Fortuna Silver Reported Strong Third-Quarter Production

Strengths

- The best performing precious metal for the week was platinum, but still off 1.84%. Traders flipped to net bullish on platinum’s long position this week. Fortuna Silver reported third-quarter production of 1.84 million ounces of silver and 66,000 ounces of gold, above consensus of 1.63 million ounces and 63,000 ounces, respectively. The beat in silver production was primarily driven by higher throughput and grades at San Jose. Silver production from Caylloma of 292,000 ounces also came in above consensus of 262,000 ounces, driven by higher grades and throughput.

- K92 Mining mill throughput of 117,938 tons (1,282 tons per day) significantly exceeded consensus of 95,000 tons, as the process plant continued its strong performance and growing throughput capacity ahead of the Stage 2A expansion flotation upgrades, on track for late fourth quarter 2022 or early first quarter 2023. Throughput was 35% higher than in the third quarter of 2021 and set a new quarterly record at Kainantu.

- Centamin PLC reported it is in the final stages of commissioning its 36MW solar power plant at the Sukari Gold Mine in Egypt. Initial work shows the plant is delivering above expectations and could offset $20 million in annual cost for diesel prices. Separately, the mine’s application for grid power has been received by the government. Should all approvals take place, full integration could start in 2024.

Weaknesses

- The worst performing precious metal for the week was silver, down 10.24%, with hedge fund managers cutting their net-long position to the lowest in five weeks. Barrick Gold reiterated it would achieve the low end of its gold production guidance, (a 19% production improvement is required quarter-over-quarter for this) and could be at or slightly below the low end of production guidance, (and costs well above the top end of prior guidance). The company reported production of 990,000 ounces (down 10% versus consensus). Gold costs were also higher, with TCC guided to be up 3%-5% quarter-over-quarter and AISC guided to be up 3%-5% quarter-over-quarter. Gold production declined 5% quarter-over-quarter, disappointing versus prior guidance.

- Superior Gold said Wednesday that it has cut production guidance for full-year 2022 after it suspended mining and development activity at the main pit of its Plutonic gold mine in Western Australia. The company attributed the stoppage to the site's underperformance linked to labor shortages and contractor issues. The miner, which dropped over 30% on Wednesday, now expects to produce 62,000 to 65,000 ounces of gold in 2022 compared to the previous target of 69,000 to 75,000 ounces. The open pit amounted to roughly 10% to15% of production this year as it made better sense to re-deploy resources toward additional underground development.

- Osisko Gold Royalties earned 23,850 attributable gold equivalent ounces ("GEO") in the quarter, excluding Renard, below the Visible Alpha consensus 26,700 GEO. Preliminary revenues were C$53.7M and costs C$4.4M for record quarterly cash margin of C$49.3M, below the consensus C$49.9 million.

Opportunities

- Torex Gold Resources reported strong third-quarter gold production of 122,200 ounces, a 10% increase over the same quarter last year. The solid result was the result of high mill throughput and record metallurgical recoveries. Thanks to the result, the company is guiding toward the high end of full-year 2022 guidance of 430,000-470,000 ounces gold, which considers lower expected fourth quarter production for planned maintenance activities.

- New Gold announced the receipt of the key permit amendment enabling mining of the C-Zone at New Afton after market close on Friday, October 7. The official receipt is a catalyst for the stock, and partially de-risks development of the new zone through 2022-2023.

- There’s a global migration underway in the gold market, as western investors dump bullion while Asian buyers take advantage of a tumbling price to snap up cheap jewelry and gold bars. Rising rates that make gold less attractive as an investment mean that large volumes of the metal are being drawn out of vaults in financial centers like New York and heading east to meet demand in Shanghai’s gold market and Istanbul’s Grand Bazaar.

Threats

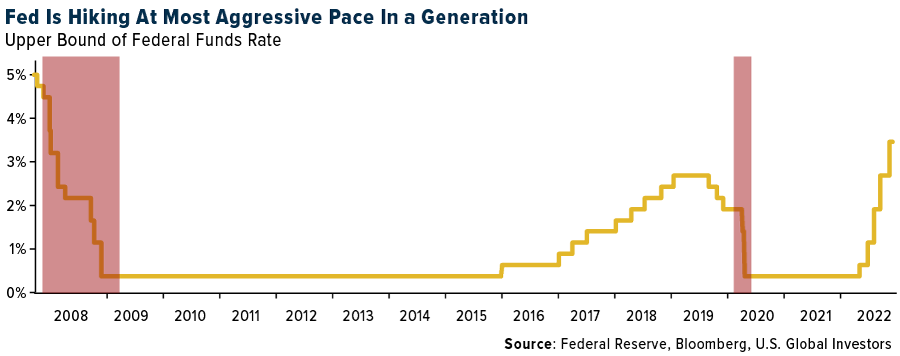

- Despite the ISM Manufacturing survey notably slowing and the JOLTS survey showing a sharp drop of more than 1 million job openings, U.S. inflation remains both elevated and concerningly broad based. Given this, it is premature to anticipate a more dovish Federal Reserve. Moreover, even as the pace of hiking will ultimately slow, a true policy pivot should only follow clear evidence that inflation has been sustainably brought back to target and that process is likely to remain a headwind for precious metals into 2023. However, many investors believe the Fed will ultimately make a policy mistake, hiking rates at the fastest pace in a generation.

- Gold extended a decline after plunging below $1,700 an ounce last week, as strong U.S. jobs data intensified concerns that the Federal Reserve will remain aggressive with rate hikes. The metal came under pressure from the stronger dollar on Monday amid weak risk sentiment in equity markets. Relentless Fed policy tightening has weighed on the asset throughout 2022, leading prices to slide 19% from its year-high in March.

- Bloomberg highlighted that the largest buyers of U.S. Treasuries have all stepped back in their eagerness to buy U.S. debt. The article notes that Japanese pension and life insurers to foreign governments and U.S. commercial banks have all balked. Particularly in the face of the upped Fed offloading of $60 billion of Treasuries from its balance sheet every month. Treasuries have already recorded their steepest losses since the 1970s, but analysts worry who the next buyer will be. Zoltan Pozsar of Credit Suisse Group AG noted that since the year 2000, there has always been a big central bank on the margin buying Treasuries. Now, the private sector is basically being tasked to fulfill what the public sector has walked away from as a massive supply of Treasuries get pushed back into the system, (without a glitch?).

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of