What An Increase In M&A Activity Among Gold Miners Could Mean

Strengths

- Gold traders were bullish for a second week on speculation a weaker dollar may support gold demand.

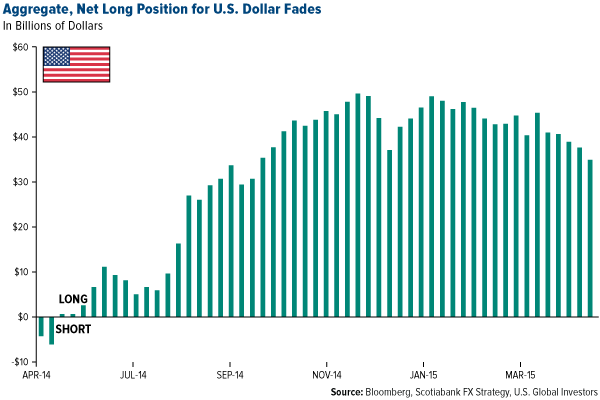

- As the U.S. dollar has seen sustained retrenchment lately, the “smart money” is taking the bullish-dollar bets off, as CFTC data show the value of positive bets in the futures pits have fallen to four-month lows.

- Bullionvault’s Gold Investor Insight rose in April as clients added the most metal in 20 months.

Weaknesses

- Investors sold the most gold from bullion-backed funds in anticipation of this week’s employment report potentially showing stronger job growth.

- Gold has posted three straight months of losses, the longest slump since December 2013. The latest payrolls report, which showed a net increase of 223,000 for April, added to recent pressure on gold.

- Societe Generale deemed gold an unreliable hedge against geopolitical risk saying the metal’s performance in periods of regional military conflicts is mixed at best.

Opportunities

- RBC published a piece looking at the next gold price cycle post an initial Fed rate hike. The firm retained a $1,250 per ounce price for 2015 in anticipation of a stronger price in the second half of the year. Further, RBC believes an initial Fed rate hike has already been priced into gold at $1,150 to $1,175. The firm also believes key Asian physical markets are likely to remain supportive, and that if the initial rate hike were to be pushed back into 2016 we would see a significant upward move in gold.

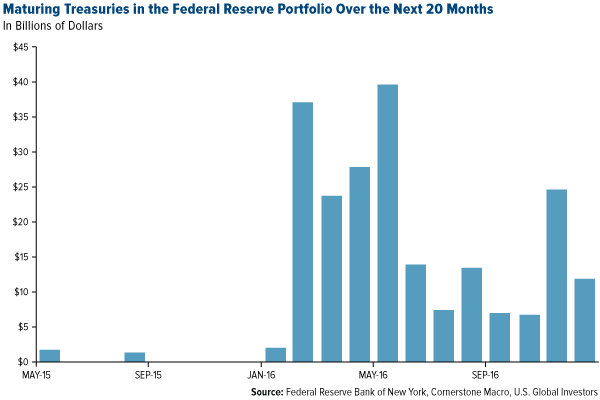

- Did you think quantitative easing (QE) had ended? In spite of having “ended” QE in October of last year, the Fed has continued to purchase about $30 billion of securities per month in order to offset maturities and reinvestments and keep its balance sheet constant. Cornerstone Macro notes the Fed will face a sort of “balance sheet cliff” next year, whereby a lot of Treasury securities in its portfolio will start maturing (see top chart below). The Fed is very unlikely to go off such a cliff and it will most likely “reverse taper” the cessation of reinvestments. Note that the Fed’s portfolio of bonds maturing in 2017 and 2018 surges, as shown in the second chart below, which means that Fed purchases of Treasuries and MBS securities are likely to continue for a lot longer.

- According to BCA, gold-mining stocks can increase in value despite the price of gold remaining range-bound. Given current low gold prices, companies have been cutting costs, reducing debt and giving serious thought to improving their allocation of capital. This is leading to increased M&A activity among gold miners looking to acquire quality assets. These mergers should result in rationalization of production and deliver earnings growth to survivors.

Threats

- South Africa’s biggest mining unions are seeing who will blink first as pay talks with gold producers become the latest battleground for membership. Both the National Union of Mineworkers and its fastest growing rival, the Association of Mineworkers and Construction Union, are overdue in presenting their demands to companies including AngloGold Ashanti and Sibanye Gold. The trade union that submits its demands last may get an opportunity to meet or exceed the demands of the other or differentiate its demands.

- Governments around the world are making it more difficult to save and transact with cash in their latest attempts to financially suppress their citizens. Their goal is to force citizens to deposit cash and charge interest as well as having total control over the money on deposit. In France, individuals will not be allowed to make cash payments exceeding 1,000 euros. Additionally, cash deposits and withdrawals totaling more than 10,000 per month will be reported to the anti-fraud and money laundering agency. Spain has prohibited cash transactions over 2,500 euros. In Sweden and Denmark the use of cash is being steadily eliminated. In Israel, individuals and businesses are still allowed to make small cash transactions, but eventually all transactions will be converted to electronic forms of payment.

- The U.S. trade balance was much weaker than expected, with the deficit expanding to $51.4 billion in March from $35.9 billion. As a result of the weaker trade data, Bank of America Merrill Lynch has cut its Q1 GDP tracking estimate to -0.5 percent, down from 0.1 percent.

********

Courtesy of http://www.usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of