Getting Comfortable With Gold

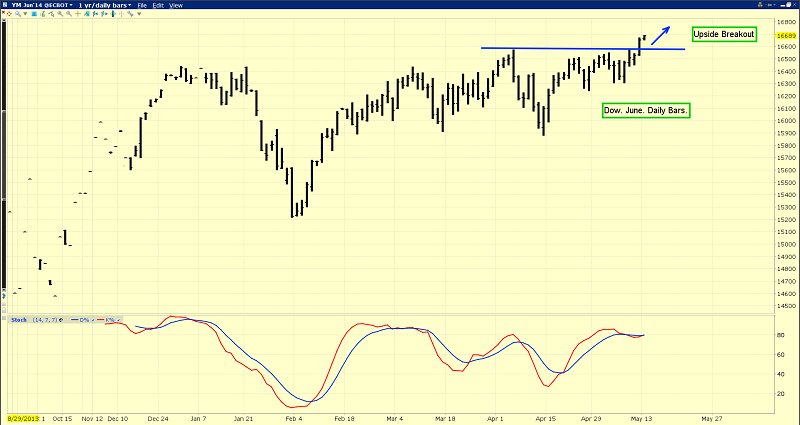

Many bank economists believe second quarter GDP growth in the United States will be about four percent. This daily Dow chart shows that a modest upside breakout to new highs occurred on Monday.

In 2013, many Western economists argued that tapering and strong growth in America would cause a huge selloff in gold. That hasn’t happened, but should gold investors be worried now?

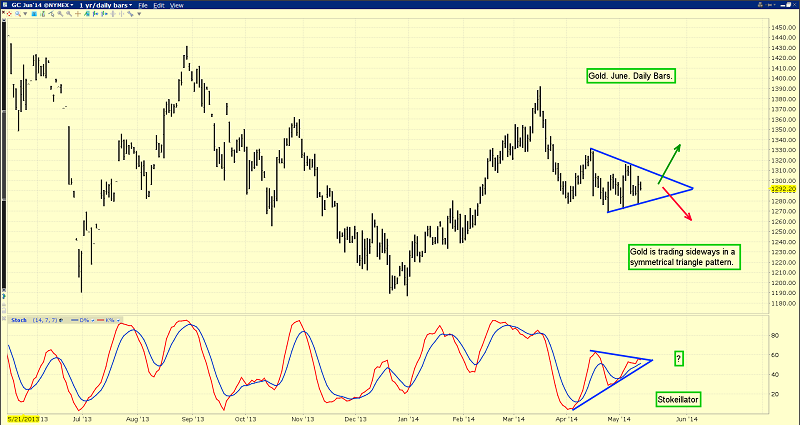

There’s no question that gold often drifts rather aimlessly in the springtime. That’s the daily chart. Gold is trading sideways in a rough triangular pattern. It suggests that a fifty dollar move could easily occur in either direction, with equal probability.

While Western economists believe a strong Dow leads to lower gold prices, I think the price action of Chinese and Indian stock markets is more important.

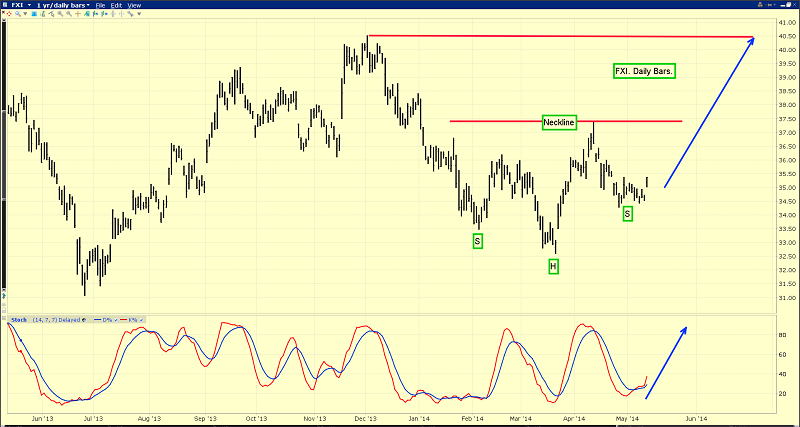

This daily FXI (Chinese stock market ETF) chart looks very bullish. There’s a strong inverse head and shoulders bottom pattern in play. The target of the pattern is roughly $40. Chinese citizens tend to spend more money on gold jewellery when times are good, and this FXI chart suggests the economy may be about six months away from improving significantly.

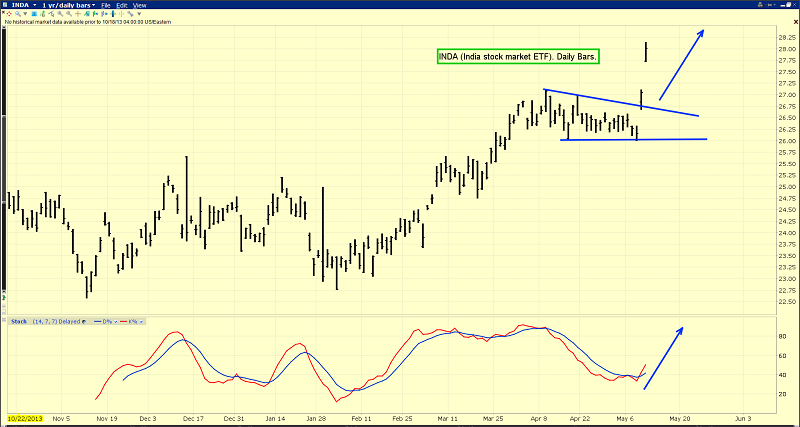

That’s the daily INDA (Indian stock market ETF) chart. It looks truly spectacular. The upside action dwarfs that of the Dow.

Indian voting has also been completed in the national election, and the results will apparently be released on May 16. The stock market is clearly anticipating good news and a much stronger economy.

I’m not interested in owning the US stock market, regardless of what kind of upside surprises may be in the pipeline there. I do own both Indian and Chinese stock market indexes as core holdings, but I think they are more important as indicators of gold demand growth.

A strong Indian economy is fabulous news for Western gold stock investors. Simply put, the richer Indians get, the more gold they buy for weddings and religious festivals.

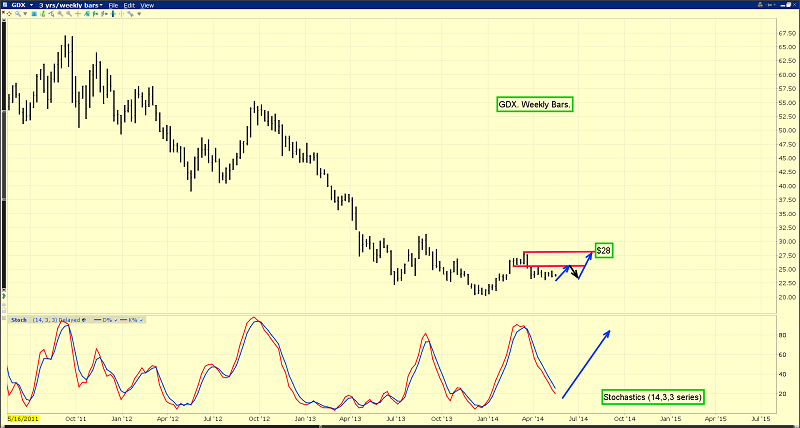

Note the position of the Stochastics oscillator on this key weekly GDX chart.

While GDX has not risen above any key intermediate trend highs since 2011, the Stochastics oscillator suggests that gold stocks may soon benefit from economic strength in both China and India.

No asset class makes an infinite number of new intermediate trend lows without a significant rally, and gold stocks are no exception to that rule.

Mainstream economists appear to be almost obsessed with the idea that strength in the Dow will produce waterfall-sized selling in the SPDR fund.

In contrast, my view is that most weak hands in that fund sold out in 2013. The total amount of gold held by the remaining SPDR investors is now only about 780 tonnes.

In the big picture of gold demand versus mine supply, the relatively small size of SPDR holdings are making them less relevant to overall gold price discovery. The liquidity being moved into SPDR and out of it, is slowly being swamped by liquidity flows in China and India.

