Gold SWOT Analysis

Strengths

- The best performing precious metal for the week was silver with a strong lift of 5.57 percent. Silver holdings in exchange traded funds are edging toward a record high, sending the metal for its biggest weekly gain since April, reports Bloomberg. Silver buying also increased to an 11-month high, according to BullionVault’s Gold Investor Index which measures a balance of client buyers against sellers. Gold buying rose to a three-month high, with its buyer/seller balance rising to 55.8 in May versus 53.5 in April.

- Citizens in the United Kingdom will now be able to buy Royal Mint gold bullion to hold in pension funds, reports Chris Howard, the Royal Mint’s director of bullion this week. Products offered include 100g, 1kg bars, along with a service that allows customers to buy a share of 400 ounce gold bars.

- Billionaire George Soros’ bet on gold miners during the first quarter has played out well, reports Bloomberg. Soros Fund Management cut its U.S. stock holdings by 37 percent in the first quarter and bought shares of gold miners along with an ETF tracking the price of gold. Soros made the move in anticipation of weakness in various global markets

Weaknesses

- The worst performing precious metal for the week was palladium, suffering a loss of 1.78 percent with the majority of the losses coming late in the week. Bloomberg’s industry analyst Eily Ong noted that Norilsk, Russia’s largest nickel and palladium producer, is boosting capital spending by 21 percent in 2016 to accelerate higher production volumes for these metals.

- India’s inbound shipments of gold during the month of May are said to have dropped 51 percent from a year earlier. The provisional import numbers show that May shipments declined to around 31 metric tons from 63 metric tons during the prior year. According to a Bloomberg article, gold imports tumbled for a fourth-straight month “as a 16 percent increase in domestic prices since the start of the year kept buyers away.”

- Chinese jeweler Chow Tai Fook saw its profit for fiscal year 2016 dive 46 percent, reports Bloomberg. However, as spot gold reached a new high earlier in the week, the company’s shares rose as much as 7 percent to December highs. According to Bloomberg Intelligence analyst Catherine Lim, higher gold prices can help reduce the company’s hedging losses, helping to narrow net income declines this year. She added that margins likely reached new lows in fiscal year 2016 given the rise of less-profitable gold jewelry sales and hedging losses.

Opportunities

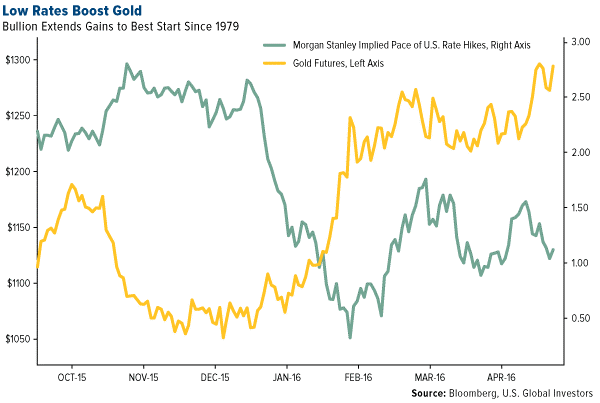

- ANZ Research believes that gold is set to resume its bull cycle, citing last week’s weak jobs data, a subsequent cautious tone by Janet Yellen, along with Brexit worries. Paul Crone, founder of Citrine Capital Management, agrees. “We’re bullish overall on gold because the global economy is pretty poor with China as an issue,” Crone said. “Gold could go as high as $1,400 an ounce.” Lastly, the ECB is also said to be driving gold higher, according to Tai Wong of BMO Capital Markets. “The ECB’s monetary amphetamine has driven gold above the key $1,250 level,” Wong said. “Draghi’s determination to drive rates ever lower fires up investors’ appetite for gold.”

- According to a survey done by Macquarie, mining M&A is set to pick up, with a focus on producing copper assets and pre-production projects in gold, reports Bloomberg. The survey points to organic growth and debt reduction as the sector’s top capital allocation priorities.

- Jaguar Mining is the focus of a recent report from PI Financial, which reviews the company’s turnaround since a spiraling downfall forced it into bankruptcy protection in 2013. As the report points out, Jaguar is now under new management, with Rodney Lamond, who has a track record in turning around troubled assets, stepping in as the new CEO earlier in the year. Jaguar is having some very promising exploration results that should help to drive down cost. The company is trading at just 3.6x 2016 Price/Free Cash Flow while compared to its peer average of 12.2x, the company is set up for a significant rerate.

Threats

- Following a surge in the gold price, China took a breather from adding to its gold reserves in May, reports Bloomberg. The People’s Bank of China (PBOC) kept assets unchanged after adding to them for 10 straight months. Last week gold traders cut their gold net long positions by a third, missing out on last Friday’s spike in the metal. In a similar note for gold, the Managing Director at Goldman Sachs has come out saying, “With the S&P 500 close to all-time highs, stretched valuations and a lack of growth, drawdown risk appears elevated.”

- Philippines’ new president-elect Rodrigo Duerte has come out warning mining companies to “shape up,” reports Business Insider. Duerte stated that his incoming government might rewrite laws to limit environmental degradation as a result of mining, continues the article. “I have a big problem with mining companies,” he said. “They are destroying the soil of our country.

This week Centerra Gold provided an update regarding its legal proceedings within the Kyrgyz Republic, reporting that its Kumtor gold mine subsidiary is now part of a lengthy criminal investigation. With instruction from the Kyrgyz, several of Kumtor’s senior managers have been advised that they will not be allowed to leave the country. In a statement from Centerra, the company says a Kyrgyz agency for environmental protection has alleged that Kumtor owes an additional $220 million in fees. Both Centerra and Kumtor Gold “strongly dispute” that any actions from their senior management were improper. The positive highlight is that Centerra has three other projects outside of the region which should be funded internally from cash and will potentially double its production.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of