Gold: Age of Uncertainty

Even though we live in an uncertain age, markets reached all-time highs. For some, markets are supposed to foretell the future, so investors must be looking across the valley and seeing lotusland. Maybe markets are confident that Trump’s TACO effect will prevail. Bombing Iran negated that. How about “FOMA” style greed? Certainly Trump’s brokering the Iranian/Israeli ceasefire helped. Then the president’s 90-day respite on reciprocal Brexit-type tariffs was the pause that refreshes which allowed markets to recoup the 20 percent odd losses. Tariff fatigue? Or maybe it is just the eye before the storm?

Our view is that a tsunami of liquidity is the major factor for the record highs. So much money has been created in the past that there are few outlets. While there is a ceasefire at home and abroad, there remains unprecedented uncertainty, from the escalating wars, to Trump’s re-escalation of his global trade war, to the geopolitical morass and Mr. Trump himself. No one knows, including the president, what lies ahead. We believe that the old broker’s advice applies here, “when in doubt, stay out.” Investors we believe are too complacent, ignoring the fact that markets are priced to perfection, stock price valuations are near record highs, and importantly fiscal deficits are unsustainable. Certainly future events are as unpredictable as Mr. Trump himself. The last time investors ignored the obvious was just before the Great Depression.

Big Borrowing Binge

Astonishingly the market rebound ignores the reality that US debt is so large that the president’s big budget bill signed into law, slashes taxes so much that the US must borrow a staggering $4 trillion, doing long term damage to the foundation of America’s economy. The White House believes the MAGA mega bill will deliver growth and that tariffs will close the spending gap but instead guarantees huge fiscal deficits. Yet the nation is heavily indebted. Interest alone costs an astounding $1 trillion year, which is more than they spend on defense. To fund his tax cuts, the bill slashed Medicaid and food stamp spending for America’s poorest in a reverse Robin Hood gambit.

During the president’s first term, public debt hit 125 percent of GDP, forcing America to borrow at an alarming level due to the fiscal imbalance. The fiscal impact of the 1,000-page mega bill continues this trend and will push federal spending up 9 percent from a year earlier, adding to the sheer volume of Treasuries which has grown from $5 trillion to over $29 trillion, equivalent to almost 100 percent of annual US economic output. America is already the largest debtor in the world with debt at a record $36 trillion and the bill adds $3.4 trillion to that debt, increasing costs which is passed on to already stretched consumers. America’s next problem is the greenback which has sunk to three-year lows effecting the long-term damage to its economy. As a result investors are backing away from US debt because its finances are beginning to look more of an emerging market country. America’s ballooning debt is its Achilles heel, and the fiscal trajectory pushes it closer to a debt crisis.

Simply American exceptionalism endangers the country’s fiscal health and we believe that Trump’s signature tax and spend bill is the tipping point because it must be financed by unprecedented borrowings, forcing the Treasury to sell a huge amount of new bonds, putting further pressure on the bond market. Investors are concerned about all of this red tape, and when tariffs are added, there are worries about stagflation as long as inflation stays above target. Investors' enthusiasm for Treasuries has already been harmed by the threat of growing deficits and debt, but this time they want to be fairly compensated for the elevated risks. At 130 percent of GDP, America's debt is at its greatest level since World War II. The rise in bond yields risks becoming entrenched as reduced demand and an exodus is exacerbated by Mr. Trump’s fiscal binge that transfers income from the poor to the rich. With the economy dependent on Mr. Trump’s agenda, tariffs will not only raise prices, but our view is that the economic cost takes an estimated trillion-dollar chunk out of America’s supply chains, retail and services. On the other hand, tariff revenue is estimated to be a paltry $300 billion based on May’s result, a drop in the bucket given that federal revenues last year was $4.9 trillion. This time, inflation will be cost-push rather than the demand-pull in Trump’s first term. That is how hyperinflation begins.

Former “first buddy,” Elon Musk’s bromance with Trump ended in a bitter public breakup after the electric vehicle tax and emission credits were suspended which resulted in Elon calling Mr. Trump’s tax bill an “abomination” that escalated into a Republican civil war and, a new party. The world’s richest man tried to run government like one of his companies, while the world’s most powerful politician runs government like his company. Mr. Musk, having failed to change government after his DOGE did not find the promised $2 trillion in savings, reduced to $1 trillion, is gone, leaving a paltry few hundred billion in spending cuts. Ironically the government is scrambling to rehire those fired federal workers. Noteworthy is that none of DOGE’s proposed cuts were in Trump’s landmark bill. So much for so few. The lesson is that Washington knows best how to spend, not cut spending.

Wars, Wars, Wars

Overlain on this big beautiful bill is the revolutionary agenda of Trump and his MAGA cabinet acolytes on the economy, technology and military. The same bill increases the budget of the Immigration and Customs Enforcement Agency (ICE) which shifts the land of the free to the land of deportation. Then there is America's cultural war, in which the government has cut off financing to its Ivy League colleges due to ideological disagreements, especially on diversity, equality, and inclusion (DEI), starting a fight against the bulwarks of free speech, education, and ideas. The US is the world leader in higher education and attracts one million foreign students that contribute as much as $50 billion annually. America’s strength has come from its universities and leadership in technology, science and medicine which made America great. But today in an America driven by division and disputes, the administration believes that the education system is broken and that if universities take government money, they must play by government rules. The education industry that attracted global talent (including Mr. Musk) will be crippled by the loss of government funding, the tightening of rules on foreign students as well as the climate and science denialism. Other MAGA targets include the big law firms, media, pharma, government agencies like USAID and even sanctuary cities like Los Angeles reflecting the divided State of America. The cure might be worse than the disease.

There is more uncertainty around Mr. Trump's battle against Democratic-run cities because the president deployed more National Guard soldiers in Los Angeles than in Iraq or Syria. Although Trump’s use of the military was specifically aimed at protecting federal agents and buildings, part was about performance and a sop to his base rather than maintain order. Not surprisingly the protests in Los Angeles have spread to other cities. Is New York next? The National Guard's highly visible use is a gift to Trump's MAGA constituency, and it is obvious that the shift towards authoritarianism is only the beginning. Who knew that torching Tesla would be a symbol of protest? The consequence? The rule of law is being stretched once more after the Supreme Court, which divided along ideological lines and prevented lower courts from overturning Trump's directives, voting 6-3 in favor in Mr. Trump's use of executive orders.

After returning to the White House promising to end the world’s conflicts, Trump’s second coming sees a deeper reality of America at war both at home and abroad. Having promised no new wars, Donald Trump started one. Despite peace pledges, the Ukraine/Russia war and the Israeli/Iran conflict festers and while the Iran bombing threatened to engulf the region, Iran still has enriched uranium and remaining nuclear infrastructure to make bombs. Much will depend on Mr. Trump who scrapped the 2018 Iran accord in his first term, whether his gamble will be measured by a durable peace because despite the ceasefire, the Israeli/Iran war is the fifth in five decades. No one knows what is next. Wars are easy to start and harder to end. With the onset of the fog of war, only years after the Afghanistan debacle, the “no war” president who covets the Nobel Peace Prize, finds himself in the middle of three wars.

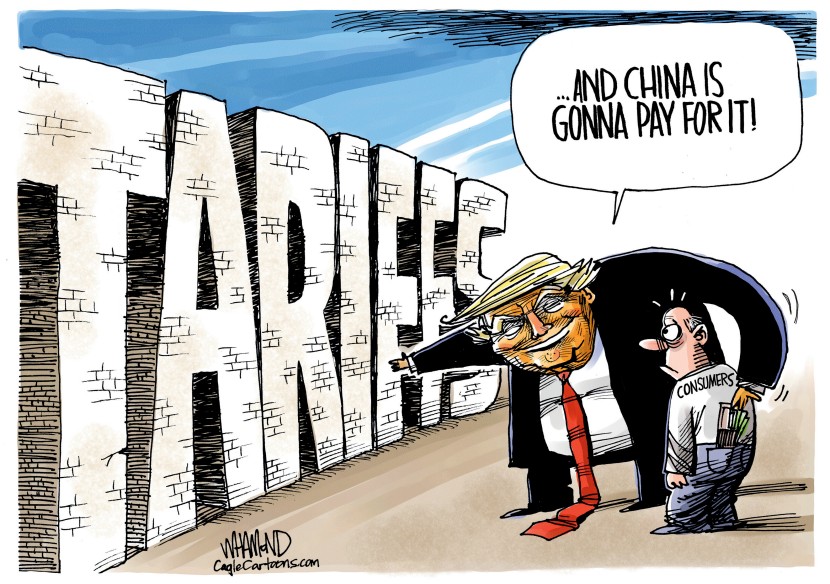

Tariffs, The Art of No Deal

Although markets are focused on Mr. Trump’s America First, they overlook his massive accumulation of power as he monetizes the presidency and runs the country like a family business. Investors would be wise to focus not on the headlines or the president, but instead on the structural problems and the outcome or consequences. It is ironic that for much of the 21st century, Americans extolled the importance of having transparent rules of law and institutions to underpin its democratic values as protection against authoritarianism. Those tenets are easily misused today. And after the 90-day pause, tariffs are back with only three trade pacts and not the 90 deals in 90 days promised. Trump said that trade deals would be easy. Wrong.

Tariffs are dangerous and detrimental. The solution can be found in history: the Smoot-Hawley Tariff Act of the 1930s was intended to safeguard farmers, but tariffs ended up being a fiasco and a tax on businesses and consumers alike. The levies so incensed America’s allies that the tit-for-tat reaction exacerbated the Great Depression. This president continues to ignore history and that his tariffs are based on erroneous theories. We believe that Trump’s trade policy ushers a new era of statecraft that will prove to be one of the most expensive pieces of policy in generations. The cost will be not paid by exporting countries but by Americans. Win or lose, the tariffs will end up in the Supreme Court but the balance of power is held by three Trump appointees.

We also believe that the “Brexit-like” effects are all too predictable. Fracturing global trade with the tariff roller-coaster has weakened trust and will dampen global economic growth, according to the OECD. US exports have dropped 5.2 percent in May, the worst since the Covid-19 virus in 2020. Consumer spending is lower for the second month in a row. Del Monte, the food giant, filed for bankruptcy because of tariffs. With the US Constitution under siege, the checks and balance of their forefathers have been negated by Trump’s assault on the rule of law. Congress long ago surrendered their authority in the first term. Nonetheless we believe Trump’s revolutionary cornucopia of regressive tariffs, profligate spending and resultant inflationary fiscal deficits is a toxic hyperinflation cocktail that raises doubts of the US as a safe haven. The roller-coaster effects of court rulings and postponed tariffs only creates more uncertainty, yet the legal system may prove to be Trump’s biggest guardrail.

Trump's tariffs are simply the beginning of the new world we live in. Protectionism is an excuse for the President to amass greater power, allowing him to make the most ambitious changes in his country’s history. The only certainty is the uncertainty and the consequences are unknown. To be sure history shows that there was no single cause that caused the Great Depression, but we believe that the series of events such as tariffs which removes as much as $1 trillion from a significant part of the world’s GDP for a paltry few hundred billions is one of the many catalysts of the coming collapse of the American house of cards.

China Syndrome

Sanctions and chip limitations were seen as short-term policy instruments to stifle the largest creditor and second-largest economy in the world. This time Mr. Trump thinks that tariffs or a tariff wall will cripple the industrial giant’s relationship. Instead tariffs have set in motion a new world order central to the shape of the 21st century. Although China and the US have declared a trade war truce, China is pursuing the long game against the US on-off tariffs. Beijing was able to weaponize exports through a licensing system, with the Ministry of Commerce (Mofcom) awarding licenses for the export of rare earths, which are essential for a variety of US industries, including defense, thanks to its control over the world's vital natural resources. Auto production lines in Canada and US have shutdown because of shortages of rare earth inventories. China discovered in Trump’s first term that to counter the US, it needed to invest in expanding its economic, military and diplomatic footprint to reduce its dependency on the US. The US on the other hand keeps using the old unipolar playbook where “might is right” but its economy is totally disorganized for the 21st century, exemplified by his desire to protect outdated steel mills.

Chinese automaker BYD even outsells Tesla in Europe while the battleground shifts to autonomous electric vehicles where China has a leadership position. Today Chinese low-cost battery storage system powers its country-wide grids. China has 10G today and its AI start-ups rival Google. At sea, China dominates global shipping and built the world’s largest navy. China has become less dependent on the world’s goods and services and is a key partner in multi-lateral global order. Imports are 18 percent today of which from the United States provided only $164 billion while America’s imports are 14 percent of their economy. Steel and aluminum, the materials used by its domestic car industry make up about 25 percent of steel consumption, so tariffs will hurt America’s own manufacturers and eventually its consumers. The Chinese economy is set to grow at 4 percent, outpacing the rest of the world notwithstanding that the US is no longer a welcoming market and Chinese housing remains in a funk. China has intensified its diplomacy, opening its markets to 11-nation BRICS in bilateral deals to broaden its influence and security in the region. BRICS now represents half of the world’s population. China simply is being seen as a more reliable partner over the US which is faced with its structural problems.

Growth is also on China's side as it closes the technological divide with the West and gains dominance in fields like artificial intelligence (AI), renewable energy, consumer goods, robotics, and batteries, allowing the country to take advantage of its near monopolization of 70 percent of the world’s rare earth production and 90 percent of its processing. China’s weaponization of rare earths is at the centre of the US-China trade war and likely was the key factor in forcing Washington to reverse its levies on China. Seventy percent of all EVs are today made in China and are among the most advanced in the world.

On top of this, Trump’s “angry man” act won’t easily rout its competitor so a transactional rapprochement along commercial lines is likely. In fact, America’s dependence on rare earths for high tech goods, EVs and jet fighters prompted the US to ease restrictions on chips, once thought to be a threat to national security. America’s defense industry will be forced to pay more, undercutting Trump’s proposed defense buildup by reducing the supply of materials needed for its national security. European car manufacturers have already applied and received licenses to buy rare earths. And, Chinese students won’t be blocked from attending America’s universities. Trump also lifted oil sanctions on Chinese refineries, buying Iranian crude in a softening of earlier conditions. Noteworthy is that China agreed to relax its rare earths exports to the US, but for only six months. Pointedly the China/US framework is not a trade agreement but simply a return to the status quo before “liberation day”. Essentially, the US canceled those punitive tariffs in exchange for continued access to rare earths and critical materials. So much, for so few gains.

China: The Banker

Equally, China’s chokehold on resources is dwarfed by its balance sheet as creditor to the world with forex reserves of $3.3 trillion at the end of June. At a crucial moment when America has grown increasingly reliant on foreign funding, China, which was once the biggest buyer of US debt, has fallen to third place behind the UK and Japan. The world has changed. At one time, China's peak holdings were more than $1.3 trillion but the stockpile is down to $757 billion to 16-year lows as China replaces the dollar holdings with gold which are denominated in dollars. Paradoxically while Mr. Trump is more interested in short-term wins, what would happen if he achieved his long-standing goal of a lower US current account deficit? Simply, less foreign money coming into the US and interest rates would need to move higher to attract funds, hurting the US economy at the same time.

Ironically, given the rise of China's economy, America has become dependent on the very country that the president calls “adversary number one” and, with higher interest rate costs resulting in more borrowings, someone must fill the financing gap. Trade between China and the US has collapsed so there are fewer dollars. China maintains a non-convertible currency and is not exposed to dollar. Simply the world’s biggest debtor’s currency is losing its status as a haven in a volatile world with few alternative replacements. Capital inflows are the mirror image of America’s trade deficit. If you block imports, so will capital. The US government needs to borrow because it spends more money that it brings in. Borrowing fills the gap, but the sheer volume of Treasury issuances is more than demand, pushing yields dangerously higher as Mr. Trump’s economic house of cards may soon collapse.

Debt, Deficits, Dysfunction

The dollar became the world's reserve currency when the Bretton Woods system, which was put in place after World War II, collapsed, but Trump’s trade policies have lessened the dollar’s influence, replacing soft power with blunt hard power. America is no longer exceptional and capital protectionism raises risk and tariffs threaten the global economic outlook. To date, the dollar has declined by almost 11 percent, sinking to its lowest level since 2023. Currently foreigners hold about a quarter of US debt and holders are demanding a risk premium at recent auctions to be better compensated for financing America’s enormous debt load.

Ultimately there are three possible outcomes. Either the US grows, cuts spending, or re-inflate inflation to make the non-dollar value of US debt go away. Spending cuts like DOGE savings, for example, were always a figment of Mr. Musk’s imagination. Politicians are unable to cut spending. The inconvenient truth is that economic growth will be hurt by Mr. Trump’s erratic tariffs on friends and foes alike and undermines investors’ confidence in Trumponomics. Mr. Trump’s tariffs are to be higher than the Great Depression, which further erodes the long-term trust and growth among allies, while his mega tax bill adds trillions of dollars to the debt load which is a sure track towards higher inflation. If America wants to slash taxes and spend trillions more than it cannot afford, with a divided America and half the population living on maxed credit cards and zero savings, why should others help? That leaves the Fed to help.

In letting the inflation genie out of the bottle, the former real estate tycoon has always been a “low interest” man and believes that the Fed should be cutting rates to help his tax agenda. Mr. Powell has a different opinion preferring to wait to see whether Trump’s tariffs will cause higher inflation, or higher unemployment or, both. In a move reminiscent of Turkey or Venezuela, where central banks capitulate to politicians which lead to stagflation or even hyperinflation, Mr. Trump is already seeking to name a successor or "shadow" chair, even though Mr. Powell's term ends in May of next year. This will increase political pressure on the Fed to maintain artificially low interest rates. Amid the realities of rising debt and economic uncertainty, the Fed is caught between a rock and a hard place since the tariff shock alone will push inflation higher, undermining the appeal of the dollar as a haven for investors. Should Powell cut rates as Mr. Trump demands, the easy money will make inflation great again. Not long ago President Nixon ahead of the 1972 election applied similar pressure to the Fed which eventually led to near-hyperinflation, financial havoc and a devalued dollar. The only certainty is uncertainty.

Under Mr. Trump, a crisis would be unpredictable, is it America first or Trump first? To date the president has surrounded himself with a “like-minded” cabinet who are largely in-step with his confrontational approach. Of concern is that the stagflation dangers are dangerously similar to those of the 1930s hyperinflation, which was caused by protectionism, the testing of democracies, and the shift toward authoritarianism. Then there is the rejection of international law and the destruction of the institutions and ideals that have supported American dominance for almost a century. The long-term damage to America's standing as a financial safe haven and weaponization of its financial system is among the most detrimental effects. Trust is the most precious commodity in markets. The lessons of history have not been absorbed by investors. According to Mark Twain, "History rhymes even though it doesn't repeat." Gold is a good thing to have.

What Damages Trust in the US Damages the Whole World

A structural shift in foreign holdings of US debt has already resulted in a drop from 50 percent in 2014 to 25 percent today. Capital is the key and as America adopts a more transactional approach with both allies and foes, there is a growing mistrust in US power and the dollar. In April, the trade deficit halved as companies front-ran liberation day, resulting in an almost 20 percent drop in imports. For some time the dollar was the keystone of the global based trading system which allowed the US to issue the world’s reserve currency to pay its debts. Nothing lasts forever. Through years of abusing its “exorbitant privilege,” people have lost confidence in the dollar. Tariffs are the tipping point, accelerating a decline in international dollar reserves from near 80 percent in the 70s to 58 percent today. Trump’s disorder is an accident ready to happen. Deficits don’t matter until they do.

For the first time in generations, governments are faced with the prospect of running out of money. The era of cheap money is over and a profligate government is scrambling to finance the largest spending package at a time when debt and deficits loom large. US debt has become risky and with the recent Moody’s downgrade of America’s treasured AAA credit rating, the fiscal worries are exacerbated by concerns about demand for US debt making America a riskier place to invest.

As a result, America's massive borrowing needs have become more challenging against the backdrop of elevated rates such that there has been a shift to shorter-term debt and Treasury bills in order to reduce financing costs but, this gamble raises refinancing risk, because if rates jump, the cost hits the budget. Of concern is that this year the US must refinance a whopping $9 trillion or 25 percent of US debt but at higher levels. But none of this, of course includes the impact from Trump’s tariffs or his tax mega bill, particularly since 10-year yields spiked above 4.5 percent. To reduce the debt burden, our concern is that the Trump administration will use unconventional methods.

