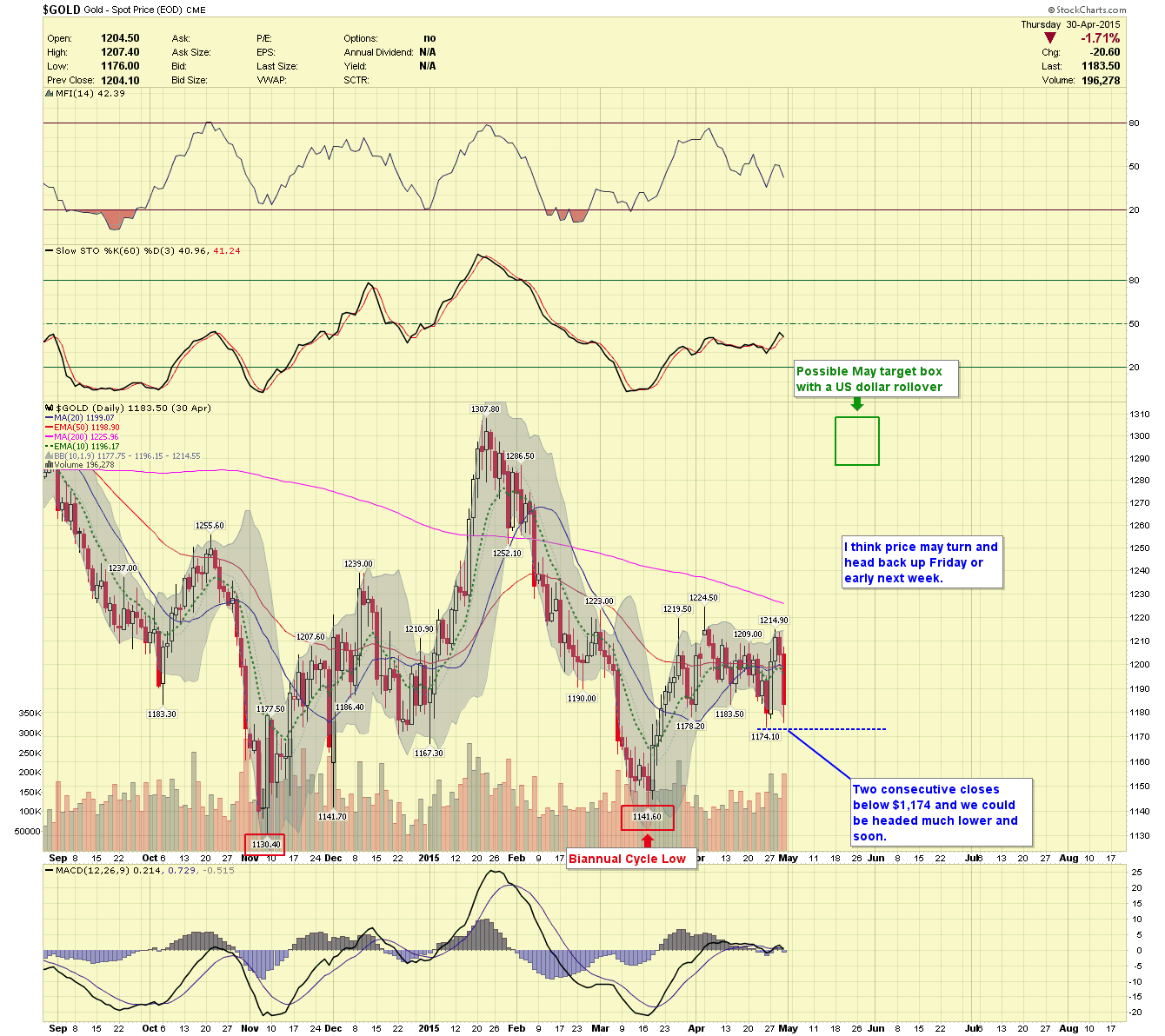

Is Gold On The Verge Of A Major Breakdown?

The current gold price and silver price action has many concerned, and we wanted to take a minute to post some thoughts. To be clear, gold could still reach our May $1,300 target. Nonetheless, if gold has two consecutive closes below the $1,174.10 cycle low, I will be forced to look at more bearish alternatives. Below is a gold chart with a few of my thoughts, the price may turn up Friday or early next week but in case it doesn’t things could fall apart for gold. No sense in getting too excited at this point, so I wanted to spend some of this article explaining why I chose oil over gold for my spring trading.

