COMEX Open Interest Data Suggests Another Gold Price Slam Imminent

Within this current fractional reserve and derivative pricing system, it’s sometimes easy to anticipate price rallies and slams by observing The Bullion Banks and their practice of increasing and decreasing the total open interest of contracts on the COMEX.

Our most recent example of this came back in December. With price down near $1250 in COMEX gold, we anticipated a bottom and a rally due to the open interest and Commitment of Traders structure. We wrote about it then, and Sprott Money posted it on December 14. Here's the link: https://www.sprottmoney.com/Blog/are-you-ready-for...

In that post, we used this chart to explain how a 10% rally in the price of COMEX gold was likely forthcoming:

Here's your updated chart as of six weeks later:

How do we know that this initial rally of 2018 has nearly run its course? By checking the same data that made us so optimistic six weeks ago. Namely, the open interest and Commitment of Traders data.

In terms of total COMEX gold open interest, this number bottomed on December 12 at 446,618 contracts. As of Tuesday this week, total OI has grown to 582,333 contracts as banks have created and fed new contracts to hungry Spec longs seeking gold exposure during this rally.

System Apologists will claim these new contracts represent new demand for hedging from the banks' mining company clients ... to which you should ask: 13,600,000 ounces worth? That's 423 metric tonnes! So you're telling me that suddenly over the past six weeks, the mining companies have decided to hedge 423 metric tonnes of future production?

That's preposterous … but that's what The Apologists will claim.

Instead, The Banks have used their old trick of increasing the overall "float" of contracts. They take the short side of the new issuance and sell the long side to the speculating hedge and technical funds. THIS is how The Banks manage and control price. If you don't yet understand this, I suggest you check out this link for a primer: https://www.tfmetalsreport.com/blog/8252/econ-101-...

So, back to the COMEX open interest discussion ... At 582,333 contracts, total COMEX gold OI is now at the highest level seen since September of 2016. It’s also within shouting distance of the ALLTIME HIGH of 657,776 seen on July 11, 2016. This fact alone should give you pause to consider that price is near a short-term top.

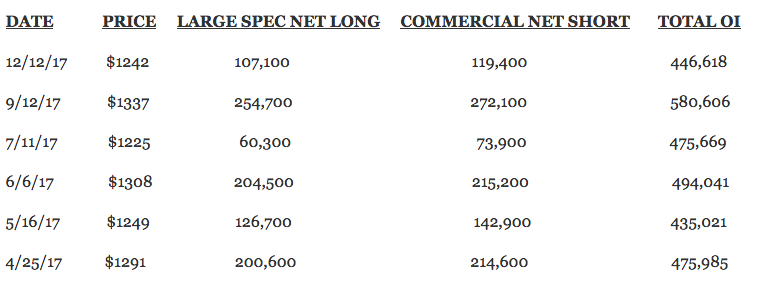

Then, consider the latest Commitment of Traders structure. Where these reports were positive and bullish back in mid-December, they are now increasingly bearish and negative. The next report this Friday will likely show a Large Spec net long position of 240,000 contracts or more, versus a "Commercial" net short position of nearly 260,000 contracts. Compare this to the most recent data below:

As you can see, The Large Specs buy long and the "Commercials" sell short on any price rally. Meanwhile, they increase the total float of open interest to meet this Spec demand. And by any measure, the current situation is clearly more like a price top than a price bottom.

The opportunity to take a long position will undoubtedly arise again. For now, history suggests that another contrived selloff is imminent.