The $29 trillion US Treasury market, which is the foundation of the global financial system and at the center of the global economy, has been under increasing strain due to the sheer number of offerings at a time when borrowing prices are rising sharply, making America's financial crisis worse. In 2006, Wall Street created derivatives that helped drive the housing boom but soon the mispriced sub-prime mortgages were found to be worthless, leaving investors and homeowners with devastating losses that triggered the financial crisis in 2008-2009. It took years for the markets and homeowners to recover from the burst housing bubble. Today, there are new forms of derivatives or money that has been created with the current administration scrambling to make bitcoins, stablecoins and other digital currencies or cybercurrencies worth something in order to finance economic growth or pay down the nation’s debt. The Fed and SEC’s have been enlisted into making cybercurrencies equivalent to money and have even changed rules to make them easier to trade.

Monetary Bailout?

Enter stablecoins whose value is to be pegged to dollars, creating yet another derivative or surrogate for money since each stablecoin is to be “collateralized” or backed by a dollar or US Treasuries and that dollar is backed by the good faith of the US economy. Of course the US would never default on its obligations despite a history showing that the US defaulted in 1985, 1971, and 1933. Stablecoin is being touted as an alternative to money because it can be transferred across the internet and outside the banking system. Donald Trump’s Trump Media recently raised $2.5 billion from investors to buy cryptocurrency, specifically bitcoin. Earlier the family promoted a $TRUMP memecoin, a look-alike and Melania has one named after her. At one time Mr. Trump thought cryptocurrency was a “scam” but soon jumped on the bandwagon when found that it was a popular way to raise money. In fact, his administration has lightened the regulatory burden even instructing the government to drop cases against crypto firms. Vice-President J.D. Vance predicted digital money would be “a force multiplier of our economic might.” The Senate passed the GENIUS net bill to create a regulatory framework. That crypto is often based offshore and in a grey world of banking is no matter, as crypto creeps into the financial ecosystem, financing indirectly America’s deficits.

Although crypto is not yet entrenched in the US banking system, it is ideal for sanctioned countries, drug dealers, Wall Street and the United States. But like other surrogates or derivatives of money, it is not money, nor backed by central banks and fungible. Most important, it is unregulated. Crypto is just another card in this Ponzi house of cards. We believe that the integration of crypto and traditional finance is an accident ready to happen, as it was in 2008-2009 after that last derivative of money, sub-prime mortgages imploded. Yes, it could happen again.

Recommendations

With the US dollar’s status as a safe haven for global capital under threat, gold is in the midst of a historic rally, doubling in a few years because gold is an alternative to the dollar. We believe like critical minerals, gold has also become part of a nation’s national security strategy. Tariffs have wreaked havoc in copper markets – is gold next? Central banks for example have been buying gold at a record pace. They have acquired a whopping 1,000 tonnes every year for the third year in a row (or about a quarter of total annual production). Iran disclosed that it has purchased 100 tonnes in the past 12 months to March. For them, gold is money. As a result central bank gold reserves are at the highest since the Sixties and gold has overtaken the euro as the world’s second largest reserve asset after the US dollar, doubling since 2019 to 23 percent. China is the largest producer in the world as well as the largest consumer, purchasing gold for the eighth consecutive month at 2,298 tonnes because it does not have enough gold to fulfill its needs. The Shanghai Gold Exchange is the largest physical bullion trader in the world. There are also supply problems as the mining industry reached peak gold two years ago.

Gold is also a defense against inflation. Mr. Trump’s financialization of the US economy will ensure that the Fed will keep printing money and a weaker dollar will drive inflation, further boosting inflation, the highest in 30 years. So far President Trump has been very reliable as an agent of dollar devaluation, from immigration, tariffs, and his administration has introduced uncertainty and volatility, undermining business and consumer confidence. At a time when voters see the economy as top concern, Trump’s desire to curtail trade and investment with the rest of the world and dismantle the ecosystem that governs such flows erodes the dollar’s underpinnings, pushing long-term bond yields up. All this is good for gold, but bad for the dollar.

Gold rose 2,300 percent from $35/oz in 1971 to $850/oz in 1980 reflecting the deterioration of the US dollar. In 1999, gold rose from $252/oz or twenty years after its peak, topping $1,900/oz in 2011 for a 653 percent increase. While $3,300/oz may seem high, it is only 74 percent above the 2011 peak at $1,900/oz. This bull market has only just begun.