I’m long-term bullish on gold and especially silver but as a trader I elect to stay nimble and flexible, adjusting to market inefficiencies. Last month I noted several bullish charts in the oil sector, many had 50%-200% price potentials. I decided then to “temporarily” shift my focus to the oil industry as it held greater short-term potential.

Though my success was mostly made buying and selling precious metals, I learned long ago that a balanced investor is developed over time and does not focus on just a single asset class. Everything has cycles, including assets, Real Estate was red hot until 2006 when supply finally overwhelmed demand. Stocks were great for 20-years but in the year 2000 they entered a multi-year range trade going nowhere. My point is a well-rounded and seasoned investor adjusts to market forces capitalizing on undervalued assets, refraining from just a singular focus.

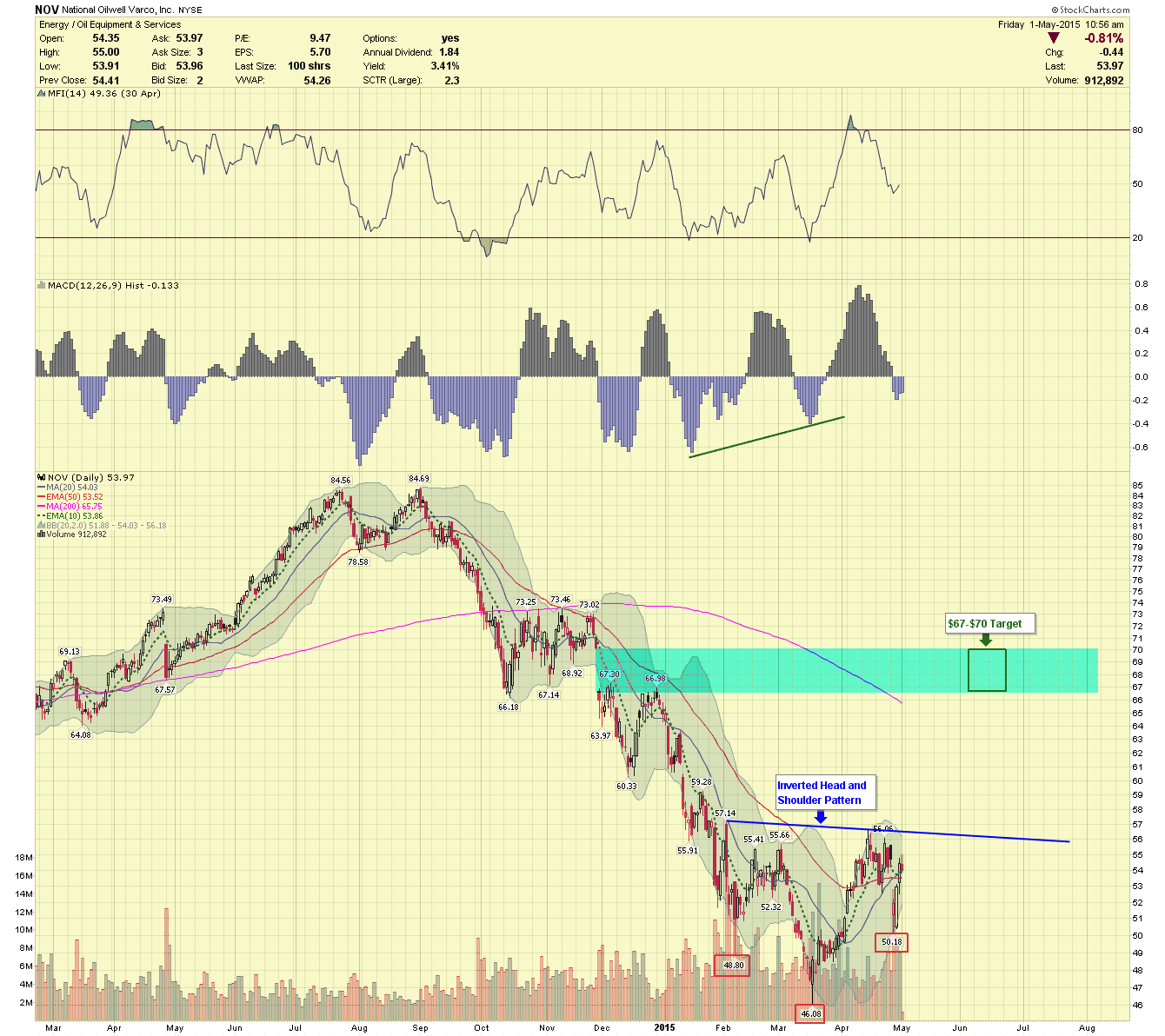

Oil recently presented better upside potential than precious metals and so I adjusted my strategy to include some energy stocks for the time being. Below are a few charts we released to our PREMIUM subscribers during the month of March, in hindsight they appear to have been respectable trading opportunities.

Today “NOV”, still has a $70.00 target and appears to be fulfilling an inverse head and shoulder pattern.

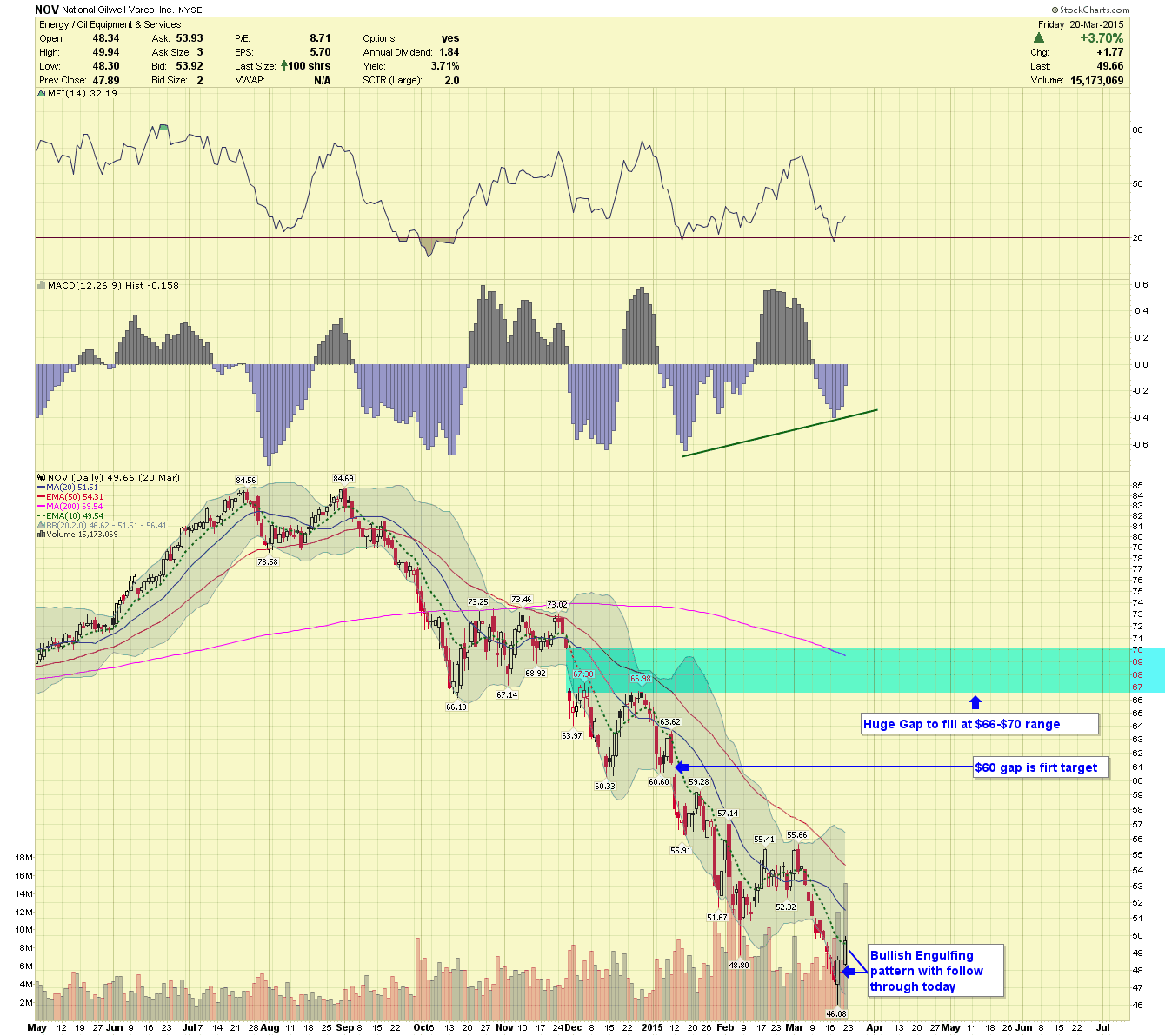

Below is the “NOV” chart when we initially released it to Premium subscribers.

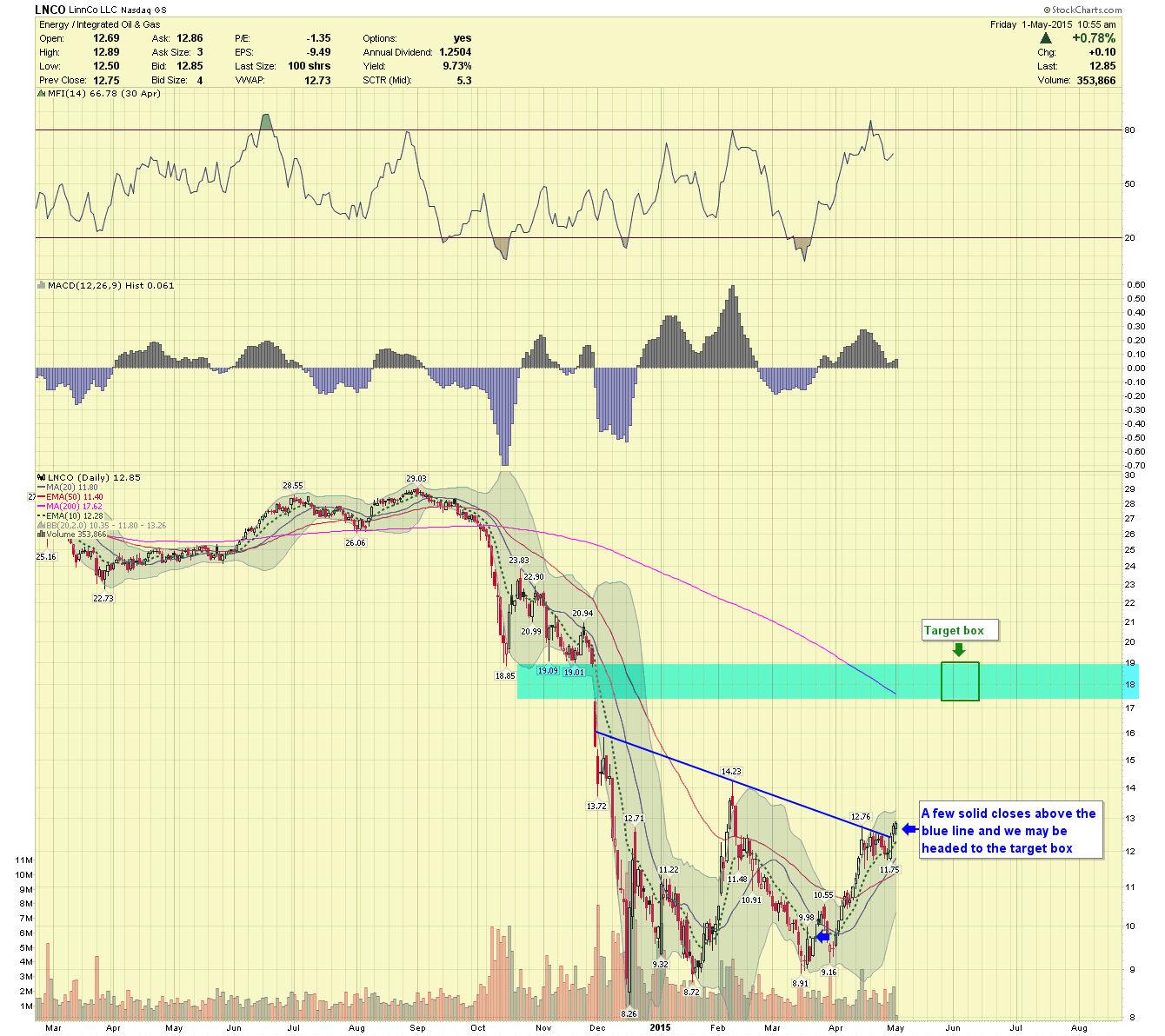

The “LNCO” chart still holds excellent potential with a target of $19.00.

Below is LNCO when released to Premium subscriber’s, it became one of my favorite trades as it included a 13% dividend on top of the potential of a 80%-90% capital gain.

The above charts are exceptional and investors will not always find opportunities like this. The entire point of this exclusive is to broaden investor horizons, encouraging long-term success through a multifaceted trading approach.

********

Chartseek.com offers multiple service levels starting from just $5.00 per Month, click here for more info.