Mining Stocks’ Rally Despite Gold’s Price Decline

Quite a few rallies in the recent months were preceded by the mining stocks’ outperformance relative to gold - and we just saw the same kind of phenomenon on Wednesday – i.e. GDX rallied while gold declined. Is the bottom in?

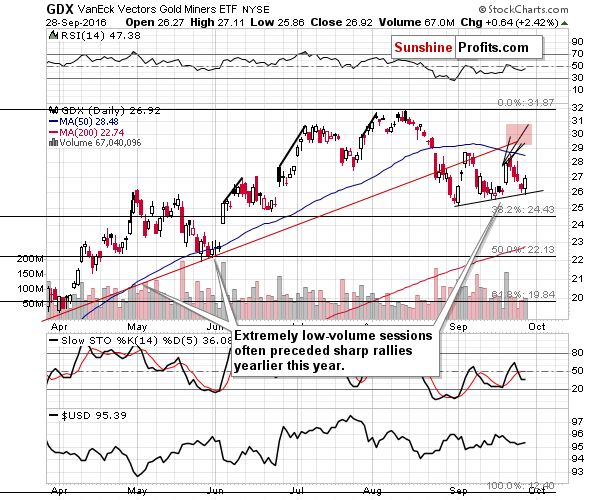

Let’s take a look at the miners’ chart for details - other charts don’t feature important changes from what we described previously. Therefore, mining stocks are the part of the PM sector that we’ll focus on in today’s free article (charts courtesy of http://stockcharts.com):

Miners indeed moved higher yesterday, which was nothing unexpected. In yesterday’s alert we explained which technical phenomenon made it quite possible:

The volume was not just low – it was extremely low [on Monday]. Can it tell us anything? It suggests extra caution as metals and miners could be on the verge of a sudden upswing - that’s what happened in the previous months. [as is apparent in the above chart]

Mining stocks declined [on Tuesday], but the volume was low once again, which means that the above comments remain up-to-date. Miners could still rally on a very temporary basis before the big decline resumes.

Moreover, GDX moved to the rising support line, which could trigger another rally before the big decline starts.

Miners had good reason to decline…as the gold price declined yesterday. However, they didn’t. Even the lack of movement would have bullish implications as miners would outperform in this case. The latter did more than that – miners rallied. Moreover, the volume that accompanied the upswing was bigger than what we’ve seen so far this week, which suggests that the move was not accidental.

The general stock market rallied as well. However, the rally was not huge enough to explain – by itself – the strength seen in mining stocks relative to gold. Consequently, we view it as a bullish signal for the very short-term. The emphasis is important, because this factor alone is not a game-changer in our view. There are many other factors that need to be considered…and quite a few of them have bearish implications (for instance the breakdown in the gold to stocks ratio that we discussed earlier this week).

So, what does yesterday’s strength in the mining stocks imply? That we could see higher prices in the precious metals sector in the next several days, but nothing more. In particular, it doesn’t invalidate the bearish outlook for the medium term – it still seems that we will have to wait at least a few additional months before gold starts rallying “todamoon”.

Summing up, it’s quite likely that the precious metals sector is close to starting another big decline, but it’s also likely that another short-term rally could be seen beforehand. The opportunity in the precious metals sector will likely present itself shortly, just like it is already the case with crude oil, forex and stocks (we currently have profitable positions in all of them).

********

The above is up-to-date at the moment of posting this article and the situation can change in the following weeks. In order to stay updated on our latest thoughts on the precious metals market (including thoughts not available publicly), we invite you to sign up for our free gold mailing list. You’ll also get free 7-day access to our premium Gold & Silver Trading Alerts. Sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Gold & Silver Investment

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,