Gold: Caveat Emptor

Covid has upended economic theory. The steepest economic collapse since the Great Depression has given way to the longest stock market rally and the biggest inflation shock since the seventies. The inflationary spike running through the United States has taken everyone by surprise. Last month US inflation surged for the fifth straight month reaching 5.4 percent in July, the highest in thirteen years, boosted by big price increases for commodities, energy and food. Hard hit by supply issues, wholesale producer prices increased 7.8 percent for the sixth month in a row to its highest level since the early eighties, ensuring further pressure on consumer prices and dimming expectations that the upward surge in prices is transitory.

Markets are surprised that inflation has been given a reset, intensifying the debate over the Fed’s ultra-loose policy and President Biden’s spending spree. For more than a quarter of a century, inflation has been non-existent as were the current generation of money managers and investors. Inflation for newbies is a general increase in the cost of goods and services. Today, inflation is even considered a good thing because it lessens the debt load and a little bit won’t hurt the poor, since the rich always pay. Andrew Sorkin wrote in the New York Times that, “inflation has long been seen as the economic villain. That view is changing”.

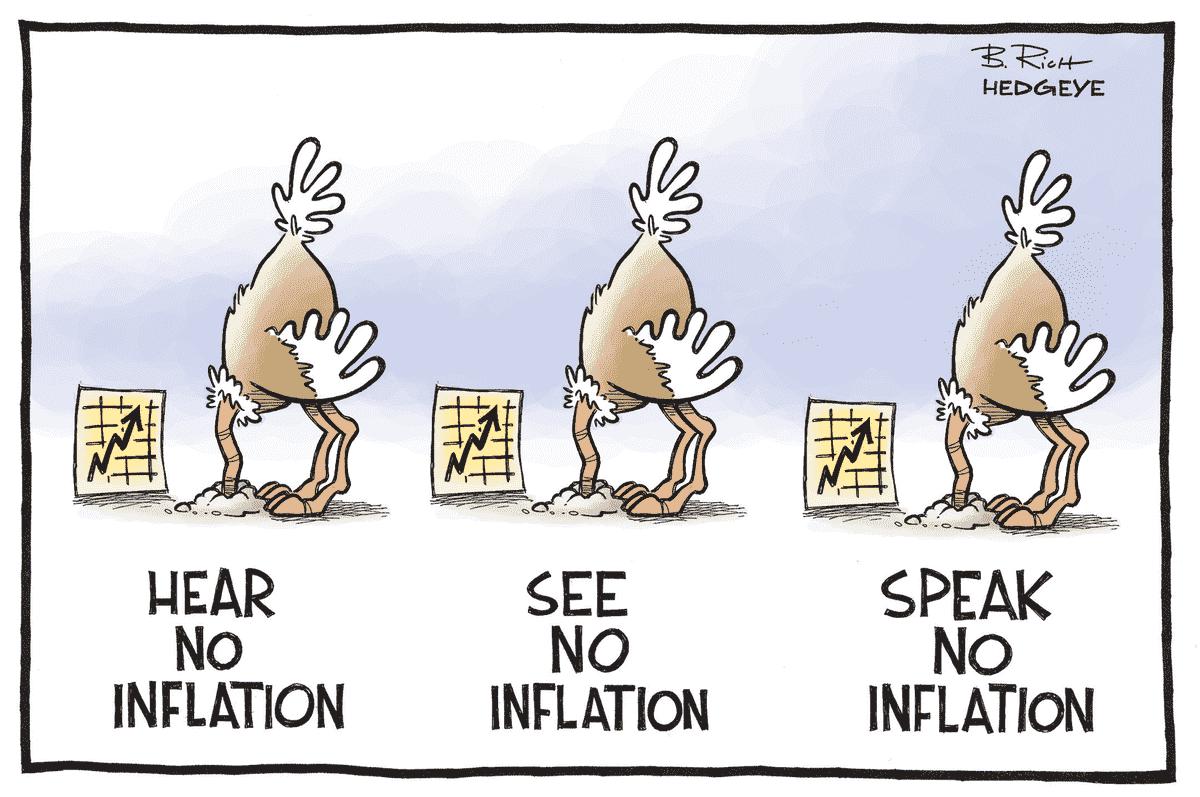

Never mind that the Fed misread inflation. The Fed’s poor record though has real consequences. But the Fed is not the only inflation culprit. Government is a big factor. The White House too downplayed the “blip” in inflation, calling it transitory despite spending 15 percent of GDP on financial support during the pandemic. Investors and markets have also subscribed to the transitory argument, believing that the bottlenecks are temporary. The belief is transitory, inflation is not.

Womb to Tomb Spending

The White House Budget Office has forecasted inflation at 2.1 percent in 2021 and 2022. We believe that the Fed is the main driver of inflation and in underestimating inflation at each meeting (latest June forecast was 3 percent) has consistently been wrong. President Biden also does not view inflation as a problem despite plans to spend $3.5 trillion as part of a “womb to tomb” stimulus package. Inflation corrupts savings, reduces the store of value of money. It is a tax, a regressive one consuming capital. Inflation is so bad that after the near hyperinflation of the seventies, the federal government “updated” the headline inflation measure, the consumer price index (CPI), leaving out volatile food and energy and replaced homeowner costs (housing) with an adjusted input or “rental equivalence” costs. Were the current numbers included, the CPI would be at double-digit levels even with food and energy stripped out. Moreover, recent data shows that the price pressures are broadening with upticks in cars and airfares, which are also not included in the index.

Since March 2020, M2 money supply has grown an extraordinary 24 percent, the fastest since World War II. Broader money, M4 increased by more than 50 percent, the largest gain in 50 years. That trajectory is expected to continue as spending will persist well beyond the pandemic. A decade of rock bottom interest rates has triggered a search for yield such that too much money chased too few goods, houses, bitcoins or stocks. After a decade of successive rounds of quantitative easing, America’s pandemic spending spree has resulted in the Fed’s balance sheet topping $8 trillion for the first time ever. And still, the government deficits are expected to grow, the feedstock of inflation. Herein lies the problem. While the Fed’s $8 billion balance sheet is part of debt management, the administration’s expansionary fiscal policy makes the Fed’s debt burden increasingly difficult because history shows that when governments subordinate monetary policy to fiscal needs, it always ends badly. Now add in President Biden’s trillion-dollar infrastructure bill which will add $256 billion to the deficit on top of the Democrat’s $3.5 trillion sweeping budgetary spending package, the spending will cause the debt ceiling to be breached, triggering yet another government stoppage. We believe that the quadrupling of money supply risks double-digit inflation a year from now. Déjà vu.

To be sure tax hikes or even a carbon tax will not close the funding gap, so deficit spending and $3 trillion deficits as far as the eye can see, are baked in the oven. The idea of soaking the rich is age old but the result is often akin to drowning the rich. Few would sympathize but the rich already pay the majority of taxes.

There are two types of inflation. The first is demand inflation, where the unprecedented fiscal blowouts stoke demand inflation while the supply disruptions or bottlenecks from a stronger economy cause overheating. The other type of inflation is supply inflation, caused when supplies are restricted from say, broken supply chains or labour disruptions which then pushes up prices for everything from semiconductors to energy to food. Today we have both types. Amid labour shortages, labour has pushed for catch-up wages despite the largesse of government keeping many at home. The higher wages have flowed to higher prices for goods, stoking demand for homes, cars and even used cars. And not included in inflation are the bills that are due but as yet unpaid, because of government pandemic relief programmes including taxes, interest and rents.

The Inflation Wheel Turns Full Circle

On his most recent trip to Europe, Joe Biden proclaimed, “America is back”. But his words on American exceptionalism only speaks louder than his actions. His leftward swing belies the centrist state of America. While this president is most comfortable in channeling the “new deal” FDR, realistically there are more similarities with LBJ who spent billions on guns (Vietnam) and butter as part of his Great Society, which resulted in an explosion in debt and near hyperinflation in the seventies. And, in a scene reminiscent of the fall of Saigon and ignoring predictions of dire consequences, President Biden presided over another of America’s defeats. America is back, but back to the seventies and they will discover like then, that they cannot continue to borrow trillions of dollars at nominal interest rates, without the consequences of inflation.

Within the current environment of zero interest rates, housing has become a big winner, particularly because mortgage payments are not only manageable at giveaway interest rates but soaring home prices have given rise to “housing fever”. Homeowners feel rich from the boom conditions, notwithstanding that they also drive-up living costs. However, lenders like the banks are not that happy because low rates also make it problematic to lend out money as tighter margins mean less profits.

Divided States of America

Consequently, bank credit has slowed and instead Wall Street has “parked” a record $1 trillion with the Fed’s overnight “reverse swap repo facility” which offers nominal returns on overnight deposits. Noteworthy is that the critical $5 trillion repo market was caught offside before in the 2008 meltdown and as recently as two years ago. Consequently, with clogged financial plumbing and a decaying $22 trillion Treasury market, these “transitory” disruptions have lately become too common. As a result, the Fed has shored up the bank reserves, raising renewed concerns of a counterparty or derivative problem. And in the falling rate environment, central bank interventions have resulted in a dramatic increase in the global pile of negative yielding debt from $12 trillion in May, close to the record $18 trillion of last January, today. Since the holder of that debt is guaranteed a loss if they hold to maturity, there will be a time when the holders will say no to losing money. Of concern is that this yield market, dominated by the Fed and only a few big players has become illiquid in the world’s most liquid market.

The downside is that investors are most vulnerable. Indeed, equity valuations are stretched but bond values too are equally vulnerable, particularly to a pick-up in inflation or tapering of rates. The average annual rate of inflation in the past forty years was 3.5 percent, yet the current yield on 10-year yield is 1.26 percent. This is unsustainable. Investors appear too complacent. As Americans struggle with Covid-19, the US economy powered by multitrillions of dollars of stimulus requires more and more dollars and, this addiction to money is a “house of cards” laying the foundation for a wave of defaults at financially risky companies. We can recall the last time the Fed tried to shrink its balance sheet and decided to pullback on “asset purchases” in 2013, the uptick in interest rates caused a surge in yields and the markets plunged in a “temper tantrum” market meltdown.

This time with the state of affairs of rising inflation, a stronger than forecast economy and a bloated balance sheet, the Fed doesn’t have many options, particularly since the debt ceiling, after a two-year suspension has been breached. Today polarized lawmakers must again extend the ceiling or risk default. All in all, a deep divide has emerged between the haves and have nots, vaccinated and unvaccinated, Republicans and Democrats, with each wielding disparate views, which is a serious problem for America’s future. The pandemic revealed the public’s distrust with their respective government. This deep divide and rising inflation has undermined all that made America great, its future, and currency itself. The dollar is not forever. Caveat Emptor.

Epidemic of Mistrust

Economic management is a key thread in the fabric of democracy. Yet recent events have also worn the fabric of democracy. The media too shares some of the blame, particularly with the proliferation of misinformation. The Great Pandemic exposed the vulnerabilities of our creaking 40-year-old health care system. This time the failures of governance could not be kicked down the road and post mortems exposed global systemic mismanagement ranging from substandard health care systems to procrastination, to shortages of PPE and ventilators and, for a time the precious vaccines. Governments can’t seem to run anything from Covid, to delivering mail or even keep our borders safe. To be sure we are not getting our money’s worth. The Commonwealth Fund released a report that of 11 rich countries, Canada ranked 10th overall, ahead of the 11th placed and bottom ranked, United States. And as scrutiny mounts, BlackRock estimated that the US spent more than four times the stimulus of the global financial crisis for less than one quarter of the shock or more than a 16-fold difference resulting in a widening of the gulf between the haves and haves-not. Money did not solve our problems. The pandemic helped create an epidemic of mistrust.

Once again, the problem goes beyond the disinformation and mismanagement. India too failed despite being one of the largest manufacturers of vaccines in the world. Amid the spreading Delta variant and wave of skepticism over governments’ response, the United States has the highest number of new cases in the world with only than half of their population vaccinated despite being the largest manufacturer of vaccines in the world. Roughly 70 percent of Americas are vaccinated but only 50 percent are fully vaccinated with both jabs. Yet, one third of America refuses even the first jab such that achieving herd immunity is unlikely. The war against the Great Pandemic is lost particularly since western governments think vaccinating their populations is the end goal. Wrong. This virus and its variants knows no borders. Covid has divided the nation and America’s politicization of the pandemic is a reflection of the deep polarisation in American politics, where the wearing or not wearing a mask has become a political statement. Ironically while the funding of better health care systems is needed, governments are trying to spend their way with handouts and the nationalisation of businesses, masking their inadequacies but leaving behind a mountain of debt. Boosters anyone?

Faced with this grim landscape of individualism, there is little wonder then that factors such as climate change or the future of energy or ESG has become intertwined with the pandemic. The reality is that government has lost a golden opportunity but its response threatened the very foundation of western democracy. Democracy is fragile and the bout of internal strife, deep polarisation and the response to the pandemic undermines its foundations. Then there is the last November election chaos or the January 6th raid on Capital Hill which was close to civil war that even today has been whitewashed and the falsehoods of a “stolen election”, are supported by a good part of the population and its legislators. Not surprisingly, American distrust in Washington has fallen to a 17 percent low.

CO2 Conundrum

Science has become a political football. Today, amid the fourth wave of the pandemic, the world has suffered fires, floods, heatwaves and drought leaving governments unprepared and steeped in rhetoric. In the US, fires have raged for weeks with almost 1.5 million acres ablaze. Wildfires in Greece, Spain and France have spoiled tourism. In China, severe floods have decimated cities. The Siberian tundra is on fire. In Germany, devastating floods closed businesses and a heat dome in North America has become deadly. In times gone by, we would say, “it was an act of god”, but the unprecedented chain of events ties in with climate change and rapid urban development. Like Covid-19, climate change has become climate disinformation.

The culprit? Humankind. To be sure the global atmosphere is warming, about 1.2 Celsius warmer than the post-industrial average. But again, our governments are unprepared and like the pandemic, there seems to be no practical global solution. The Paris Agreement to keep warming to within 1.5 degrees has failed, despite the recognition that CO2 emissions were known to be a major factor in global warming. The UN Intergovernmental Panel already has given up, warning that the world will be 1.5 Celsius warmer within two decades. The planet has warmed by about 1.2 degrees and every day we see the consequences. Yet six years after the adoption of the Paris Agreement and coincidently before the upcoming UN COP26 climate summit in November, and after the trillions spent on climate change, carbon dioxide levels averaged 419 parts per million in May, the highest ever in human history. COP26 is shorthand for “Climate Change Confederate of Parties” which was set up by the UN almost 27 years ago, and since the first conference, global annual output of CO2 emissions has doubled to about 14 billion tonnes a year of carbon. More meetings don’t seem to help.

Carbon Footprints

It seems Mother Earth is crying for help and we are not doing her any favours. Climate change is a slippery slope and the cost of decarbonisation has become top of mind for governments. and businesses, and investors. Extreme weather events around the globe, from floods in Western Germany, scorching heat in the Pacific Northwest to tornadoes outside Toronto are reminders that the globe is heating up. Government coffers are bare after the pandemic, so politicians are only left with the hot air of rhetoric. The epicenter of the Canadian oil industry is Alberta, which contributed to Canada’s prosperity for almost a century, supercharging the Canadian economy. But in the past few years, Calgary has been hollowed out by low commodity prices, declining reserves and the ESG movement. Yet, the Canadian government has committed billions towards green new deals, recoveries and subsidies but efforts to decarbonize have largely failed because government is part of the problem. Headline targets haven’t solved the problem. Regulations should address the pressure points to bring down costs. As an example, despite handouts or incentives to buy more electric vehicles (EVs), today there are more skidoos than EVs.

