January Has Historically Been A Strong Calendar Month For Gold

Strengths

- The best performing metal for the week was gold, up 2.09 percent and closely followed by silver.

- Gold surged above $1,200 an ounce this week on the back of President-elect Trump’s press conference which provided little detail regarding any economic stimulus plans, reports Bloomberg. “Expectations are so high that we think there are greater chances that traders may feel that they did not get what they bargained for,” Naeem Aslam, chief market analyst at Think Markets said. “Under such a scenario, we could see gold continue its rally.”

- In preparation for Chinese Lunar New Year, Asian buyers have stepped up their purchases of gold, sending the yellow metal to a five-week high. In the past 10 years, January has been gold’s strongest calendar month. Other positive news in the gold space comes from Toachi Mining this week. The company reported results from its ongoing drilling at the La Plata gold-rich volcanogenic massive sulfide (VMS) project in Ecuador. One of the highlights of the release was the intersect of 15.89 meters grading at 7.63 grams per tonne gold, 49.74 grams per tonne silver, 11.82 percent zinc and 0.97 percent lead.

Weaknesses

- The worst performing metal for the week was palladium, down 0.71 percent, the only precious metal to lose ground this week after a strong start for the year with a gain of 10.38 percent. Hedge fund managers bet wrong for a second week, reports Bloomberg, becoming so bearish on gold lately that many missed the biggest rally since early November. Investors cut bets on higher prices for an eighth straight week just as gold extended its rebound, the article continues.

- Detour Gold fell as much as 8.1 percent earlier in the week, underperforming all of its gold mining peers while the gold price advanced, reports Bloomberg. The company’s Detour Lake mine is at least 33 million tonnes behind in total tonnage mined, according to a note from CIBC on January 8. CIBC noted that additional financing may be needed if further capex is required for stripping. Detour was downgraded to “buy” from “top pick” at Cormark Securities.

- UBS says that Freeport-McMoRan investors should use caution when it comes to a new Indonesian mining law that needs additional clarity, writes Bloomberg. UBS analyst Andreas Bokkenheuser believes the law could be a “large negative” if it requires the company to convert its Contract of Work (COW) into a mining license. An analyst at Scotiabank agrees, explaining this is negative for Freeport as the new law requires miners to divest stake down to 49 percent and to give up its COW agreement. Bloomberg writes that the company can no longer export semi-processed metal after regulations allowing shipments lapsed on Wednesday, although the mine is continuing to operate.

Opportunities

- In a note this week, UBS says it is optimistic on the prospect of fiscal policy boosting U.S. growth looks to be priced in, as much more evidence may now be needed before yields and the dollar can move higher. Former U.S. Treasury Secretary Lawrence Summers said last week that investors are far too sanguine about the risks of Trump’s policies, reports Bloomberg, which analysts at Eurasia Group said could contribute to a level of global instability not seen since WWII. A median estimate of analysts and traders in a Bloomberg survey think gold could rally to $1,300 by year-end. Merk also out with an interesting note on how gold reacts during presidential transition years this week. “Since Nixon took the U.S. dollar off the gold standard in 1971, there have been seven Presidential transition years,” the group writes. On average, the S&P 500 was negative for those seven calendar years of transition while the average gains for gold was 14.8 percent. One theory behind this? Policy disappointment of a new incoming administration.

- Christopher Mahon of Baring Asset Management is seeking shelter in gold this year, reports Bloomberg. Mahon has one major conviction about 2017, which is that central-bank bashing by politicians will become the new normal. In the past few months Mahon has built up a 4 percent allocation to bullion in his 1.7 billion pound fund. The precious metals team at HSBC has also made its forecast for gold in the New Year, maintaining a bullish stance on the metal. The team forecasts a gold price of $1,282 an ounce in 2017 and $1,310 in 2018.

- Scotiabank hosted a teach-in by Klondex Mines President and CEO Paul Huet recently, and in its latest report, Scotiabank shares four key takeaways from the meeting: 1) Work is advancing on the Hollister project with more updates coming, 2) True North continues delivering positive surprises as operations ramp up, 3) stronger quarter-over-quarter production from Fire Creek and Midas is expected in the fourth quarter of 2016, and 4) the recently-acquired Aurora project offers longer-term upside potential. Bloomberg reports the latest from Goldcorp this week as well – the company will buy 9.5m shares of Auryn Resources, at a 20-percent premium to the prior closing price.

Threats

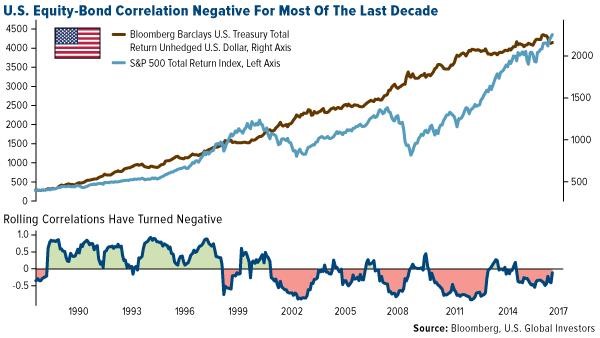

- Decades of divergence between stocks and bonds could be ending, says Sanford C. Bernstein & Co., which would mean a shift in investor assumptions, reports Bloomberg. A new era with rising inflation could see equities and bonds return to the historic positive correlation they’ve displayed since 1763, according to analysts led by Inigo Fraser Jenkins. “If the path of inflation is set to be generally upward from here then we should expect this correlation to rise,” they stated. This will make it harder for investors to diversify, and also suggests that a 10 percent allocation to gold and gold stocks might be a prudent addition to a portfolio in these circumstances to broaden an investors diversification mix.

- ICBC believes that the real rates reversal has been good for gold, but doesn’t think that it will last. The group says it seems too soon for markets to give up on the Trumponomics reflation trade, maintaining its view that the current rally is about to lose steam. ICBC adds that a more sustainable turn will have to wait until mid-year, and that gold could get a much stronger bid if the policy ping-pong between fiscal hawks and doves becomes stuck.

- Citigroup shared its outlook for gold in its January 13 report, saying that in the medium-term higher real rates and a stronger dollar could send prices lower. Citi says the gold price is more likely to drop to $1,100 an ounce than stay above $1,200 in the second quarter. In addition, two top gold forecasters from BNP Paribas SA and Rising Glory Finance both see gold prices returning to three figures this year, a price level last seen in 2009. Both cite the outlook for higher U.S. interest rates weighing on non-yield bearing bullion, reports Bloomberg.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of