Gold Stocks’ 2014 Resistance Holding In Wake Of Brexit

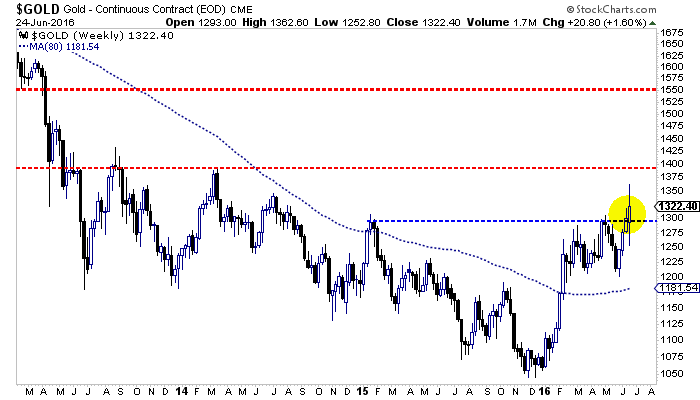

What a last 24 hours for markets! At one point Gold was up $100/oz, S&P500 futures were limit down and the British Pound was down over 8%! The volatility has subsided, perhaps temporarily and Gold settled around $1320/oz as Silver settled below key resistance at $18. The miners predictably gapped up…but the strength was sold. As miners remain below 2014 resistance, we expect Gold to retest $1300/oz before moving higher.

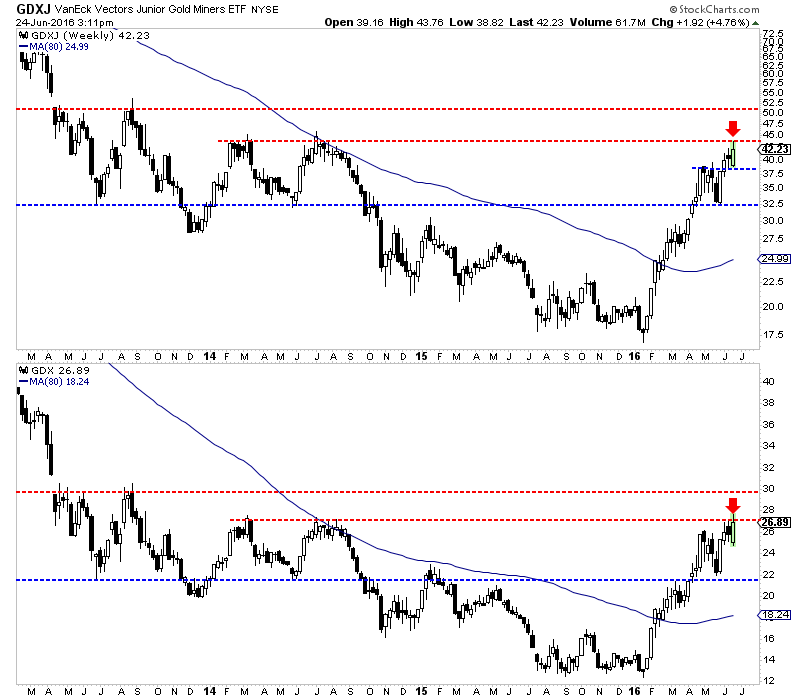

The chart below plots the weekly candlestick charts of GDXJ (top) and GDX. The miners gained 5% to 6% on the week thanks to Brexit but note that miners sold off today after testing 2014 resistance. GDXJ, which has resistance at $43-$45 reached $43.76 today before declining and GDX, which has resistance at $27-$28, reached $27.71 before declining.

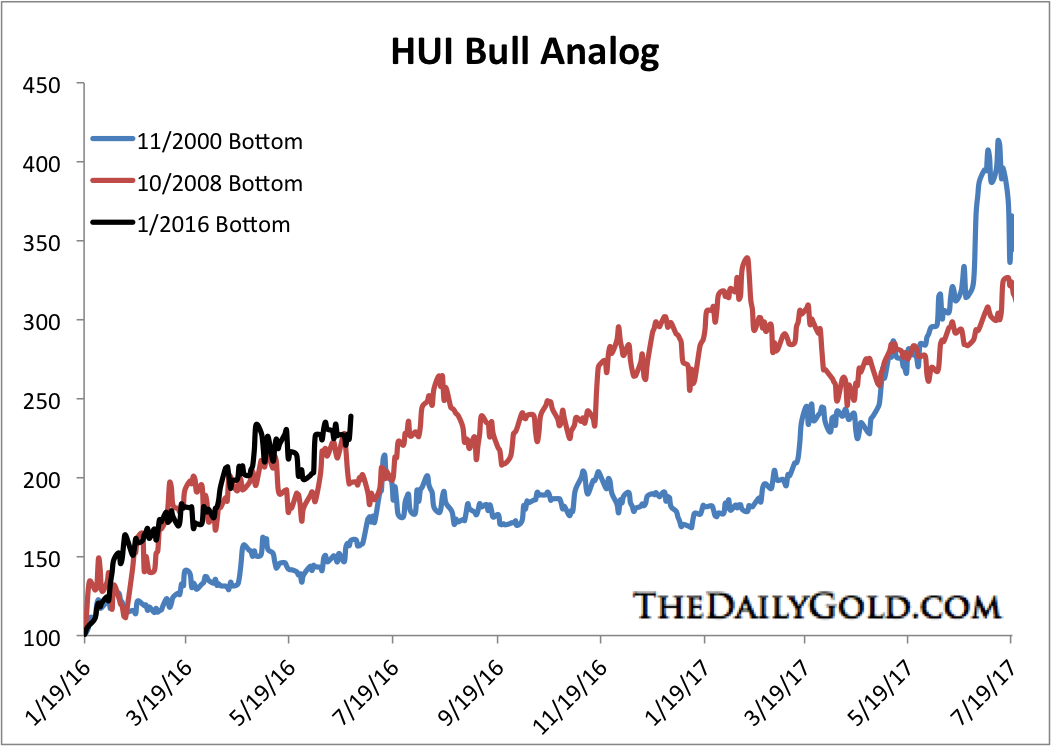

We should also note that the miners remain stretched when viewed through the lenses of history. Specifically, Brexit pushed the rebound above the 2008-2009 rebound.

Given the action in the miners today and their historically overbought condition, coupled with Gold selling off from much higher levels, I expect Gold to retest $1300/oz next week. A retest is only that and nothing more. While Gold has technically not formed a reverse head and shoulders bottom, it nevertheless has a potential measured target of $1550/oz. There is some resistance at $1330 and $1380 to $1400. However, there is very little resistance from $1400 to $1550.

News events rarely change market trends as the market typically leads news. However, Brexit could be an indication of a new bullish development for precious metals. That would be the long-term disintegration of Europe, which would be very negative for the Euro, the world’s second largest currency. This news propelled Gold through $1300 and could be the catalyst to take it towards $1400 over the next few months. Meanwhile, gold stocks could back and fill just a bit before again testing 2014 resistance levels.

Jordan Roy-Byrne CMT, MFTA