Gold and Oil Fuel the Canadian Stock Market Rally

One of the best performing markets this year is Canada. The Toronto Stock Exchange (TSX) has gained over 10% this year. That is more than twice as much as the SP500 which has gained 4.75

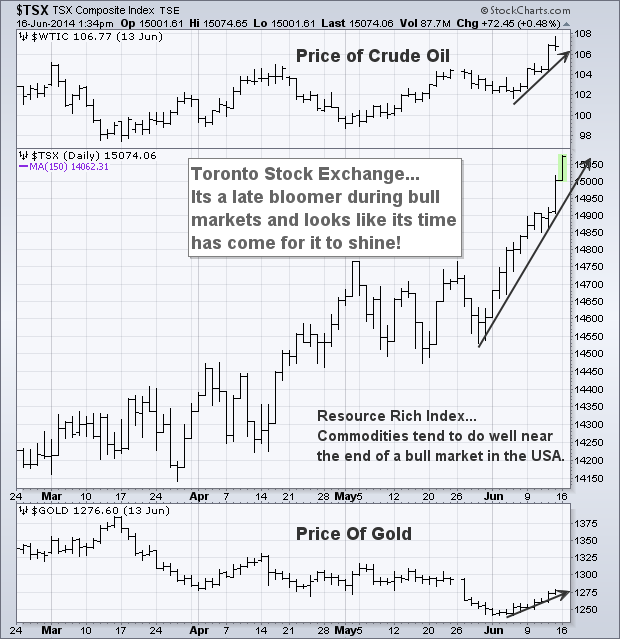

The TSX Composite Index has exceeded its 2011 peak and is about to test the 2008 high. A large part of the strength is coming from rising commodity prices. The TSX Composite is resource-weighted and this market has lagged its counterparts around the world in the last year. This means it is time for Canada to play catch-up.

These equities may hold up well when the US market starts to correct. This is because the TSX’s is heavily weighted in late-cycle stocks (resources), it’s not unusual for the Canadian

market to lag in the early stages of a bull market in the USA, catch up in the late stages, and then outperform toward the end. This appears to be happening now.

Last week's surges in gold and oil prices are fueling the rally in Canada. The two strongest Canadian stock groups were materials and energy.

Gold Stocks Lead The Way Higher – GDXJ

The junior gold miners chart shows that money is flowing into these stocks this month. Because they are the most leverage way to play the price of gold, speculative traders and investors tend to put their money to work in these stocks first, before they start accumulating physical gold.

Precious metals mining stocks (GDX, GDXJ, SIL) tend to lead the price of gold by a few days and sometimes a couple weeks.

The chart below clearly shows gold junior stocks surging and breaking through key resistance levels. I am waiting to see the larger cap PM stocks clear their key resistance levels (GDX & SIL) before I will start to get interested in building a long position again in the precious metals sector.

Trading Conclusion:

The chart below, courtesy of Donald W. Dony, shows how the market moves in terms of sectors and commodities. Our focus is on the stock market cycle below (blue cycle) and the numbers 9, 10, and 11.

In the last few months we have seen money move towards the safer investments. Utilities have performed very well, and so has the energy sector. Precious metals on the other hand are still trying to find a bottom. I feel this will happen sooner than later but until then metals will be volatile.

Typically commodities perform well in the late stages of a bull market which is where the US market feels as though it is at within its life cycle.

Get My Premium Trade Ideas & Video Newsletter And Profit: www.GoldAndOilGuy.com

Chris Vermeulen