Having said that, I think this is a time for gold investors to focus on fundamentals very carefully. Most bank economist forecasts for a strong US economy went badly awry in the first quarter, but their current forecasts in the 3% - 4% range for the second quarter are much more likely to be correct.

GDP growth of that kind of size could put short to intermediate term pressure on US bond prices, driving yields a bit higher. As I look towards the fall and winter quarters of 2014, I think the Chinese economy will rebound, and India’s will surge. That’s bullish for gold.

Unfortunately, there’s a period of time before that, where gold prices could be pushed modestly lower, by strong US growth numbers.

I’ve told gold investors many times about the importance of bond yields to gold prices. Many commodities have turned lower recently, and I believe it may be because institutional investors are concerned that powerful GDP growth could trigger higher T-bond yields.

That’s the daily natural gas chart. Despite low stocks from the winter, and record-setting heat being forecast for the summer, prices are dropping.

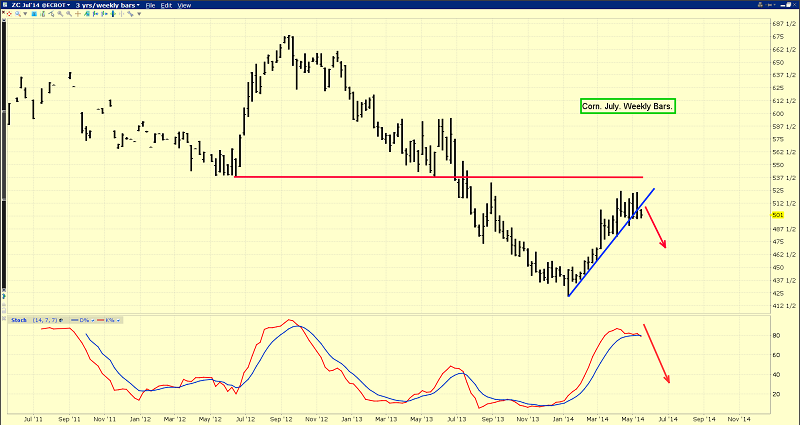

This weekly corn chart also shows signs of technical weakness.

That’s the daily wheat chart, and its upside advance has stalled, although the uptrend line is still intact. These key food commodities are usually good leading indicators for the commodity market as a whole, and for gold.

The geopolitical events involving the Ukraine and Iran could cause gold to surge hundreds of dollars higher, but unless that happens gold investors may need a few more months of patience. Even if Narendra Modi wins the election, it will take months to rebuild the Indian gold jewellery businesses that were destroyed by the mafia, banks, and crooked government officials there. Western gold investors depend on Indian demand to drive the gold price higher. Until that demand is unleashed, they may have to deal with the possibility of higher T-bond yields, particularly if upcoming US GDP numbers bring a shocking upside surprise.

Yesterday, BNP Paribas raised their overall forecast for gold in 2014, from $1095 to $1255, but they see a year-end decline to $1190. Here’s their view: “We think the market has now absorbed the fact that QE3 (third round of Fed quantitative easing) asset purchases will end this year, shifting speculation to when a first rate hike will materialize,” BNP echoes my concern about rising rates, but their view is that interest rates won’t become a bearish price driver for gold until later in the year.

I don’t agree with the BNP scenario. I think tapering was priced into gold by the end of 2013, and most of the price decline last year was caused by draconian restrictions imposed in the Indian market, not by fears of tapering. In the present timeframe, I expect interest rate concerns to appear sooner rather than later. The good news is that rate worries should be quickly replaced by concerns about inflation, and by enormous growth in Indian demand that appears in the second half of the year. Overall, I’m projecting good growth in China and spectacular growth in India. That means gold should move higher with only modest volatility. In China, 2014 is the year of the horse. In the Western gold community, 2014 should go down in history as the year that investors leave greed and fear behind, and get fully comfortable with gold and gold stocks ownership!

********

Special Offer For Gold-Eagle Readers: Please send an Email to [email protected] and I’ll send you my free “Silver Bull Wedge” report. A key bull wedge pattern has appeared on the silver chart. I’ll show you what I think it means, and how I’m playing it!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: