Gold Price Performance Leaves Other Assets Dead In The Water Since 1972

During the past 42 years gold has far out-performed the Dow Stock Index and the US Real Estate market. Surely this will be an astounding revelation to most investors. Here are the charts showing the early price trajectory of these three asset classes since 1972.

During the past 42 years gold has far out-performed the Dow Stock Index and the US Real Estate market. Surely this will be an astounding revelation to most investors. Here are the charts showing the early price trajectory of these three asset classes since 1972.

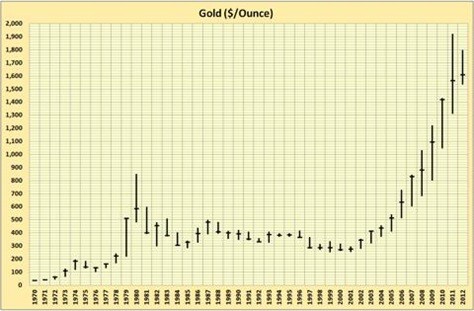

GOLD

DOW STOCK INDEX

US REAL ESTATE

And here are the details regarding the performance of these three asset classes.

Asset Appreciation during the past 42 years…since 1972 (as of January 24, 2014):

(Note 1: Ave Return/Year = Total Appreciation/42)

(Note 2: CAGR is Compound Annual Growth rate)

(Note 3: Current appreciated value if you invested $100,000 in January 1972)

Stock Brokers and Real Estate Agents are going to wet their pants when they read this.

Even more incentive to diversify your investment portfolio with some gold is the following provocative image:

Democratic Administrations have nearly always fueled the gold price higher

History is testament that many Democrat Presidents have boosted gold prices. Here’s the irrefutable record.

- During Franklin D Roosevelt Presidency (1933-1945) the gold price rose 69% from $20.69-$35.00

- During Lyndon B Johnson Presidency (1963-1969) the gold price rose 18% from $35.00-$41.28

- During Jimmy Carter’s Presidency (1977-1981) the gold price rose 507% from $140-$850

- During Barack Obama’s Presidency (from 2009) gold price is up 44% from $875-$1260 (so far)

This begs the question:

How high might the price of gold rise by the time Obama leaves the Presidency?

Obviously, this is difficult to estimate…especially since the humongous price rise during the Carter Administration occurred during his last two years as President. To be sure President Obama will be in the White House for another two years. The average gold price rise during the Democratic Administrations of FDR, LBJ and Carter was +198%. And if we project this to President Obama’s remaining period (but taking into account how much gold has already increased), then the price of gold will have topped $2,600/oz by the time the new President takes command.

And it is this analyst’s considered opinion that yet again:

Gold’s Performance Will Leave Other Asset Classes Dead In The Water During 2014