The Ultimate Conspiracy Theory "The People are Out to Get U.S.!"

"Anti-government extremists opposed to taxes and regulations pose a growing threat to local law enforcement officers in the United States, the FBI warned on Monday. These extremists, sometimes known as "sovereign citizens," believe they can live outside any type of government authority, FBI agents said at a news conference. The extremists may refuse to pay taxes, defy government environmental regulations * and believe the United States went bankrupt by going off the gold standard *."

I know what you're thinking; this statement from the FBI is the Justice Department's opening salvo for the prosecution of Jon Corzine for stealing over a billion dollars from his clients at MF Global: but you are wrong. The tipoff they are talking about you and me, and not members of some LA street gang or a renegade US Senator, is the FBI's spokesman said they are targeting people who they believe; * believe * they can live outside * any type * of government authority." I don't believe that, and suspect I attract readers who don't either. But when politicians and police begin to regulate lemonade stands, and who knows what else; it's time for a major roll back of government from our daily lives. It's the desire to be left alone to manage our own affairs is what the FBI is actually warning against.

I know what you're thinking; this statement from the FBI is the Justice Department's opening salvo for the prosecution of Jon Corzine for stealing over a billion dollars from his clients at MF Global: but you are wrong. The tipoff they are talking about you and me, and not members of some LA street gang or a renegade US Senator, is the FBI's spokesman said they are targeting people who they believe; * believe * they can live outside * any type * of government authority." I don't believe that, and suspect I attract readers who don't either. But when politicians and police begin to regulate lemonade stands, and who knows what else; it's time for a major roll back of government from our daily lives. It's the desire to be left alone to manage our own affairs is what the FBI is actually warning against.

As far as going after Senator/Governor Corzine, it's not going to happen as far as the Obama's Justice Department is concerned. There are political calculations in this, and calculating politically costs more money than you and I will ever have, but exactly the kind of money Mr. Corzine, and his friends, can rise in a few days for President Obama. Contrary to widely held public opinion, Wall Street is largely a democratic institution, and has been since Boss Tweed ran city hall in the 1860s & 70s. Obama is not going to risk hundreds of millions of his campaign's expected funding for the 2012 elections by prosecuting one of his largest fund raisers, Jon Corzine. The government will continue to stall its Corzine investigation, as it did with each of the Clinton era scandals, until MF Global becomes ancient history, as did the Whitewater scandal, or so they hope.

No debate on the virtues limited government is possible with people who hold the majority of law-biding citizens in total contempt. The federal, state, county and city governments will continue growing, writing paychecks to a growing number of people who are very willing to keep the "ignorant masses" in-line for our own protection. This press conference by the FBI places everyone on notice that Washington is big and is going to get much bigger, with or without our approval. Today, any opposition to the grand schemes of politicians and their unaccountable bureaucrats is an act of "extremism" that will not be tolerated by Washington's entrenched bureaucracy.

To hear this from the FBI is bad. But having Reuters, and other news agencies, who must have been present, not demand from this FBI official some clarification of exactly who they were talking about, or say nothing in defense of the personal freedom the US constitution guarantees the humblest American, is just another milestone along the road we are now traveling.

We see in all this an expression of the ultimate conspiracy theory held by two classes of our ruling elite: the US Government's "law enforcement" officers and the main-stream media; both believe "dark forces" in the general population are out to get them. It's comical that both groups fail to see how they lack the moral authority to threaten scofflaws, when they protect absolute scoundrels like the "Honorable" Jon Corzine. It's also unfortunate that the average person on the street fails understand why this is; Jon Corzine is a member of America's elite political class, a person of influence in the highest circles of power in Washington, friend to both Democrat and Republican office holders: PLUS HE IS A FORMER CEO OF GOLDMAN'S SACKS. Trust me, I got the spelling correct.

If America's "high-and-mighty" were honest with themselves, they would admit their greatest fear is that the unwashed masses will one day wake up and demand an accounting from those currently controlling the nation's purse strings, and the US dollar itself. So we see here, the need for the above FBI statement to the dreaded "sovereign citizens", aka, people who still expect Washington should be accountable for what they do.

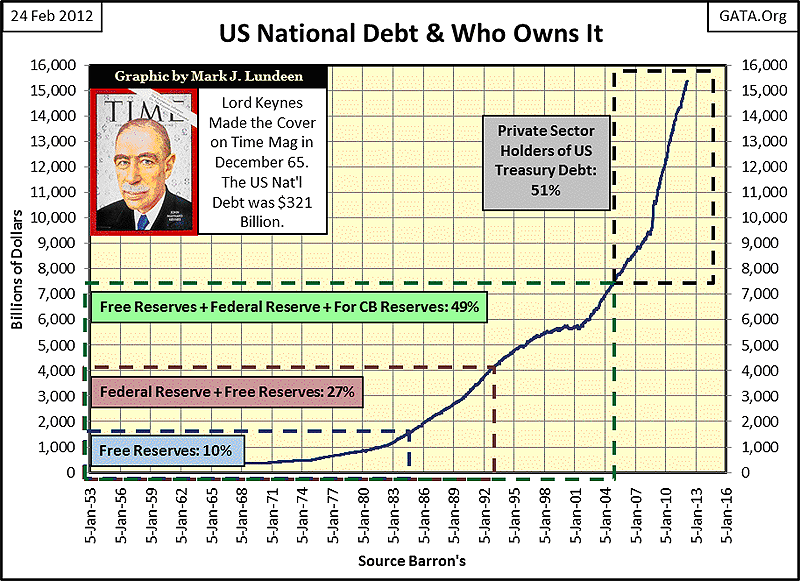

Item #1 on my list of things * we should all be afraid of * is the extent banks have monetized the US national debt. The Federal Reserve has monetized more than 100% of the US national debt that existed when Alan Greenspan was selected to chair the Federal Reserve, as we see in the table below.

