The Relationship Between Money Supply And Stock Prices

Internationally known bond strategist Hunkar Ozyasar makes a scholarly and comprehensive description of the material influence Money Supply has on Stock Prices:

Internationally known bond strategist Hunkar Ozyasar makes a scholarly and comprehensive description of the material influence Money Supply has on Stock Prices:

“Money supply is one of the most basic parameters in an economy and measures the abundance or scarcity of money. Stock prices tend to move higher when the money supply in an economy is high. Plenty of money circulating in the economy both makes more money available to invest in stocks and also makes alternative investment instruments, such as bonds less attractive.

Money Supply

The amount of money in an economy is referred to as the money supply. This consists of far more than the bills and coins circulating. In fact, the physical money makes up less than one-tenth of all the money in a typical, developed economy. The rest of the money in the economy is virtual. The unused line of credit in your credit card account or in that of a large corporation's commercial bank account are considered part of the money supply because these can be used just as readily as bills and coins to buy goods and services. Economists keep a close eye on money supply because this figure determines the purchasing power and therefore potential demand for products and services.

The Fed and Interest Rates

The U.S. Federal Reserve Board, often referred to as the Fed, can control money supply through a number of measures. The primary method used by the Fed involves buying and selling Treasury Bills. This results in either withdrawal or addition of money into the economy. The immediate result is a change in interest rates. When there is a lot of money around, it becomes cheaper to borrow it. When the money supply is low, not many individuals and institutions will have funds that they can lend out. The borrowers must, therefore, offer higher interest rates to be able to borrow. Interest rates are often referred to as the cost of money.

Interest Rates and Stocks

An increase in money supply and the resulting drop in interest rates makes stocks a more attractive investment. When investors can only obtain a low level of return by lending money, whether to a bank or a corporation or by purchasing Treasury bills, they tend to shift more money to stocks. This is often referred to as chasing yield. Imagine an investor who calculates that he needs $500,000 to retire comfortably in 10 years, but has only $400,000 in his retirement account. If bank deposits offer a 5 percent annual interest rate, simply keeping the money in the local bank will result in a balance exceeding $500,000 in 10 years. But if bank deposits yield 2 percent or less, the investor will look for riskier, yet potentially more profitable alternatives, such as stocks.

Increased Demand

An additional reason stocks do well when the money supply is high is the increase in general demand in the economy. When the borrowing rates are low, mortgage rates also decline, making homes more affordable and increasing demand for such items as TV sets, washing machines and so on. Car sales also go up when the financing rates drop. The lower rates partially trickle down to interest rates charged on credit card purchases, and consumers purchase more of essentially every imaginable good and service. The result is an increase in sales for most companies, which increases profits and usually results in higher stock prices.” (Source: http://finance.zacks.com/relationship-between-money-supply-stock-prices-7764.html )

An Exemplary Example of the Commanding Influence of Increased Money Supply on Stocks

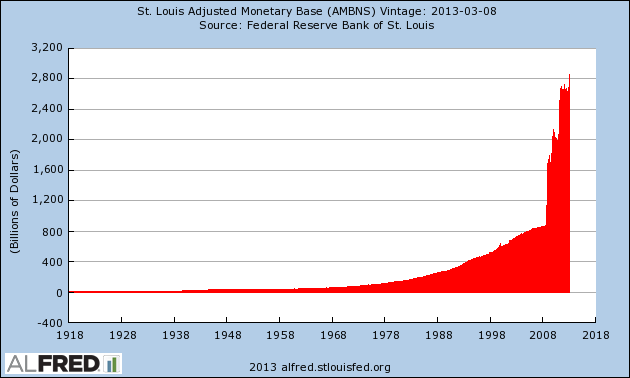

In late 2007 the US economy was rapidly sliding into recession. Consequently, US stocks went into a nose dive. During the next 9 months, the DOW Index plummeted about 2,800 points (a horrific loss of -20%). The Fed in its fear that this bear market rout might deteriorate into a full-blown BEAR MARKET CRASH, made the decision to dramatically increase the Money Supply. The Fed’s objective was to dramatically increase liquidity with a view to shore up Wall Street stocks values. The chart below clearly shows that Money Supply was materially increased in August 2008. And since late 2008 the Fed has relentlessly increased the Money Supply (M1), which indubitably fueled the DOW Index advance (and most Wall Street stocks) during the past 8 years to the recent all-time highs.

http://stockcharts.com/h-sc/ui?s=%24%24M1&p=W&yr=12&mn=0&dy=0&id=p08129851324&listNum=1&a=467865370

Ways The Fed Increases Money Supply

- Open Market Operations

- The Discount Rate

- Reserve Ratios

Yes, The Fed Does Also Directly Influence the Broad Money Supply Through QE

Additionally, the Monetary Base has been pumped up by the Fed – as the following two charts demonstrate.

Indeed The Fed Money Creation Fueled Artificial Stock Gains from 2008 to the recent all-time high.

Excessive Increases In Money Supply Can Lead To HYPERINFLATION

Germans Must Remember the Currency Tragedy of the Weimar Republic from 1918-1924

Avid students of economic history remember what happened in the Germany in 1920s, which then was referred to as the Weimar Republic HYPERINFLATION.

Avid students of economic history remember what happened in the Germany in 1920s, which then was referred to as the Weimar Republic HYPERINFLATION.

In the long run, inflation is determined by the growth rate of the money supply. This cycle tends to happen when citizens lose all faith in the government or as a result of extremely high government overspending during a war. When a government overspends, it must borrow from a central bank to make up the difference, leading to a rapid rise in the money supply. This causes a shortage of products and services and erodes the value of the money, which drives prices up dramatically; not by the amount that most of us are used to when gas prices go up or when food prices go up but an extremely fast rise in the prices of everyday necessities.

The great economist Milton Friedman said that 'inflation is always and everywhere a monetary phenomenon.' In order to explain the link between inflation and the money supply, economists use what's called the quantity theory of money. It centers around the quantity equation.

After the First World War, prices in Germany’s Weimar Republic soared at an unbelievable rate of 855 million percent per year! Moreover, its currency became well-nigh WORTHLESS…as the graph below attests.

Students of German history will certainly remember what happened during the Hyper-Inflation of the Weimar Republic from 1918-1924 when German paper Marks became virtually WORTHLESS (See above chart):

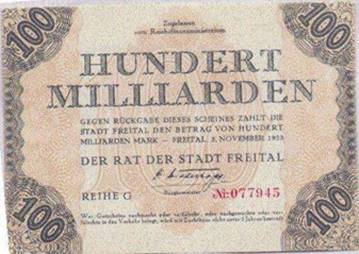

Moreover, the following will give the reader an idea of the viral currency inflation (monetary debasement) that plagued Germany from 1918-1924). Here is a photo of a German banknote for 100 Million Mark.

This near WORTHLESS bill represents 100 million. In fact, in November 1923 One Billion would only buy 3 pounds of meat, or; 2 glasses of beer, or; one loaf of bread.

(Source: https://www.gold-eagle.com/article/ultimate-demise-euro-union )

Related Articles