Gold Forecast: The Bull Run in Gold Miners is Just Starting

After years of going nowhere, gold launched into the next stage of its bull market.

After years of going nowhere, gold launched into the next stage of its bull market.

While inexperienced investors might feel inclined to capitalize on recent profits, such a move could prove detrimental in the long run.

Gold and silver miners have underperformed the metals for years - recent evidence suggests that may finally be changing.

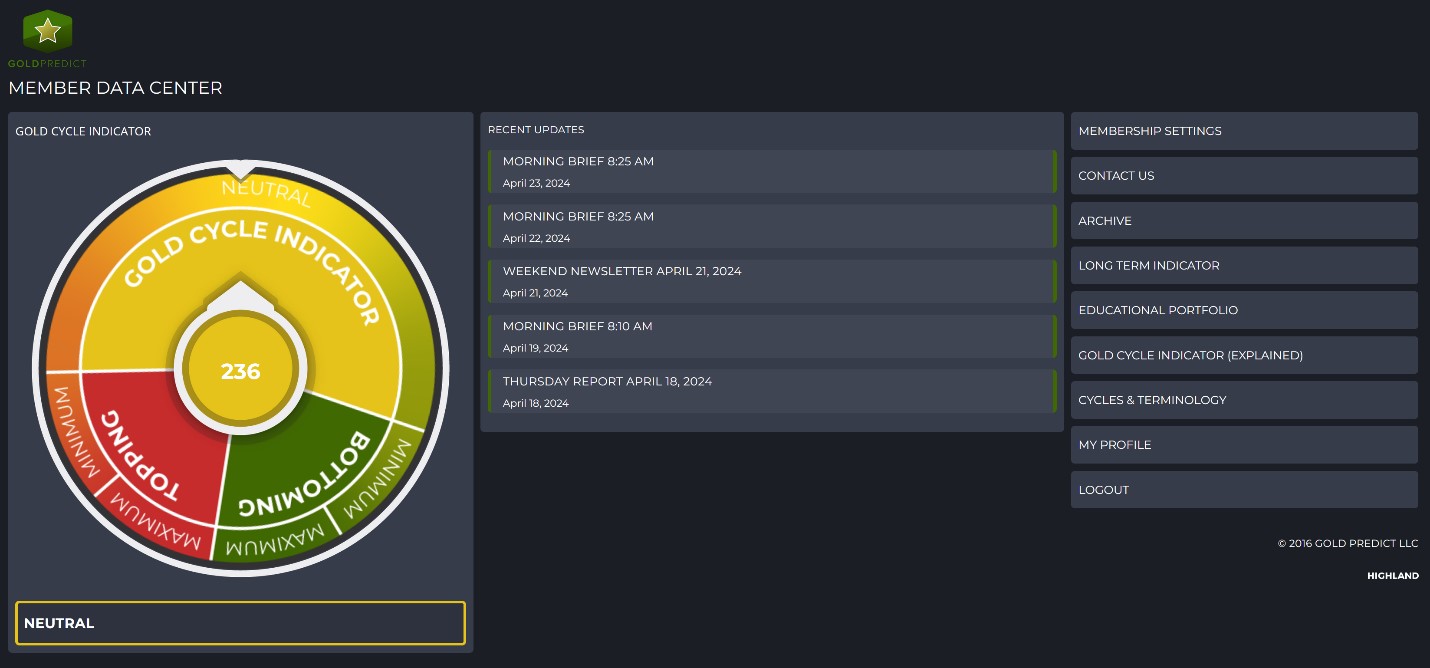

Our Gold Cycle Indicator finished at 236; we hedge our mining portfolio once it advances above 350.

GOLD MONTHLY- The monthly gold chart confirmed a major breakout, and we think prices could test $3000 in 2024. By 2030, we see prices trading over $8000.

GOLD- In the near term, gold is consolidating after spiking to $2448. We think prices could challenge $2500 before slipping into the next four-month cycle low due mid-June.

SILVER- Silver is taking a breather after spiking above $29.00; we see the potential for a significant short squeeze above $30.00. Currently, prices are consolidating ahead of next week's Fed announcement.

PLATINUM- Platinum remains deeply undervalued, and we see prices trading at parity with gold later this decade. In the early 2000s, prices were often double that of gold.

GDX- The pattern in miners is remarkably symmetrical. The recent pullback to $32.50 appears complete, and we see miners taking the lead and outperforming metals from here.

GDXJ- Juniors found support near $40.00 and the pullback looks complete. We expect prices to make fresh highs above $45.00 in May.

SILJ- Silver juniors reversed Monday's down gap, and a breakout above $12.00 should follow.

NEM- The market liked Newmont's Q1 EPS beat and positive second-half outlook. Prices broke cleanly above the downtrend line, and the late February low looks like a generational bottom.

Conclusion

The gold bull market is in full swing, and sub-$2000 prices may be forever in the past. Gold miners are on the move and have a lot of potential. Silver could rip to the upside once it gets above $30.00.

AG Thorson is a registered CMT and an expert in technical analysis. For daily market updates, consider subscribing www.GoldPredict.com.

******