Pruning The Golden Tree

Over the past week or so, gold and associated assets have rallied quite nicely.

This is the daily gold chart.

The $1237 price area is a good place to book partial profits on positions bought in my $1220 - $1200 buy zone.

Gold feels quite solid here. The five and ten day moving averages have turned up. The 14,7,7 Stochastics oscillator is also flashing a buy signal and moving higher.

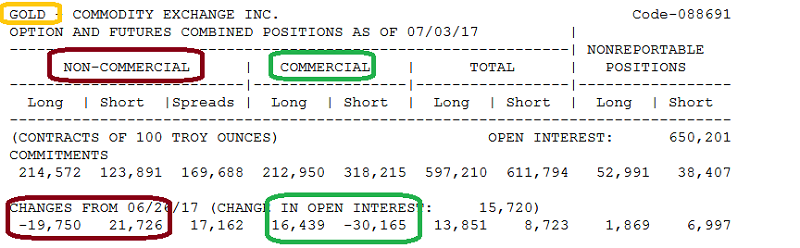

The latest COT report was also very positive.

While the rally can continue, smart investors book profit systematically into strength and good news. So, I’m adamant that some profit should be booked here. Gold has rallied more than $30 from the $1205 area low.

If the rally accelerates, the wise investor books even more profit. If it stalls, investors should get a chance to buy again at lower prices… using some of the market’s money rather than theirs!

Gold stocks are not likely to reverse their multi-decade bear cycle against bullion until US money velocity stages a new bull run, but they still outperform bullion on rallies.

My focus in the precious metals market in 2017 has been GDX and individual gold stocks, mainly to prepare for that bullish reversal in money velocity. The reversal should produce a multi-decade cycle of gold stock outperformance against bullion.

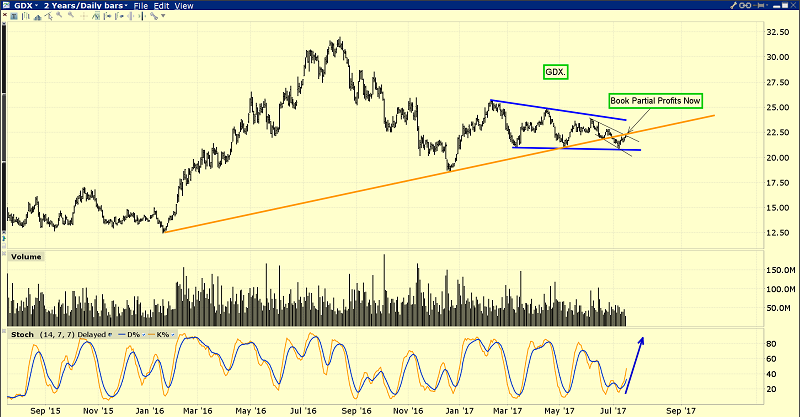

This is the interesting GDX chart.

I’ve been an aggressive buyer of GDX into the recent $21 area lows, and partial profits definitely need to be booked now. This chart shows that GDX is bumping up against a significant supply-side trendline.

If the price moves back below $21, that capital can be re-deployed into GDX even more aggressively. I’m a buyer on every ten cents decline, and a partial seller on 50 cents rallies from my buy points.

This isn’t so much “trading” as it is pruning. As they grow, lawns must be mowed and hedges must be pruned. As the price of GDX increases, some profit must also be pruned. Investors can use my pyramid generator to do that systematically.

Regardless, core positions in the precious metal sector need to be held with an iron fist. Just as a gardener mows their lawn rather than ripping the whole lawn out by the roots, the gold market investor needs to hold large core positions to take advantage of what I call the “gold bull era”.

That’s a snapshot of recent Indian gold imports, courtesy of Nick Laird.

I’ve stated that the 2013 – 2016 slowdown in these imports should be viewed as a temporary issue.

The imports slowdown created the swoon in gold from $1500 to $1100 and the bigger swoon in mining stocks. The good news is that the swoon is over.

As Chindian citizens get more wealth, they buy phones, cars, and other gadgets. They also buy more gold. Unlike phones and cars, it’s very hard to increase the supply of gold. The bull era will be created by an ongoing failure of gold supply to meet the exponential demand growth from Chindian citizens.

The price of gold will be driven relentlessly higher from this process not just in terms of price, but in terms of time. Empires tend to peak after about 200 years.

The relentless rise of the Chinese and Indian gold-oriented empires should move the gold price consistently higher for the next 100 – 200 years.

The West is in decline, and the decline could become a stagflationary nightmare. For wealth building purposes, I would suggest that the world gold community should view the decline of the West as very thick icing on a bull era cake.

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Yellowcakes & Gold Stock Steaks!” report. Uranium stocks were the hottest sector in the world yesterday, and Chinese reactor growth is set to send key stocks soaring higher for many years. I highlight the cream of the uranium stocks crop, along with six exciting junior gold stocks poised to surge higher now!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: