How Will Gold React To The Next Rate Hike?

Strengths

- The best performing precious metal for the week was gold, down 2.43 percent, but still leading its precious metals peers. Gold imports by India are said to have risen nearly three-fold in February from a year earlier, reports Bloomberg, jumping 175 percent. Jewelers are restocking for the upcoming festival and wedding period that starts next month.

- The U.S. saw its largest trade deficit since March of 2012, reports Bloomberg, as a jump in merchandise imports in January exceeded a smaller gain in shipments overseas. “The wider deficit indicates trade, which subtracted 1.7 percent from fourth-quarter growth, will weigh on the economy in early 2017,” the article continues. A stronger dollar has made exports less competitive and could be hindrance to boosting manufacturing jobs in the U.S. as President Trump promised.

- Joni Teves, strategist at UBS, writes that the research group expects underlying positive sentiment toward gold to remain broadly intact as uncertainty lingers. In its Global Precious Metals Comment, Teves outlines that despite the recent increase in positioning, gold market length remains relatively subdued with net positions in Comex accounting for about 50 percent of the record. Similarly, UBS writes “there really isn’t much expectation of an aggressive selloff in gold – this has been a common theme among our conversations with market participants in different regions.”

Weaknesses

- The worst performing precious metal for the week was platinum, down 5.72 percent. Silver price was not far behind with a loss of 5.22 percent.

- According to a weekly Bloomberg survey, nearly half of gold traders and analysts are bearish on gold as the dollar strengthens amid expectations of a Fed rate hike next week. Overseas, the People’s Bank of China reports gold holdings unchanged for a fourth-straight month, coming in at 59.24 million ounces by the end of February. Similarly, Bullionvault’s Gold Investor Index, which measures the balance of client buyers against sellers, fell to the lowest level since July.

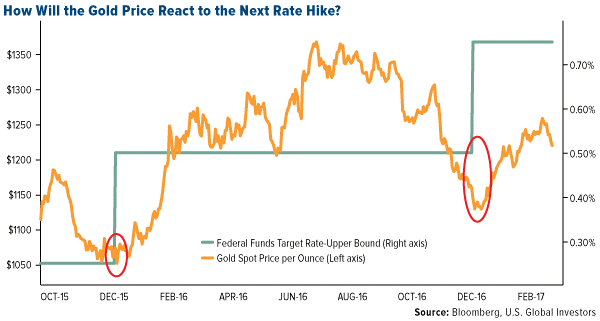

- Gold fell below $1,200 an ounce this week, the longest losing streak since October, on better-than-expected U.S. private jobs data – adding to positive economic talk that boosted the dollar. “Three weeks ago the possibility of a rate hike in March was very small, but now it’s 100 percent,” said Bob Takai, CEO and president of Sumitomo Corp. So where exactly does the Fed see rates headed? The chart below gives a quick comparison between the Fed Funds Target versus where the Taylor Rule Estimate, estimating close to 4 percent. The sudden shift to raise rates in March may reflect that the Fed is behind the curve again.

Opportunities

- Hedge funds are bracing themselves for tough times ahead this year, reports Bloomberg. Managers have stopped loading up on bullish positioning, becoming less reliant on U.S. stocks and selling economically sensitive bank shares and materials like copper, the article continues. Now they are buying gold. Quants from UBS and Goldman Sachs are also seeing opportunity for the yellow metal, using different modeling techniques they conclude that the dollar is perhaps 30 percent overvalued. And despite gold being under pressure leading up to the next rate hike, Bank of America still sees gold prices rallying by around $200 by the end of the year.

- Mike McGlone, a BI Commodity Strategist, writes this week that commodities often prevail in tightening cycles, perhaps now more than ever. For example, bullion gained 52 percent in the June 2004 to June 2006 tightening cycle and 5 percent from the June 1999 to May 2000 tightening cycle. “The Fed is only tightening when they are concerned about inflation,” McGlone said. “That is good for gold.” In fact, the yellow metal bottomed a day after the past two tightenings and rallied thereafter.

- After four years of restraint, Bloomberg reports that mining investment bankers say deal-making is starting to flow again. Paul Knight of Barclays Plc says this is the busiest it’s been in his four years with the company. “If our experience here is any indication of what’s happening around the street, you may well see more M&A activity at the end of this year than we’ve seen in the last three or four years,” Knight commented. China Gold, the nation’s largest government-owned gold producer is even back on the acquisition hunt after bulking up mines, reports Bloomberg.

Threats

- Morgan Stanley points out that a revised draft of South Africa’s mining charter could still contain very disadvantageous requirements for mining companies that are not reflected in the share prices. One of the key concerns around the potential draft includes the fact that the once empowered, always empowered rule no longer applies and companies have to empower back to 26 percent if they are below the threshold.

- Steven Mnuchin’s picks for the top ranks of the U.S. Treasury are being stalled due to resistance from the White House, reports Bloomberg. More specifically, questions about loyalty to Trump have played a role in at least two cases – including one recruit whose Twitter account was scrutinized for potential criticism of the president. On the flip side, David Nason, who is a leading candidate to be named the Fed’s bank supervision chief, told the White House he is no longer interested in the job. Nason plans to pursue opportunities at GE instead. And if you thought Russian hacking in the U.S. has pulled back since the election, you would be wrong. Liberal think tanks, critical of President Trump, around the U.S. are finding that their firewalls have been breached by Cozy Bear and they are being asked to pay ransoms in bitcoin to prevent sensitive data from potentially being leaked.

- According to a study by consultant Roland Berger GmbH, the proposed U.S. border tax would make most automakers unprofitable, reports Bloomberg, along with strain consumers and lead to job losses rather than gains. “The planned charge would increase the average cost of a car by $3,300, prompting a drop in demand and forcing manufacturers to react by shrinking their U.S. workforce,” the firm said in a presentation on Wednesday.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of