The Fed Meet & Weekly Gold Chart Stochastics

With gold consolidating in the $2000 area, tomorrow’s Fed decision is likely the catalyst for the next move…

Which could be a surge toward the $2080 highs!

short-term chart.

As the mark-to-model bank accounting albatross finally came home to roost, my $1808 buy zone turned into a key launchpad for the metals and miners.

The $1960-$2000 sell zone was hit very quickly.

What’s next for gold from here? Well, for a look at the daily chart for gold:

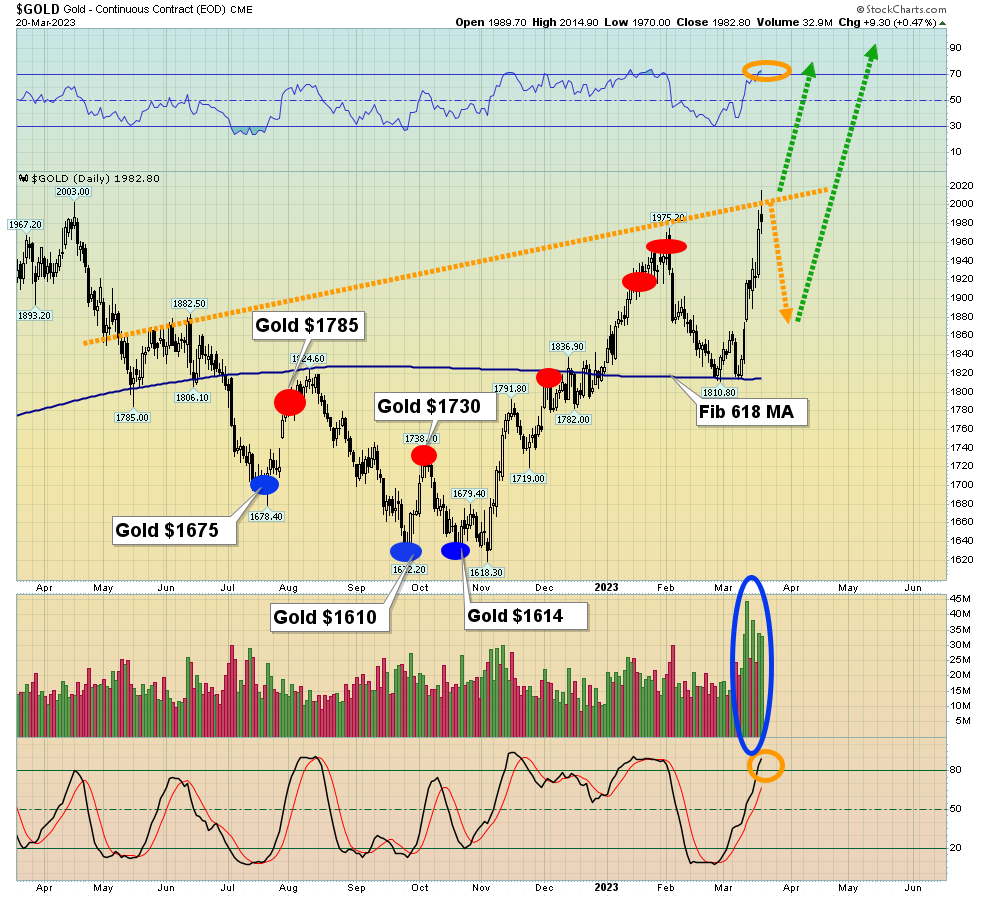

There are amber lights all over this chart; RSI and Stochastics are both overbought, and gold is far above the 618MA. There’s also trendline and round number ($2000) resistance in play.

Clearly, profit booking is a solid plan of action right now, given the imminent Fed announcement and the technical state of the daily gold chart.

Having said that, I’ll dare to suggest the profit booking should be modest, and that’s because of the stunning action occurring on the weekly chart.

To view it:

The $2000 area is obviously major resistance but the action of my key 14,5,5 Stochastics oscillator (in the momentum zone of 50) suggests investors need to consider a scenario… where gold is about to surge to $2080, $2200, or even $2500.

Gold is consolidating sideways in a rough $400 rectangular range trade between $2000 and $1600. Basis the Edwards & Magee technical analysis handbook, the rectangle formation has roughly a 67% chance of breaking out in the direction of the existing trend…

Which has been up since the $1167 low.

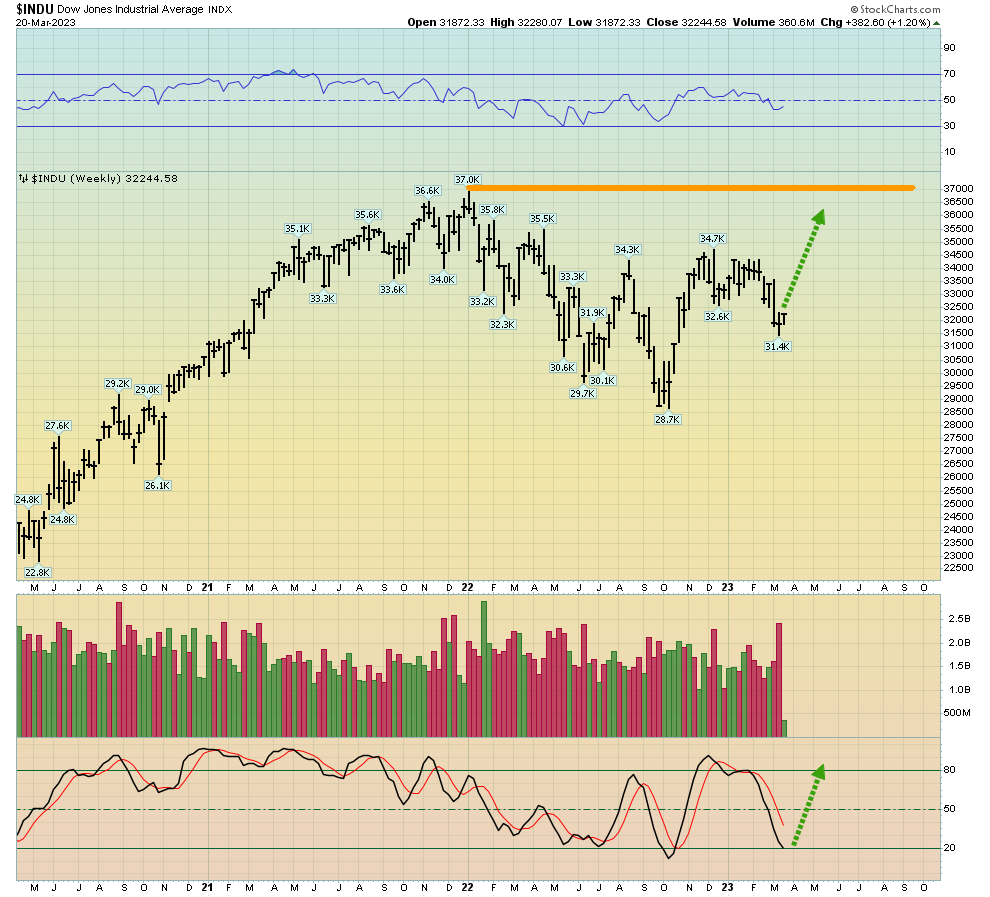

What about the US stock market?

In the short and medium term, the market is oversold. A rally seems imminent.

Since the 2008 OTC derivatives fiasco, the US stock market has morphed from a solid leading indicator for the economy to a macabre soup kitchen for a new class of welfare bum; the stock market investors of America.

Events like the destruction of the average citizen’s purchasing power are celebrated as huge buy signals for stocks.

The central bank then prints massive amounts of fiat, not to help the citizens, but to generate another rally for stock and bond market investors!

What about real estate? In the medium term, it’s likely to be relatively stable. Real estate brokers are offering lower-rate mortgages to entice buyers, and as failed stock market investors race to the “safe haven” bond market, rates fall.

long-term bond chart.

Ultimately, stock market investors will realize they’ve jumped out of a stock market fry pan and into an end-of-empire US government bond market fire.

For another look at the same chart:

It can be argued that a US bond market “super top” has been forming since 2011.

The bottom line: When empires die, their currencies collapse, and they hike rates to try to put out the fire. That makes the situation worse because the economy struggles and global investors shy away.

I’ve urged gold bugs to play the “long game”; the banking system is corrupt and failing, but it’s a slow-motion train wreck that could take one or two decades to reach the fireball stage.

Gold stocks will become the go-to asset for money managers, but the road to that “honey pot” is paved with as much molasses as it is with gold. A significant amount of investor patience is required.

daily GDX chart.

I targeted a gain of 10% for GDX from the buy zone of gold $1808.

I usually project a 20% gain (or more) for GDX from my buy zones, but this buy zone was “Grade C” quality, and the banking crisis created a rush to the safety of gold bullion rather than to the miners.

For a look at the weekly chart:

Note the action of the 14,5,5 Stochastics oscillator at the bottom of the chart. It’s in sync with the weekly gold chart. Once the Fed meeting is in the rear-view mirror, a rally to $33, and then $40, may be in the cards!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Race Cars” report. I highlight under the radar juniors sporting sudden bursts of volume that usually precede massive rallies! Key investor tactics are included in the report.

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: