The Month Of June: A Gold Price Swoon

Another week in the 2021-2025 war cycle is underway, and for investors properly positioned, it’s been a cakewalk… with lots of golden icing on the cake.

Western governments seem eager to turn middle earners into the poor, and their “all stick and no carrot” actions may also cause hundreds of millions of the world’s poorest citizens to starve. These governments call it, “freedom fighting”.

Oil may be ending a minor trend rally, but it’s also breaking out of a significant ascending triangle pattern.

I’ve predicted that food riots would begin in some nations on a sustained move above $130 for oil.

In America, the riots likely won’t begin until oil trades above $200, but there will be “isolated incidents” of shootouts at gas stations and grocery stores.

More desperate citizens will mentally break down and embrace violence and robbery as the only practical solution to feed, transport, and shelter themselves and their families.

The awesome XLE chart. To stay ahead of the mayhem, investors need to own gold and silver, but also energy stocks and a diversified commodity fund or ETF.

Three meals a day becomes two, two becomes one, and the only question is… how long before one becomes none?

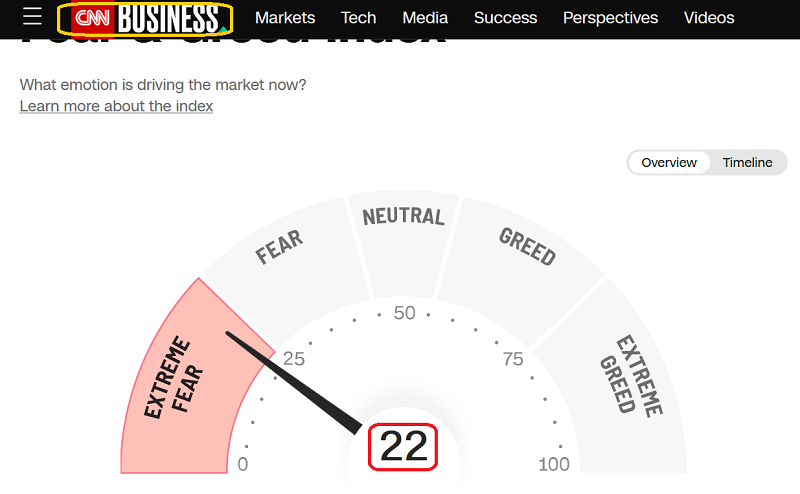

The CNN GFI (greed and fear index) shows US stock market investors are demoralized, afraid, and rightfully so:

The nation is only beginning month 18 of a 60month war cycle, rates are rising in a real estate bubble, both political parties worship fiat money (fiat is the backbone of socialism), and the CAPE ratio for the SP500 is higher than it was in 1929!

Yet, incredibly, stock market gurus are calling this horrifying situation… a roaring buy signal for the market.

The Dow chart. I’ve only issued four major buy signals in the last 40 years, and I have no intention of issuing another for a long time. The bottom line is this:

It could be ten or twenty years before the US stock market offers investors reasonable value again.

My focus for stock market investing is China and India, and the Chinese market is now reaching what is best termed, the outskirts zone of reasonable valuation.

More importantly, unlike the silly citizens of the West, Chindians view strength in the economy and stock market as a great reason to buy lots of gold. I’ve defined what lies ahead as a “gold bull era”, with rising gold prices for the next 100 to 200 years, and the return of gold as money, in digital form. In a nutshell: like the small Western gold community, 3 billion Chindians understand that fiat money is the barbaric relic, not gold.

The past 50 years have been a disaster for the dollar versus gold, and the next 50 are poised to be much, much worse.

What about crypto? The interesting bitcoin chart. I’ve predicted a massive decoupling event for crypto and the stock market, where crypto begins moving higher with gold, the stock market tumbles into a gulag and...

The decoupling event may be starting now. In my Crypto Palace newsletter, I issued a massive sell crypto and buy gold signal in the $65,000 area for bitcoin. Now, it may be time to buy bitcoin again, not with gold, but with fiat! At $499/year and about 4 issues a week, my newsletter is superb value. To celebrate the decoupling, I’m offering new and renewing subscribers a special half price offer of $259 for 15 months. Send me an Email or click this link to get the special price. Thanks!

The XME metals and mining stocks ETF. It’s a perfect way to play the current global situation, with exposure to gold miners… and the base metals that rise even in the face of aggressive rate hikes.

I’m a seller of 30% of my XME trading position at about $60 and at $65 for the rest. From there, pure gold and silver miners should again get the spotlight.

While XLE and XME look perky, the gold and silver ETFs like GOAU, GDX, GDXJ, SIL, and SILJ don’t have much volume on the rally.

A double bottom pattern is possible for most of these ETFs. The US jobs report is Friday and gold is often soft going into that report. Tuesday is also often a soft day for gold, and it’s the weak season for demand in Asia.

Looking ahead, Chinese lockdowns could be mostly lifted by July and US money managers may show concern that the only demand that the Fed’s tiny rate hikes are reducing is the demand for food. Republican victories in the US mid-term elections could produce a de facto freeze in government operations, with a democrat president locking horns with a republican congress on almost every issue.

The month of June? Yes, it could bring a gold price swoon, but when gold was $2000, I laid out the $1835-$1775 as the buy zone of focus. At $1775, if it happens, it will an “all aboard” signal for the pure gold and silver miners. All aboard a bull era starship, with a destination of all-time highs for gold, silver… and most miners too!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With Gold!” report. I highlight ten under the radar junior miners that have price and volume action suggesting imminent upside action! Key investor tactics are included in the report.

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

*******

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: