Gold's Rally: A Study In Perfection

The gold price action continues to look spectacular, as the rally gains both technical and fundamental momentum. This is the beautiful daily gold chart.

Gold has staged a majestic upside breakout, as I predicted it would, from an important symmetrical triangle pattern. The upside fun continues this morning, with the world’s ultimate asset rising overnight again, in solid Asian trading.

My $1320 target is coming closer.

From a fundamental perspective, it’s important to understand the difference between the gold market now, and during the 2009 – 2011 rally.

Institutional buyers then tended to be leveraged hedge funds. They believed Ben Bernanke’s QE program would be inflationary, even though Ben himself stated it could be quite deflationary, which it was. For several years, I’ve suggested that the exit from QE and interest rate hikes will create all the inflation those hedge fund managers wanted to see.

That’s coming into play now, and value-oriented funds are eagerly buying gold. These are very strong hands. While I don’t engage in gold market price chasing, those who do so now don’t face anywhere near the risk they did before these powerful institutional buyers joined the “gold buying party”.

If a Western gold investor has lots of precious metal sector investments now, they should not be greedy and buy more as the price rises. If they have none at all, they should definitely be a buyer right now, because they are in the company of deep-pocketed institutions.

These institutions appear to be committed to the precious metal asset class for the long term as a value play, and won’t be easily shaken from their positions for many years to come! Also, whether gold rises or falls now, those money managers will likely keep buying regularly.

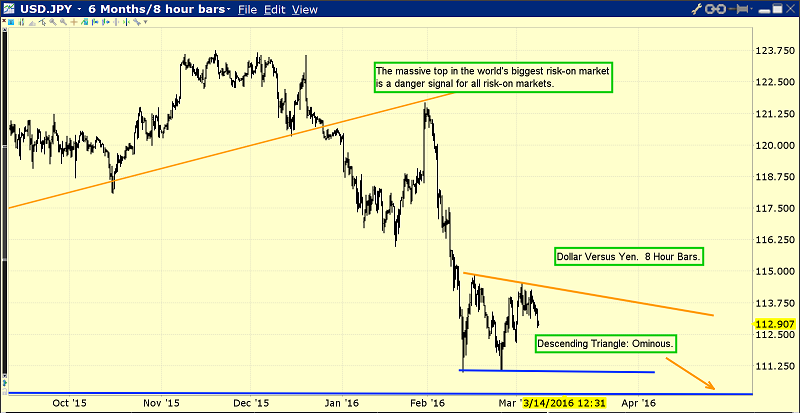

That’s an eight hour bars chart of the US dollar versus the yen, and it looks technically ominous.

A descending triangle is beginning to form, and that is occurring as gold has burst out of the bullish symmetrical triangle.

Gold is not likely to have a significant sell-off until the dollar can rally against the yen, and that looks unlikely right now.

If the dollar breaks under the 111 level on that chart, it could be because Janet Yellen has raised rates again, creating another stock market panic, and more “risk-off” buying of the yen and gold!

More rate hikes will also move more money out of the Fed and into the commercial banking system. For commercial banks, fractional reserve banking rewards outweigh the risks of making new loans. They get “peanuts” in interest at the Fed, and as the banks move that money, it adds to inflation, creating even more concerns about inflation.

Top institutional money managers know that Janet can only raise interest rates in a limited way, or it will create a debt crisis within the US government. Janet also uses Phillips Curve theory to argue that higher inflation boosts GDP.

So, a limited number of rate hikes are likely, and real rates are likely to decline because of inflation that rises faster than her rate hikes, and that’s the ideal environment for gold!

This is the important daily oil chart. Technically, oil may be ready to challenge the key downtrend line I’ve highlighted. The $40 price is a key psychological number as well, and if it is exceeded, I expect money managers to begin talking about inflation more aggressively. That should produce an acceleration in the already-substantial SPDR fund buying. There are now 793 tons in this important gold fund!

Also, influential economist Jeff Currie of Goldman Sachs may have unleashed a tidal wave of institutional buying, when he recently stated that oil will lead the general commodity market into a new upcycle later this year.

Institutions are committing money to the sector now as a percentage of new money they receive. That’s a very powerful force that can create higher prices for most commodities.

This is the short term chart of the Dow. Gold surged as global stock markets crashed after Janet’s first rate hike, but gold is surging again, as stock markets rally!

Clearly, for the world’s ultimate asset, the rally is a “study in perfection”. All the lights are green! The Chinese stock market is forming a gargantuan inverse head & shoulders pattern. I’ve argued that Chinese leaders will be successful in leading the nation’s transition into a domestic consumption oriented economy, and this chart adds serious weight to my assertion.

Chinese citizens like to buy a lot of gold when they prosper. Also, the Chinese stock market is highly correlated to general commodity markets, while the US stock market is highly correlated to printed money and low interest rates from the Fed.

As Janet ends the printed money fun and hikes rates, I expect the Chinese stock market will diverge from the US market, and rally strongly while the US market may implode. Obviously, I invest where my mouth is, which is gold, silver, Chindian stock markets, and commodity stocks.

This is the phenomenal GDX weekly chart.

A huge inverse head and shoulders bottom pattern continues to get “sculpted” onto the chart. This is forming because of large institutional money manager liquidity flows coming into this great sector. The rally should continue until roughly the $23 area for GDX. From there, the right shoulder should form. At that point, I’m predicting an enormous rally begins, carrying GDX to beyond the $30 marker!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Silver Stocks Shall Rock!” report. I cover 6 key silver stocks poised to lead the precious metal sector during the next key stage of the gold price rally, alongside with 3 great gold stocks that seem ready to join the upside fun!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: