The Price of Gold in Foreign Currencies

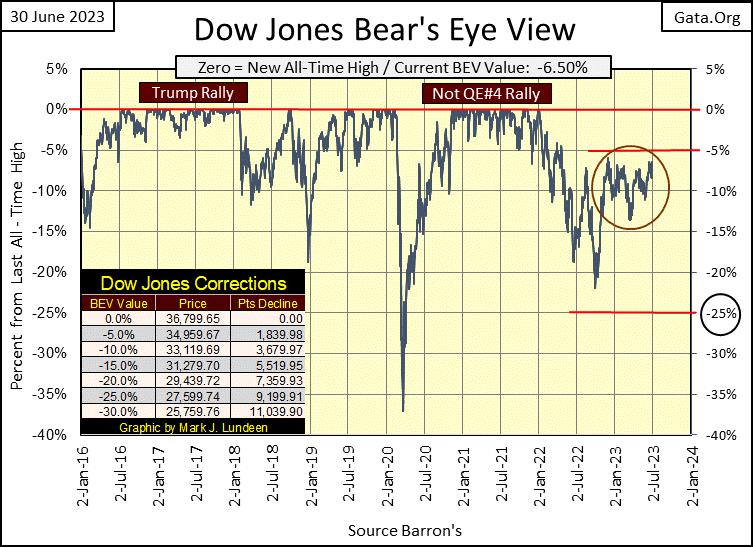

The Dow Jones did good this week, but remains rangebound between its BEV -5% and -15% lines within the circle below, as it has been since November. Not much to say that hasn’t already been said for months now, until something new happens by breaking above the one (34,959), or below the other (31,279).

Before the Dow Jones can break above its BEV -5% line (34,959) in the chart above, it first must close above, and then stay above 34,500 in the chart below, something it has found impossible to do since last November.

Not for the first time; two weeks ago, the Dow Jones made an attempt on 34,500. Then in the following week, it was repelled back below it, only to see this week making a comeback, closing just short of 34,500.

So, what is going to happen in the weeks to come? I don’t know. Should the Dow Jones make an honest effort at making a new all-time high, I wouldn’t be shocked. Should it make a new all-time high, it wouldn’t be grounds to decide I need to become a bull on the market. In this snake pit of a market, that would be a huge mistake.

I don’t like this market, as there is nothing fundamentally bullish driving it upward;

valuations remain grossly overvalued,

bond yields and interest rates continue trending higher,

bankruptcies and debt defaults are also on the rise,

consumers are being consumed by the debts they’ve taken on.

Look at the yield for the long T-bond below, at its yield spike since it bottomed in August 2020. I believe we’re seeing the first stage of a massive, multi-decade bear market in debt. That never was, or ever will be good for the bulls running around on Wall Street.

What is driving this market is politics, and the ability of the markets’ “regulators” to manipulate financial asset valuations, for the benefit of those who hold power in Washington DC.

Next year is a presidential election. Should President Trump win in November 2024, it will be bad news for the deep state, and they know it. Therefore, the market must not do anything that would enrage the voters, like a bear market. Biden, the Democrats and RINO Republicans already have enough problems coming their way in 2024, without the voters complaining their retirement accounts have been cut in half by Mr Bear.

So, I believe we’ll continue seeing this lukewarm advance that never does much good for the bulls, except maybe avoid the major-market crash, that remains lurking in the shadows, somewhere ahead of us.