Gold stocks have been winning investments this year amid investor uncertainty. However, the main driver can be found on the supply side. Peak gold arrived two years and the long lead times, requirement for billions of capital and dearth of discoveries have contributed to higher gold prices. In addition to the mining companies looking to replace in-situ ounces, there are countries such as China, which are acquiring overseas mines as part of its national security in an attempt to clinch vital resources to stockpile. Consequently, Zijin has been on an acquisition spree, partnering with Barrick. China has avoided North American because of the anti-Chinese investment rules but they have surfaced in Africa, Latin America and South America. Gold miners have become precious.

Gold miners’ second quarter results should be much higher due to the almost 14 percent increase in the gold price over the first quarter. Margins are wide and with balance sheets cashed up, the higher cash flow allows them to increase exploration budgets, dividends and buyback shares. The dilemma for the mining industry however is reserve replacement and the shifting landscape provides a tailwind for M&A activity as miners find it cheaper to buy ounces on Bay Street, rather than spend money on traditional exploration because it can take up to 10 years from discovery to first pour. To date dealmaking has resulted in further industry consolidation for both growth and optionality. Discovery Silver bought the Porcupine complex from Newmont for $425 million which is a big price given reclamation liabilities. Last year AngloGold bought Egyptian based Centamin to diversify geographically. Moreover, geographic risks has been a major factor with West African players having to fend off governments wanting to pluck the golden goose. Barrick remains locked in a dispute with the Mali government and earlier Centerra lost its flagship to the Kyrgyz Republic which was never replaced.

Today we are beginning to see an investment shift from the major gold producers to the developers who are bringing on production in the current cycle. We believe that the developers hold the best upside potential. We monitor about 20 developers and have focused on those with feasibility studies that are economic in the current cycle. Osisko Development, Perpetua, and Skeena currently stand out. Unfortunately the low hanging fruit has been picked and for the majors, there are few Tier-1 candidates. Newmont for example just completed the sale of half a dozen non-core mines that they inherited from the disastrous $16.8 billion acquisition of Newcrest and $10 billion for Goldcorp as the company continues to sort out integration problems even after taking big writedowns. Bigness was certainly not best here. Among the seniors we like Barrick and Agnico Eagle. The developers like McEwen Mining, B2Gold and Endeavour are favoured here. McEwen is developing the world-class copper Los Azules in Argentina. As for M&A, expect Lundin and Eldorado to be active.

Agnico Eagle Mines Ltd.

Agnico is the largest Canadian gold producer with mines in Canada, Finland and Mexico. The company’s guidance remained unchanged and continues to focus on its gold assets generating healthy cash flow particularly from its large Canadian base. Agnico Eagle has done well with acquisitions such as Kirkland Lake which brought Detour Lake and higher-grade Fosterville in Australia and later, Canadian Malartic in Québec. Agnico Eagle has also grown through organic expansion in a hub and spoke strategy filling up spare capacity (Marban material will be processed at Malartic). Also, Agnico is an investor in early-stage projects building up a farm team or skunk works which gives Agnico exposure to a multitude of plays, and a pipeline for both brownfield and greenfield opportunities, including Hope Bay. We like the shares here for growth and strong cash flow.

Barrick Gold Corp.

Barrick’s collection of Tier 1 assets includes Pueblo Viejo, Nevada Gold Mines JV and Lumwana which are expected to be major contributors this year. Barrick’s long-term growth will come from Reko Diq in Pakistan as it brings in government and Saudi partners in order to defray geopolitical risk, helping arrange a $2 billion financing. Reko Diq has a 37 year mine-life and will produce about 500,000 ounces plus 460 kt of copper annually. Barrick is an old hand in dealing with governments. Mali’s military government is selling one metric ton of gold that Barrick held at its Loulo-Gounkoto mine on hopes to reopen the mine currently on “care and investment”. Both parties are mired in a standoff while the government threatens to nationalize the largest mine in Mali that represents about 15 percent of Barrick’s production. Barrick has been through this many times and the positive and patient outcomes in Tanzania and PNG were successful. Ironically Barrick has grown through acquisitions, but since Mark Bristow and John Thornton have been in the saddle, they have gone about pruning and building up assets, emphasizing organic growth. Buy.

