The Next Golden Rocket (Part II)

From being heavily involved in the gold market since 2001 I have seen numerous gold mining shares rocket 300% - 1200% in value. Long time readers of my reports know I call these rare plays “Golden Rockets” and I would like to talk about a stock which has all the ingredients to emerge as a huge winner.

From being heavily involved in the gold market since 2001 I have seen numerous gold mining shares rocket 300% - 1200% in value. Long time readers of my reports know I call these rare plays “Golden Rockets” and I would like to talk about a stock which has all the ingredients to emerge as a huge winner.

Before I get into the details it is important that you know where we are in terms of the resource and specifically metals like gold, silver, copper, nickel etc…

For YEARS commentators have been saying buy precious metals and gold stocks, and they have been dead wrong in terms of their timing. In short my readers and I have waited over three years for the next bull market to start in this sector. In fact, we have not traded or owned a single gold stock since 2011.

You see when it comes to trading/investing, timing is EVERYTHING. Even if you pick the best stocks they can underperform if the overall sector is out of favor. You do not want to own shares of companies when they are out of favor because it will pull the share price down nine times out of ten no matter how strong the company financials may be.

The key is to patiently sit on the sidelines until the market tips its hand showing its true strength/weaknesses and then wait the perfect opportunity presents its self which is what I am sharing with you here.

As a technical analyst 90% of my work is based around price (price patterns, momentum, sentiment, and volume). Taking into account global markets, US equities market, the dollar, commodities, and economic data I have provided a simple comparison on what I feel will happen with US equities, gold, and gold miners.

Most of my analysis is mimicking that of 2000 when stocks topped and gold miners emerged to generate an average return of 1000% (10x ROI).

With the US equities market teetering on the verge of collapse, properly positioned gold miners are basing and preparing to rocket higher as a leveraged safe haven play.

Now let’s get into the important stuff… My Golden Rocket Play!

The company is Discovery Ventures Inc. (TSX.V: DVN) and they have a high grade gold and copper claim. There are several things I like about this play that make it highly attractive and it will get the attention of investors over time.

The details I share are a quick overview so be sure to perform your own due diligence.

Here is a run-down of their core project which is called “Max Mine and Mill”:

The Max Mine and Mill Project consists of 59 mineral claims totaling approximately 5,489 hectares and certain under surface rights located in Revelstoke mining division of the Province of British Columbia.

The Max Mine and Mill includes an underground molybdenum mine, crushing, milling and concentrating facilities, tailings storage facilities, mineral claims, mining leases, licenses and other holdings located near Trout Lake in the Revelstoke mining division of the Province of British Columbia.

What really excites me about Discovery is that this new mine is entering the market at a great time. A few years ago claims, mining equipment and energy were selling at premium prices. In the last couple years Discovery cleverly acquired to properties (Max Mine & Willa) including state of the art mining equipment. The Max Mine won the 2009 B.C Mining & Sustainability Award, which proves the land and location of this project is great.

The cost of the Max Mine and Mill could have easily cost a company $100 million for the land and equipment but because the previous company was mining another material which no longer has much value Discovery purchased the package for only $6 million.

The Max Mine portion of the deal also came with a massive tax savings. Discovery now has a $50,000,000 tax pool which means potentially a quicker return on investment for Discovery and a higher earnings per share for investors.

An added bonus with the new properties is that Discovery needed a mill solution, and ironically one of the properties had one. Now both projects (Max Mine and Willa) can share the mill, which saved Discovery a lot money and will cut down in processing costs when they go into production in the coming months.

Discovery now has fully permitted mining project located in the best jurisdiction in the world for exploration and mining, and the Kootenay region has a prolific history in this sector.

Discovery Ventures Preliminary Economic Assessment (PEA)

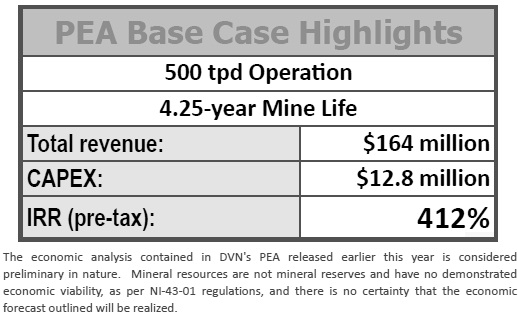

Discovery Ventures has a powerful PEA for its two new properties (Max Mine and Willa). What the PEA shows is the potential life expectancy of these new properties based on their current mineral findings, production per day, estimated revenues (will vary depending on commodity value), IRR%, and their CAPEX.

These are very attractive numbers, but if you don’t know what they mean let me explain:

The company should be able to produce 500 tons per day of high grade material through their state of the art equipment. There is enough material for them to mine for 4.25 years. With the current price of gold, silver and copper they could generate $164,000,000 in revenue.

I should also mention that DVN also announced that is has filed an application with the ministry of mines to re-open the existing adit portals and conduct underground exploration activities to sample some of the mineralized zones, which could increase the mines life and revenues.

What I like about these numbers is that I feel commodities especially metals will enter a new bull market which will last 3-5 years and it should start later this year. When precious metals become the global safe haven from collapsing currencies the price of gold will soar. I would not be surprised to see gold double or triple in value.

The IRR means (What is Internal Rate of Return?). The higher the number the more desirable the project is by investors. And with an IRR of 412% Discovery is a hidden gem in my opinion.

The CAPEX for this project is extremely low… and as investors that is exactly what we want. It means the cost to maintain project each year is low. (What is Capital Expenditure?)

Golden Rocket Chart Analysis: DVN.V

Unfortunately this company launched at almost the worst time back in 2010. They started just before the price of gold and silver topped out. But with every negative there is always a positive takeaway. And that is the fact that they have survived once of the most difficult times this sector has seen in years and the share price is trading with a low evaluation.

During the past few years the share price has been building a major basing pattern between 10 – 50 cents. Shares have been moving from those of weak hands to those of strong long-term investors. And this is exactly what the On Balance volume indicator at the bottom is telling us.

As this gold exploration company sees light at the end of the tunnel to start gold production investors continue to want more shares.

This will be Discovery Ventures first project to go into production and it is the key which will ignite the rocket under the share price. Once this company staring producing and making money investors of all types will want to own shares.

View Live Updated Chart Analysis: https://stockcharts.com/public/1992897/tenpp/2

A great comparative example of what Discovery Ventures has with another company of the past with a similar situation is Klondex Mines Ltd. (TST: KDX). In 2013 they had a low of $0.91 and the price continues to climb with a current price of $3.38. That is a 370% return during a time when gold and silver have been in a bear market. Just imagine the potential for Discovery Ventures (TSX.V: DVN) when it starts production and the gold price rises!

Concluding Thoughts:

Naturally I am a very conservative person in both life and trading. But I also know that when things make logical sense and there is a potentially great investment I always put some of my money to work with them. I like Discovery Vernture (Symbol: TSX.V: DVN) for the reasons stated above and why I own shares of this stock.

Last but not least today they announced confirmation of a $7 million line of credit, which also has some of the funds being convertible into shares for the investor providing the capital. This is great for Discovery and its shareholders long term. This will allow them to compete the balance of the work and become a full production gold mine.

Here is my first stock pick a few weeks ago - an oil exploration company that is about to start production - CLICK HERE

Chris Vermeulen

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Discovery Ventures Inc. In addition, the author owns shares of Discovery Ventures Inc. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

********