Are We Headed For A Passive Index Meltdown?

Without Googling, try to guess who said the following quote: “If everybody indexed, the only word you could use is chaos, catastrophe. The markets would fail.”

Give up?

The speaker, believe it or not, is John Bogle, founder of Vanguard, which has been at the forefront of indexing. Bogle made the comment last year at the Berkshire Hathaway shareholder meeting, basically admitting that there’s a limit to the amount of passive investing the market can handle and still function efficiently.

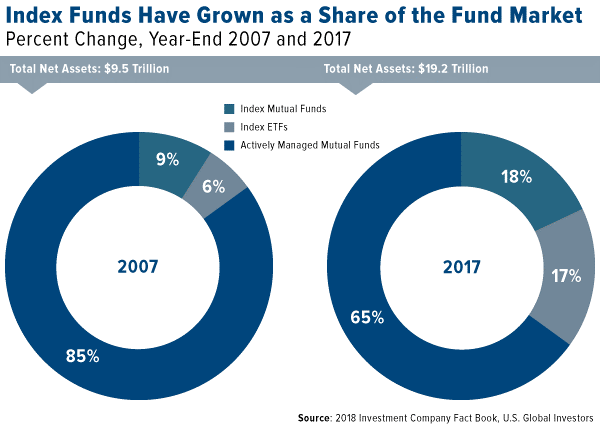

The thing is, we’re testing that limit more and more every day as passive mutual funds and ETFs—those that seek not to “beat the market” but track an index—take up a larger slice of the pie. The share has increased dramatically in the past 10 years, rising from only 15 percent in 2007 to as much as 35 percent by the end of 2017.

As for when passive investments will overtake the active market, Moody’s Investors Service estimates we’ll see this happen sometime between 2021 and 2024. Markets simply wouldn’t be able to function without active managers calling the shots—rewarding good corporate governance and punishing the bad—so Bogle’s what-if scenario of 100 percent indexing is, for now, purely hypothetical.

Nevertheless, the seismic shift into indexing has come with some unexpected consequences, including price distortion. New research, which I’ll get into below, shows that it has inflated share prices for a number of popular stocks. A lot of trading now is based not on fundamentals but on low fees. These ramifications have only intensified as active managers have increasingly been pushed to the side.

Watch Out for Rebalance Risk

This could end very badly for some investors, as I told CNBC Asia last week. It’s possible we could see a correction when it comes time for a number of multibillion-dollar funds to rebalance at year’s end. The same thing happened to the tech bubble in 2000, when everyone rebalanced after a phenomenal run-up in tech stocks.

And remember what happened to small-cap gold stocks last year when the massive VanEck Vectors Junior Gold Miners ETF (GDXJ) was forced to restructure its portfolio? They were knocked down despite having incredible fundamentals.

Take a look at the following chart. Internet commerce stocks—Apple, Amazon and the like—are up nearly eight times since May 2010.

This isn’t just the second largest bubble of the past four decades. E-commerce is also vastly overrepresented in equity indices, meaning extraordinary amounts of money are flowing into a very small number of stocks relative to the broader market. Apple alone is featured in almost 210 indices, according to Vincent Deluard, macro strategist at INTL FCStone.

If there’s a rush to the exit, in other words, the selloff would cut through a significant swath of index investors unawares. And just as Warren Buffett once said, “Only when the tide goes out do you discover who’s been swimming naked.”

A Huge Opportunity in Under-Indexed Stocks

Deluard’s research also suggests that passive index investors could be missing the hidden gems. After analyzing returns in the Russell 3000 Index, he found that stocks that are overrepresented in indices—again, think Apple—have been underperforming those in fewer indices. Despite lagging for the past five years, stocks that were in 75 indices or fewer returned more than 60 percent for the 12-month period, while the performance of stocks featured in 200 indices or more was around half that. Over-indexed stocks were also 2.5 times more expensive, Deluard found.

Whether we’re dealing with causation or correlation is probably too complex for me to get into here. The implication, as I see it, is that there’s huge potential for gains in stocks that are least loved by index providers. Talented active managers who are able to uncover these hidden gems and make the appropriate allocations are worth every cent investors pay them in fees.

In the Race to the Bottom, Everyone Ends Up Last

As I said earlier, a lot of trading now is based not on fundamentals but expense ratios. There’s been a race to the bottom to see who can provide the lowest fees. Fidelity appears to be first to introduce a no-fee fund—the catch being the investor must use Fidelity’s brokerage firm. Some industry experts now believe it’s only a matter of time before we see an index fund with negative fees.

You get what you pay for, as the saying goes, and buying cheap often comes with a high price in the long run. A tummy tuck in Tijuana costs a whole lot less than one in L.A., but you might end up having to pay far more in medical expenses should a mishap occur.

The same thinking applies with certain passive mutual funds and ETFs.

Recently Ray Dalio, billionaire founder of Bridgewater Associates, told CNBC that we’re in the “seventh inning” right now, as such, investors should probably get “more defensive.” In addition, the Goldman Bull/Bear Indicator just hit its highest level since 1969.

*********

Investors who feel this bull-run might be getting long in the tooth would be prudent to make sure they have their recommended 10 percent weighting in gold and gold stocks, as well as a position in short-term, tax-free municipal bonds. Both assets have long been sought as safe havens in times of economic uncertainty and have performed well even when markets are down.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Russell 3000 Index is a market-capitalization-weighted equity index maintained by the FTSE Russell that provides exposure to the entire U.S. stock market. The index tracks the performance of the 3,000 largest U.S.-traded stocks which represent about 98% of all U.S incorporated equity securities. The Nikkei 225 Stock Average is Japan's premiere stock index. It includes the top 225 blue-chip companies listed on the Tokyo Stock Exchange. The SET Index is a Thai composite stock market index which is calculated from the prices of all common stocks (including unit trusts of property funds) on the main board of the Stock Exchange of Thailand (SET), except for stocks that have been suspended for more than one year. The Nasdaq 100 Index is a basket of the 100 largest, most actively traded U.S companies listed on the Nasdaq stock exchange. The S&P Homebuilders Select Industry Index represents the homebuilding sub-industry portion of the S&P Total Markets Index. The SSE Composite, which is short for the Shanghai Stock Exchange Composite Index, is a market composite made up of all the A-shares and B-shares that trade on the Shanghai Stock Exchange. The NASDAQ Biotechnology Index is a stock market index made up of securities of NASDAQ-listed companies classified according to the Industry Classification Benchmark as either Biotechnology or Pharmaceuticals. The Dow Jones Internet Commerce Index is designed to measure the 15 largest and most actively traded internet commerce stocks. The Goldman Sachs bull/bear indicator takes into account five factors: growth momentum (measured by the average percentile for U.S. ISM indexes), the slop of the yield curve, core inflation, unemployment and stock valuations as measured by the Shiller price-earnings multiple.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 6/30/2018.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of