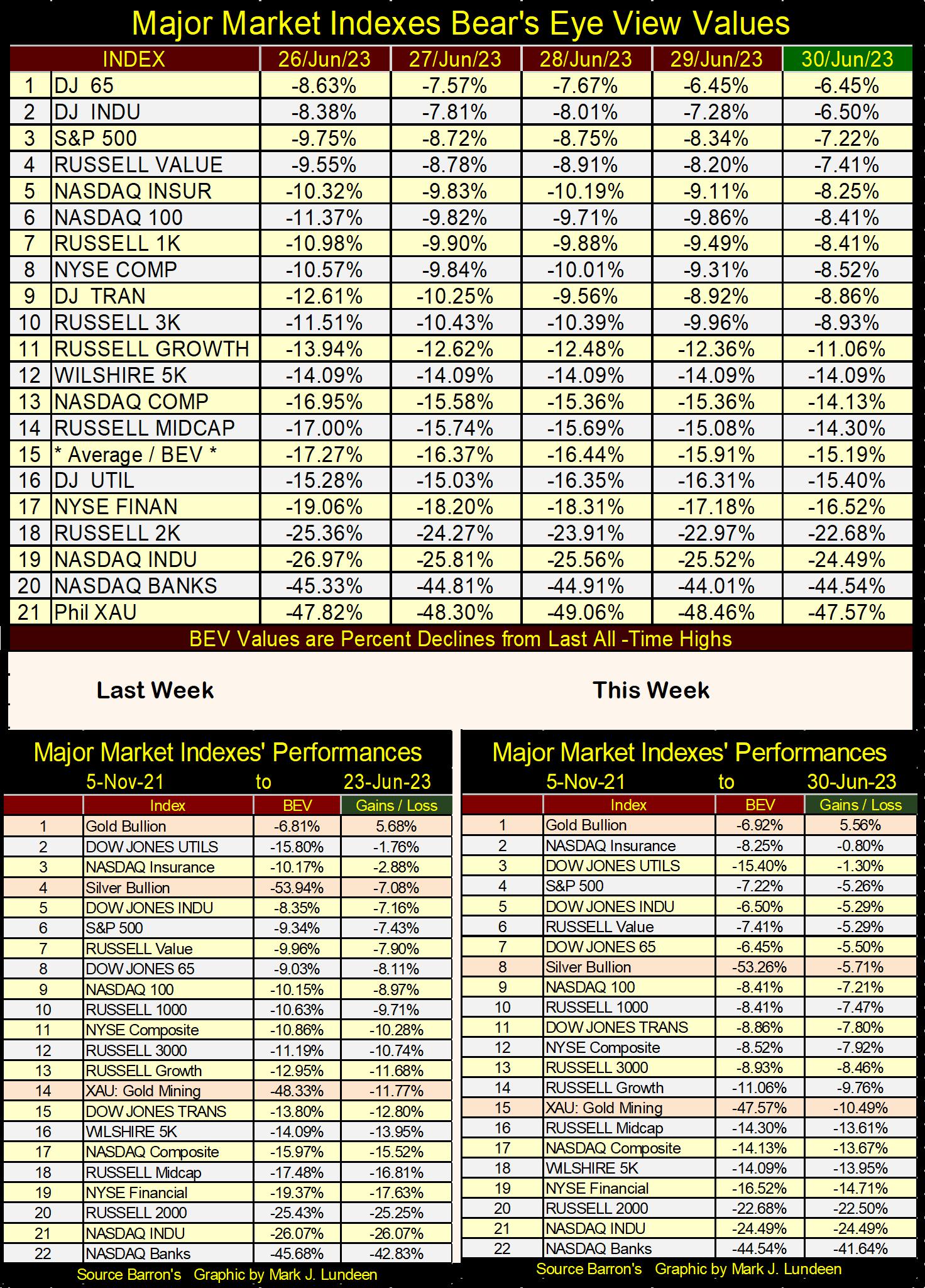

The major market indexes I follow, except for the Dow Jones Utilities and the XAU, were all up nicely this week in their BEV table below. But it’s been months now since we’ve seen any of these indexes close in scoring position; a BEV value between -0.01% to -4.99%.

Will we see some of these indexes close in scoring position in the weeks and months to come? Oh hum; yes, most likely, and possibly some new BEV Zeros too.

In the performance table above for this week (right side), gold continues holding on to the #1 position, as it has for months. Silver and the XAU fell down this week, but its not that they lost valuation; rather the indexes that replace them advanced more this week than did they.

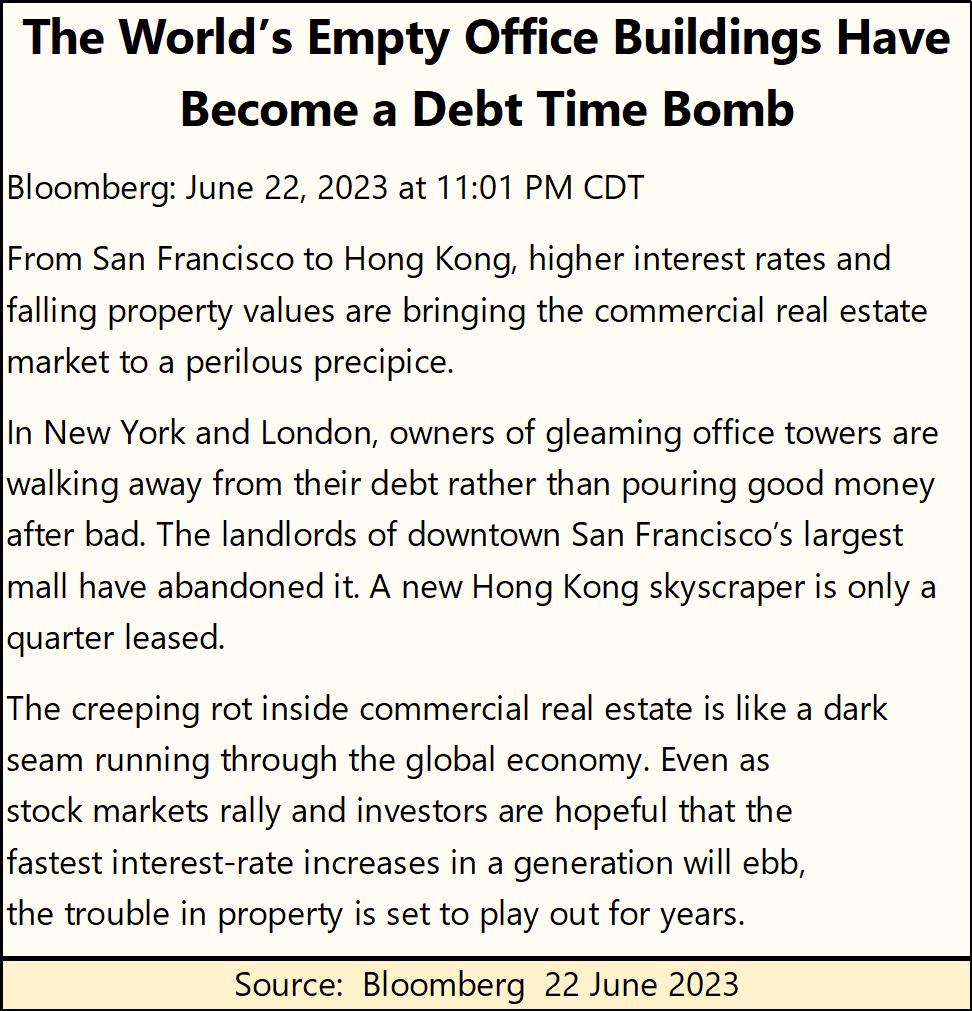

For something new and exciting, something this week’s article desperately needs, let’s look at the price of gold in currencies other than the US dollar in the table below.

How does one come up with the price of gold, say in Thailand baht? Barron’s publishes exchange rates; so many units of foreign currency per US dollar. One takes the exchange rate, and multiply that by the dollar price of gold. As I have close of week forex data going back decades, as I do for the price of gold, it is simple creating the table below.

I used data from Barron’s 10 August 2020 issue as a base (the last Barron’s issue where gold saw a weekly all-time high in US dollar terms), to compare with this week’s data. I was curious if other currencies, unlike gold in US dollars (#30 below), have seen gold increase above their highs of August 2020. Some have, in fact 21 have in the table below. Some by a little, like the Israeli Shekel (#20; up by 2.39%), others by a lot, like Turkey’s New Lira (#1; up by 239.43%).

The prices seen above have two components to them;

the US dollar price of gold,

exchange rates between the US dollar and each national currency.

For the Mexican peso (#38), it saw the price of gold fall 27.92% in peso terms, because the Mexican peso over the past three years, has grown stronger relative to the US dollar. Way to go Mexico!

On the other hand, Turkey (#1) has seen the price of gold increase by 239.43%, as the Turkish Lira collapsed relative to the US dollar. For the average Turk on the street, who purchased an ounce of gold for 14,726 lira in August 2020, their purchasing power was protected as their lira collapsed, as an ounce of gold can now be sold for 49,984 lira.

This is what makes gold so important; because we live in a world where central bankers’ “monetary policy” dictate whether the valuation of the scrip they publish, and then “inject” into their financial systems, rises, or falls in the market place.

Eventually, all paper-money schemes collapse under the abuse they sustain at the hands of politicians, academics, and bankers. Vain mortals all, sitting around a big table somewhere, feeling important, and enriching themselves by playing God with other peoples’ money, at the expense of those other people.

This is why central bankers, like the idiot savants at the FOMC hate gold so much; as it potentially stands in their way of manipulating market valuations. That as well as they fear the public, and the financial system will eventually understand a rising price of gold (silver too) is a failing grade for their “monetary policy.”

In 1966, when Alan Greenspan wrote the comments below, it was illegal for US citizens to own gold, and so it was until 1974.

So, has the price of gold and silver been manipulated downward for decades? In 2023, if you think the price of gold and silver isn’t manipulated by bankers and their “market regulators,” the inability of your understanding, to understand the precious metal markets, may be as simple as either ignorance or apathy.

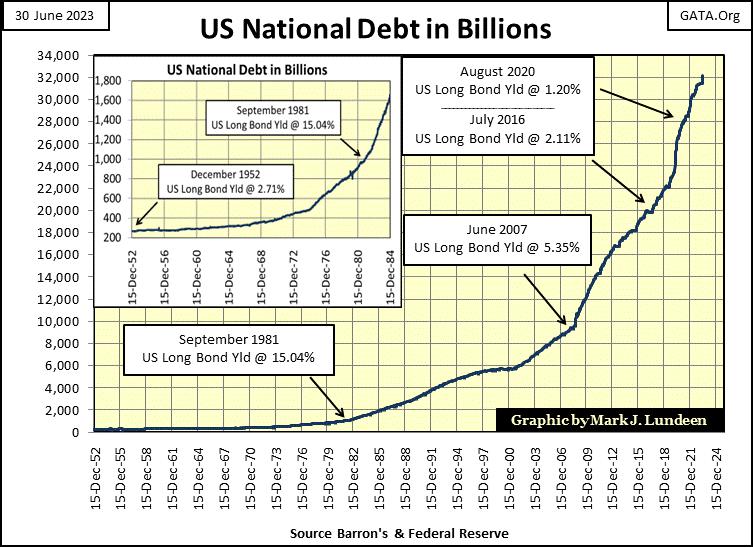

One feature of a gold standard, is the limitation of credit (debt) creation it places on that nation’s banking system. Seeing the US national debt increase from $300 billion in 1952, to now over $32,000 billion in 2023, is proof positive the dollars used in America’s national debt, have no connection to a gold reserve held by the US Treasury.

America’s engine-of-inflation is powered by a finely tuned, three-step process;

Congress habitually spends in excess of taxes collected by the IRS,

the US Treasury issues the required T-debt to fund Congress’ spendthrift ways,

the idiots at the FOMC “monetize” this debt by issuing paper, or digital dollars to purchase as much T-debt, and at prices, set by their “monetary policy.”

With the availability of US dollars no longer limited by a $35 gold peg, debts created by the banking system, and prices seen in the markets continued climbing in the 20th and 21st centuries. Note also how bond yields below declined from 1981 to 2020, as debt continued rising; yields for the long T-bond declined from 15.04% to 1.20%.

That is what is called a bull market for stocks, bonds and real estate, as a tsunami of “liquidity” floods into the financial system, market valuations of the things trading on Wall Street were driven higher, as yields and rates declined.

Unfortunately for the bulls, bond yields and interest rates bottomed in August 2020, and have risen considerably since then. Mortgage rates too. As yields and rates continue rising, the bull market in the global financial system ceases to be.

On Wall Street; they never ring a bell to tell the public when it is time to sell. They never have, and never will. But looking around, it’s becoming obvious that Mr Bear and his clean-up crew, are moving in to take down what the bulls have built up.

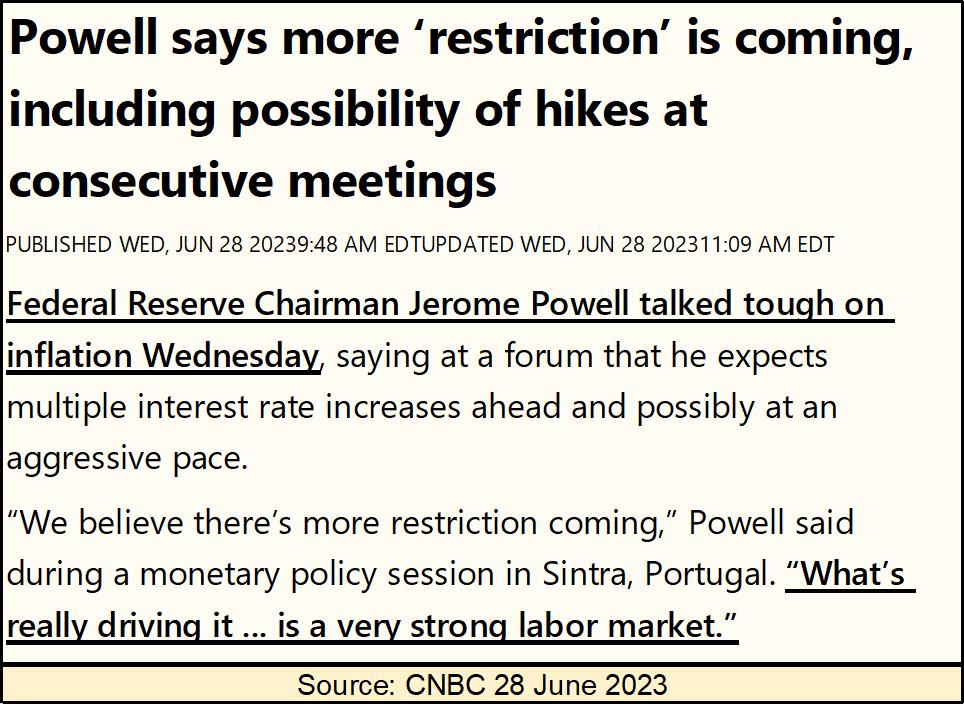

Rising interest rates and bond yields will do all that, and more. Apparently, more rate increases are what the idiots at the FOMC intend to do, as 2023 flows towards 2024.

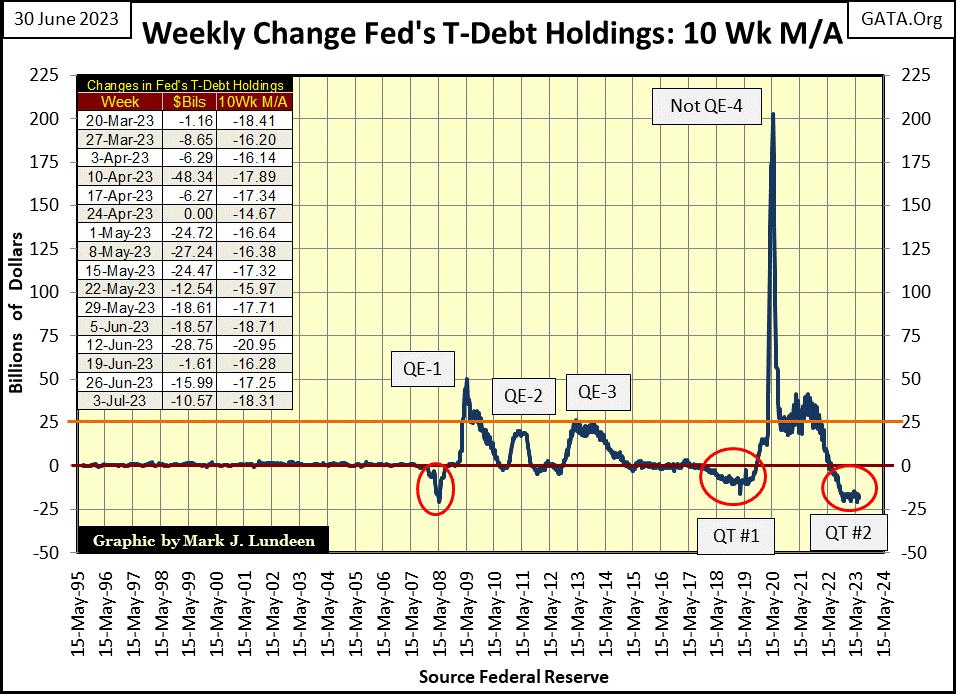

Strong labor market? After having the economy shut down for over two years with a fake pandemic, as consumer prices rose, wage-earners are now demanding an increase in their hourly rates, and that is the cause of inflation? Not Fed-Chairman Powell’s own Not QE #4 below?

That the financial media just passes on this BS from the leading idiot at the FOMC as “financial news,” with no challenge or comment, should tell anyone who isn’t ignorant or apathetic about “monetary policy,” whose side the financial media is on – not on the side of the greedy wage-earners who are solely, yes 101% responsible for rising CPI inflation, by their asking for a pay raise.

So, Chairman Powell simply must, he has no choice but continue raising his Fed Funds rate to increase unemployment, to drive inflation, and greedy wage earners back under control.

Never doubt Chairman Powell, and the other idiots at the FOMC don’t know exactly what they are doing.

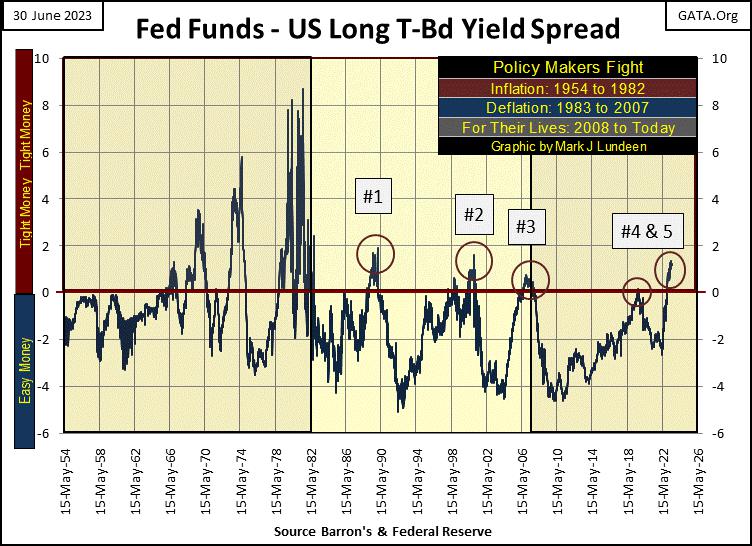

As seen in the chart below, since the early 1980s, every time the idiots inverted the yield curve (#1-4) a selling panic resulted somewhere on Wall Street, and a recession in the economy, as a bubble * THEY INFLATED * was popped by * THEIR INVERSION * of the yield curve;

Leveraged-Buyout bubble,

NASDAQ High-Tech bubble,

Sub-Prime Mortgage bubble,

March 2020 Flash Crash.

Now for the fifth time (#5) they’ve inverted the yield curve, as Powell promises to continue inverting the yield curve to ever more extreme levels. Somewhere off in the distance; do you hear a bell ringing?

Let’s move on to gold’s BEV chart. Like everything else in the market, gold has been running in place for a long time now; between its BEV 0.0% (new all-time high / BEV Zero) line and its BEV -20% lines.

Like everything else, it’s becoming difficult finding something interesting to comment on in the gold market, and so it will continue being until it either makes a new all-time high, a close above $2061, or a valuation claw back below its BEV -20% line ($1649). For the week, let’s leave it at that.

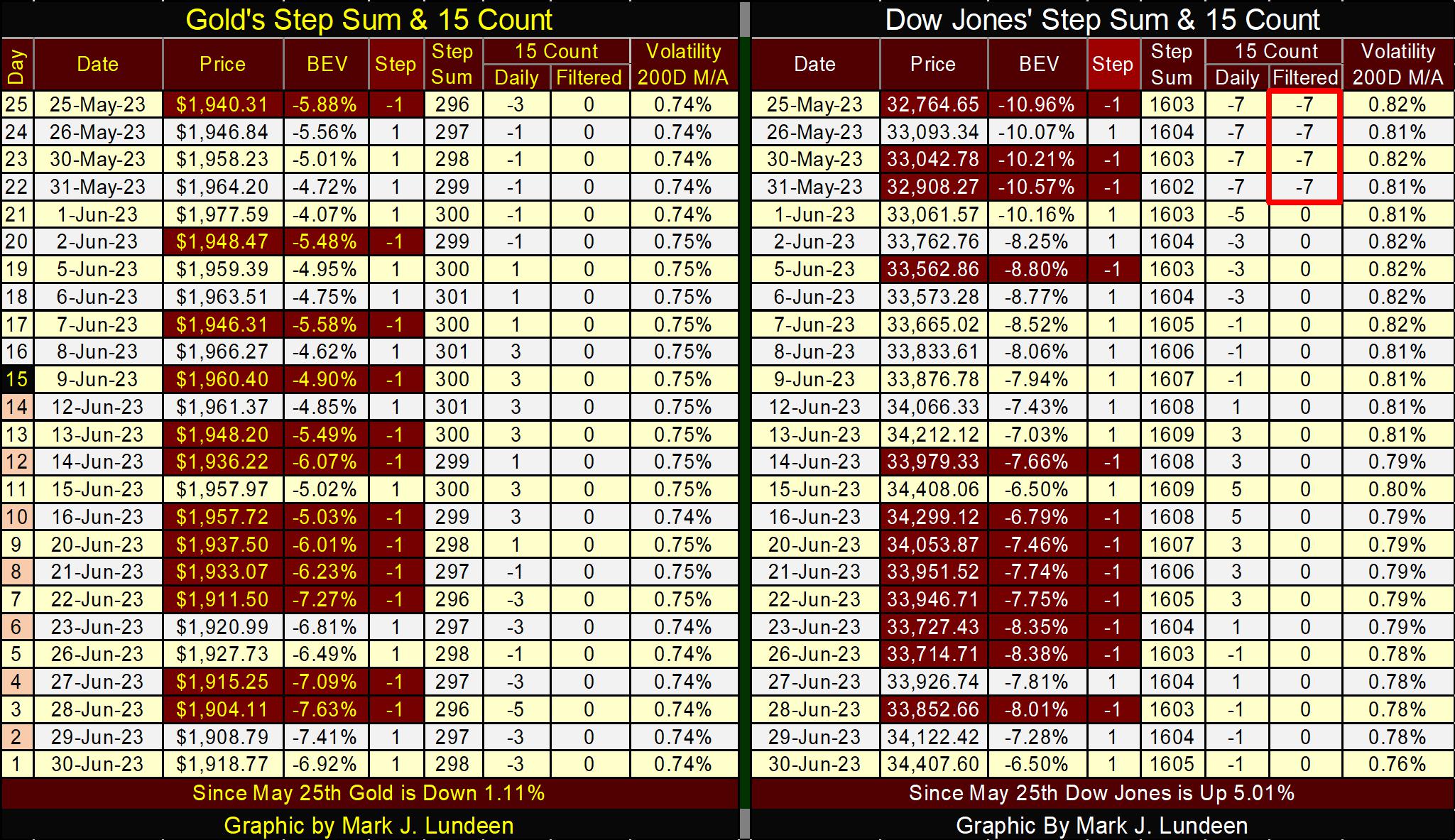

On gold’s side of the step sum table below, one thing I like is how so far, the “policy makers” have failed to force gold to close below $1900 after all the selling seen below since May 25th. They may achieve a sub $1900 gold price next week, and again maybe not, but they will try. As always, we’ll know more next week.

Everything on the Dow Jones side of the table has also become tedious, except I note how Dow Jones daily volatility’s 200D M/A continues declining, closing the week at 0.76%. That is very bullish, so why am I such a bear? Because this market has a foul odor to it.

Keep in mind, these guys, the “policy makers” have so many irons in the fire, it won’t be hard for them to miss a step, resulting in the entire pile of poop they are attempting to support, to come tumbling down. Well, the potential for disaster in the financial markets is always there.

The Earth is actually a small place. Evil on this scale will not be supported for long on our planet, as God won’t have it.

Here is a song by Johnny Cash that says it better than I ever could

https://www.youtube.com/watch?v=DQTCS6aWRSc

Just because * THEY PLAN * to keep things under control until after the November 2024 election, doesn’t mean they’ll succeed making their plan our future reality.

Eskay Mining did well this week. Looking at it in US$, it closed at $0.39 on May 17th, then at the close of June, today, it closed at $0.78. Still far from the $2.30 it was trading at in February 2022, but the market is responding favorably to the company’s start of their 2023 exploration program.

In mineral exploration, there is no guarantee for success until the company has actually located an ore body, via drilling core samples and assay. But the geophysical work the company has accomplished strongly suggests Eskay Mining has the potential for locating a couple of Eskay Creek type of gold and silver deposits. The company’s exploration program for this year, is to focus exclusively on proving that is a fact.

My expectations are that Eskay Mining will do exactly that in 2023; “find gold in them thar hills,” and lots of it too. If so, the $2.30 it was trading at in February 2022, will be exceeded by a good amount. If you’re curious why I’m so excited about Eskay Mining in 2023, here is a short video on the company in the link below.

https://www.youtube.com/watch?v=4nw2up4EXMU

Mark J. Lundeen

********