Canada Wildfires Still Not Reflected In Official Oil Inventories

A month and a half after they began, the Fort McMurray wildfires in Alberta, Canada still blaze on in contained patches. Already estimated to be the most expensive disaster in Canadian history, costing the Albertan economy $70 million per day, the fires are now believed to be the (criminal) work of humans, according to the Royal Canadian Mounted Police (RCMP).

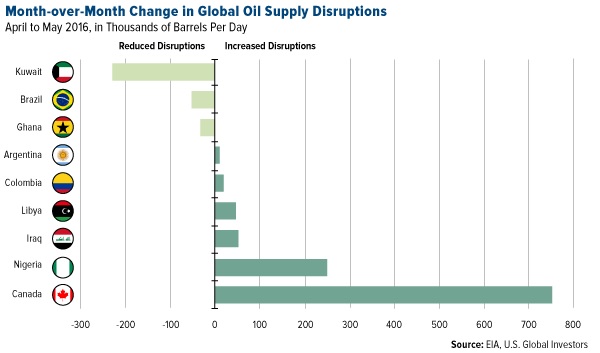

Regardless of how it started, “the beast,” as some call it, has been a major disruptor to oil sands operations north of the fires. Affected exploration companies are looking at a collective loss of more than $1.4 billion. The U.S. Energy Information Administration (EIA) estimates that an average of 800,000 barrels per day in production were taken offline last month, contributing greatly to May’s having the highest monthly level of unplanned global oil supply disruptions since the agency began tracking such data in 2011.

Altogether, 3.6 million barrels per day were lost in May around the world, nudging crude prices up to levels we haven’t seen since July of last year.

This month, disruptions caused by the fires are expected to average 400,000 barrels per day. Many companies such as Suncor Energy, ConocoPhillips Canada, Syncrude Canada and Athabasca Oil have returned to the oil sands and are now beginning to pump crude again, but it will be weeks before they resume full production.

Similarly, it will be days before the disruptions “show up” in the official inventories at Cushing, Oklahoma, the largest commercial storage hub in the U.S. When this happens, it might prompt investors to buy crude based on lower inventories, even if only in the short term, helping to lift prices even more.

All Pipes Lead to Cushing

A lot of Canadian oil—not to mention crude from North Dakota and gas from Pennsylvania—bottlenecks in Cushing, Oklahoma, where it’s all stored and blended. From there it’s dispatched by rail and pipelines to refineries in the Gulf of Mexico and elsewhere.

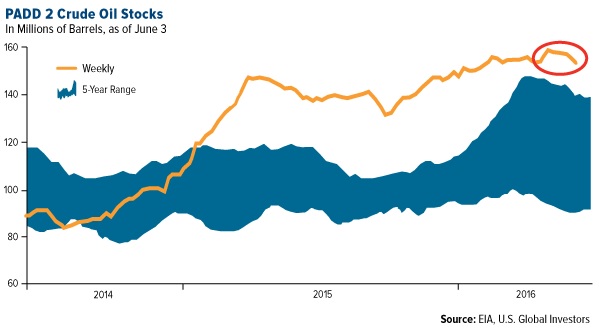

Every week, the EIA releases a report detailing crude flows and oil stock levels in each of the nation’s Petroleum Administration for Defense Districts, or PADDs, of which there are five: New England (PADD 1), Midwest (2), Gulf Coast (3), Rocky Mountain (4) and West Coast (5). Many analysts and investors pay special attention to PADD 2 because, among other reasons, the overwhelming majority of Canada’s crude exports to the U.S. enter through the Midwest district, usually through Chicago, before ending up in Cushing.

Looking at PADD 2, then, gives you a good idea of what percentage of inventory change at Cushing is a reflection of fluctuations in Canada’s output.

Good Things Come to Those Who Wait

Below, you can see that storage levels in PADD 2 are still above their five-year range, though with a narrower margin than the same time last year. At the tail end of the weekly amount, the line is clearly tapering down—maybe not dramatically, but it’s a good sign that supply and demand could be starting to rebalance, as I discussed in an earlier post.

You might infer that at least some of this drawdown is a result of the production outages in Alberta. But the truth is that we probably won’t see a meaningful decline until later this month. That’s mainly because oil moves at only three to five miles per hour through the Keystone Pipeline, creating a delay of between five and six weeks from the time it leaves Calgary to the time it arrives in Cushing. The other reason is that Canada might have initially exported some of its local inventories to make up for the supply disruption.

Sophisticated investors have already accounted for this time delay. They will also be first to act when the disruption is fully reflected in the EIA’s weekly reports.

In any case, lower inventories in the short-term should temporarily help supply and demand rebalance, along with the drop in the North American rig count.

********

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 3/31/2016: Suncor Energy Inc.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of