To understand the implications of this, one has to understand that the money our banking system lends to you for credit-card debt or mortgages is no longer the savings of widows and orphans, but created effortlessly on a computer keyboard. A dollar or a billion dollars to be lent to you, me or the former Greek government (at low interest rates a free market would never allow), takes no more time or effort than for me to write this paragraph. The Federal Reserve has only to "monetize" the unpaid bills of the US Government to create the unlimited bank credit that now pollutes global balance sheets.

The hard part of the credit cycle comes when "consumers" must use their wages and income to service debts to their bank, with interest. So, this is how banks today actually do get something back for the nothing they lend out. Unlike the Federal Government's Federal Reserve, debtors know it's much more difficult to earn a billion dollars than just one. If you want to see why the world is drowning in debt, or why in our world of ever-rising income everyone feels so poor, one only has to see the extent the US national debt has been monetized in my next chart. And this is just the US T-debt central bankers have monetized; the mad-dog of monetization, Doctor Bernanke, has also "monetized" a significant portion of the insolvent US mortgage market too!

I placed Lord Keynes' Time magazine cover December, 1965 in the chart. And due to the total chaos central banking finds its self in 2012, I'm also nominating both Lord Keynes' earthly remains and the FBI for Time Magazine's man of the year for 2012. "Policy" has always been about "teamwork" and need of team-members not to "rock-the-boat." So, in this time of growing doubt, and general fear of things to come, this is a great team to maintain confidence in the world's reserve currency.

So what is so great about Lord Keynes? Absolutely nothing! He didn't invent the idea of monetizing government debt. Credit for that goes to John Law who in the early 18th century devised a monetary system based on France's national debt. Law's debt-back money ended in disaster, and ultimately to the French Revolution decades later. France didn't restore its finances again until Napoleon devised a new monetary system backed by cannon, infantry and plunder. Keynes, a Fabian Socialist, earned his place in monetary history by recognizing the short comings of the gold standard, and keeping dumb of John Law. The problem with gold, as Keynes saw it, was that it limited the growth of government, the expansion of credit (debt) by a nation's banking system, and worst of all, limited the employment opportunities of fellow economists to manage "policy" in government. This may sound like a clever little quip, and it is, but it is also true.

In the first third of the 20th century, Europe's and American academics began demanding more say in the affairs of the world. Limited government and sound money had little attraction to the modern college professor who want to "make a difference" then or now. Former president of Princeton University, Woodrow Wilson (also 28th President of the United States) who after giving the United States the income tax and the Federal Reserve, moved on to tell the world what to do. Academics in the early years of the 20th century greatly contributed to the economic theories of Fascism, National Socialism, and Communism, as they still do today, with pay checks financed with the inflation seen in the chart above. This is why economists today have no love for gold. With a college education required in any management position in the public and private sectors today, it's no wonder everything is a mess, with a professional class more concerned with "compliance" to the bureaucracy's apparatchiks than with profits in a free market.

Keynes' great contribution to economics was in popularizing the idea of monetizing the US Congress' unpaid bills, which in the 1930s were tiny compared to what they were when Time placed him on its cover in 1965. When Roosevelt was first sworn in as president, the US national debt was only $16.8 billion, a real outrage at the time, so much so that FDR actually ran for office promising to cut the national debt. By December 1965, the national debt had expanded to $321.5 billion, and except for crazy-gold bugs, everyone was comfortable with the idea that ours was a world where Washington's debts would only grow larger and be either rolled over or monetized by the Fed - and they were right. This $321 billion was finally monetized by Doctor Greenspan by November 1993.

Do I think the FBI reads my stuff? I hope they do, because taking the US dollar off the classic gold standard * DID * bankrupt the United States, as the gold standard was the only effective check on the re-election ambitions of America's entrenched political class, who finance their programs with inflationary funding from their creation: the Federal Reserve.

It's a bad world we live in, I wouldn't doubt it if the major, but unspoken reason for the trillion dollar annual deficits Washington runs is largely motivated by Doctor Bernanke's need to have sufficient debt to monetize for his future quantitative easing programs needed to "save the banking system." Geeze Louise, this mad man, and his esteemed colleagues in central banking, have already monetized America's national debt up to the first month of George W Bush's second term as president; January 2005, look at my chart above! And for all this, these evil men think they are entitled to the gold of the Greek people?

"You are a den of vipers and thieves. I intend to rout you out, and by the eternal God, I will rout you out! ..."

- President Andrew Jackson: To a delegation of bankers discussing the Bank Renewal Bill, 1832

To all special agents who may read this, and love and care for their family and friends, it's the lack of a honest dollar that will eventually take the FBI from its honorable role of protector of honest citizens, and their property, and make them romper-room attendants for Washington's greater daycare center. No one in Europe or North America will escape the fate of Greece unless something changes. Something sensible like letting failed government policies fail, that plus insisting that unserviceable-illiquid debt be written off, not monetized for the purposes of creating ever more debt that by intent, can never be paid off by college students, young parents, or the people of Greece.

Mark J. Lundeen

25 February 2012