Gold SWOT: Gold Purchases In India This Year Are Forecast To Drop To The Lowest Since The Pandemic

Strengths

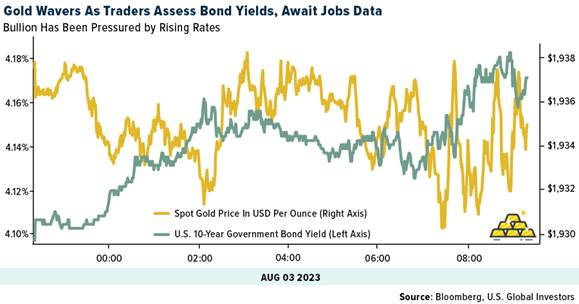

- The best performing precious metal for the week was palladium, up 1.24%, as Nornickel reported that it expects to see a moderated palladium deficit in 2023. Gold edged up as Fitch Ratings’ move to strip the U.S. of its top-tier sovereign credit grade triggered risk-off sentiment, sending global stocks falling. Both European stocks and U.S. equities futures declined, giving the precious metal a boost after its 1.1% drop on Tuesday. The dollar also inched higher, underscoring the greenback and bullion’s status as safe haven assets. Gold finished the next two days with losses but rallied on Friday with the change in nonfarm payrolls coming in lighter than expectations.

- Hochschild Mining has finally received the Environmental permit for the core Inmaculada mine (75% NPV) which will allow the mine to operate for an additional 20 years, removing a key overhang for the stock. The share price closed up nearly 18% on the news.

- Torex Gold reported a second quarter 2023 financial beat. Financial results include second-quarter adjusted EPS of $0.44, a beat versus consensus of $0.37. Quarterly CFPS of $1.07 also beat consensus of $0.84. Annual guidance ranges were maintained, and management indicated that it expects full-year costs to be at the high end of guidance ranges.

Weaknesses

- The worst performing precious metal for the week was silver, down 3.23%, as the historic 3-to-1 move for silver and gold were lockstep this week. AngloGold released a 1H23 trading statement guided to a 48-58% year-over-year decline in headline earnings per share (HEPS) to USc30-37, which is 46-56% below company compiled consensus of 68 cents per share. Management highlighted that HEPS were negatively impacted by a non-cash environmental provision of $38 million net of tax and the effect of continued industry-wide inflation which impacted operating costs by $111 million.

- SilverCrest detailed its updated technical report for its flagship Las Chispas underground mine, located in Sonora state, Mexico, with higher operating and capital costs and lower ounces than expected. The updated technical report envisions 42 million ounces silver and 423,000 ounces gold of production (10% below consensus) driven by silver head grade declining to 396 grams per ton silver due to higher mining dilution from a greater use of bulk mining methods.

- Centerra Gold reported second quarter 2023 EPS of -$0.20, a miss versus -$0.15 consensus, reports Reuters. Against consensus, the EPS miss was driven mainly by lower sales and higher production costs, though production was higher than expected.

Opportunities

- Pan American Silver announced the sale of its MARA, Agua de la Falda, Morococha assets and non-controlling equity interests for total cash consideration of $593 million, plus royalties on MARA and Agua de la Falda. PAAS noted that the divestments will save care and maintenance costs at MARA and Morococha; which represents annual attributable savings of $60 million out of PAAS’ $98-$109 million guidance for 2023, with closing expected to be completed in the third quarter of this year.

- According to Bank of America, the primary knock against Endeavor Mining is the jurisdiction risk (100% West Africa), although investors are primarily concerned about Burkina Faso. Beyond this sale, the company has several ways to further reduce exposure to the country including growth projects outside of Burkina Faso.

- Bloomberg reports that Saudi Arabia has held talks with Barrick about investing in Pakistan, while Barrick's CEO has commented the company is not in talks to sell a share of its stake in the Reko Diq project in the country. Barrick's exposure to Reko Diq has historically represented a key investor concern and overhang for shares due to the project's high geopolitical risk exposure. A potential partnership to advance Reko Diq with a geographically strategic partner like Saudi Arabia, plus confirm its value, could be viewed constructively.

Threats

- Sibanye-Stillwater announced that the Kloof 4 shaft experienced an incident that will negatively impact H2/23 gold production. The Kloof 4 shaft produces 115-120,000 ounces annually, so for 2023 the impact could be around 50,000 ounces (6-7% of total gold production) assuming no further production for the year. The company is currently evaluating the extent of the damage and the production impact. The gold operations accounted for 10% of group EBITDA in the first quarter of this year.

- In a turnaround that has already taken it from one of the world’s biggest gold buyers to a top seller this year, Kazakhstan’s central bank is looking to cut the metal’s

share to as low as half of its $34.5 billion reserves. Alongside its counterparts in Turkey and Uzbekistan, the National Bank of Kazakhstan has emerged among the institutions that have contributed to a second straight quarter of decline in

bullion purchases from central banks, whose buying accounted for nearly a quarter of global gold demand last year. - Gold purchases in India this year are forecast to drop to the lowest since the Covid-19 pandemic hit the second-biggest consuming nation in 2020, with high domestic prices deterring buyers. Indians are expected buy between 650 and 750 tons of the precious metal in 2023, said P.R. Somasundaram, the regional chief executive officer for India at the World Gold Council. The range is lower than the 774 tons bought last year and the least since the 446 tons purchased in 2020, according to the London-based group’s data.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of