Yet, by curbing the use of fossil fuels and natural gas while elevating solar and wind, we risk rupturing the fragile electrical grid, needed to charge all those green batteries. Carbon emissions are a fact of life and today will affect overall profitability by putting a lens on everything ESG, raising the inflation risk. To be sure, alternative energy savers like wind power, hydrogen, carbon capture, and storage are needed but the paradox is that natural gas, a fossil fuel that produces half as much CO2 as coal, is also used to generate electricity. The problem is not fossil fuels but our consumption. What if Calgary became the biggest source of hydrogen in Canada? Changes in attitudes, behaviours and incentives are needed. Hopefully our politicians, particularly in the upcoming election will face reality. More tellingly is that little has been done to reduce oil consumption as demand continues to rise, particularly in the less developed world. Cutting production before we cut demand has pushed up prices. Climate action has been frozen in government policymaking quicksand. Climate change will be inflationary.

China too has launched a national carbon emission trading scheme (ETS) modelled after the European Union which produces only 8 percent of current global greenhouse gas emmissions. To date, China has established seven exchanges on which some 400 million tonnes of greenhouse gas permits were traded by mid year 2020. North America has yet to establish an exchange and has been slow to the party. The United States is the world’s second largest emitter and lags behind China and Europe in usage of EVs, where EVs only represent 2 percent of the US market versus 6 percent in China and 11 percent in the UK.

Greening the Economy Will be Inflationary

In the United States, President Biden’s executive order targeted EV sales to make up 50 percent of US sales by 2030 but the order is voluntary and more window dressing. Billions are needed as well as incentives or subsidies for consumers to buy something they currently do not want. President Biden’s $1 trillion infrastructure bill included $7.5 billion for charging stations, a fraction needed if Detroit somehow managed to meet the President’s goal of some 4 million cars. A network of stations or more than five times the allocation for changing stations alone would be needed, excluding subsidies normally offered to purchase the EVs. The cost of greening America keeps going up. Climate change will be inflationary, very inflationary.

Electric cars, renewables, wind power and other decarbonising measures help but look at solar panels today which are everywhere as countries seek to reduce their reliance on fossil fuels. Most of them are made in China from carbon dioxide belching coal-burning plants and favourable tax treatments for taxpayers unwittingly subsidizes this activity. Politicians are looking for a quick fix. Investors too. There isn’t one. It is the never normal.

To shut down the old economy to build the new economy will cost money, which will push up inflation. The economic costs are already visible and are growing. Copper prices are near record highs and there is not enough copper to meet EV demand. Unfortunately greening the economy will be a continuing inflationary headwind. Yet like the pandemic, we are unprepared. Today everyone will say that they will support climate change, but they won’t want to pay for it. A carbon tax makes sense but shouldn’t go into government general revenues, it should go to new technologies or businesses that cut carbon emissions. Instead, we get more hot air, ineffective subsidies and more heavy government regulation. Subsidies will be skewed on everything ESG related from executive pay to carbon emissions to listings. A greener economy can’t be fixed with the practices that broke them. Yet, the climate extreme of fire and floods is a global threat that demands national solutions and the response to date suggests that it has become more of a political football. If we can’t even inoculate our populations against a deadly virus, how are we able to save Mother Earth? Will the planet burn while our politicians fiddle?

China’s Crackdown

Will Afghanistan prove to be Joe Biden’s Waterloo? Some 60 nations issued a statement that Afghans and their citizens should be allowed to leave, however most potential host countries are having trouble with the last wave of refugees. The fall of Kabul has also undermined America’s standing particularly with its Asian allies Japan, Korea and Taiwan laying bare the extent of their reliance on the US raising doubts about America’s support against China. Or, what should America’s core allies, like NATO who joined America in Afghanistan make of America’s unilateral withdrawal which left their soldiers behind. Without America’s protective umbrella, should they ratchet up defense spending joining the arms race? And with the US out of the picture, other countries like China, Russia and Iran have already stepped into the vacuum as the Taliban victory redraws Asia’s geopolitical map which has forever changed, and with it America’s influence, credibility and trust.

Beijing’s latest moves have also unleashed shockwaves across global markets wiping out trillions in market value as Wall Street finds itself in the crosshairs of a battle between the two superpowers. The US and China are in a protracted battle for global supremacy, caught in the Thucydides Trap by Graham Allison who described in 12 of 16 past cases in which a rising power confronted an incumbent power, the result was bloodshed. Relations have deteriorated into a new Cold War fought across numerous fronts from technology, military, economic and culture. Not dissimilar to Washington’s antitrust rules, Beijing has recently flexed its regulatory muscle, cracking down on China’s largest companies from the tech sector to the $100 billion a year private education industry. The education sector has grown exponentially but the government has reined in the sector in an attempt to level the playing field to make education more affordable. The revised rules startled markets and came on the heels of tighter regulations which made it more difficult for China’s unicorns to seek US listings. It is believed the measures are a part of Beijing’s desire to keep capital and companies closer to home, on its own exchanges, under China’s own rules.

The new restrictions increased investor risk for foreign investment as BlackRock, Sequoia and Goldman lured by China’s vast pool of middle-class savings, poured capital into China. China opened up to foreign investors more than four decades ago and last year overtook the United States as the world’s leading destination for foreign funds. However, America’s recently toughened regulatory stance, and nascent Cold War has forced both countries to become more insular, with the corporate sector a major casualty. Investors are spooked. Wall Street is now caught in the crossfire as an emboldened China seeks to repatriate capital back to China. China is among the largest holder of US debt and is the dominant supplier of American imports. China’s Belt and Road Initiative continues to be part of its outreach stretching from East Asia to Europe. China is a key manufacturing country with the world’s biggest consumer market and a fast-growing savings market and the shift, to tighten central authority in a more hostile environment is part of a broader economic strategy. China aims to create new winners and losers with more of a focus on value added sectors such as smart manufacturing, deep tech and vocational education similar to Germany. Nothing is new now.

Chinese firms with American listings are worth more than $2 trillion and while the recent carnage following Beijing’s crackdown has triggered panic on Wall Street, Beijing’s inward turn of keeping capital at home is just the beginning. While top performing property and healthcare companies were exposed, China’s growing consumer market also created opportunities. Tighter US regulations only created an unwelcome domestic climate and although the developing battle over Chinese listings undermined investor trust, Wall Street was a major casualty and the debacle hurt Americans where they least expected, in their pocketbooks and 401ks. To no surprise, US businesses are now urging the government to restart China talks and scrap its punitive tariffs because they are missing out on the largest market in the world.

Playing the Long Game

Still, most global capitalists remain unperturbed as inflows into China alone topped $2 trillion last year. The Trump tit-for-tat trade war thus had little impact on Chinese inflows and outflows because the trade skirmish became part of America’s two-year election cycle. However, Mr. Biden has since escalated tensions and the new Cold War seems to have legs. Each side has escalated, putting more regulatory muscle behind their policies. However, America has felt the geopolitical shocks of past wars and the string of deficits and record debt leaves them vulnerable. Beijing has an excess of savings and in opening its financial markets to outsiders, drove China’s renminbi up, in turn hurting China’s exports. Nonetheless despite the challenges, China’s exports increased 19 percent in July. With the largest foreign exchange reserves in the world, China’s pile has further grown as it stabilized its much-in-demand currency. Playing the long game, Beijing continues to maintain capital controls with inflows and outflows closely monitored and, we believe the recent regulatory clampdown is an attempt to balance its international balance sheet.

Meantime, the Biden administration’s battle for supremacy with China has demonized everything Chinese. Yet, before China, there was the Cold War with Russia, then Japan was a target following Vietnam. Another common denominator is Biden’s framing that the US is the champion of freedom and democracy. China, however is not to blame for America’s democratic slide. It was not China, behind the storming of Capital Hill. It was not China that toughened US voting laws. It was not China that left Kabul. As for China’s state capitalism, that model allowed China to grow at the fastest rate in a century, elevating its poor. Simply much of the deterioration of American democracy is due to domestic reasons. Beating up on China only weakens the United States.

Once before, America was caught in an unseemly pullout that would have reaching consequences. Saigon? No, China. In the midst of the Civil War in 1949, the China White Paper from Dean Acheson to Harry Truman called for the withdrawal of American support because the civil war was, "beyond the control of the government of the United States". With the subsequent withdrawal of US support and leaving behind $2 billion of military aid, Mao Zedong's Communists defeated the US-allied nascent Chinese democratic movement and Chiang Kai-shek's Nationalists fled to Taiwan. Sadly Afghanistan was not America's only "forever war".

Why does this matter? America is the largest debtor in the world while China is the world’s largest creditor. Economies today do not operate in isolation. Foreigners own some 25 percent of American debt. The Chinese hold over a trillion in US debt and today has not yet used its creditor position as a retaliatory measure, although China has dumped Treasuries for the fourth straight month. The US and China have a mutual interest in financial interdependence. Yet, greater hostilities will hurt both countries and risks the end of US financial hegemony.

America, The Bubble

Of concern is that while the US economy is enjoying the fastest recovery since the 1980s, the record stimulus risks overheating, ending in double-digit inflation and stoking unhealthy asset and credit inflation. Already the five biggest tech giants (FAANG) made a whopping $75 billion in the last quarter, more than the GDP of most nations. Today America’s bubble is premised on the assumption that low rates and the status quo will last forever. It won’t. There are the midterms next year where Mr. Biden has little room to manoeuvre because of a razor thin majority with only 50 Democrats in the Senate. His precarious hold was recently frustrated by a couple of his own Democrats who stymied his agenda, forestalling scrapping the filibuster which means the Democrats require ten Republicans to pass any legislation in the hyper-partisan climate.

The pandemic, rising inflation and Joe Biden’s spending spree has also given the Republicans ammunition and a reflection of Biden’s dilemma is that the top selling book today in the United States, is “American Marxism” by Mark Levin. Conservatives are rejoicing gleefully watching Biden’s leftward pivot which endangers his House majority and President Biden’s popularity even among Democrats and independents has led to double digit losses sinking below 50 percent. Among moderate independents, he is at 48 percent. Saigon II will not help.

America’s Achilles Heel

But our governments are no strangers to incompetence and we believe failings from climate change to fighting the virus leaves investors wondering whom they could trust. The Taliban triumph revived doubts about American exceptionalism and of US foreign policy promises and loyalty with some of America’s closest allies. The White House was warned. What lies behind these failings is America’s management of its affairs; or lack there of, particularly regarding the world’s biggest currency which allowed America to become a global financial hegemon. Currency risk is the United State’s Achilles heel because America must borrow to keep its economy going. The United States does not exist in isolation. Heavily in debt, the US owes 25 percent of its indebtedness to outsiders. Important because Bidenomics calls for the financing of back-to-back $3 trillion deficits this fiscal year and next. And faced with the financing those deficits is the reality that their federal debt is pegged at a problematic 110 percent of gross domestic product. While the market seems to have priced the world as back to normal, it is the never normal. America’s red ink is unsustainable.

Fifty years ago, under the crushing weight of debt to foreigners, President Nixon severed the dollar’s link with the gold standard, replacing the dollar’s backing not with gold but the “full faith” of the United States’ economy. What followed was an era of fiat money debt-fueled spending and the great inflation of the seventies and early eighties. After years of massive deficits from LBJ’s Great Society and financing the Vietnam War, the United States did not have enough gold to back its debts. The Fed also tried to keep rates low until Paul Volcker forced rates to the roof to stop hyperinflation. Since 1971, the greenback’s purchasing power has lost 98 percent in real terms. Today America not only has record debts but the Fed keeps creating dollars as the tsunami of money cheapens the world’s leading currency. Money is free. America’s debt is larger than its economy and it is unlikely that debt will every be repaid, debasing the dollar. In less than 10 years, America’s debt has doubled to $29 trillion, another record. The dollar is structurally weak. The present system depends on the dollar, however without confidence in the dollar, the world has no valid reserve currency. America’s exorbitant privilege is not infinite as are the laws of economics.

Gold is To Be the New Global Currency

The crux is that America is reliant on foreign capital to fund its deficits and profligate spending – that is America’s Achilles heel. The greenback is overvalued, deficits are unsustainable and inflation is their next problem. In Washington they do not seem to care. Both the economic vulnerability and geopolitical risk are more acute than it appears. If interest rates rise, paying down and servicing the debt will become unmanageable. Interest on their debt alone tops $500 billion and that is at new zero rates. America is operating a reckless financial system whose main characteristics are rising deficits and a rising stock market. A consequence of America’s profligacy, is that the dollar must depreciate further which will exacerbate rising inflation. And again, America remains divided against this threat. What damages trust in the US, damages trust in the whole world.

Investor confidence is fleeting. History shows that there is a cycle of debt, and borrowing trillions of dollars only makes it harder to be repaid. The overvaluation and bubble-like market conditions have masked many problems but the swamp is draining; exposing some very ugly frogs. Credit Suisse alone suffered a $5.5 billion loss from the collapse of Archegos Capital which cost the big banks a total of $10 billion in losses. Greensill in the UK filed for bankruptcy in March, sparking a corporate and political scandal, shortly after the Wirecard implosion in Germany. Today, the crackdown from Beijing has hurt many of the big private equity players as Chinese tech stocks dropped the most since 2008. While global capital has so far digested these shocks, risk keeps piling up. Awash in a sea of debt, growing public and investor disenchantment over government mismanagement of the economy, pandemic and ESG has created inequalities and an unjust society. Without confidence, there will be pressure for familiar old remedies. Our problems are being treated as everybody’s problem and therefore nobody’s. All in all, gold is a good thing to have.

There was a time when gold was money. In today’s uncertain world, gold is back in fashion. Part of gold’s role is that it is a barometer of uncertainty. The biggest driver though is that as an inflation hedge against depreciating currencies, negative US real rates and geopolitical uncertainty. Gold is the canary in the mine. It warbles today. Are we listen to its warnings?

Gold was one of the best performing assets during the first half of 2020, but in a few days, gold was caught in a flash crash, dropping $100 as 30,000 gold contracts were dumped on Comex, equivalent to 3 million ounces. The Comex and physical markets are two separate markets and while there has been steady buying of physical gold in the past two years, lead by the central banks, Comex on the other is a paper market and subject to short-term manipulation because it is outside the purview of the SEC. History shows that the moves tend to be “transitory” and an excellent purchase opportunity. Central banks bought 90 tonnes this spring and data player Palantir Technologies bought $50 million in gold bars in August. Amid fears of the Taliban takeover, the US froze $9.44 billion of Afghanistan’s international reserves including $1.4 billion of gold, depriving the new regime needed cash and an economic lifeline. For nations, gold is a reserve asset. Gold has since recovered and the flash crash did not change market fundamentals. The last two gold cycles saw peaks in 1980 and 2019 and each high surpassed the previous peak. Despite the pullback, we believe that gold remains in a bull market and expect the next peak at $2,200 an ounce.

Recommendations

Agnico Eagle Mines Ltd.

Agnico posted a strong second quarter throwing off $228 million in free cash flow on almost 500,000 ounces of production. Production in the second half will be stronger due to Kittila, La India and Amaruq contributions ensuring Agnico’s guidance of 2 million ounces at AISC of $1,000 the year. East Gouldie underground is expected to be Agnico’s next big contributor. The land package is huge and Agnico picked up nearby ground totaling about 20 kilometres. At Canadian Malartic joint venture, there are 10 rigs turning and the area is being systematically explored. Agnico has more than 16 exploration projects ensuring its organic growth prospects with the drill bit. We like the shares here.

Barrick Gold Corp.

The second largest gold miner, Barrick reported revenues of $2.89 billion of which 10 percent was from copper. Rather than dump its copper assets in the last cycle, CEO Bristow hopes to boost Barrick’s exposure to 20 percent. While acquisitions are desired with the green metal near highs, there are not many copper mines on the block. Instead, we expect Barrick to grow organically over the near term. A good example is the Phase 6 heap leach facility at Veladero was recently commissioned. Barrick will also go ahead at Goldrush in Nevada and capex should be less than $1 billion, which is not a problem with $5 billion in cash. The third shaft at Turquoise Ridge has reached total depth. At joint venture Pueblo Viejo in the Dominican Republic, a mine life extension plan is waiting for government approval. In Mali, the third underground mine, Luolo Gounkoto complex came on stream. Looking ahead Barrick is also spending on exploration, securing four exploration licenses in the Egyptian Eastern Desert where Centamin has been mining the giant Sukari deposit for years. We continue to recommend the core asset because of Barrick’s project pipeline and low-cost array of Tier I assets and aggressive management despite losing Catherine Raw at yearend. Buy

B2Gold Gold Corp.

B2Gold had a strong quarter and will meet guidance with a major contribution from Fekola. Total cash costs were under $800 an ounce (Fekola, Otjikoto and Masbate). However, cash flow was hit by a large tax payment such that cash flow was negative. Guidance was maintained with AISC at $900 an ounce. The other bad mark was the license dispute with Mali over Menankoto which will delay the Anaconda expansion plans although B2Gold has licenses for Bantakoto North and North Menankoto. The other uncertainty is the delay at Gramalota where another review of the feasibility study will hopefully lower costs and boost returns. The project will be delayed a year however. On the positive side, the Kiaka project Burkina Faso is being updated. B2Gold has a strong balance sheet, ending the quarter with $382 million. Fekola is a crown jewel and higher grades are expected with the inclusion of Cardinal ore. We like this low-cost producer here.

Centamin PLC

UK-based miner is often overlooked but has successfully built the Sukari Gold Mine in Egypt. In the first half the company earned almost $200 million on production of 204,000 ounces. Centamin is expanding the open pit mine going underground with plans to be released before yearend as part of a three-year plan. However, the shares weakened due to a pit failure forcing the company to temporarily halt operations. The news is disappointing but could present a purchase opportunity since they plan to go underground. Centamin is seeking a buyer for its Burkina Faso project.

Centerra Gold Inc.

Intermediate producer, Centerra reported a loss of $852 million as it wrote down the Kumtor Gold mine in the Kyrgyz Republic which nationalized the mine in May. Centerra has spent $3 billion developing Kumtor which accounts for 10 percent of the Kyrgyz Republic’s economy. The dispute now will drag on and Centerra is left with Mount Milligan in British Columbia and the Oksut mine in Turkey. Centerra has almost $900 million in cash and no debt. Nonetheless, with the loss of Kumtor, Centerra shares are only an option on a resolution with the government. Given the protracted nature of discussions so far and expected lengthy binding arbitration process and chapter 11 proceedings, there is little on the horizon that is encouraging. We think the shares are dead money here since they have few options.

Eldorado Gold Corp.

Eldorado’s results were better due to lower than expected tax expense but costs jumped at Lamaque. At Olympias in Greece, lower output also boosted costs and production was affected by work slowdowns. Meantime Eldorado has cash of $410 million as well as $150 million available under a revolver. Eldorado refinanced its debt with a $500 million note due 2029. Eldorado’s high pressure grinding roll circuit at Kisladag in Turkey will boost revenues, extending that mine’s life. At Lamaque, the Triangle Underground will be completed in the fourth quarter as the decline is extended. In Greece, progress is slow despite the government agreement. An update for Kassandra was filed. Eldorado is looking for a JV partner to build Skouries and a feasibility study is expected before yearend. Overall capex was $72 million in the quarter with spending at Kisladag and Lamaque. Eldorado is caught where they have to spend money at Lamaque and in Greece to ensure their long-term growth prospects. Unfortunately, higher costs and modest output makes the effort challenging.

IAMGold Corp

Mid-tier producer IAMGold managed to lose money despite producing 139,000 ounces of gold at a whopping AISC of $1,422 an ounce. IAMGold operates three mines, Rosebel, Essakane and Westwood with only Essakane performing well at AISC of $1,060 an ounce. Guidance at Rosebel was lowered. IAMGold’s JV Côté is 27 percent complete with most of the engineering complete, however cost pressures are rising as management now expects to spend $950 million for its 70 percent share. We have been skeptical of Côté from a continuity point of view and believe the return is not worth the money – already the price tag for this year has increased to $1,175 billion, exceeding the feasibility study. With $301 million to be spent this year IAMGold has cash and equivalent of $825 million but they are betting the farm on Côté. We believe that this is too risky and that Essakane on its own can’t support IAMGold’s stock price. Sell.

Kinross Gold Corporation

Kinross missed production guidance and produced 538,000 ounces in the quarter at AISC of $1,069 an ounce due to lower production from Bald Mountain, Round Mountain and Tasiast. Costs rose. The disruption from a fire at Tasiast and restart will cost $35 million for mill repairs. Pit wall problems at Round Mountain will cost $50 million. On a positive note, Paracutu in Brazil had another strong quarter despite a pick-up in power costs due to a local drought. Nonetheless, Kinross hopes to produce 2.7 to 2.9 million ounces next year and 2023. La Coipa remains on budget which requires capex of $900 million or so with first production in mid-2022. Kinross’ balance sheet has $676 million in cash plus notes, sufficient to fund for the current cycle. We prefer B2Gold here.

Kirkland Lake Gold Ltd.

Kirkland had a record strong quarter earning $244 million or $0.91 per share, generating free cash flow of $131 million. Cash increased to a whopping $860 million and the balance sheet has no debt. High grade (29.2g/t) Fosterville in Australia produced 158,000 ounces at a cash cost of $162 an ounce with an AISC of $353 an ounce. On the other hand, grade (0.96 g/t) challenged Detour Lake produced 166,000 ounces at AISC of $1,090 an ounce. Kirkland continues to improve Detour with the processing plant expansion, camp expansion and air strip improvements. At Macassa the mine produced 55,300 ounces and # 4 shaft deepening continues, reaching 5,600 feet in June. Kirkland is a very profitable gold miner and the long-term reserves at Detour stand it in good stead with its peers. With a full treasury, excess free cash flow and astute management, we expect Kirkland to be an acquisitor or consolidator, using its premium valued paper as currency.

Lundin Gold Inc.

At Fruta del Norte (FDN), Lundin produced 109,000 ounces comprising 66,000 ounces of concentrate and 43,000 ounces of doré reflecting record quarterly mine tonnage of almost 398,000 tonnes with average grade milled at 11.1 g/t. So far 2.4 kilometres of underground development has been completed. Lundin has cash of $192 million and working capital of $109 million. The Zamora bridge is completed. The South Ventilation Raise (SVR) was delayed into the second quarter of 2021 but won’t impact production this year or next. As well, the 4,200 tonnes per day expansion from 3,500 tonnes per day is on track to be completed in the next quarter. Lundin should produce 400,000 ounces at AISC of $810/oz. Lundin operates the richest mine in the world and is in the midst of a 10,000-metre drilling programme to boost reserves in addition to a 9,000-metre regional exploration drill program. We like the area around FDN and believe there is potential to discover additional deposits in an exciting area. Ecuador is a new and potentially big gold district. Buy.

New Gold Inc.

New Gold produced 67,000 ounces or 106,000 gold equivalent ounces (GEO) but cash costs increased to $1,000 an ounce reflecting lower grades at Rainy River’s “East Lobe” zone. Problem-prone Rainy River grade was below expectation and it is expected that guidance will again be lowered since East Lobe was to represent 50 percent of planned production in the second half. The news is disappointing particularly since the balance sheet remains tight with debt at $489 million versus cash of $130 million. New Gold’s other mine, New Afton benefited from higher copper prices but grade also slipped resulting in cash cost of almost $1,000 an ounce. New Gold is mining gold at a loss at a time when the price of gold remains north of $1,700 an ounce. With a declining production profile and rising costs, New Gold is a sell.

Newmont Corp.

100-year-old Newmont produced 1.45 million ounces of gold and over 300,0000 gold equivalent ounces, generating free cash flow of $578 million from 12 operating mines and two joint ventures. Dividends were increased and the miner is among the top 10 percent of the S&P large cap dividend payers. Adjusted EBITDA was nearly $1.6 billion. In the second half, output will improve from Ahafo and better grades from Tanami. Over the midterm, Newmont is derisking the huge $2 billion Yanacocha’s sulfide but the change in the Peruvian government could delay this multibillion project. After turning Penasquito around, Newmont is still trying to optimize and revive the old Goldcorp assets such as Musselwhite and Eleonore. As current levels, we prefer Barrick for more certainty over the midterm outlook.

Yamana Gold Inc.

Yamana produced 217,000 ounces due to record production from Jacobina and higher grades from El Penon in Chile as well as higher output form Cerro Moro. The Jacobina Phase 2 expansion will increase throughput to 8,500 tonnes per day and production to 230,000 ounces in 2023 at a cost of less than $20 million. At newly acquired Wasamac with reserves of almost 2 million ounces and NPV estimated in range of $850 million to $900 million using a $1,800 gold price, Wasamac is projected for the next cycle since it won’t be in production until 2024. In Yamana’s second quarter, free cash flow was $50 million but the company hopes to spend $25-$30 million on exploration which is needed because Yamana’s mines are mature. Yamana also paid out dividends of about $115 million and bought back shares costing over $200 million. The problem is that Yamana still carries debt of almost $1 billion. We do not like Yamana trying to “suck and blow” at the same time. It can’t pay out dividends, buy back shares, explore and sustain its existing four mines and one joint venture and then finance Wasamac all at the same time. Something has to give and we don’t want to wait around to find out. Sell.

John R. Ing

Please refer to the Legal Section of our website (maisonplacements.com) for our Research Disclosures for an explanation of our rating structure at https://maisonplacements.com/research-reports.

********