The Tide Has Turned

The world’s economic landscape is changing and after a disastrous decade, America is once again in the driver’s seat. Contrary to the 2000-2011 time frame (when the developing nations fared a lot better than America), the tide seems to have turned in favour of the world’s largest economy.

As you will recall, at the turn of the millennium, American business was booming and Wall Street was caught up in an epic technology bubble! Back then, American assets were highly sought after and even its currency was extremely strong. Unfortunately, that period of prosperity did not last forever and the bursting of the technology bubble in March 2000 ushered in an era of painful adjustment. Thereafter, in the aftermath of the NASDAQ bust, Mr. Greenspan helped ignite America’s housing boom and we all know how that story ended. To make matters worse, the US Dollar also topped out in 2001 and for almost 10 years, holders of American assets also suffered due to currency devaluation.

It is interesting to observe that during America’s painful decade-long adjustment period, the developing economies (primarily due to China’s historic fixed-asset investment binge) grew at an impressive pace and the commodity-producing nations enjoyed bonanza years! In fact, China’s entry into in the World Trade Organisation in 2001 was primarily responsible for this unprecedented boom and this era of prosperity created enormous wealth in the developing world. Thus, during the previous decade, investors gorged on the stock markets of the developing nations and bid up their currencies. Furthermore, this love affair with China also prompted investors to buy commodities and this monumental bull market created additional problems for the commodity-importing developed world.

Bearing in mind the above factors, between 2000 and 2010, stocks in the developed world significantly unperformed their counterparts in the developing nations (Figure 1).

Figure 1: Performance of various stock markets (September 1999 - January 2010)

Source: www.stockcharts.com

Thereafter, when not many investors were expecting it, the pendulum swung again and the great bull market in commodities ended in April 2011. Furthermore, that peak in commodities also coincided with the top in the stock markets of the developing nations. Interestingly, the US Dollar also bottomed out in April 2011 and since then, American assets have performed exceptionally well.

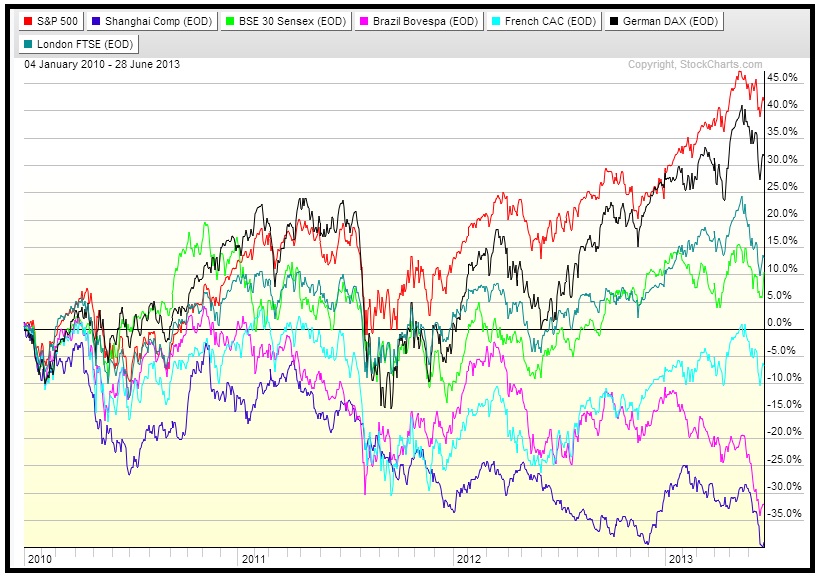

In fact, if you review Figure 2 objectively, you will note that since January 2010, the S&P500 Index has been the best performer amongst all the major stock averages. Furthermore, you can also see that over the past 3½ years, the stock markets of the developed world have significantly outperformed the stock markets of Brazil, China and India!

Figure 2: Performance of various stock markets (January 2010 – present)

Source: www.stockcharts.com

Although it is difficult to know for sure, we are of the view that the recent poor showing by the stock markets of the developing nations is due to severe problems within China’s economy. Make no mistake, thanks to its unprecedented stimulus, China has now got a massive debt-fueled housing bubble and perhaps this is why investors have been withdrawing capital from the developing world.

Whether you agree with us or not, hard data reveals that China’s debt (over 200% of GDP!) is now out of control and the world’s second largest economy remains extremely vulnerable to a hard landing. To complicate matters even further, China’s debt binge is accelerating and its shadow banking system (wealth management products) has now become enormous!

If history is any guide, China is now awfully close to its credit bust and the odds are stacked against the ‘soft landing’ scenario. Look. Throughout recorded history, debt booms have never ended with a gentle adjustment; and such manias have always ended in tears. Thus, unless ‘this time is different’, we can expect a painful deflationary bust in China.

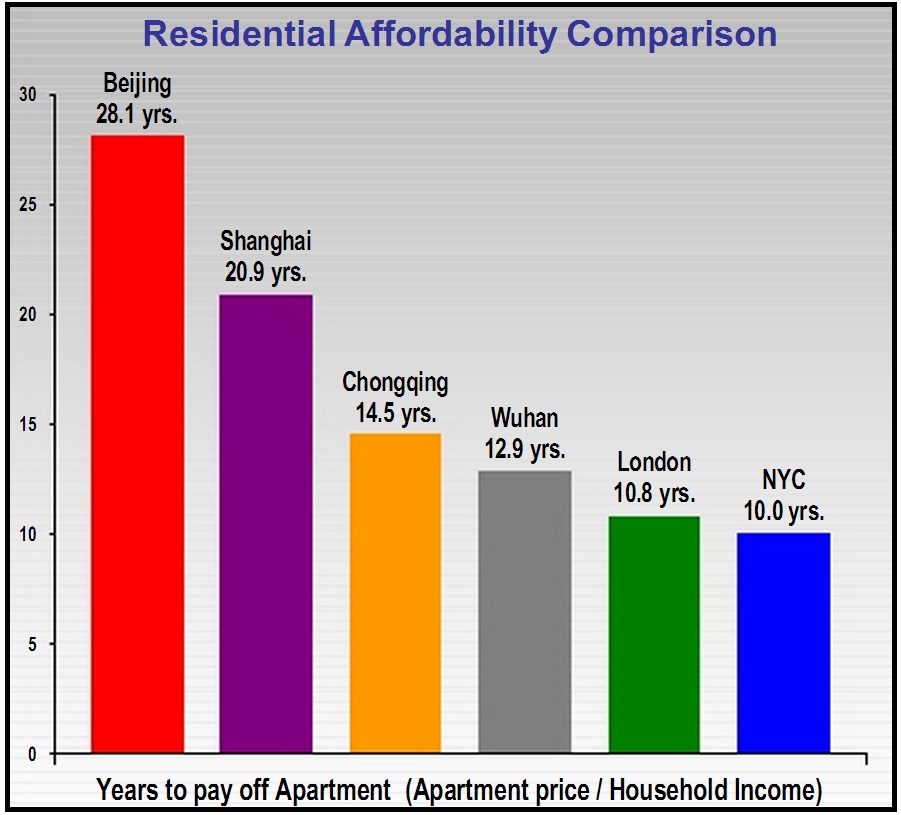

If our assessment is correct, China’s fixed-asset investment boom will end badly and its property market will probably undergo a painful contraction. Remember, home affordability in China is now off the charts and it currently takes over 20 years of income to buy an apartment in either Beijing or Shanghai (Figure 3). Moreover, China’s residential property stock is now valued at almost 400% of GDP and this ratio has even surpassed Japan’s lofty level prior to its epic bust!

Figure 3: China’s property is extremely unaffordable!

Source: Kynikos Associates

At this stage, we do not know when China’s property market will collapse, but we do know that its banking sector remains vulnerable to an abrupt downward adjustment. Furthermore, it is interesting to observe that similar to the US, China has also rolled out questionable ‘wealth management products’ and this shadow banking market is now worth US$2 trillion!

Needless to say, when China’s property market deflates, its non-performing loans will spike and numerous new investors will learn some very old lessons.

In our view, the ongoing deflation in commodities is a clear sign that China’s fixed-asset investment binge is slowing down and if things get ugly, the stock markets of the developing world will probably take it on the chin. Furthermore, the economies and stock markets of the commodity-producing nations (Australia, Brazil and Canada) will also undergo a painful contraction.

It is notable that over the past few weeks, the Australian and Canadian Dollars have weakened significantly and this is another indication that all is not well in China’s ‘miracle economy’. Thus, if we get a full-blown property bust in China, it is conceivable that the high-beta developing economies will severely underperform relative to the developed world.

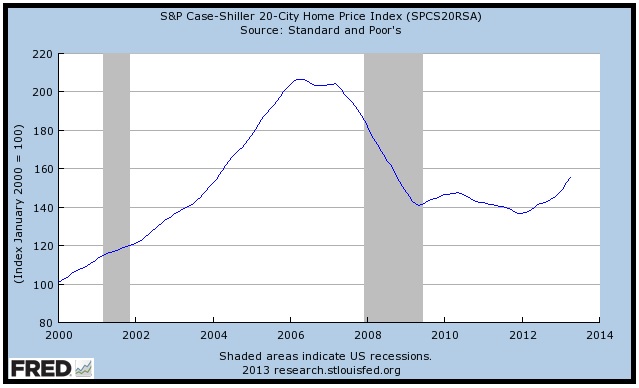

It is noteworthy that whereas China’s property market seems to be peaking, after its historic property bust, America’s housing market is bottoming out (Figure 4). Furthermore, if historical patterns play out, it is probable that America’s property prices may appreciate for several years.

Figure 4: S&P Case-Shiller 20-City Home Price Index

Source: St. Louis Fed

In our view, the ongoing recovery in America’s housing market is a big tail-wind for the world’s largest economy and it may provide the necessary impetus for a sustainable advance on Wall Street. In fact, as American property prices continue to appreciate, the number of households with negative equity will diminish and unleash a powerful ‘wealth effect’. When American homeowners breathe a sigh of relief, they will undoubtedly open their wallets and increase their discretionary spending.

Bearing in mind the ongoing improvement in America’s property market, we remain optimistic about the prospects of Wall Street. In our view, if the housing recovery plays out, American businesses will prosper and become more valuable; thereby pushing up their corresponding stock prices. Moreover, we suspect that the laggards of the previous decade (biotechnology, consumer discretionary, consumer staples, financials and healthcare) will continue to outperform the broad market. Conversely, we believe that the cyclical sectors such as commodities and industrials; as well as precious metals miners will continue to disappoint investors.

Given our expectations, we have allocated our equity and fund portfolios to the strongest sectors and geographical areas. Short-term volatility notwithstanding, we remain confident that our holdings will produce good growth over the following months.

Puru Saxena

Website – www.purusaxena.com

Copyright © 2005-2013 Puru Saxena Limited. All rights reserved.

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.