Gold: World Reflation Is Here

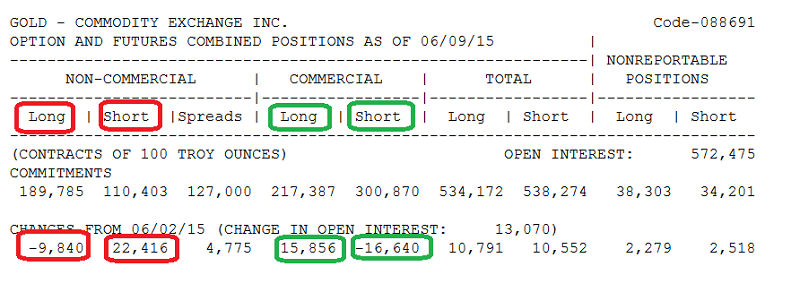

The latest COT report is very good news for professional gold investors.

The world’s largest banks dominate gold trading. They are the “commercials”, and it’s clear they have been very aggressive buyers into the tail end of gold’s seasonal weakness.

Tomorrow’s FOMC announcement could lay the foundation for a multi-month rally in gold, silver, and mining stocks.

The banks are sitting on a giant “QE money ball”. Unfortunately, the money ball has been deflationary because it just sat there in the banks, like coins in a piggy bank. I believe Janet Yellen’s main focus since taking the Fed Chair has been “monetizing” that money ball, by adding velocity to it.

I’ve argued that she is a much bigger dove than most analysts realize. After becoming the Chair of the Fed, Janet’s first order of business, as I predicted it would be, was to taper QE to zero.

By killing QE, she put some pressure on banks to loan out the money ball. Rate hikes will be the next tool she employs to make sure the money ball gets loaned out into the general economy. Here’s why:

Bank profits will surge when the money ball loans begin.

Officials from both the World Bank and the IMF have made public statements that Janet should not hike rates until 2016. In contrast, I think she should hike rates tomorrow at 2PM, to start the inflationary fun.

That should accelerate the powerful rally that is already occurring in many gold and silver stocks around the world!

In 2014, I predicted that 2015 would see most bank economists become neutral to bullish on gold. That theme is in play now. I also predicted that inflation would appear in the second half of this year, stunning most gold analysts.

Morgan Stanley economists have an outstanding track record. They issued a rare “triple sell signal” for the US stock market in 2007, and the market almost immediately began its worst tumble since 1929.

Now, these superb economists are singing my song, which is the song of world reflation. They suggest that “lowflation” will trough in this quarter, and rise six-fold in the richest countries, from 0.3% to 1.7% in 2016.

I think it may rise more than Morgan Stanley’s economists suggest, because most US jobs growth has been in low paying sectors like restaurants and bars. Enormous wage hikes are imminent in these sectors, and those hikes should move inflation strongly higher.

While I see Janet in a very strong position now, confident and acting with surgical precision to ramp up inflation, that’s not the case for the US government. It might become a bit desperate, as Janet begins to hike rates. Former Fed Chair Alan Greenspan has made numerous public statements that the debt-soaked US government has become too big a part of the economy.

Is anybody really listening to Alan? I don’t think so, and they will pay a price for that. Higher rates will put pressure on the government to get its financial house in order. Unfortunately, the US government is likely to react to higher inflation, simply by aggressively hiking government worker wages. In my professional opinion, a stock market tumble linked to shocking reflation could happen as early as October of this year.

Inflation news is not just in America. In Canada, the socialist NDP party is a contender now, as neocon Steve Harper’s actions in the Mid-East have become unpopular with the citizens.

In the UK, there are also signs of reflation. The Western gold community can expect to see much more inflationary news like this around the world, for the rest of 2015!

The weak season for gold (the first half of the calendar year) is caused mainly by waning Indian demand. The strong season (the second half of the calendar year) is caused by strengthening Indian demand.

The monsoon rains (essential to farmers who buy gold with crop revenues) are forecast at about 88% of normal in July – September this year. That could mean that gold’s strong season lacks zest, but I think Western reflation and the Greek crisis will make up for that. Gold should be firm over the next six months.

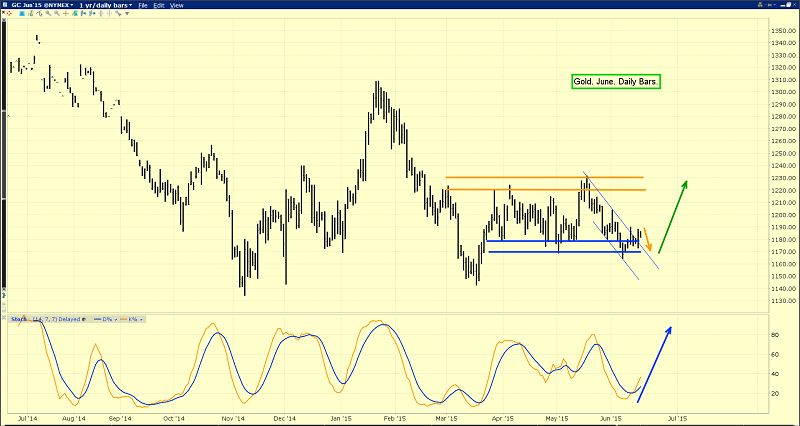

That’s the daily gold chart. Note the buy signal on my 14,7,7 Stochastics series oscillator at the bottom of the chart.

A “bull era” is clearly here. Chinese banks are mandated by the Chinese government to promote gold in a positive way. The Bank of China is itself owned by the Chinese government. I expect more Chinese banks will likely join the LBMA before the end of the year.

Gold stocks and silver stocks could see enormous liquidity flows come into them, as more economists take the same view on inflation as Morgan Stanley.

That’s the daily chart for GDX. Note the awesome position of the 14,7,7 Stochastics oscillator at the bottom of the chart!

That’s the daily chart for Barrick. In late April, I predicted a seasonal pullback would occur, with an $11 target. It went to $11.18, and now I’m predicting a massive Barrick rally will stun the bears, and lead gold stocks higher in gold’s strong season!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Silver Stocks Rock!” report. As good as many gold stocks look now, numerous key silver stocks like even better! I highlight why that is, and where my key buy and sell points are for six of them!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to: Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: