant amount of the time following the after 2008 crisis years, palladium outperformed its cousins the other precious metals, all of which had strong performances. Strong and gradually increasing demand from China and other emerging markets drove palladium prices. Emissions controls became more common in gasoline vehicles and palladium continued to grow its market share of these controls and other electronics. The icing on the palladium cake turned out to be threatened and tight supplies from main palladium mining and producing countries Russia and South Africa.”

Palladium Versus Gold Ratio Sounds Warning Alarms For The US Economy

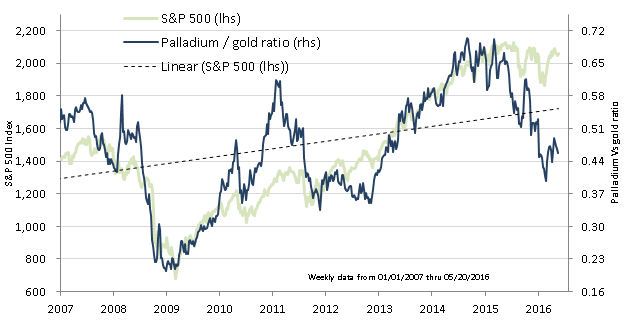

The palladium to gold ratio is important because of some of this ratio’s other correlations. In fact the palladium versus gold relationship is related to both the US stock markets and global GDP levels. There is a strong trend between palladium to gold and the direction of both stock markets and GDP. Consider that the price of palladium has collapsed over the last year vis-à-vis gold. From March in 2015 to end of May in 2016, the Palladium/Gold ratio has plummeted from 0.70 down to the present approximately 0.44. This is a shocking decline of 37% in about a year’s time. You can see this sharp move downward over the last year on the chart here:

Source: http://sophisticatedinvestor.com/palladium-versus-gold-ratio-sounding-warning-alarms-economy/

Here below is a long-term 36-year chart of the Palladium price super-imposed with the S&P500 stock index. Clearly, the S&P500 runs in tandem with the price of palladium. In fact this industrial metal might be considered a leading indicator of the US economy. Moreover, it is imperative to notice the price of palladium has been declining since mid-2014, while the S&P500 Index has levitated higher…indubitably fueled by the US Fed via Quantitative Easing with a view to giving the impression all is well (when in actuality the US economy is faltering on many fronts). Therefore, if history is testament, US stocks will again follow the price of palladium downward (as the S&P500 did in 2000-2002 and 2007-2008 bear market periods).

Palladium Short-Term Price Forecast

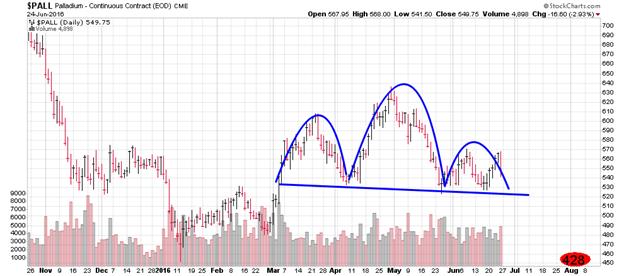

The daily palladium chart shows a bearish Head&Shoulders pattern in formation. In the event the neckline at $532 is cut, palladium would have a downside price objective of about $428.

http://stockcharts.com/h-sc/ui?s=$PALL&p=D&yr=0&mn=8&dy=0&id=p95537562586&a=464420962&listNum=2

BREXIT Fait Accompli Heralds Bear Market For Stocks…Worldwide

On June 23 the UK approved the BREXIT, which paves the way for the collapse of the ill-fated Euro Union. Indubitably, this will generate severe economic havoc worldwide. A realistic sign of what looms on the horizon are the stock market reactions on June 24, 2016. Stock markets on all continents were mercilessly hammered down globally. US stock indices plummeted on average -3%...while European stock indices tumbled between -3% to -8%. Furthermore, Asian stock declined -2% to -8% (Nikkei). It’s an international stock market rout of epoch proportions. And while panicked investors stampeded to the safe havens of gold, silver and platinum (up $62, up $0.48 and up $19, respectively), contrarily, PALLADIUM sold-off -$16 on Friday…duly reflecting the declining trend in industrial usage…especially now in the wake of BREXIT!

Conclusions

Palladium price and the S&P500 Index have in general run parallel since 1980. Moreover, there is nothing on the horizon which might alter this in tandem movement. Furthermore, the chart above clearly shows the price of palladium is in decline for NEARLY TWO YEARS. Moreover, the palladium chart suggests the metal might decline to about $428 if the bearish Head&Shoulders neckline is cut. Consequently, the S&P500 will most likely soon follow suit by heading south…which means the rebirth of a Bear Market in stocks. All the above is supported by other technical factors signaling that a Bear Market looms on the horizon. One of the most convincing signs is the chart showing a BEARISH TRIPLE Top of the Dow Stock Index:US Bond ratio. The last TWO times this ratio topped, ravaging Bear Market in US stocks began:

Based upon the above rationale, the Dow Stocks Index might eventually be hammered down to old support at about 7500.

********

Related Palladium Articles

US Stock Market Breaks Long-Term Uptrend

A Bear Market In US Stocks Looms…Indeed A Déjà vu 2007-2008

Brexit As A Roadmap...For YOU!

PALLADIUM Price Forecast Factors