Gold's Golden Week

I’ve noted that when China’s markets go quiet during the “Golden Week” holiday, the gold price tends to soften.

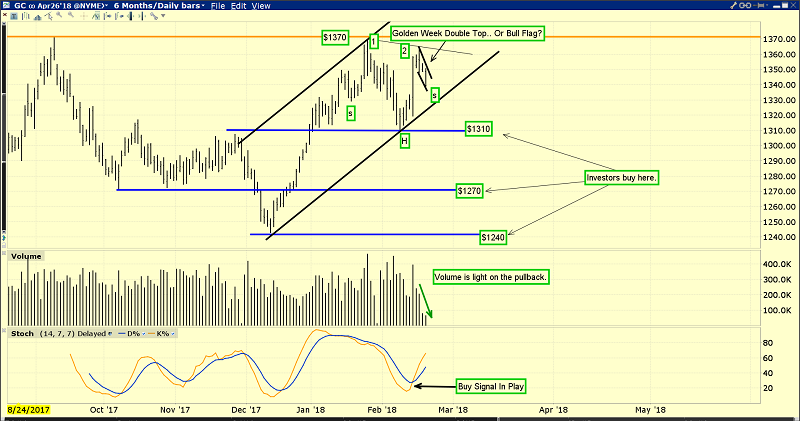

This is the key gold chart. Price softness is expected during this holiday, and the good news is that it is occurring on very light volume.

The bears would argue there’s a small double top in play, while the bulls have an inverse head and shoulders bottom pattern on their team. A bull flag pattern may also have formed.

I’ve told investors to expect a substantial battle between the bulls and bears in the $1370 area, and that’s exactly what is taking place.

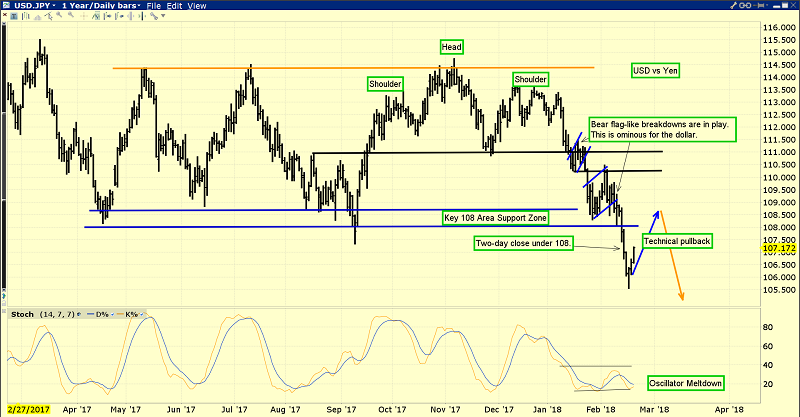

This is the US dollar versus Japanese yen chart. After tumbling through key support at 108, a relief rally is now in play.

The 108 area is now resistance. For gold, the price action of the dollar against the yen is very important. I expect the dollar’s relief rally to fail in the 108 – 110 area, and then a descent towards par (100) should get underway.

That would be a key signal that gold is going to move above $1370 and attract significant institutional interest by doing so.

In terms of trading volume, gold is a huge market. On a daily basis, dollar volume for gold trading in London is about as big as all the dollar volume for all the stocks traded on the New York Stock Exchange.

Banks trade gold as a FOREX market currency. In terms of volume, it’s the fifth most active in the world. So, when the gold price weakens as Chinese buyers go on holiday, that can affect other major markets.

For example, today the Dow is down, bonds are down, but the dollar is up against the yen. That’s because Golden Week is pushing gold down against the dollar and FOREX traders are reacting to that in the dollar-yen market.

This is the T-bond chart. Most bank analysts thought that gold would fall if the Fed launched quantitative tightening and rate hikes. Instead, gold has rallied since the tightening cycle began, as I predicted it would.

Most investors underestimate the effects of love trade demand for gold (or lack of it) on the world’s major markets. Gold demand growth in China and India can put pressure on US interest rates. That’s because bank FOREX traders react to the rise in the gold price by selling the dollar.

Credit Suisse notes that countries like China are increasing their “dedollarization”. That’s more good news for gold.

Trump and most congressmen are aggressively increasing the US government’s debt. I’ve argued that Trump likely believes there is no solution to the government’s debt problem other than gold revaluation, dollar devaluation, and T-bond default.

Since there is no real solution and Trump is a pragmatist, he just lets the debt rise to the T-bond default/gold revaluation point. It’s a wise move on his part, and fabulous news for gold stocks!

This is the GDX chart. GDX has again entered my ultra-important $23 - $18 accumulation zone. Investors need to keep their eye on the US M2 money velocity reversal prize, because that is what will produce sustained outperformance of gold stocks against gold.

Fred Hickey does a spectacular job of outlining the mindboggling undervaluation of gold stocks versus bullion. The same is true for the silver stocks; the miners have cut costs but are trading at generational lows against bullion.

Fred notes that for the average GDX component stock the spread between the company’s revenues and costs is about the same as it was in 2012, there are less GDX shares outstanding now, but the GDX ETF price is now about $22 versus about $45 in 2012!

Many gold market analysts have noted the facts that Fred notes. To repeat, what creates a sustained outperformance of gold stocks versus bullion is inflation. To get serious inflation, money velocity must rise.

To get a rise in money velocity, fiat money must move out of the deflationary hands of the US government (T-bonds) and into the fractional reserve banking system. To get that job done, rate hikes and quantitative tightening are mandatory catalysts.

The great news is that Jerome Powell is now sitting in the Fed’s big chair. On March 21 he is going to set the tone for the rest of the year with his statements and actions. Jerome has stated that he doesn’t really follow the stock market.

That’s a slap in the face for mainstream analysts that literally worship the US stock market as some kind of “supreme being”. Jerome is set to do a lot of the things that Paul Volker did in the 1970s (without the cigars, fanfare, and ego).

Ben Bernanke promoted deflation with QE and rate chops. That produced a dramatic acceleration in the gold stocks versus gold bear cycle. Janet Yellen talked a great inflationary talk, enacted the right policies to get the inflationary job done, but moved at a snail’s pace.

Jerome has tax cut inflationary wind at his back, and I expect most market gurus (mainstream and gold) to find themselves shell shocked when Jerome shows them on March 21 just how focused he really is on reversing US money velocity. Let’s hope the entire world gold community is as focused as I am on accumulating key gold stocks in my $23 - $18 buy zone for GDX, in preparation for a major league bull market in US money velocity!

*********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Silver Jockeys On Golden Horses!” report. I suggest a twelve must-own gold and silver stocks for the coming gold bull inflationary era, with a solid mix of juniors, intermediates, and seniors that are all outperforming their peers right now!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: