Speculative Bubbles And Intermediate Gold Targets (Part 1)

The Pause Before A Finale

The Pause Before A Finale

It’s my belief that the gold and silver bull market has been taking a well-deserved respite before it enters the final rally phase, conceivably ending in a speculative mania. Precious metals appreciated significantly into 2011 from their bear market lows of the 1990’s, but the traditional signs of a speculative bubble were absent. Fundamentally gold and silver prices must be revalued as a reckoning for the colossal mismanagement of currencies by governments worldwide. in In my opinion this revaluation will likely end in a speculative bubble for both gold and silver prices.

Speculative Bubble Defined

What is a speculative bubble or mania? Paul Krugman says, it is described as a situation in which asset prices appear to be based on implausible or inconsistent views about the future. An example would be the tech bubble of the late 1990’s. During this bubble, any company with “Dot-com” in their title rocketed higher to amazing levels, regardless of fundamentals. Investors at that time believed that this phenomenon was the “new normal” and that the ridiculous valuations were a product of the “new economy.” During speculative bubbles investors ignore earnings, price ratios, and even common sense; they are immersed in the excitement and no longer think rationally.

One of the first recorded manias emerged out of the Dutch golden age around 1637. Then tulip bulbs were the epicenter of a real frenzy; it’s reported that some tulip bulbs sold for ten (10) times the annual salary of a skilled Dutch craftsman.

Human Nature Causes Bubbles

Speculative bubbles begin and are then subsequently fueled by the rawest of human emotions…fear and greed. The psychology surrounding these events submits that human nature is in fact entirely predictable. Most individuals are followers, similar to lemmings, never really thinking for themselves…they simply do what everyone else before them has done. The fact that you’re reading this encourages me and I applaud you!

It’s because of our inherent need to be accepted human beings inevitably conform, forever giving rise to our modern trends and occasionally speculative manias. Near the climax of the speculative bubble almost everyone has been involved, some learn stories about friends or neighbors getting rich and want their share of the pie. The fear of missing out overpowers the masses as more and more inevitability buy-in.

Intermediate Gold Price Update

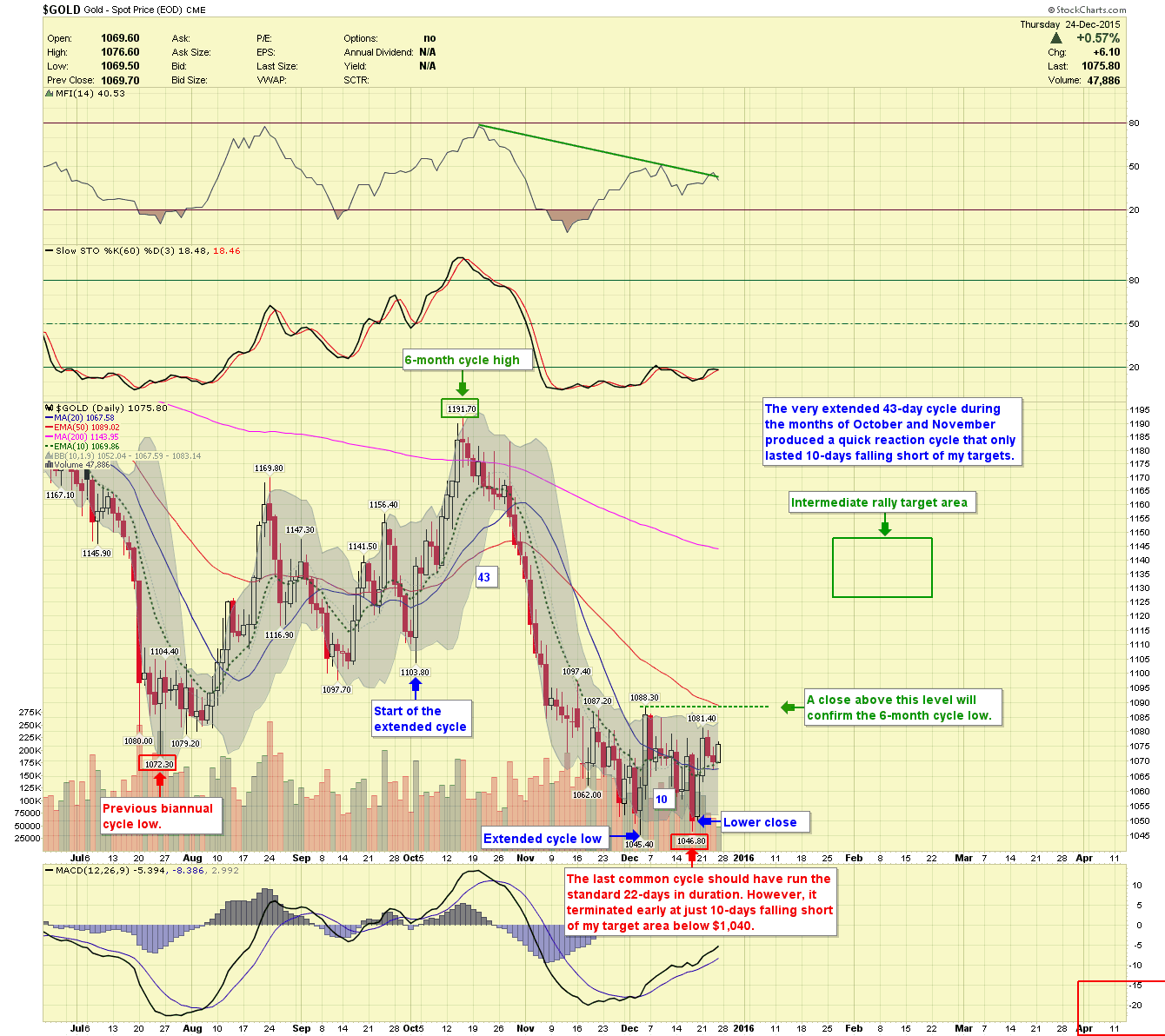

Metals and Miners have run out of time to reach my target areas by year-end. After reexamining the price structure, I adjusted the count slightly and believe the 6-month cycle lows for both metals and miners has arrived.

Gold Daily Chart: The common cycle for gold lasts approximately 22-trading days. 4 or 5 common cycles make up a 6-month cycle, sometimes referred to as the biannual cycle. The cycle starting in early October extended to 43-days, well past normal. Because of this the following cycle aborted quickly at just 10-days, failing to reach my target area below $1,040 by a few dollars.

Gold Weekly Chart: The weekly chart of gold shows a 6-month cycle low of $1,045.40 and a small bullish engulfing pattern forming this week. Prices will likely head to the 50-week average from here, and I have an initial target estimated in February. IF prices top in February as expected for prices to fall until April or May of 2016, potentially testing the $1,000 level in gold.

In Part 2 we will look at the factors that will make the next bubble different. Additionally, we will investigate various ways to invest.

********

Visit us at: www.BuyGoldPrice.com