What Could Strengthen Gold Heading Into 2017?

Strengths

- The best performing precious metal this week was silver with a gain 0.76 percent. Electronic chat documents released by Deutsche Bank show that UBS and Deutsche Bank, along with others, regularly conspired trades with one another to trigger stop-loss orders, coining the name “STOP BUSTERS” for themselves, according to court documents. Plaintiffs contend that the records show these banks conspired to fix the spread on silver offered to customers and used illegal strategies to rig prices.

- BullionVault’s Gold Investor Index, which measures the balance of client buyers against sellers, jumped to its highest in five years, reports Bloomberg. The gauge of gold buying rose to 59.3 in November from 56.8 in October, while the silver gauge retreated.

- Gold premiums in China soared to a three-year high following the news of reported gold import curbs in the country along with limited supply of the precious metal, reports ZeroHedge. The import curbs may be part of China’s efforts to limit outflows of the yuan after the currency’s slide to its weakest in more than eight weeks, the article continues. Coin sales from the U.S. Mint have also risen, for a fourth straight month in fact, following the U.S. election. The 2016 American Eagle gold coin in one-ounce, quarter-ounce and tenth-ounce sizes are sold out, reports Dave Harper with The Buzz.

Weaknesses

- The worst performing precious metal this week was palladium, down 1.77 percent. Commerzbank AG believes that palladium, the best-performing precious metal in the second half of 2016, could be heading for a “price correction” early in the year, reports Bloomberg. Commerzbank also noted that gold, having the worst returns over this same period, could benefit from still-low interest rates and “ultra-low” monetary policy in 2017.

- Platinum miners, on the other hand, are contending with a 50-percent drop in prices for the metal since 2011. In addition, Sibanye Gold has agreed to pay more than its market value for Stillwater Mining Co. for $2.2 billion, giving it charge of the world’s highest-grade deposit of PGMs, reports Bloomberg.

- Exchange-traded funds backed by precious metals saw a net outflow of $6.24 billion over the past month, as gold prices tumbled to a 10-month low, reports Bloomberg. Overseas, China reported that its gold reserves remain unchanged in November from a month earlier, at 59.24 million troy ounces. According to Bloomberg, this marks only the second time the country has paused monthly buying after disclosing a 57 percent increase in holdings since 2009, as of June 2015.

Opportunities

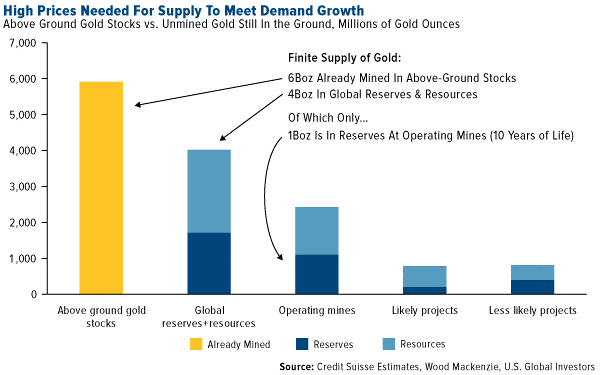

- According to a report from Credit Suisse, higher gold prices are needed for supply to meet demand growth. “The total delineated gold reserves at current prices are unlikely to keep pace with demand over the long term,” states the report. Operating mines have only around 1 billion ounces of reserves left, or around 10 years of mine life. In relation to the chart below, the Credit Suisse explains that significantly higher gold prices are likely needed to increase recycled gold supply above recent levels.

- New Shariah-compliant rules approved on November 19 for trading gold, now allow the precious metal to be accepted as an investment in Islamic finance. The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) developed the standards with the help of the World Gold Council, which has said the new rules could spur demand for “hundreds of tons” of gold, reports Bloomberg. According to Mohd Daud Bakar, a Shariah scholar, the SPDR Gold Trust (the biggest bullion-backed ETF) will probably qualify, and the standard may open new demand to central banks.

- London-based manager of the Old Mutual Gold & Silver Fund says that gold will strengthen as the Fed fails to increase interest rates fast enough to keep up with inflation. Commerzbank is also positive on the metal, forecasting it to climb next year each quarter to an average of $1,300 an ounce in the fourth quarter and extend its gains in 2018 to $1,400 an ounce by the third quarter of that year. “The headwind from U.S. dollar appreciation and the rise of bond yields should abate,” the bank says. Similarly, Citi says that mining companies are changing their behavior, which could lead to value creation in the coming years, reports Bloomberg.

Threats

- Barnabas Gan, an economist with Oversea-Chinese Banking Corp (and one of the most accurate bullion forecasters tracked by Bloomberg), believes gold will be on the retreat in 2017 “on rosier global economic growth and tighter policy from the Federal Reserve,” reports Bloomberg. Gan say that bullion will be at $1,175 an ounce in the first quarter, $1,150 between April and June, $1,125 in the third period and $1,100 by the fourth.

- Bank of America Merrill Lynch forecasts gold to trade around $1,200 an ounce by mid-2017, implying limited upside near-term. Just five months ago the bank called for gold to hit $1,500 an ounce, a much different tone than this new forecast. After prices hit a 13-month high following Brexit, the bank increased its 2017 outlook in July. Now that prices are low, they are forecasting lower. Costanzian Theory would suggest investors do the opposite of the bank’s recommendation.

- JP Morgan cited in a recent report that a tail risk for the market could be realized if the U.S. dollar continues to strengthen, yields rise and global central banks turn more hawkish. “This combination would increase the risk of recession,” the report states. In this situation we could see monetary policy reverse and the application of aggressive monetary and fiscal easing. “In these circumstances, it would not be unreasonable for safe haven, inflation sensitive assets such as gold to reach all-time highs.” The bank advocates a barbell approach – long stocks, long gold as a means to balance the threat of an equity correction.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of