China Bought Gold For Fifth Straight Month

Strengths

-

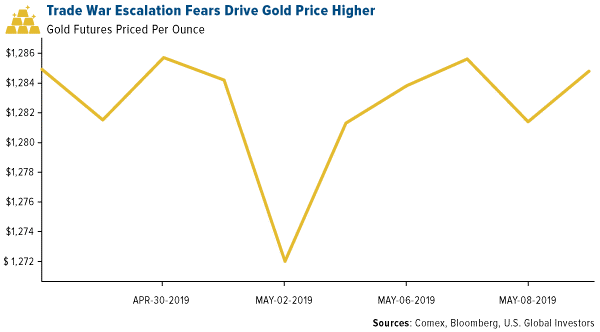

The best performing metal this week was gold, up 0.54 percent. Gold traders ended the week neutral on the price of gold as many are awaiting more details on the trade talks between the U.S. and China, according to the weekly Bloomberg survey. The BullionVault gold index measuring the balance between buyers against sellers held steady in April at 54.5 after hitting a six-month high in March, reports Bloomberg.

-

China has now bought gold for the fifth straight month. The People’ Bank of China grew gold reserves to 61.1 million ounces in April, marking the biggest boost since 2016. Ole Hansen, head of commodity strategy at Saxo Bank A/S, told Bloomberg that “banks buying is the underlying demand story which continues to develop from central banks seeking to de-dollarize their reserves.” Gold imports by India grew to 121 tons last month from 52.8 tons a year earlier, as prices fell and demand grew ahead of the second-biggest gold-buying day in the Hindu calendar.

-

The growing trade dispute between the U.S. and China helped gold regain some of its luster as investors look to it as a safe haven during times of geopolitical tension. The yellow metal and the U.S. dollar usually move in separate directions. However, if tensions keep getting worse, the two could climb alongside one another, writes Bloomberg’s Eddie van der Walt. The London Metal Exchange has named its first female chairman, Gay Huey Evans, and plans to continue increasing the number of females in senior positions via external hiring and internal promotion. This is positive for the industry, which is heavily dominated by men.

Weaknesses

· The worst performing metal this week was silver, down 1.05 percent, likely on the threat of new counter tariffs hinted at by China. Turkey’s gold reserves fell $14 million from the previous week, according to weekly figures from the central bank. South Africa saw its gold output fall for an 18th straight month in March, extending the longest run of contractions since the financial crisis, reports Bloomberg. Gold output fell 18 percent from a year earlier. South Africa is also the world’s biggest platinum producer and saw output of platinum-group metals fall 0.5 percent – the first drop in seven months.

· Although gold rose on trade war news, palladium fell briefly below $1,300 an ounce on Thursday for the first time since January, as weakening car sales hurt the outlook for demand, writes Bloomberg’s Rupert Rowling. Another hit to demand for platinum lies with the share of diesel passenger cars in new registrations in Europe falling below 33 percent in the first quarter of this year. Despite diesel engines becoming cleaner, they have still fallen out of favor with consumers hurting platinum but helping palladium which is used more in gasoline engines.

· A minor dispute occurred between Acacia Mining and its parent company Barrick Gold after Barrick CEO Mark Bristow expressed his frustration over the failure to resolve a tax dispute between Acacia and the Tanzanian government, reports Bloomberg. Acacia CEO Peter Geleta pushed back saying that Acacia was already in talks with the government before Barrick stepped in. Acacia was hit with a $190 billion tax bill, but then Barrick’s executive chairman struck a deal for Acacia to only pay $300 million to the Tanzanian government and agree to split returns from operations moving forward.

Opportunities

· Barrick Gold plans on raising $1.5 billion from asset sales after completing its acquisition of Randgold Resources at the beginning of this year, according to CEO Mark Bristow. The gold sector had been awaiting a wave of asset sales in the wake of the mega-merger. Bristow also commented they would not rule out adding new assets to the portfolio though.

· AngloGold Ashanti plans on selling its last South African mine, which is the world’s deepest. The sale would be the final step in AngloGold’s withdrawal from the nation after it sold and shut other mines in the country to stem losses, writes Bloomberg. South Africa’s gold mining industry was once the world’s largest, but has faced many challenges in trying to remain profitable in recent years. Gold Fields had a smooth sailing bond sale this week that raised $1 billion that will be used to refinance existing debt.

· Norilsk Nickel analysts, including Anton Berlin, said in a report this week that they see no signs of substituting palladium with platinum by automakers in pollution-control devices. The world’s largest palladium miner also said in the report that only a small portion of palladium can be substituted in gasoline cars. This is positive for palladium demand.

Threats

· Updating a 147-year-old mining law could be a big threat for miners in the United States. House Republicans have showed some willingness to work with Democrats on updating a law that helped spur mineral exploration after the discovery of gold in California. Existing mining law doesn’t require companies to pay royalty fees or be financially responsible for cleaning up abandoned mining laws, reports Bloomberg. The proposed bill will institute an 8 to 12.5 percent royalty rate on mines, have companies pay for cleanup and give communities more control over the location of new mines.

· Venezuelan President Nicolas Maduro is cracking down on arrests of opposition leaders after last week there was an attempt to topple the autocrat, which many nations have now declared is a defunct ruler. The longer Maduro is in power, the longer the threat remains of the nation selling more of its gold reserves to generate some cash flow.

· Junk bond issuance hit a 20-month high, pricing $3 billion in bonds on Thursday. Sales of $12 billion in this week alone make it the busiest since September 2017, reports Bloomberg’s Gowri Gurumurthy. This is a signal that investors are fleeing the market.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of