Copper Confirms The Negative Outlook For Precious Metals And Oil

Technical analysis of the charts suggest copper is "riding for a fall."

We have already observed how oil and precious metals are looking set to turn lower, especially oil. Moreover, the medium-term bearish outlook for these commodities is confirmed by the negative setup that we will now examine on the latest charts for copper. Ordinarily we are not all that interested in copper, because there are few suitable trading vehicles we can use to play it. Consequently, our interest is mainly due to copper’s implications for other markets.

On its 6-month chart we can see how the sharp rally in copper last October and November has been followed by a largely unsuccessful attempt to push higher. Moreover, the pattern that has formed now looks like a bearish Rising Wedge, accompanied by dwindling upside momentum, which is increasing downside risk.

The long-term, 10-year chart also gives rise to concern for the following reason. We can see that not only has the rally brought copper to the upper boundary of its major downtrend channel, but it has also brought it up into a zone of quite heavy resistance. Therefore, it is not hard to understand why it is having trouble making any further progress… making it increasingly vulnerable to turning lower again.

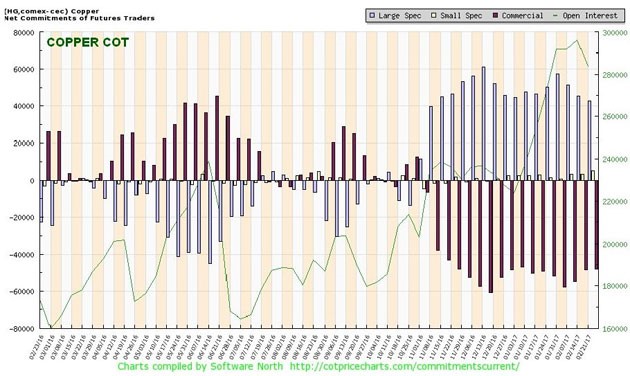

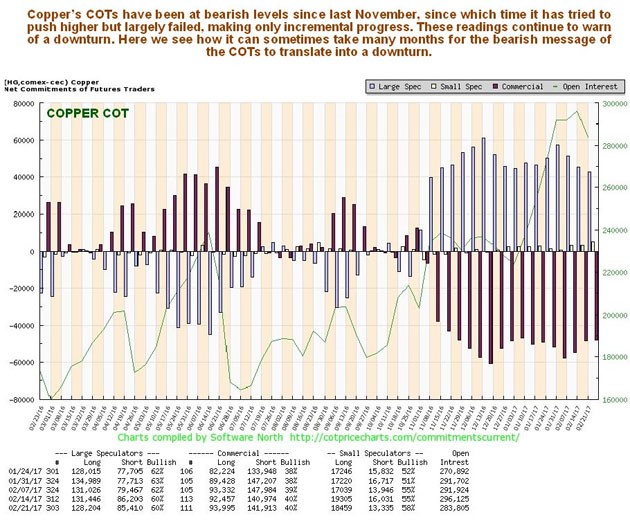

By mid-December copper's COTs have turned decidedly bearish. Furthermore, they have stayed that way ever since, with high Commercial short and large spec long positions proving a major impediment to further gains…thus continuing to threaten to force copper back down again.

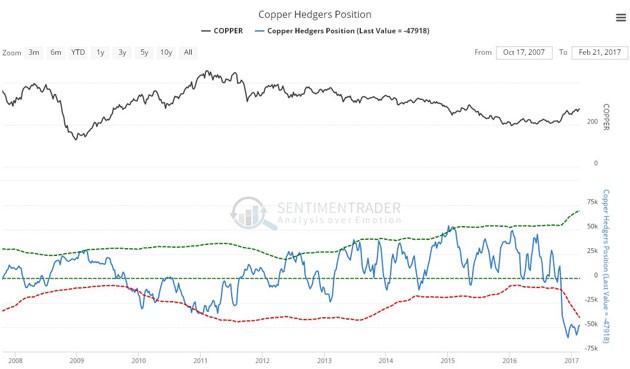

Copper's latest hedgers chart looks awful, like oil's, with it close to record extremes. This chart indicates a high probability that copper will soon break down and drop hard.

Chart courtesy of sentimentrader.com

Finally, the latest copper Optix, or optimism chart, shows excess bullishness, which again should translate into lower copper prices before much longer.

Chart courtesy of sentimentrader.com

Conclusion: Copper is riding for a fall, and thus provides further evidence that the metals and oil complex are set to drop. Additionally, there is confirmation of the bearish looking setups that we have already observed in gold, silver and oil, especially the latter.

********

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.