A Simple Dollar Hedge

Introduction

A few weeks ago, a US subscriber emailed me and asked about currency trading, because he was quite concerned about the dollar, after reading about the long Euro and short dollar positions by the two most powerful men in the world, Warren Buffett and Bill Gates. I think the Forex market is a very treacherous place for a novice trader, and there is a better alternative….

Dollar and the Loonie

The Canadian dollar ( loonie) like most other foreign currencies, has an inverse relationship with the dollar.

A mirror opposite.

The Latest Signals

A sell signal for the dollar.

And a buy signal for the loonie.

The Big Fives

Obviously, precious metals offer excellent return as a hedge against the depreciating dollar, but for those who seek diversification and safety, the big five as affectionately known in Canada, are the five chartered Canadian banks. The big five carries an average P/E of 13, and a yield of 3.5% and they have very similar cycles with the loonie and of course, the precious metals.

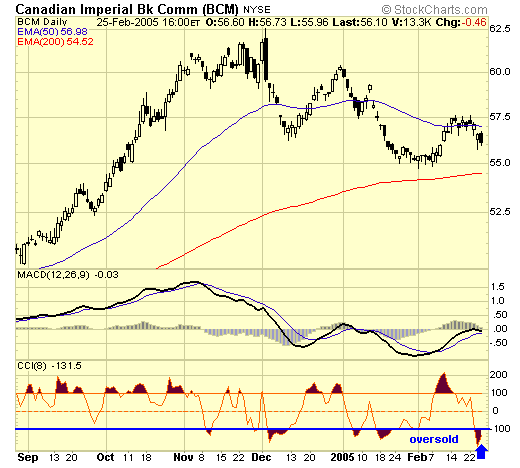

The current pullback is oversold, a good place to enter.

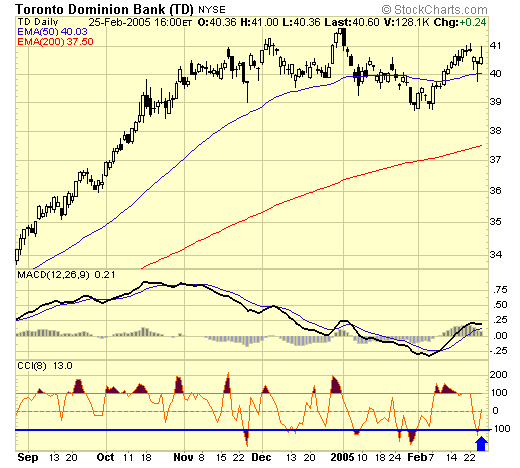

Same here, buy it now.

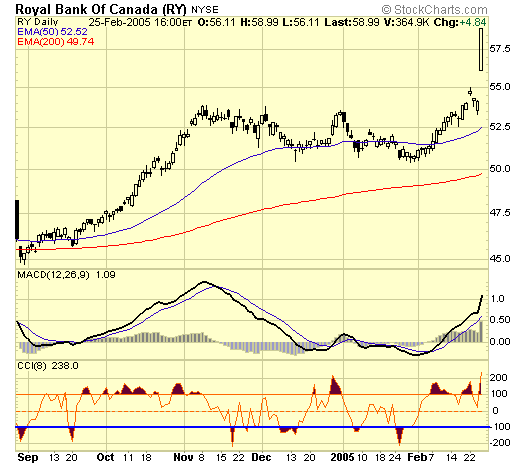

A buy also after a small pullback.

Another buy.

RY reported earnings today, and it was a blow out. Don't chase it, wait for a pullback and buy it when its oversold.

Summary

The Canadian chartered banks are extremely well run, with very strict structure on loans and mortgages, therefore, very profitable. All five are traded at New York thru your regular brokers or online, and all are denominated in dollar, therefore no currency exchange is involved and you don't need to open a Canadian account, how is that for simplicity, eh?

Jack Chan at www.traderscorporation.com

26 February 2005