B2Gold Corp.

Results were in line with expectations and unlike Barrick, B2Gold’s negotiation with the State of Mali resulted in a go-ahead at Fekola Regional under the new mining 2023 code. B2Gold is bringing on the billion-dollar Goose project in Nunavut in the second half of this year, which is expected to produce 270,000 ounces annually at $1,500 AISC. B2Gold’s next mines are likely Gramalote in Colombia (potential 240,000 ounce/year) and the Antelope project in Namibia near its Otjikoto open pit. B2Gold has a stake in Snowline Gold. We like the shares of this developer. Buy.

Eldorado Gold Corp.

Mid-tier Eldorado’s Skouries copper/gold mine is two-thirds complete and will come on stream Q1 next year producing 300,000 gold-equivalent ounces which is a potential Tier 1 asset that will boost Eldorado’s production. Eldorado reported AISC of $1,559/oz from Lamaque in Québec and will produce 520,000 ounces from Efemçukuru and Kışladağ in Türkiye and Olympias in Greece. Skouries is fully funded and will be a major contributor. We like Eldorado here.

Endeavour Mining PLC

The West Africa producer completed major projects in Côte d’Ivoire and with five mines also in Senegal and Burkina Faso, Eldorado should produce 1,250,000 ounces this year. Execution is key and Endeavour’s BIOX plant expansion Sabodala-Massawa is generating good returns. Reserves were boosted at Assafou-Dibibango which should produce 329,000 ounces/year at AISC under $1,000/oz. We like Endeavour for its ability to grow production through both acquisitions and organic growth, generating attractive returns. Endeavour expects lower production in the second half with slightly lower grades at Lafigué. Buy.

IAMGOLD Corp.

Mid-tier IAMGOLD is bringing on Côté Gold which achieved nameplate throughput at 36,000 tpd over a 30-day period. To be sure Côté is a major producer but teething problems will be a major factor. Mine grade will also be critical. We believe IAMGOLD has bet the farm on Côté whilst Renaud Adams tries to bring Côté on stream. A second cone crusher is to be installed. IAMGOLD’s Westwood is high cost and Essakane in Burkina Faso is a mature operation also with high costs. Balance sheet rebuild is IAMGOLD’s next task. Sell.

Kinross Gold Corp.

Kinross is developing the open pit and underground Great Bear project in Ontario acquired for $1.8 billion and has spent time and billions to bring the mine into production. However Great Bear is not yet built nor even in feasibility stage and thus will likely miss cycle since completion at the earliest is at the end of the decade. In the interim Kinross has mature mines with Round Mountain and Bald Mountain short-lived lives. Paracatu is a consistent performer and Tasiast has been problem prone with recoveries key. Man Choh has extended Fort Knox’s life in Alaska. Consequently we view Kinross is a source of funds. Sell.

Lundin Gold Inc.

Lundin Gold is a single mine but what a mine in Ecuador, 100 percent owned Fruta del Norte (FDN) is among the richest in the world and the lowest costs among the majors and as a result has steadily increased dividends. The miner produced 139,000 ounces in Q2. Lundin discovered a promising new copper-gold porphyry system nearby FDN. Lundin mine is a cash flow machine and likely takeover target. Newmont is Lundin’s largest shareholder at 32 percent, followed by the Lundin family at 26 percent. Ironically, Fruta del Norte was once owned by Kinross. Lundin will produce 510,000 ounces at AISC of $950/oz but the upside is multiple targets like Bonza Sur. Buy.

Newmont Corp.

Senior player Newmont’s shares have lagged as costs increased with AISC of $1,600/oz. The miner is the largest in the world with mines in four continents producing 5,700,000 ounces but results continue to show difficulty integrating acquisitions of Newcrest and even Goldcorp. Problems continue at Peñasquito and recently laid off workers at high-cost Merian in Suriname as operating and sustaining cost have plagued results. Reserves declined last year which is not a problem at 134 million in-situ ounces. Free cash flow in the first quarter, however, was a whopping $1.2 billion. Nonetheless more of that cash flow would be better spent reducing costs at their almost dozen mines. Bigness is not always best. Sell.

*******