Go Big With Gold

US democrats and republicans continue their exuberant battle over who is the best steward of the nation’s fiat money system. Interestingly, a key question may be:

Is this really a battle worth fighting?

The horrifying US dollar versus gold chart.

I’ll dare to suggest it’s time to for fiat enthusiasts to admit failure, embrace the gold money cake, and consider icing it with a small amount of crypto!

Most governments have no savings, so a modest crisis like the financial crisis in 2008 or Corona in 2020 sees them attack citizen freedom with vicious FATCA goon squads and barbaric lockdowns.

Horrifically, while this happens the central banks print trillions of dollars of handout money for the elite.

What happens to a nation silly enough to live this kind of fiat-obsessed life and… what happens if there is a much bigger crisis?

The stock market roadmap chart. I’ve talked about a potential 2021-2025 war cycle, and it could be dire.

Looking at US history, the depression of the 1930’s was ended with the war cycle years of 1941-1945, which of course was World War Two.

A stock and economic meltdown now could be “fixed” in a similar way. World War Two was the last war where the American government had any real success at all, but the nation was a gargantuan creditor at the time.

Going into this war cycle as the world’s largest debtor is a situation best viewed as a harbinger of horror.

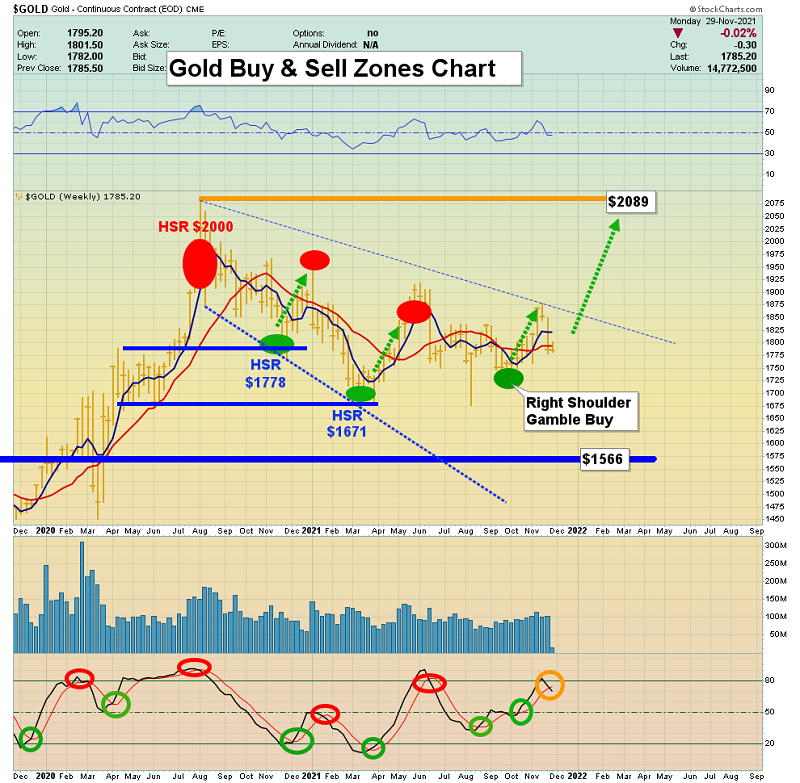

Gold is clearly the asset of sanity in these disturbing times. Since issuing a sell-signal at round number $2000 in the summer of 2020, I’ve issued three significant buy alerts, with a focus on the miners.

The November 2020, March 2021, and September 2021 buy alerts were all followed by powerful rallies in the mining stocks, but… what’s next for investors?

The next major buy alert is going to come on a breakout above $2089 or a dip to $1566.

Given that Chinese New Year approaches as India may launch a “price maker” bullion exchange, the odds favour the upside breakout, but either situation should be a big winner for mining stock investors.

If gold trades at $1566-$1450, the ensuing rally is likely to produce “across the board gains” of 50%-100% for the miners in just a couple of months. If gold breaks out above $2089, the gains are likely to be even bigger, in the 100%-300% range, also in just a few months.

In an inflationary environment, the South African miners have a history of leading, and that’s the case now.

Stocks like Anglo, Goldfields, and Harmony are showcasing significant base patterns (and breakouts that are holding). This is a positive and largely unnoticed signpost for the entire gold and silver sector.

I think the fiat enthusiasts of the world are going to learn that their money is a lot more transitory than the inflation they think they can get rid of with a couple of rate hikes.

What about silver? I like silver here, especially the miners. The SIL daily chart. There’s a fabulous rounding bottom pattern in play and a January breakout to the upside looks like the most likely outcome.

US elections in 2022 are likely to see the civil war cycle come to life in a bigger way. It could become physical war, especially if my stock market roadmap plays out as I’ve indicated.

The “Go big with gold!” chart. For 2022, a rally to the neckline looks to be the play.

The year 2023 looks even better for gold, with America devolving into a state of “civil fiat war”, the stock market tumbling but the Fed hiking anyway as inflation surges, and gold on track for a beeline run to $3000.

This will be happening while Asian jewellery markets recover magnificently, and money managers of the world engage in power buying of the mightiest miners!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “All Hands On Golden Deck!” report. I highlight fifteen must-own miners, with hardcore buy and sell tactics for eager gold bug investors!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: