Treasury Market Peaked In June 2012…What Has Happen Since Then?

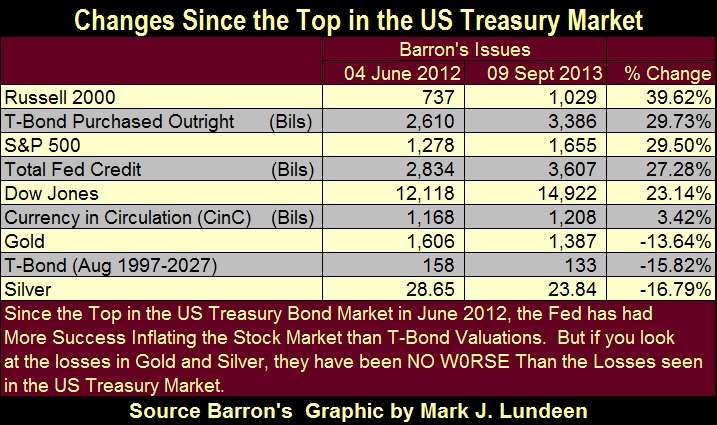

Investors have the choice of risking their money in various markets. Let’s see how things have gone for stocks, US T-bonds and the old monetary metals since the top in the US Treasury bond market in Barron’s 4 June 2012 issue. Looking at the stock market via the indexes listed in the table below, stocks have been the best performing asset class. But as always, there are specific stock groups in the market that have lost investors lots of money, say like the Home Construction group that has lost 27% in the past 52-weeks. The only group in the Dow Jones Total Market that has done worse in the past 52-weeks has been the gold miners who have lost 49%. That will one day change for the better; but when I don’t know.

Going back to the Dow Jones S&P500 and the Russell 2K, I believe it’s notable that their gains have been in line with the expansion of the Federal Reserve’s balance sheet since June 2013. For that reason I really doubt the gains in the stock market have anything to do with increases in profitability or sales, even if earnings for the Dow Jones are currently at their all-time high, and the earnings for the S&P500 are not far from their all-time high. Anyways, this is the first “bull market” on Wall Street where growing unemployment has been an issue after years of gains (March 2009 to present). So, if you are making money in the stock market, good for you. Just don’t fall in love with it, as once the Fed stops supporting Wall Street, and one day it will, the stock market has only one way to go; and that is down more than most people believe possible.

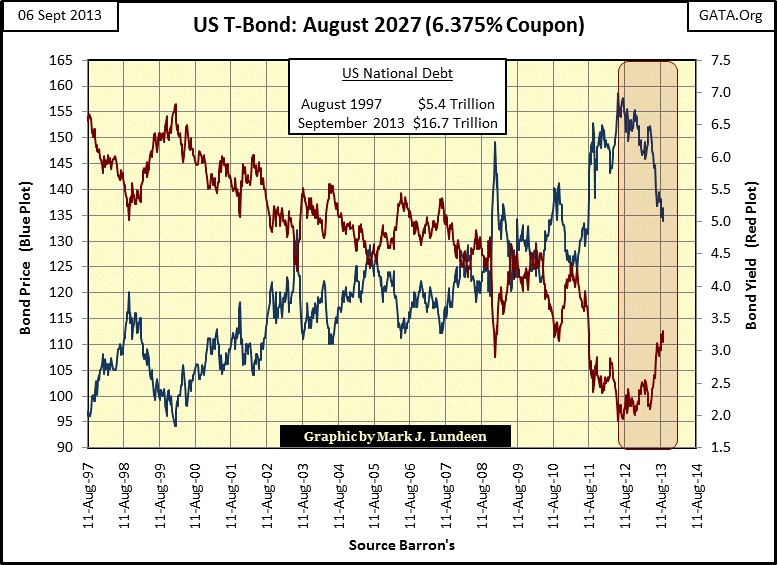

That the Federal Reserve is not all powerful when it comes to dictating market valuations can be seen in the chart below. The current yield for this 30yr T-bond issued in August 1997 at its June 2012 top was 1.91%, but its coupon from 1997 is 6.38% (Red Plot / Right Scale). That was a decline of 447 basis points in yield during some of the worst financial panics in the past 100 years. We can all blame Alan Greenspan and Doctor Bernanke for this monetary madness. But shortly before Doctor Bernanke began his $85 billion monthly QE program, T-Bond yields began to rise and bond prices begin to decline as we see in the box below. I expect we are seeing the start of a massive bear market in bonds that began in June 2012. For your information; since the end of World War 2 bond bull and bear markets have lasted for decades once they become established, and have reached yield and price extremes few could have expected. The last bear market in the US Treasury market ended with long bond yields at 15%. I expect to see this record yield from 1981 to be exceeded by a good measure before this bear market in T-Bonds is over.

Here is a chart of the Fed’s balance sheet going back to 1953. This chart documents how the Fed has managed the affairs of the US dollar, the world’s reserve currency. They have done a terrible job for domestic and international holders of US dollars. But Wall Street and Washington have supported the Fed’s efforts in creating this horrific inflation as it was to their benefit. That such inflation would harm everyone else isn’t a concern to them.

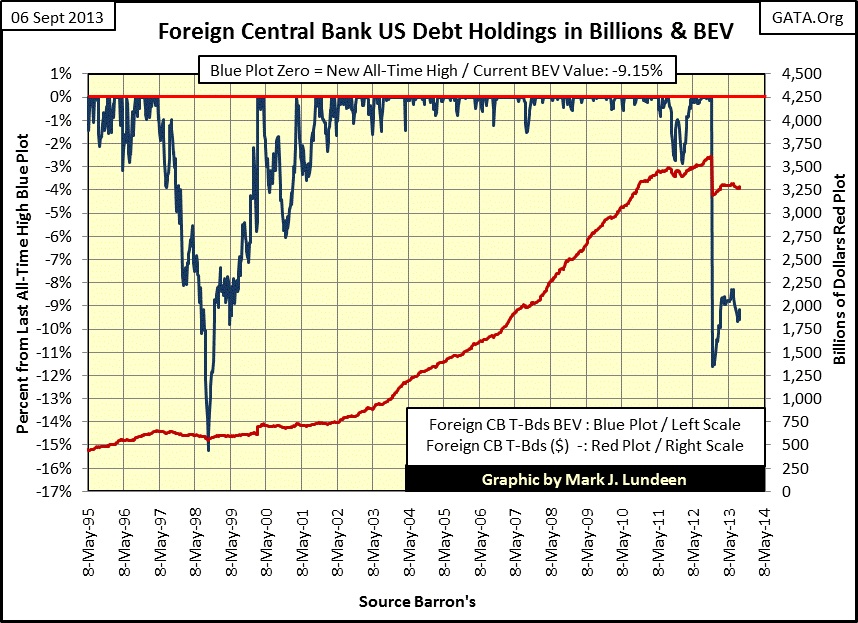

So, we see the huge increase in the blue plot above, showing the Federal Reserve’s $800 billion dollar increase in its holdings of US Treasury debt since November 2012, and we ask ourselves why have T-bond yields increased and their prices declined with all this artificial demand coming from the Federal Reserve? Part of the answer can be seen below; in November of 2012, the global central banks sold an 11% slice ($420 billion dollars) of their US Treasury bonds in just one week. I don’t know who did the selling.

The last time something like this happened was in 1998, during the “Asian Contagion” when the inflationary flows from the Fed blew a bubble in the Asian stock markets, which then reversed causing a “deflationary” crisis in the “Tiger Markets.” But as you can see in the Blue BEV plot above, this decline took a year to complete; not one week.

So, keep in mind that day to day things don’t seem to change much. It’s easy for most people to believe that the trends in the financial markets that began in the early 1980s will continue forever, just like the financial media would have their consumers of “news” believe. But market stability with rising prices for stocks and bonds is not a permanent trend as change is the one constant we all have to contend with on our lives’ journey from our mother’s womb to our tomb. Our current apparent normalcy is being funded with the Federal Reserve’s massive inflation via its QE program, and that has been the case since early 2008 when the mortgage crisis began to erupt.

I get frustrated with the markets, and that so few people get as upset as I do on phony valuations in the stock and bond markets. But I keep in mind that massive monetary inflation has never offered much of a future for any society that became addicted to it, and the United States is profoundly addicted to the Federal Reserves’ cheap money and low interest rates.

When the world sees the Fed withdrawing its support from the financial markets, or when the US dollar is no longer accepted as the “reserve currency” by the global markets for payment settlement in international trade, American financial assets will begin to deflate in a bear market that will be remembered for a long time to come. So what should we do to preserve our hard earned wealth? I like gold and silver, as much as the banking system hates it.

I haven’t written much lately. Sorry but I’ve not been well, but I’m getting better and I expect I’ll be sending out my normal weekly articles beginning next week. So this has been a short article for this week. Hopefully next week’s article will be longer and have more detail.