Platinum Is Outshining Gold

Strengths

- The best performing precious metal for the week was platinum, up 3.38 percent and marking eight straight trading days of gains. China has seen an 11 percent jump in auto sales through May, spurred by a tax cut on purchases.

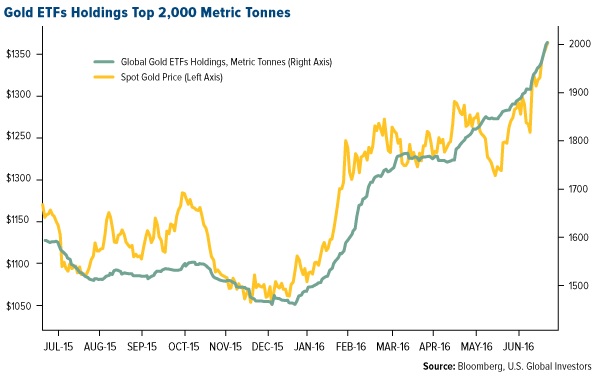

- Gold demand has surged this year as seen in global gold ETF holdings. Holdings have increased by more than 500 tonnes since January, reaching a high of over 2,000 tonnes for the first time in three years. Investor gold demand has been prompted by slow global growth, negative interest rates in Europe and Japan, and the unlikelihood of the Federal Reserve raising rates in the near future.

- China resumed buying gold in June after taking an uncharacteristic break in May. The People’s Bank of China, the country’s central bank, purchased 15.6 tonnes, increasing its reserves to 1,823 tonnes. Retail investor buying is on the increase in China as well, as outstanding shares in the Huaan Yifu Gold ETF, China’s largest bullion-backed ETF, jumped to a record high of 17.58 tonnes of bullion equivalent on Tuesday this week, according to David Xu at Huaan Asset Management Co.

Weaknesses

- The worst performing precious metal for the week was gold, up 1.83 percent, which has been pretty steady as of late marking the sixth consecutive weekly gain.

- Payrolls for June busted through expectations, climbing to 287,000. At the same time, wages advanced less than expected. The news sent gold into a swing between gains and losses. Chris Gaffney, president of EverBank World Markets in St. Louis, commented that members of the Fed “are breathing a sigh of relief after this report, but the U.S. economy and more importantly the global economy is still in a state of uncertainty,” and that those concerns “will keep them from moving rates higher in 2016.”

- India’s gold imports dropped almost by half in June compared to a year earlier. June imports of 32 tonnes were 43 percent less than June last year, at 55.7 tonnes. This is a significant drop for India, which, along with China, are the top two countries for gold consumption.

Opportunities

- Gold forecasts are coming in resoundingly bullish. ABN Amro, rated as the most accurate forecaster by Bloomberg, targets a gold price of $1,425 per ounce, according to analyst Georgette Boele in a report received Thursday. Boele cites prospects for accommodative central bank policies in Europe and elsewhere in the world. UBS also pronounced its target at $1,400, up from $1,250. UBS analyst Joni Teves sees gold reaching this level in the short term, writing that “gold has likely entered the early stages of the next bull run.” Teves also sees prices averaging $1,340 in the second half of this year. State Street, meanwhile, sees a price range of between $1,400 and $1,450, recommending that clients hold between 2 and 10 percent of their portfolios in gold.

- Jeff Gundlach says he’s not selling gold. The DoubleLine Capital founder calls gold the best alternative to stocks and bonds, as reported by Reuters. Gundlach goes on to say that 10-year Treasuries at current yields are the “worst trade location” ever, and stressed the uncertainty seen by policymakers and European banks. Gold options traders are also showing their expectations that prices will keep climbing. Compared to puts hedging against a 10 percent drop, calls betting on a 10 percent gain through the biggest gold ETF are nearing the most expensive since 2009.

- Even while gold has seen a big boost of 7 percent following the Brexit vote, silver is outshining, having jumped 17 percent. Silver enjoys demand for jewelry and “safe haven” appeal, similar to gold, but has more industrial use than gold. Simona Gambarini, an economist at Capital Economics, expects silver supply to contract. Demand in China has been strong, due to consumers seeking a cheaper alternative to gold. Central banks may also start building up their silver holdings, according to Andrew Chanin, CEO of PureFunds. Sean Brodrick of Oxford Club sees silver reaching $25 per ounce by the end of the year.

Threats

- The Japanese yen is in danger of collapse, according to Yukio Noguchi, a university professor and former Ministry of Finance official. He sees a scenario where the yen could drop to 300 per U.S. dollar, compared to last week’s rate of 101 yen per dollar. Amid this uncertainty, along with negative interest rates, Japanese investors are buying gold to store in Switzerland, according to BullionVault. Japanese consumers see Switzerland as a safer place to hold their gold than at home in Japan.

- The United Nations stated last month that Congolese exporters are ignoring requirements to source gold from conflict-free mining states. The illegal gold trade is being smuggled, largely to buying houses in Dubai. Sophia Pickles from Global Witness says that “Congo and the United Arab Emirates have dramatically failed” to uphold their responsibilities to put conflict and human rights abuses in check.

- Centerra Gold agreed to acquire Thompson Creek Metals for $1.1 billion to expand its North American holdings. The deal would represent a 32 percent premium on Monday’s closing prices for the equity, which was essentially worthless unless the debt and unpaid interest were settle too. Centerra has been in a dispute with the Kyrgyzstan government over its Kumtor Gold Mine, which generates most of the company’s revenue. Kyrgyzaltyn, The Kyrgyzstan state-backed gold company, voted against the planned acquisition deal on the basis that it will dilute its shareholding in Centerra. It is unclear what the next move of the Kyrgyz government will be to the proposed deal.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of