Precious Metals Remain In Neutral Mode Since 22nd Of February 2018!

Although gold has been acting pretty strong over the last three months, it was not able to breakout through the massive resistance zone between 1,350 USD and 1,375 USD so far! Actually, all that did happen since the top in January was a tricky and confusing sideways consolidation. Investors and traders want to avoid such a challenging and trendless period in any market, as it usually creates too many misleading signals.

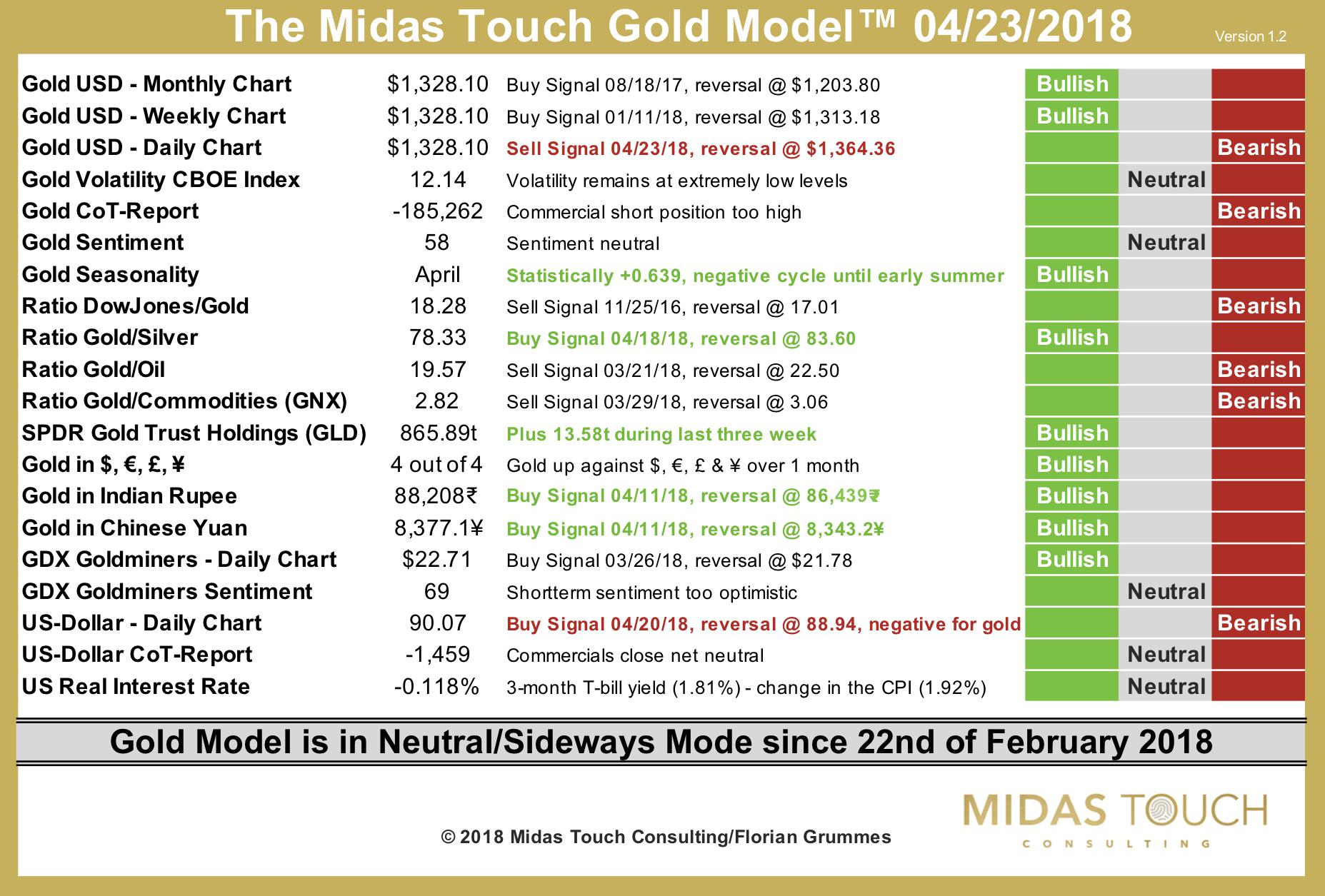

Fortunately, our Midas Touch Gold Model™ has done a great job to bring clarity into this consolidation. As well, I personally have been expressing my skepticism over the last couple of months as the seasonal cycle usually brings an important low somewhere in June or July. Hence, buying into strong gold prices in springtime has never been a promising strategy!

Since 22nd of February the Midas Touch Gold Model™ is in neutral/sideways mode. It doesn´t take too much to shift its conclusion to a bullish one but so far gold was not able to do that. Especially as the daily chart for gold in US-Dollar has flipped around to a bearish reading today, it is just prudent to expect more sideways action and probably one last pullback towards and maybe even below 1,300 USD. As well the US-Dollar has a new buy signal which transform into a bearish reading for gold of course.

Nevertheless, the Midas Touch Gold Model™ has a couple of new bull signals. Most importantly might be the bullish signal from the Gold/Silver-Ratio. Silver has been lagging for quite some time and just recently came back to life. According to the ratio silver is extremely undervalued and the ratio´s bullish signal is a promising development for the whole sector. Just understand that the ratio is not a short-term guide but more a mid- to longer-term proposition.

As ETF buying seems to be picking up, the SPDR Gold Trust indicator now is bullish again. And finally, both measurements for gold´s trend in Asia, Gold in Indian Rupee and Gold in Chinese Yuan, are still on a buy signal. With more weakness in gold especially the bullish signal in Chinese Yuan could change rather soon. In this case, the Midas Touch Gold Model™ would then move back into a more balanced neutral conclusion.

Overall, the Midas Touch Gold Model™ remains neutral and confirms my recommendation to observe this market from the sidelines. Should we get this final pullback (call it a “lap of honor” before the breakout) towards and maybe below 1,300 USD, gold will become an aggressive buy recommendation. Until then remain patient!

*********

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter here: http://bit.ly/1EUdt2K

© Midas Touch Consulting, Florian Grummes 2018 all rights reserved

Hohenzollerstrasse 36, 80802 Munich, Germany

Disclaimer & Limitation of Liability

The above represents the opinion and analysis of Mr Florian Grummes, based on data available to him, at the time of writing. Mr. Grummes's opinions are his own and are not a recommendation or an offer to buy or sell securities. Mr. Grummes is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in the Midas Touch. As trading and investing in any financial markets may involve serious risk of loss, Mr. Grummes recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Florian Grummes is not a Registered Securities Advisor. Therefore Mr. Grummes's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction. The passing on and reproduction of this report is only legal with a written permission of the author. This report is free of charge. You can sign up here: http://eepurl.com/pOKDb

Hinweis gemäß § 34 WpHG (Deutschland):

Mitarbeiter und Redakteure des Midas Touch Gold Newsletter halten folgende in dieser Ausgabe besprochenen Wertpapiere: physisches Gold und Silber, Bitcoins sowie Gold-Terminkontrakte.

Imprint & Legal Disclosure

Anbieterkennzeichnung gemäß § 6 Teledienstgesetz (TDG)/Impressum bzw. Informationen gem § 5 ECG, §14UGB, §24Mediengesetz

Herausgeber und verantwortlich im Sinne des Presserechts / inhaltlich Verantwortlicher gemäß §6 MDStV

Florian Grummes

Hohenzollernstrasse 36

80801 München

Germany

E-Mail: [email protected]

Website: www.midastouch-consulting.com

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at:

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at: