2016 Year-end Review And Forward Analysis For 2017

As always, I provide no predictions or forecasts for the future.

As a successful long-term investor, I remain faithful to Warren Buffett’s life long commitment in investing by observing his two rules.

- Rule #1 – Do not lose money.

- Rule #2 – Do not forget rule #1.

Looking Back On 2016

Our long-term investment model has switched back to favoring equities after placing us on the defensive in 2015. A false alarm in hindsight.

The growth sector as represented by $SPX also switched back to a major buy signal in late 2016.

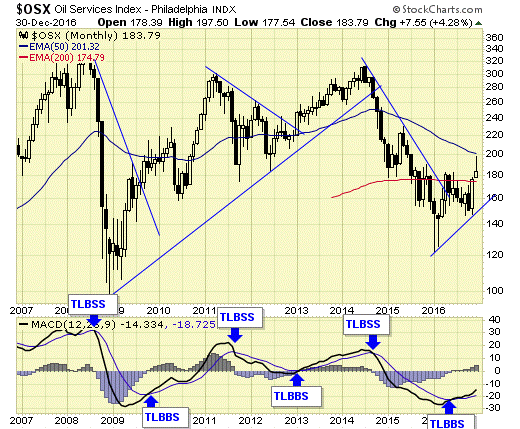

The oil and energy sector as represented by $OSX had a major buy signal in early 2016, ending the major sell signal from 2014. The multi-month consolidation after the new major buy signal provided us with excellent entries, with a 40% allocation for the long-term.

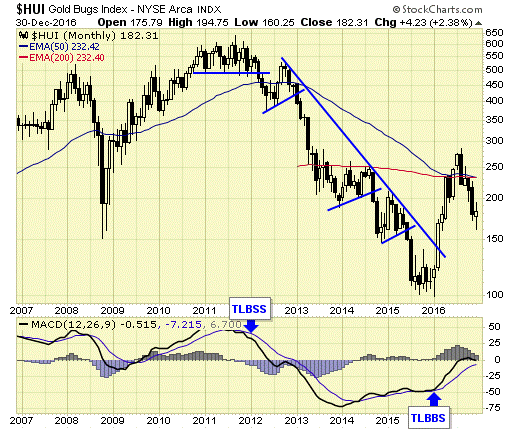

The gold sector as represented by $HUI had a major buy signal early in 2016, but it was a price spike and no entries could be made, and no consolidation with no trendline support established so far to set up for a long-term allocation.

Copper sector also had a major buy signal in 2016. TECK went straight up, while FCX consolidated and we entered near the bottom of the consolidation range, with a 10% allocation for the long-term.

Summary

All three sectors are on major buy signals at the end of 2016.

The best opportunities were in the energy sector where we took a 40% allocation intended to be held for the long-term.

These positions are up on average of 14.8% as of 12/31.

We also took a 10% long-term position in FCX, a giant in the copper sector.

FCX is up 23% as of 12/31.

It was another profitable year.

Looking Forward To 2017

Our long-term stocks/bond model switched back to favoring equities in 2016, therefore, I’m looking for new opportunities to be fully invested in 2017.

The growth sector is in a super bull market with no overhead resistance.

The major breakout in 2013 after a 12-year consolidation rendered this a young bull and should have plenty of upside in coming years.

Any sharp correction with a spike in VIX will be buying opportunities in 2017.

USD remains on a major buy signal since 2011.

As long as the dollar remains in a bull market, precious metals will be under pressure overall although we may see some sharp bounces periodically.

$HUI is on a major buy signal, and we need to see a multi-month consolidation, with trendline support established before considering any long-term allocations.

Crude oil bottomed in 2016 and a new bull market is in progress.

$OSX is on major buy signal with established trendline support.

We look for new buying opportunities in 2017 at cycle bottoms.

Summary

All three sectors are on major buy signals.

- Growth sector has no overhead resistance, any sharp correction with a spike in VIX in 2017 will be buying opportunities, ideally confirmed with a cycle bottom.

- Energy sector has trendline support and plenty of potential upside, looking for new buying opportunities at cycle bottoms in 2017.

- Gold sector needs to establish trendline support on the monthly chart, ideally after a multi-month consolidation. If so, I may consider some long-term positions at a cycle bottom.

- FCX is an individual stock and I am content with a 10% long-term holding. However, should we see a correction to the 50/200ema in 2017, I may consider adding to positions if there is investable capital.

- I will also consider some short term trading upon set ups and if risks are manageable.

- Looking for new opportunities in 2017 to put the remaining capital to work to become fully invested.

Thank you for your continuous support and looking forward to another profitable year together.

Jack Chan is the editor of simply profits at www.simplyprofits.org, established in 2006. Jack bought his first mining stock, Hoko exploration in 1979, and has been active in the markets for the past thirty seven years. Technical analysis has helped him filtering out the noise and focusing on the when, and leave the why to the fundamental analysts. His proprietary trading models have enabled him to identify the Nasdaq top in 2000, the new gold bull market in 2001, the stock market top in 2007, and the US dollar bottom in 2011.

In his spare time, Jack is an avid golfer and tennis player, and volunteers his time coaching and lecturing at local clubs and universities.