Short Gold Speculative Positions At Extreme Level

Strengths

- Gold maintained its rebound from a three-month low on concerns that economic risks in China and Greece will prompt the Federal Reserve to delay raising interest rates.

- Swiss gold flows counter reports of slackening gold demand. Despite the weak gold price, Swiss data shows that physical gold demand continues to be strong and gold is still moving from west to east. Switzerland is on pace to export a little under 2,000 tons of gold in 2015, the second-most active year on record. Since the country is home to four of the biggest gold refineries in the world, and almost two-thirds of the world’s gold is refined in Switzerland, it makes an excellent source of gold flow data for investors.

- Claude Resources reported second quarter 2015 gold production of 20,619 ounces, a 10-percent increase from a year ago. The record-breaking first half performance of 41,686 ounces has resulted in the company increasing its gold production guidance to between 68,000 and 72,000 ounces in 2015. Kirkland Lake reported results for its fiscal 2015 fourth quarter and achieved a head grade of 0.42 ounces per ton, or 14.4 grams per ton. It produced 37,979 ounces of gold in the quarter and a total of 153,957 ounces for the full year. Centamin second quarter 2015 output results were up 33 percent year-over-year for a total of 107,781 ounces of gold.

Weaknesses

- The standoff in Greece hasn’t sparked much demand for gold, which is traditionally seen as a store of value amid crises. The metal fell in the past four quarters in the longest slump since 1997. Holdings in exchange-traded products backed by bullion fell 5.4 percent since this year’s February peak and are near the lowest in six years.

- South African trade union UASA said that while gold producers tabled a “good opening offer” in pay negotiations last week, it still needs work. The producers offered wage increases of as much as 13 percent, plus a share of profits. Virtually unchanged housing allowances and increases not linked to inflation were also issues.

- All commodity futures markets in China were limited down earlier in the week as Chinese hedge funds have increasingly hedged long stock market positions by aggressively shorting commodities, as they are now prevented from shorting equities.

Opportunities

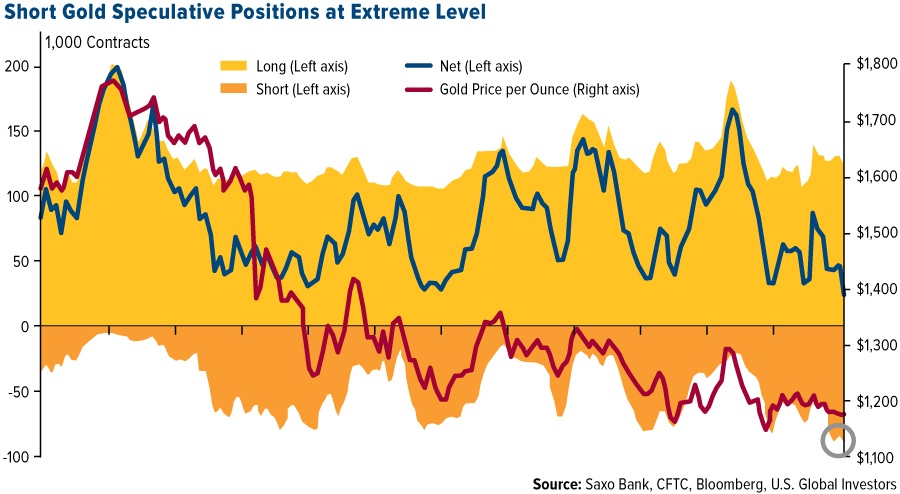

- Large gold futures investors such as hedge funds have slashed overall bullish positions by a whopping 55 percent. That’s more than 14 million ounces below levels hit in January this year when gold reached its 2015 peak. The net long positioning is also the lowest since October 2006 when gold was worth less than $600 an ounce.

- Central banks around the world have one thing in common: they like to print money. Since 2008, the U.S. Federal Reserve has increased money supply by 67 percent, or more than $5 trillion, while the European Central Bank has also joined the game, starting its 1.1 trillion euro quantitative easing program earlier this year. For any investor, managing risk is necessary. In market conditions like this, gold provides a great hedge against not only stock market downturns but also the monetary crisis that part of the world is already experiencing.

- Based on the latest Office of Comptroller of the Currency quarterly derivative report, JPMorgan and Citigroup seem to have literally cornered the commodity derivatives complex as their notional exposures soared by 1,690 percent and 1,260 percent, from $226 billion to $4 trillion and $3.9 billion to $53 billion, respectively, in one quarter. This accounts for more than 96 percent of the total outstanding derivatives. The lack of corresponding movement in the spot price of gold when the derivatives book is cornered creates an uncertainty of great magnitude.

Threats

- The Boston Consulting Group has taken on mineral exploration in a recent report titled “Tackling the Crisis in Mineral Exploration,” which details the lack of big, important discoveries in recent years despite a massive increase in exploration spending.

- Cornerstone Macro has released a report about the unprecedented disconnect between central bank easing and economic activity. Despite 57 global central bank easing policies since the beginning of 2015, China has continued to deteriorate, the eurozone economy has run intro structural headwinds, and Japan’s economic recovery appears to have stalled in Q2. This is a very unusual time where, despite a global easing cycle, global growth is not accelerating and, if anything, is continuing to slow.

- In a recent interview, influential investor Marc Faber issued a warning to those who still think that Greece doesn’t matter in the grand scheme of things. He spoke about the likelihood of contagion being very high and how the European Union continued to pump money into Greece, in part to bail out its own banks and suddenly now realizing the debt is no longer manageable. Chiming in on China, he said he had expected the market to fall at least 40 percent from the peak given the speculative run up.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of